Sanitary Valves Market in India Size 2024-2028

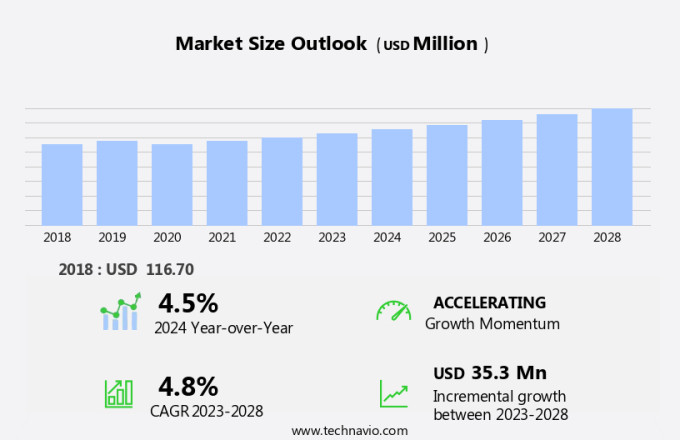

The sanitary valves market in India size is forecast to increase by USD 35.3 billion at a CAGR of 4.8% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing usage of these valves in sectors such as food and beverages and pharmaceuticals. The adoption of advanced technologies like smart positioning systems is also driving market expansion. However, the market is facing challenges due to the volatility in raw material prices, which can impact the profitability of manufacturers. In addition, stringent regulations regarding sanitation and hygiene are pushing the demand for sanitary valves in various industries. Overall, the market is expected to grow steadily In the coming years, driven by these trends and challenges.

What will be the Size of the Sanitary Valves Market in India During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for cleanliness and contamination prevention in various industries. Key end-users include the food and beverage, pharmaceutical, biotechnology, cosmetics, and semiconductor sectors. Stainless steel sanitary valves are popular choices due to their corrosion resistance and ability to meet stringent hygiene standards. Hydraulic systems in India's manufacturing sector are also driving demand for hydraulic valves, which require sanitary valves for fluid management and pressure regulation in hygienic applications. Automation in food processing and the production of packaged foods, such as processed and sterilized items, further boosts the market. Sanitary pumps, including centrifugal, positive displacement, and rotary pumps, are also essential components of fluid management systems In these industries.

How is this Sanitary Valves in India Industry segmented and which is the largest segment?

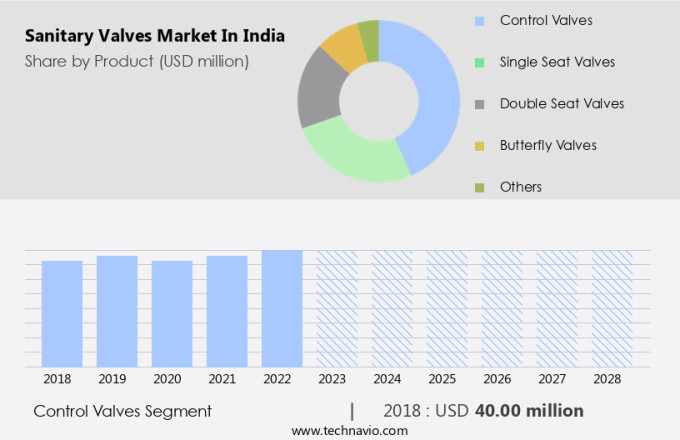

The sanitary valves in India industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Control valves

- Single seat valves

- Double seat valves

- Butterfly valves

- Others

- End-user

- Processed food

- Pharmaceutical

- Beverages

- Dairy

- Others

- Geography

- India

By Product Insights

- The control valves segment is estimated to witness significant growth during the forecast period.

Control valves are essential components in various industries for managing the flow of fluids, gases, or mixtures. In the context of hygienic applications, sanitary control valves play a crucial role in sectors such as pharmaceuticals, food and beverages, and dairy. These valves ensure the maintenance of a sterile environment, which is vital for the production of ready-to-eat food and pharmaceutical products. Sanitary control valves come in various types, including globe valves, diaphragm valves, pinch valves, gate valves, ball valves, and plug valves. Linear valves like globe valves, diaphragm valves, pinch valves, and gate valves operate by varying the size of the flow passage, while rotatory valves like ball valves and plug valves function by rotating a closure element.

Sanitary ball valves, sterile environment valves, sanitary pumps, valve positioners, smart technology, pharmaceutical valves, and aseptic valves are integral components of this market. Companies focus on innovation, hygiene, and sanitation to cater to the evolving needs of industries.

Get a glance at the Sanitary Valves in India Industry report of share of various segments Request Free Sample

The Control valves segment was valued at USD 40.00 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our sanitary valves market in India researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Sanitary Valves in India Industry?

