Satellite Propulsion System Market Size 2024-2028

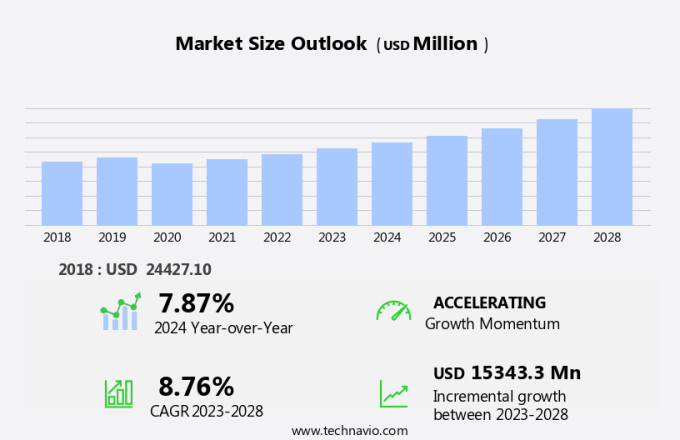

The satellite propulsion system market size is forecast to increase by USD 15.34 billion at a CAGR of 8.76% between 2023 and 2028.

- The market is experiencing significant growth, driven by the emergence of low-cost satellites. This trend is fueled by the increasing demand for cost-effective space exploration and communication solutions. However, one challenge facing the market is the insufficient thrust generation with all-electric propulsion systems. Traditional propulsion systems using inert gases continue to dominate due to their superior thrust capabilities. The market analysis also highlights the need for advancements in propulsion technology to address this challenge and meet the evolving demands of the satellite industry. Additionally, the miniaturization of satellites and the increasing focus on reusable launch vehicles are expected to provide new opportunities for market growth.

- Overall, the market is poised for growth, with a focus on improving efficiency, reducing costs, and enhancing performance.

What will be the Size of the Satellite Propulsion System Market During the Forecast Period?

- The market is a critical segment of the space technology industry, driven by the increasing demand for launch vehicles and artificial satellites. Industrialized countries dominate this market due to their significant investments in space exploration and high-speed broadband infrastructure. Government funding and space agencies play a pivotal role in driving market growth, particularly In the development and deployment of primary propulsion systems for spacecraft. Technological improvements in satellite propulsion systems, such as electric propulsion systems and both bipropellant and monopropellant propulsion systems, are reducing the cost of satellite manufacturing and launching, making it accessible to private companies and space startups.

- The fiscal climate also influences market trends, with a growing emphasis on affordable broadband and station-keeping for low-cost satellites in developing nations. The solar system's vast expanse necessitates the continuous innovation and development of efficient propulsion systems for orbit raising and maintaining satellite positions at launch pads.

How is this Satellite Propulsion System Industry segmented and which is the largest segment?

The satellite propulsion system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Chemical propulsion

- Hybrid propulsion

- All-electric propulsion

- Application

- MEO satellite

- GEO satellite

- LEO satellite

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

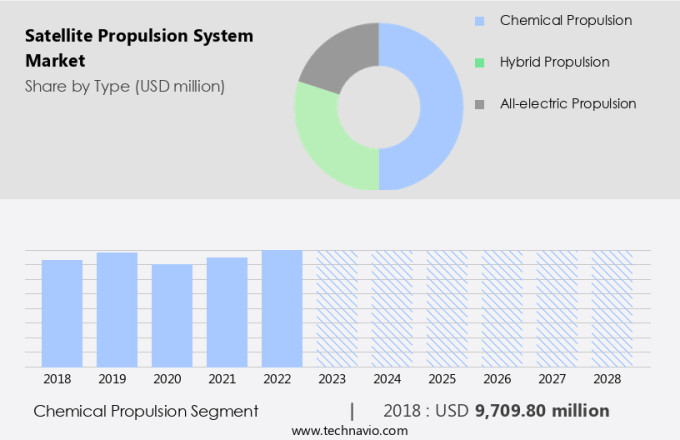

- The chemical propulsion segment is estimated to witness significant growth during the forecast period.

Satellite propulsion systems play a crucial role in enabling the movement and positioning of satellites in orbit. Traditional chemical propulsion systems, while effective, carry a significant amount of fuel and limit the payload capacity of satellites, particularly for nano and microsatellites. These systems also lack the ability to be stopped or restarted once ignited, requiring multiple stages for multiple burns and increasing overall weight and cost. Alternative propulsion technologies, such as digital control systems, commercial space industry-backed pneumatic/hybrid systems, cold gas propulsion, and pulsed plasma propulsion, offer more efficiency and flexibility. Green liquid propulsion systems are also gaining traction due to their environmental benefits.

These advancements aim to enhance satellite performance and reduce operational costs.

Get a glance at the Satellite Propulsion System Industry report of share of various segments Request Free Sample

The Chemical propulsion segment was valued at USD 9.71 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

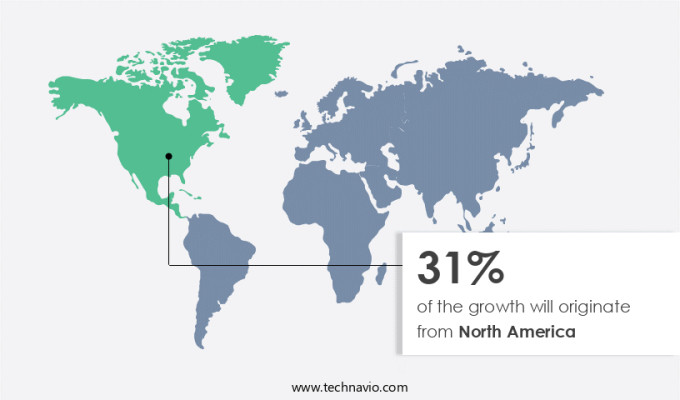

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region leads The market, driven by the US, Canada, and Mexico. These industrialized countries possess advanced infrastructures and are actively engaged in space programs. Notable entities like NASA and SpaceX are innovating reusable satellite launch vehicles to cater to the increasing demand for satellites. The US government's civilian space sector, managed by NASA, focuses on aeronautics research, exploration systems, science, and space operations. Developing nations are also investing in satellite technology to provide affordable broadband access, with low-cost, high-speed solutions becoming increasingly important. The market is expected to grow significantly due to these factors.

Market Dynamics

Our satellite propulsion system market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Satellite Propulsion System Industry?

Emergence of low-cost satellites is the key driver of the market.

- The market is witnessing significant advancements due to the increasing focus on cost-effective and efficient space technology by industrialized countries and developing nations. In recent years, the use of new-generation and reusable launch vehicles has gained momentum, driving down the cost of satellite launches. For instance, in January 2020, the Indian Space Research Organization (ISRO) announced the launch of low-cost satellite launch vehicles, and the successful flight-test of its Reusable Launch Vehicle-Technology Demonstrator (RLV-TD). Similarly, SpaceX is developing a fully reusable space launch vehicle for multiple satellite launch missions. Satellite propulsion systems are essential for various applications, including high-speed broadband, telecommunications, Earth observation, and space exploration.

- These systems are used for orbit raising, station-keeping, attitude control, and primary propulsion. The market for satellite propulsion systems is diverse, with various types of propulsion systems, such as chemical rockets, electric propulsion systems, momentum wheels, green chemical propulsion, hydrazine, cold gas propulsion, pulsed plasma propulsion, green liquid, ambipolar thrusters, and water electrolyzed cold gas thrusters. Government space agencies and commercial space industry players are investing in technological improvements to make satellite propulsion systems more affordable and efficient. Pneumatic/hybrid systems and Bipropellant Propulsion System are some of the emerging propulsion technologies. The commercial space industry, including space startups and private companies, is also playing a crucial role in driving the growth of the market.

- The fiscal climate and space taxis are some of the key factors influencing the market. The vacuum of space provides unique challenges for propulsion systems, requiring advanced technologies and digital control systems for optimal performance. Overall, the market is expected to continue growing due to the increasing demand for affordable broadband, Earth observation, and space exploration.

What are the market trends shaping the Satellite Propulsion System Industry?

Propulsion by inert gases is the upcoming market trend.

- Satellite propulsion systems play a crucial role In the space industry, enabling the control and maneuverability of spacecraft and satellites. Propulsion systems, including electric propulsion systems and chemical rockets, are essential components of launch vehicles, powering the ascent of satellites into the vacuum of space. Industrialized countries and space agencies invest heavily In these technologies to support their space exploration initiatives and provide high-speed broadband connectivity to developing nations. Air Liquide, a leading player In the space technology sector, has contributed significantly to space-based exploration for over five decades. The company's expertise lies in producing propellants, such as xenon, which are ionized and accelerated using high electric potential at thrusters' exits for interplanetary and satellite attitude control applications.

- The power requirements for these systems fall withIn the kW range. Other propulsion systems, such as momentum wheels, green chemical propulsion, cold gas propulsion, pulsed plasma propulsion, and ambipolar thrusters, are also used for orbit raising, station-keeping, and primary propulsion in low-cost satellites. The commercial space industry, including telecommunications and Earth observation, benefits significantly from these advancements in space technology. Pneumatic/hybrid systems and cold gas thrusters are also employed for attitude control and digital control systems. The fiscal climate and the growth of space startups and private companies have led to technological improvements in satellite propulsion systems, making space launches more affordable and accessible.

What challenges does the Satellite Propulsion System Industry face during its growth?

Insufficient thrust generation with all-electric propulsion systems is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for nano and microsatellites from industrialized countries and developing nations. These satellites require high-reliability standards and longer mission life for various space applications. While all-electric propulsion systems, which are commonly used for small and low-cost satellites, offer advantages such as fuel efficiency and long-life operation, they face challenges in withstanding the extreme conditions of satellite launches and space exposure. For instance, during the launch of two electric-powered satellites, the all-electric propulsion system did not provide sufficient thrust at the initial stage compared to chemical fuels. Space technology continues to evolve, with advancements in propulsion systems playing a crucial role.

- Both chemical and electric propulsion systems are used for satellite propulsion. Chemical rockets use propellant to generate thrust, while electric propulsion systems use electric power. Momentum wheels, green chemical propulsion, hydrazine, and cold gas propulsion are some of the commonly used chemical propulsion methods. Electric propulsion systems include technologies such as ion thrusters, electrically charged grids, and plasma propulsion. The commercial space industry, including telecommunications and Earth observation sectors, is driving the demand for low-cost satellites and affordable broadband services. Space agencies and private companies are investing in technological improvements to develop more efficient and cost-effective propulsion systems. The fiscal climate and the increasing number of space startups are also contributing to the growth of the market.

- In conclusion, the market is witnessing significant growth due to the increasing demand for small and low-cost satellites. While all-electric propulsion systems offer advantages, they face challenges in withstanding the extreme conditions of satellite launches and space exposure. The commercial space industry and space agencies are investing in technological improvements to develop more efficient and cost-effective propulsion systems. The market dynamics include the increasing demand for high-speed broadband, the role of government funding, and the growing influence of the aerospace park and industrial ecosystem.

Exclusive Customer Landscape

The satellite propulsion system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the satellite propulsion system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, satellite propulsion system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Airbus SE - The Company specializes in designing and manufacturing advanced Satellite Propulsion Systems for the US market. Our proprietary technology ensures optimal performance and efficiency in orbit maintenance and maneuvering. Our systems utilize environmentally friendly propellants and are designed for extended mission durations. With a focus on innovation and reliability, we cater to the needs of leading satellite manufacturers and operators. Our solutions enable enhanced satellite capabilities, contributing to advancements in telecommunications, earth observation, and navigation systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- ArianeGroup

- CU Aerospace

- ESCO Technologies Inc.

- Eutelsat S.A.

- Hispasat SA

- IHI Corp.

- Inmarsat Global Ltd.

- Intelsat US LLC

- Moog Inc.

- Northrop Grumman Corp.

- OHB SE

- Rafael Advanced Defense Systems Ltd.

- Safran SA

- SES SA

- SKY Perfect JSAT Holdings Inc.

- Starfish Space

- Telesat Corp.

- Thaicom Public Co. Ltd.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Satellite Propulsion Systems: Market Dynamics and Technological Advancements Satellite propulsion systems play a crucial role In the space industry, enabling the deployment and maneuvering of artificial satellites in various orbits. These systems are essential for maintaining the position of satellites In their designated orbits, performing orbit raising, station-keeping, and other necessary functions. The satellite propulsion market is driven by several factors. The increasing demand for high-speed broadband and telecommunications services, particularly in industrialized countries, is a significant factor. Governments and private entities invest heavily in satellite technology to expand their telecommunications infrastructure and provide affordable broadband to their populations.

Moreover, the development of low-cost satellites and the emergence of new space startups and private companies have led to an increase In the number of satellite launches. This trend is expected to continue as technological improvements in satellite propulsion systems make space travel more accessible and cost-effective. Satellite propulsion systems come in various types, including chemical rockets, electric propulsion systems, momentum wheels, and pneumatic/hybrid systems. Chemical propulsion systems use propellants such as hydrazine, nitrogen tetroxide, and kerosene to generate thrust. Electric propulsion systems, on the other hand, use electric fields to accelerate ions or electrons, generating thrust more efficiently than chemical propulsion.

The vacuum of space presents unique challenges for satellite propulsion systems, requiring them to be highly efficient and reliable. The use of green chemical propulsion and other environmentally-friendly technologies is becoming increasingly important as concerns about space debris and the environmental impact of space travel grow. Solar system exploration also relies heavily on satellite propulsion systems. Space agencies and private companies use these systems to send spacecraft to other planets and moons, enabling us to expand our knowledge of the solar system and beyond. The commercial space industry is also driving innovation in satellite propulsion systems. Digital control systems and attitude control technologies have made it possible to develop more precise and efficient propulsion systems.

New propulsion technologies, such as ambipolar thrusters, water electrolyzed thrusters, and cold gas thrusters, are being developed to meet the growing demand for affordable and efficient satellite propulsion. The fiscal climate also plays a role In the satellite propulsion market. Government funding for space programs and private investment in space technology can significantly impact the market's growth. The development of space taxis and reusable rockets is expected to further reduce the cost of space travel and satellite deployment. In conclusion, the satellite propulsion market is driven by the growing demand for high-speed broadband and telecommunications services, the increasing number of satellite launches, and the development of new technologies.

The use of green propulsion systems and the growing role of the commercial space industry are expected to shape the future of satellite propulsion.

|

Satellite Propulsion System Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.76% |

|

Market growth 2024-2028 |

USD 15343.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.87 |

|

Key countries |

US, UK, China, Russia, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Satellite Propulsion System Market Research and Growth Report?

- CAGR of the Satellite Propulsion System industry during the forecast period

- Detailed information on factors that will drive the Satellite Propulsion System growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the satellite propulsion system market growth of industry companies

We can help! Our analysts can customize this satellite propulsion system market research report to meet your requirements.