Satellite-enabled IoT Market Size 2024-2028

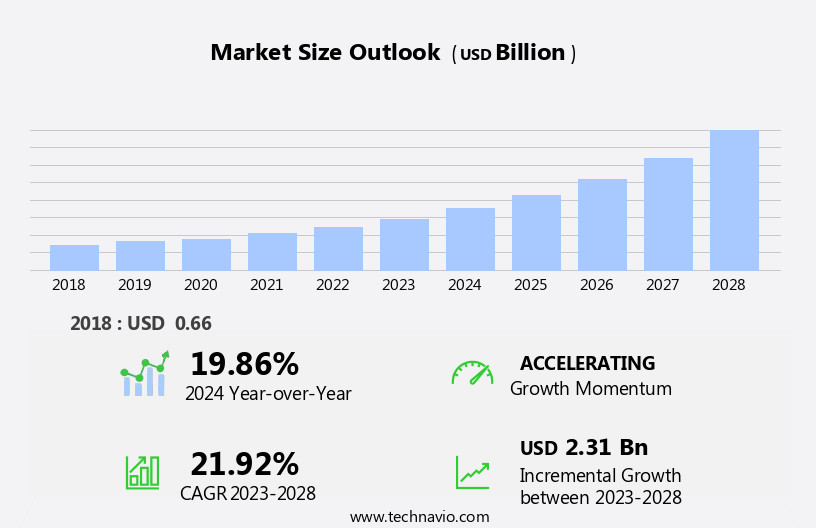

The satellite-enabled iot market size is forecast to increase by USD 2.31 billion at a CAGR of 21.92% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing usage of the Internet of Things (IoT) in various industries and the substantial research and development (R&D) spending in the aerospace and defense sectors. The integration of IoT with satellite technology enables real-time data collection and transmission from remote locations, making it an essential solution for various applications, including agriculture, transportation, and energy. However, the market is not without challenges. Regulatory issues surrounding satellite operations and services pose a significant hurdle, requiring companies to comply with stringent regulations and standards.

- Despite these challenges, the market's strategic landscape offers ample opportunities for companies to capitalize on the growing demand for satellite-enabled IoT solutions. Companies seeking to navigate this market effectively should focus on developing innovative technologies, complying with regulatory requirements, and collaborating with key industry players to expand their reach and offer comprehensive solutions.

What will be the Size of the Satellite-enabled IoT Market during the forecast period?

- The market encompasses the use of Low Earth Orbit (LEO) satellites for direct-to-satellite connectivity, particularly in less developed countries and defense organizations. This market has gained traction due to the increasing demand for high-speed broadband in remote areas and the need for real-time situational awareness. LEO satellites offer advantages such as low latency, high-frequency bands like Ka-band and V-band, and the ability to cover vast geographical areas. The market's growth can be attributed to the proliferation of IoT devices, the adoption of AI-based algorithms, and the integration of satellite technology with various industries, including agriculture, nature monitoring, and economic activities.

- The 1990s saw the initial development of LEO satellite constellations, but recent advancements in technology have led to an opportunity for growth, with companies like Myriota, Astrocast, and Hiberband Direct entering the fray. Despite the potential, challenges remain, such as cybersecurity attacks and the need for ground gateways. As 5G networks continue to roll out, the integration of satellite technology with terrestrial networks may further expand the market's reach. Overall, the market is poised for significant growth, offering a promising future for various applications, from precision agriculture to industrialized countries' economic development.

How is this Satellite-enabled IoT Industry segmented?

The satellite-enabled iot industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Large enterprise

- SMEs

- Service

- Direct-to-satellite

- Satellite IoT backhaul

- Geography

- North America

- US

- Europe

- France

- Russia

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Source Insights

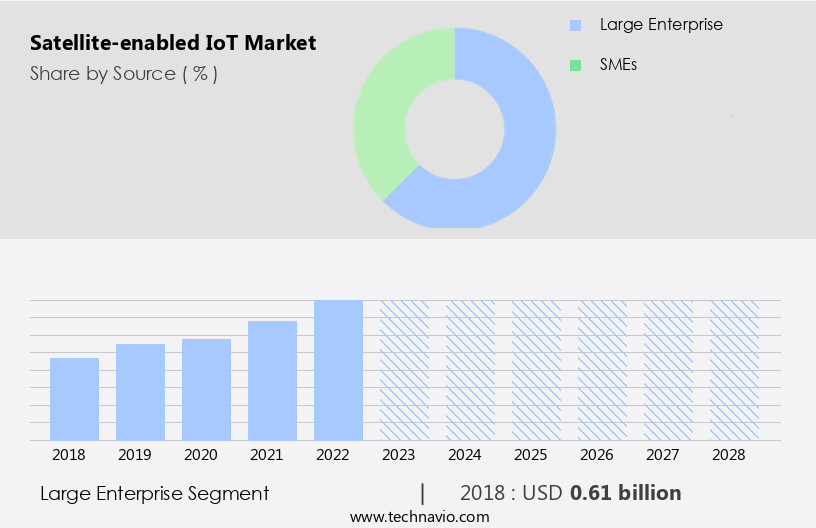

The large enterprise segment is estimated to witness significant growth during the forecast period.

The Satellite IoT market encompasses LEO (Low Earth Orbit) satellites that enable economic activities in industrialized and less developed countries. LEO-based services, such as precision farming with GPS, navigation applications, nature monitoring, and disaster response, are gaining traction. High-speed broadband via Ka-band and direct-to-satellite connectivity offer real-time data transfer for IoT devices, especially in remote areas with limited terrestrial network coverage. Challenges in satellite IoT include cybersecurity attacks and the need for advanced AI-based algorithms for data processing. New farming techniques like Precision Agriculture 4.0 and the gas industry are major consumers of satellite IoT services. Medium Earth Orbit (MEO) and Geostationary Earth Orbit (GEO) satellites also play a role, but LEO satellites' lower altitude offers advantages for IoT applications.

Satellite IoT market dynamics include increasing demand for satellite IoT backhaul for real-time data transfer, the growing number of IoT connections, and the need for application servers and central control systems. V-band spectrum is an emerging technology for satellite IoT. Market players like Astrocast and Myriota are focusing on providing low-cost, high-data-rate satellite IoT solutions. Satellite IoT applications include positioning, asset management, situational awareness, and disaster response. IoT devices require direct-to-satellite services for connectivity, bypassing the need for ground gateways. The satellite IoT market presents opportunities for various industries, including agriculture, defense organizations, and consumers in need of internet connectivity in remote locations.

Get a glance at the market report of share of various segments Request Free Sample

The Large enterprise segment was valued at USD 0.61 billion in 2018 and showed a gradual increase during the forecast period.

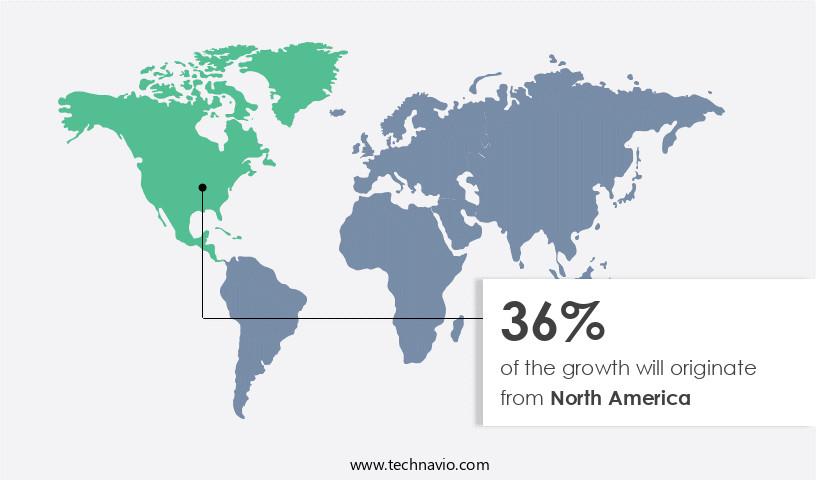

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Satellite IoT market encompasses LEO satellites that facilitate economic activities in industrialized and less developed countries. This market has gained significant traction due to the increasing demand for precision farming, navigation applications, and real-time data transfer. LEO-based services, such as GPS, high-speed broadband, and Ka-band, offer direct-to-satellite connectivity and direct-to-satellite services, enabling service types like disaster response, nature monitoring, and consumers' situational awareness. New farming techniques like Precision Agriculture 4.0 and Agriculture 5.G networks are utilizing satellite IoT backhaul for data transmission, enabling AI-based algorithms to optimize crop yields and improve overall efficiency. The satellite IoT market also caters to industries like gas, where IoT devices require remote area connectivity for asset management and internet connectivity in remote locations.

Defense organizations and various verticals, including agriculture, rely on satellite IoT for data rates, low altitude, and cybersecurity. Companies like Astrocast and Myriota provide V-band spectrum technologies for satellite IoT, offering high data rates and low latency. The challenge of satellite IoT lies in the cost of electronic equipment and band spectrum technologies, while the opportunity lies in the potential for growth and innovation. Satellite IoT applications include positioning applications, ground gateways, central control systems, and application servers. As the market evolves, it is essential to address cybersecurity attacks and ensure the security of satellite IoT networks. The market dynamics of satellite IoT are influenced by the altitude of the satellite type, with LEO orbits providing advantages over Medium Earth Orbit and Geostationary Earth Orbit.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Satellite-enabled IoT Industry?

- Increasing usage of Internet is the key driver of the market.

- The market has experienced significant growth due to the increasing global demand for reliable and swift Internet connectivity, particularly in rural and under-served regions. With more individuals gaining access to the Internet worldwide, the need for dependable connectivity is becoming increasingly crucial. Satellites bridge the digital divide by providing Internet access to areas where terrestrial infrastructure is weak or non-existent.

- This enables users to communicate, transmit and receive data, and access the Internet from anywhere. The in demand for broadband Internet services is a primary driver for the global satellite industry. Online activities, such as e-commerce, online learning, telecommuting, streaming videos, and social media, are becoming increasingly popular and require high-speed Internet connections.

What are the market trends shaping the Satellite-enabled IoT Industry?

- Increasing R and D spending on aerospace and defense is the upcoming market trend.

- The market experiences significant growth due to increasing research and development (R&D) investments in the aerospace and defense sector. These investments facilitate advancements in satellite technology, including the design of more efficient propulsion systems, communication capabilities, sensors, and imaging technologies. The resulting improvements enhance the functionality, reliability, and performance of defense satellites. Furthermore, R&D expenditures contribute to the development of more sophisticated satellite communication systems, offering enhanced encryption capabilities, faster data transmission rates, and safer satellite connections.

- This technological progression is crucial for maintaining a competitive edge and ensuring the security and effectiveness of IoT applications in various industries.

What challenges does the Satellite-enabled IoT Industry face during its growth?

- Regulatory issues in satellite operations and services is a key challenge affecting the industry growth.

- The market faces significant challenges from government regulations. These rules can significantly impact the growth and profitability of businesses in this sector. Governments control satellite operations and services through various means, including limitations on launches, spectrum allocation, licensing, and technical criteria. The stringent regulations are often put in place for reasons of national security or protection of domestic industries. New competitors find it difficult to enter the market due to the time and financial resources required to secure necessary permits and approvals.

- These regulations add complexity and cost to the market, making it a challenging environment for businesses.

Exclusive Customer Landscape

The satellite-enabled iot market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the satellite-enabled iot market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, satellite-enabled iot market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Al Yah Satellite Communications Co. PJSC - Satellite-enabled Internet of Things (IoT) solutions, such as Thuraya's M2M offering, provide uninterrupted connectivity for government operations across land and sea. This cutting-edge technology ensures seamless communication in remote areas, enhancing situational awareness and operational efficiency. Thuraya's IoT services leverage advanced satellite technology to deliver reliable, high-speed data transmission, making it an indispensable tool for civil defense and other critical government applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Yah Satellite Communications Co. PJSC

- Astrocast

- EMnify GmbH

- Eutelsat Communications S.A.

- Fleet Space Technologies Pty Ltd.

- Globalstar Inc.

- GMV Innovating Solutions SL

- Inmarsat Global Ltd.

- Intelsat US LLC

- Iridium Communications Inc.

- Kineis

- Kongsberg Gruppen ASA

- Myriota

- OQ Technology

- ORBCOMM Inc.

- SATELIO IOT SERVICES S.L.

- Space Exploration Technologies Corp.

- Thales Group

- Viasat Inc.

- Vodafone Group Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market: A Game Changer in Economic Activities The integration of Low Earth Orbit (LEO) satellites into the Internet of Things (IoT) ecosystem is revolutionizing economic activities across various industries. This technological advancement offers a unique blend of precision, real-time data transfer, and connectivity, particularly in regions where terrestrial networks may not be readily available or reliable. LEO satellites, with their low altitude, enable high-speed broadband and direct-to-satellite connectivity, making them an attractive option for industries that require real-time data transfer and situational awareness. These services extend beyond navigation applications, encompassing nature monitoring, precision farming, asset management, disaster response, and more.

The economic potential of LEO-based services is vast, with applications in industries such as agriculture, gas, defense, and consumer sectors. In the agriculture vertical, LEO satellites are transforming traditional farming practices into precision agriculture, allowing farmers to optimize crop yields and reduce water usage through AI-based algorithms and real-time data transfer. The challenge of providing internet connectivity to remote areas is a significant hurdle for less developed countries. LEO satellites offer an opportunity to bridge this digital divide, providing affordable and reliable internet access to these regions. The satellite IoT market is poised to grow exponentially, driven by the demand for high-speed, low-latency connectivity.

The satellite IoT market is not without its challenges, however. Cybersecurity attacks and the need for secure data transmission are critical concerns. With the increasing number of IoT devices and the vast amounts of data being transmitted, ensuring data security is paramount. Central control systems and application servers play a crucial role in managing and securing this data. The satellite IoT market is also witnessing intense competition, with various satellite types, including LEO, Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO), vying for market share. Each satellite type offers unique advantages, and the choice depends on the specific application requirements.

The satellite IoT market is still in its infancy, but its potential is immense. As the technology matures and becomes more affordable, we can expect to see widespread adoption across various industries, transforming the way we live, work, and connect. The future of the satellite IoT market is bright, offering numerous opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.92% |

|

Market growth 2024-2028 |

USD 2.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.86 |

|

Key countries |

US, China, Japan, Russia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Satellite-enabled IoT Market Research and Growth Report?

- CAGR of the Satellite-enabled IoT industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the satellite-enabled iot market growth of industry companies

We can help! Our analysts can customize this satellite-enabled iot market research report to meet your requirements.