Rising use of sanitary valves in food and beverages and pharmaceutical industries is the key driver of the market.

- Sanitary valves play a crucial role in maintaining cleanliness and preventing contamination in various industries, including food and beverage, pharmaceutical, biotechnology, cosmetics, and semiconductor manufacturing. In India, the demand for sanitary valves is expected to grow significantly due to increased investments In the food and beverage sector. With rising disposable incomes and changing consumer preferences, the food industry is witnessing a surge in ready-to-eat food production and online food aggregator services. This growth will lead to an increase In the deployment of sanitary valves, particularly stainless steel valves, for pressure regulation and flow control in hydraulic systems. In the pharmaceutical industry, hygiene and sanitation are of utmost importance.

- Sanitary ball valves, aseptic valves, and isolation valves are commonly used in pharmaceutical manufacturing to ensure a sterile environment. These valves are made from corrosion-resistant materials such as stainless steel, alloy steel, and PFA, ensuring the purity of the process fluids. The biotechnology industry also requires sanitary valves for various applications, including fermentation, mixing, spraying, preservation, and air filtration. These valves are essential in maintaining the hygiene standards required in biotechnology applications. Sanitary pumps, such as Unibloc Pump, are also used extensively In the food and beverage industry for fluid management. Valve positioners and smart technology are increasingly being used to optimize the performance of these pumps and improve energy efficiency.

- In conclusion, the market is expected to grow significantly due to the increasing demand for hygiene and sanitation in various industries, including food and beverage, pharmaceutical, and biotechnology. The use of stainless steel, alloy steel, and other corrosion-resistant materials in sanitary valve manufacturing will continue to be a key trend In the market. Additionally, the adoption of automation and smart technology in valve manufacturing and operation will further drive market growth.

What are the market trends shaping the Sanitary Valves in India Industry?

Rising adoption of smart positioning systems is the upcoming market trend.

- Sanitary valves play a crucial role in maintaining cleanliness and preventing contamination in various industries, including food and beverage, pharmaceutical, biotechnology, cosmetics, and more. These industries require sanitary valves made of corrosion-resistant materials, such as stainless steel, to ensure the integrity of their processes. Hydraulic systems, which utilize hydraulic valves for pressure regulation and flow control, are commonly used in machinery for machinery automation. Sanitary ball valves are widely used in applications that demand a sterile environment, such as pharmaceutical manufacturing and water treatment. In the food and beverage sector, sanitary pumps, including Unibloc Pump, are employed to transport ready-to-eat food and processed or packaged foods.

- Online food aggregators and other food processing facilities rely on these pumps for efficient and hygienic fluid management. Smart technology, such as valve positioners, is increasingly being integrated into sanitary valve systems to enhance process integrity. These positioners use microprocessors to control valve operation and monitor data for online diagnostics, enabling early detection of valve wear and minimizing downtime. Pharmaceutical valves, including aseptic valves, are designed to meet stringent hygiene and sanitation standards, ensuring the production of custom-made healthcare products. Materials like stainless steel, alloy steel, carbon steel, PVC, and PFA are commonly used in sanitary valve manufacturing due to their corrosion resistance and compatibility with various applications.

- Sanitary valves are essential for industries that prioritize energy efficiency, hygienic design, and biotechnology applications. They are used in fermentation, mixing, spraying, preservation, air filtration, transportation, and more. In conclusion, sanitary valves are a vital component in various industries, including food and beverage, pharmaceutical, biotechnology, and cosmetics. Their role in maintaining cleanliness, preventing contamination, and ensuring process integrity is crucial. The integration of smart technology and advanced materials has further enhanced their functionality and efficiency.

What challenges does Sanitary Valves in India Industry face during the growth?

Fluctuation in raw material prices is a key challenge affecting the industry growth.

- Sanitary valves play a crucial role in maintaining cleanliness and preventing contamination in various industries such as food and beverage, pharmaceutical, biotechnology, cosmetics, and more. These industries demand sanitary valves made of corrosion-resistant materials like stainless steel for hydraulic systems, pressure regulation, and flow control in machinery. Sanitary ball valves, sterile environment-friendly, are widely used in applications requiring aseptic conditions. Sanitary pumps, including centrifugal pumps, positive displacement pumps, and rotary pumps, are integral to fluid management In these industries. Ready-to-eat food manufacturers and online food aggregators rely on sanitary valves to ensure hygiene standards In their processes. Pharmaceutical manufacturing, chemical processing, water treatment, and dairy processing also require sanitary valves made of food-grade materials for equipment cleanliness during fermentation, mixing, spraying, preservation, and air filtration.

- The demand for custom-made healthcare products and energy efficiency drives the need for hygienic design and biotechnology applications. Materials like stainless steel, alloy steel, carbon steel, PVC, and PFA are used in manufacturing sanitary valves, with stainless steel being a popular choice due to its corrosion resistance. Specialized materials are essential to prevent contamination and ensure a sterile environment in various applications. The rising prices of raw materials, including copper, stainless steel, cast iron, aluminum, brass, and bronze, pose a challenge for companies, affecting their profit margins.

Exclusive Customer Landscape

The sanitary valves market in India forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sanitary valves market in India report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sanitary valves market in India forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alfa Laval AB - The Company provides a range of sanitary valve solutions in India, including the SBV sanitary ball valve. Our product offerings adhere to stringent hygiene standards, ensuring optimal performance and reliability in various industrial applications. The SBV sanitary ball valve, in particular, is known for its leak-free design and ease of maintenance, making it a preferred choice for customers In the US and beyond. Our commitment to quality and innovation sets US apart In the competitive sanitary valves market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Alis Controls

- Bharat Industrial Valve

- Cashco Inc.

- Century Steel Corp.

- Emerson Electric Co.

- INOXPA India Pvt. Ltd.

- ITT Inc.

- Jignesh Steel

- Kieselmann GmbH

- Krones AG

- KSB SE and Co. KGaA

- Mallinath Metal

- Rotolok Ltd.

- Sanipure Water Systems

- Spirax Sarco Ltd

- SPX FLOW Inc.

- Zabs Engineers LLP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to various industries that prioritize cleanliness and contamination prevention. These industries include, but are not limited to, food and beverage, pharmaceutical, biotechnology, cosmetics, and semiconductor sectors. The demand for sanitary valves is driven by the need for maintaining a sterile environment and ensuring the highest levels of hygiene and sanitation. Sanitary valves are essential components in machinery used for fluid management In these industries. They play a crucial role in pressure regulation and flow control, ensuring the smooth operation of hydraulic systems and sanitary pumps. The use of sanitary ball valves, for instance, is prevalent in applications requiring a sterile environment, such as in pharmaceutical manufacturing and dairy processing.

Stainless steel valves are popular choices due to their corrosion resistance and compatibility with food-grade materials. Hydraulic systems and sanitary pumps, which are integral to the functioning of machinery In these industries, often employ stainless steel valves to maintaIn the integrity of the fluid being processed. The food and beverage sector, which includes ready-to-eat food and online food aggregators, is a significant consumer of sanitary valves. The industry's stringent hygiene standards necessitate the use of valves that can maintain equipment cleanliness during fluid transfer and processing. The pharmaceutical sector, too, relies on sanitary valves for the production of custom-made healthcare products.

Pharmaceutical manufacturing processes require aseptic valves to maintaIn the sterility of the environment and prevent contamination. These valves are designed to minimize the risk of particle ingression and are often used in conjunction with sterilization processes. Biotechnology applications, such as fermentation, mixing, spraying, preservation, and air filtration, also necessitate the use of sanitary valves. These valves help maintaIn the required conditions for the growth of microorganisms and ensure the purity of the final product. The semiconductor industry, which deals with the production of electronic components, also utilizes sanitary valves. The industry's focus on energy efficiency and hygienic design necessitates the use of corrosion-resistant valves, such as those made of alloy steel or PFA, to maintaIn the cleanliness and efficiency of the production processes.

The transportation of fluids in various industries, including water treatment and chemical processing, also relies on sanitary valves. These valves ensure the smooth flow of fluids and maintaIn the required pressure levels, contributing to the overall efficiency and productivity of the processes. In conclusion, the market caters to various industries that prioritize cleanliness and contamination prevention. The demand for sanitary valves is driven by the need for maintaining a sterile environment and ensuring the highest levels of hygiene and sanitation. Stainless steel valves, hydraulic systems, sanitary pumps, and various types of sanitary valves, such as ball valves, butterfly valves, diaphragm valves, plug valves, gate valves, flanged valves, threaded valves, welded valves, clamp valves, and union valves, play a crucial role In the smooth functioning of machinery In these industries.

The use of materials like stainless steel, alloy steel, carbon steel, PVC, and PFA ensures the compatibility of the valves with the fluids being processed and the stringent hygiene standards required by the industries.

|

Sanitary Valves Market in India Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 35.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

India and APAC |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sanitary Valves Market in India Research and Growth Report?

- CAGR of the Sanitary Valves in India industry during the forecast period

- Detailed information on factors that will drive the Sanitary Valves in India growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sanitary valves market in India growth of industry companies

We can help! Our analysts can customize this sanitary valves market in India research report to meet your requirements.