Sanitary Valves Market Size 2024-2028

The sanitary valves market size is forecast to increase by USD 524.4 billion at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for product safety and quality control in various industries, particularly in the processed food industry and pharmaceuticals. The adoption of automation technologies, such as smart valve positioners, is a major trend driving market growth. These advanced technologies enable dynamic adjustments, ensuring consistent process control and reducing human error. In the pharmaceutical sector, the use of aseptic valves is crucial for maintaining the sterility of the production process. Raw material price fluctuations pose a challenge to market growth, but the benefits of sanitary valves in ensuring product safety and improving overall efficiency outweigh the costs.

Sanitary valves play a crucial role in maintaining the cleanliness and hygiene of industrial pipe networks in the food and beverage, biotechnology, and cosmetics industries. These industries demand uncompromised sanitation standards to ensure the production of uncontaminated products. Sanitary valves are specifically designed to prevent contamination and ensure the smooth flow of fluids. They are made from hygienic materials such as stainless steel, which offers excellent corrosion resistance and longevity. Hydraulic valves, including butterfly, ball, and diaphragm types, are widely used in these industries due to their ability to maintain cleanliness and prevent germ growth.

Moreover, the dairy industry and processed foods sector heavily rely on sanitary valves for their applications. The production of these products requires stringent adherence to hygienic regulations. Sanitary valves help maintain the cleanliness of the production process, ensuring the production of safe and high-quality products. Biotechnology and cosmetics industries also benefit from sanitary valves. These industries require the use of sustainable materials that can withstand harsh chemicals and maintain the cleanliness of the production process. Sanitary valves made from hygienic materials meet these requirements and offer long-term durability. Smart valves and automated sanitary valves have gained popularity in recent years due to their process control capabilities.

Furthermore, these valves offer improved efficiency, reduced downtime, and enhanced safety features. They are particularly useful in industries where precise control of fluid flow is essential. In conclusion, sanitary valves are an essential component in maintaining the cleanliness and hygiene of industrial pipe networks in the food and beverage, biotechnology, and cosmetics industries. Their ability to prevent contamination, ensure smooth fluid flow, and adhere to hygienic regulations makes them indispensable in these industries. The use of sustainable materials and advanced technologies such as smart valves and automated sanitary valves further enhances their value proposition.

Market Segmentation

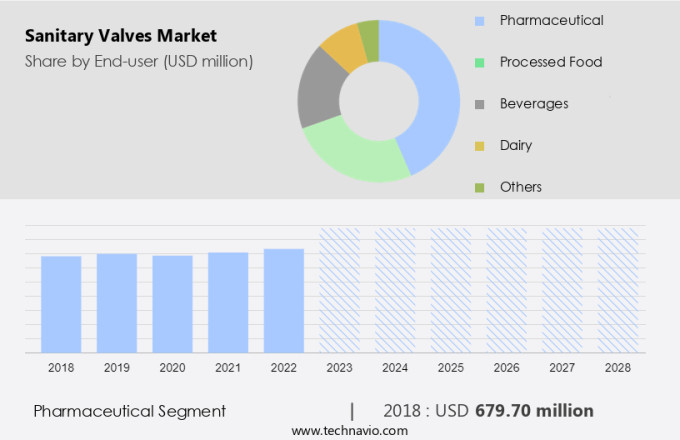

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical

- Processed food

- Beverages

- Dairy

- Others

- Product

- Control valves

- Double valves

- Single valves

- Butterfly valves

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

The pharmaceutical segment is estimated to witness significant growth during the forecast period. In the realm of industrial pipe networks, sanitary valves have gained significant importance, particularly in sectors with stringent hygiene and sanitation standards, such as the dairy industry, processed foods, and beverages. These industries prioritize cleanliness to maintain product quality and adhere to regulatory requirements. Sanitary valves, with their hygienic materials and design, are essential in ensuring fluid flow while upholding these standards. In the pharmaceutical sector, where the production of critical life-saving drugs is concerned, the significance of sanitary valves is amplified. The pharmaceutical industry demands valves with effective sanitary seals and drain capabilities due to the potential consequences of deviations in production processes. Strict regulations in this industry necessitate the use of sanitary valves to prevent product recalls and penalties for subpar product quality.

Get a glance at the market share of various segments Request Free Sample

The pharmaceutical segment was valued at USD 679.70 million in 2018 and showed a gradual increase during the forecast period.

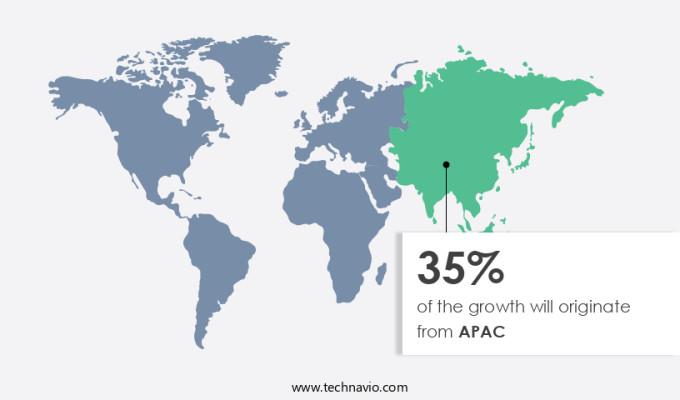

Regional Insights

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in APAC is the largest contributor to the global industry, with continued growth anticipated throughout the forecast period. The food and beverage sector's expansion in APAC, home to several populous countries, fuels the demand for sanitary valves. However, the unorganized sector dominates this industry, with numerous small and medium enterprises scattered across the region. The proliferation of e-commerce platforms enables these businesses to reach a broader consumer base, increasing the market potential. Automated sanitary valves, such as those made of disposable materials like plastic and stainless steel, are essential for process control in the food and beverage industry to mitigate contamination risks.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising use of sanitary valves in food and beverages and pharmaceutical industries is the key driver of the market. In the highly regulated industries of food and beverage and pharmaceuticals, maintaining a sanitary and hygienic environment is paramount. Sanitary valves play a crucial role in ensuring contamination prevention within fluid handling systems in these sectors. The demand for sanitary valves is driven by the increasing organic growth of these industries. Consumers' growing preference for healthy and nutritious food and beverages, including ready-to-eat (RTE) options, has fueled this growth.

Moreover, strict regulations mandate the adoption of stringent hygiene practices, making sanitary valves an essential component in production processes. Stainless steel sanitary valves, known for their longevity and corrosion resistance, are popular choices in these industries. Hydraulic valves and pressure regulation valves are other types of sanitary valves that find extensive use in the food and beverage and pharmaceutical industries. The global market for sanitary valves is expected to expand significantly due to these factors.

Market Trends

The development of valve positioner technology is the upcoming trend in the market. Valve positioners play a crucial role in adjusting actuator positions based on control signals. Traditional valve positioners include pneumatic, electric, and electro-pneumatic types. Pneumatic valve positioners utilize air pressure, electric valve positioners rely on electric signals, and electro-pneumatic valve positioners combine both electricity and air. Each type offers unique advantages and is suitable for specific applications. Given the increasing adoption of digital technologies in industries, smart valve positioners are gaining popularity. These advanced positioners use sensors to provide valuable data on valve stroke and thrust, output pressure, temperature, valve seat/plug wear, and performance. This data is essential for product safety, quality control, and automation in sectors such as pharmaceuticals, processed food, and other industries that require stringent quality standards.

Moreover, the integration of automation technologies in valve positioners enables dynamic adjustments, enhancing overall process efficiency. The cost reduction of sensors and advancements in sensor technology have made these smart positioners a cost-effective solution for end-users. As a result, industries are increasingly adopting smart valve positioners to ensure optimal performance and maintain regulatory compliance.

Market Challenge

Fluctuation in raw material prices is a key challenge affecting the market growth. The market is witnessing significant growth due to the increasing health consciousness among consumers and the rising demand for maintaining a sterile environment in various industries. Online food aggregators and food processing companies are key contributors to this market's expansion. Sanitary ball valves, sanitary pumps, and electro-pneumatic valves are popular choices for controlling the flow of fluids in these applications. Contamination control is a critical factor driving the adoption of these valves. Advanced valve positioner technology is being increasingly utilized to ensure precise valve positioning and improve overall system efficiency. However, the prevalence of counterfeit and fraudulent fluid handling products, including valves, poses a significant challenge to the industry.

However, these products, which are often of inferior quality, can compromise the safety and efficiency of the entire system. It is essential for manufacturers and end-users to prioritize authenticity and quality to mitigate potential risks and ensure optimal performance. The use of authentic and high-quality sanitary valves is crucial for maintaining the integrity of the fluid handling system and ensuring the safety and quality of the final product.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adamant Valves - The company offers sanitary faucets such as AV 2MEC encapsulated sanitary 3-piece ball faucets. Also, the company manufactures and supplies a line of sanitary valves such as sanitary butterfly faucets, sanitary ball valves, sanitary check valves, sanitary sight glasses, sanitary unions, and more.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- APEX Industrial solutions

- Assured Automation

- Cashco Inc.

- Central States Industrial

- CSK-BIO PTE LTD.

- Dixon Valve and Coupling Co. LLC

- Emerson Electric Co.

- Haitima Corp.

- Haleson

- Holland Applied Technologies Inc.

- Integral Process Controls India (P) Ltd.

- ITT Inc.

- MISUMI Group Inc.

- Modentic Industrial Corp.

- Sanitary Fittings LLC

- SMC S.r.l.

- Swagelok Co.

- Valtorc International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sanitary valves play a crucial role in the prevention of contamination in various industries, including biotechnology and the processed food and beverage sector. These valves are designed with hygienic materials and smooth surfaces to ensure a sterile environment for the production of uncontaminated products. Stainless steel valves, such as sanitary ball valves and sanitary butterfly valves, are popular choices due to their longevity and corrosion resistance. Hydraulic valves and electric pumps are used for pressure regulation and flow control in these industries. Health consciousness and stringent hygiene standards have led to the increased adoption of automation technologies, such as smart valve positioners and automated sanitary valves, for precise control and dynamic adjustments.

Moreover, the pharmaceutical industry and dairy industry require aseptic valves and sterile conditions for the production of sensitive products. Valve positioner technology, including electro-pneumatic valves and smart valves, ensures accurate positioning and maintains product safety and quality. The processed food industry, which includes online food aggregators, must adhere to strict safety standards and legal regulations. Sanitary pumps and heat transfer systems are essential for fluid handling and maintaining hygiene standards. Specialty valves, such as diaphragm valves and disposable plastic valves, are used for specific applications and ensure product purity. In conclusion, sanitary valves are essential components in industries that require contamination control, including biotechnology, cosmetics, and the food and beverage sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market Growth 2024-2028 |

USD 524.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

China, US, Germany, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adamant Valves, Alfa Laval AB, APEX Industrial solutions, Assured Automation, Cashco Inc., Central States Industrial, CSK-BIO PTE LTD., Dixon Valve and Coupling Co. LLC , Emerson Electric Co., Haitima Corp., Haleson, Holland Applied Technologies Inc. , Integral Process Controls India (P) Ltd., ITT Inc., MISUMI Group Inc., Modentic Industrial Corp., Sanitary Fittings LLC, SMC S.r.l. , Swagelok Co., and Valtorc International |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch