Sauces And Dressings Market Size 2025-2029

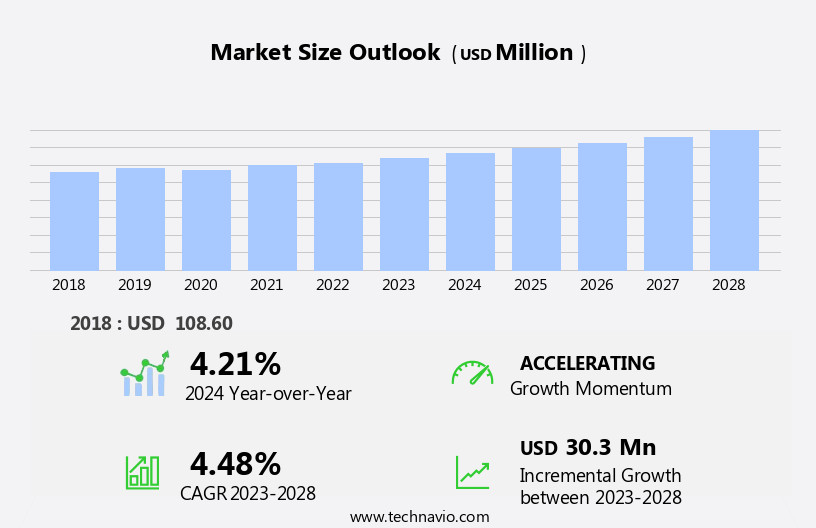

The sauces and dressings market size is forecast to increase by USD 32.8 million, at a CAGR of 4.6% between 2024 and 2029.

- The market is characterized by the dynamic interplay of key drivers, trends, and challenges. New product launches continue to shape the market landscape, with companies introducing innovative offerings to cater to evolving consumer preferences. The emergence of private label brands poses a significant challenge, as they increasingly capture market share with their competitive pricing and customized offerings. Fluctuating raw material prices add complexity to the market, requiring companies to adapt their strategies and manage costs effectively.

- Navigating these dynamics will require strategic planning and agility from market participants. Companies seeking to capitalize on opportunities and mitigate challenges must stay abreast of consumer trends and market developments, while also managing their supply chains and pricing strategies effectively.

What will be the Size of the Sauces And Dressings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer preferences for convenience, flavor, and health. Grocery stores and restaurant chains remain key players in this dynamic market, offering a wide range of options from traditional favorites like ketchup and mayonnaise to more exotic offerings such as hollandaise and béarnaise sauces. Tomato puree and tomato paste serve as essential bases for many sauces and dressings, while spice blends and flavor enhancers add depth and complexity. Regulatory compliance and shelf life are critical considerations for suppliers, requiring robust quality control processes and efficient supply chain management. Consumer trends towards all-natural and clean label ingredients have led to innovation in the market, with many manufacturers focusing on herb blends and natural flavor profiles.

Online retailers and food service providers have also emerged as significant players, offering convenience and flexibility to consumers. French dressing, honey mustard, thousand island dressing, and caesar dressing are just a few of the many types of sauces and dressings that cater to diverse tastes and preferences. Ingredients sourcing and production processes are continually evolving to meet the demands of this dynamic market. Marketing strategies play a crucial role in differentiating brands and capturing market share. From ranch dressing's ranch-themed marketing to Worcestershire sauce's rich history and heritage, sauces and dressings offer ample opportunities for creative and effective marketing campaigns.

Hot sauce and soy sauce, with their distinct flavor profiles and versatility, continue to gain popularity, with BBQ sauce and Italian dressing also remaining staples in the market. Nutritional information and health claims are increasingly important factors in consumer decision-making, driving innovation in low-sodium, low-sugar, and organic offerings. Overall, the market is a continuously unfolding landscape, with new trends, players, and innovations emerging regularly. From grocery stores to restaurant chains, convenience stores, and online retailers, the market's diversity and dynamism offer endless opportunities for growth and success.

How is this Sauces And Dressings Industry segmented?

The sauces and dressings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Table and cooking sauces

- Dressings

- Pickled products

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Independent retailers

- Online retailers

- Others

- Application

- Household consumption

- Foodservice industry

- Industrial use

- Packaging

- Bottles

- Jars

- Pouches

- Single-Serve Packets

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The table and cooking sauces segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of condiments, from table sauces like ketchup and mustard to dressings such as ranch, caesar, and Italian. Consumer preferences for all-natural, herb-blended, and flavorful options continue to drive market growth. Regulatory compliance and quality control are paramount in production processes to ensure food safety. Tomato paste and puree are key ingredients in various sauces and dressings, including popular choices like marinara, pizza, and barbecue sauces. Convenience stores and grocery stores cater to consumers' demand for quick and easy meals, contributing significantly to the market's revenue. Online retailers have also emerged as a significant distribution channel, offering consumers a wider selection and convenience.

Soy sauce, Worcestershire sauce, hot sauce, and flavor enhancers are essential components in various culinary applications, from Asian cuisine to Western dishes. Restaurant chains and food service establishments are major consumers of sauces and dressings due to their large-scale operations and the need for consistent flavor profiles. Marketing strategies focusing on nutritional information and convenience have gained traction, with honey mustard, Thousand Island dressing, and French dressing being popular options for health-conscious consumers. Production processes must balance affordability, taste, and quality to cater to diverse consumer preferences. Innovations in production techniques, such as improved shelf life and supply chain management, have streamlined operations and reduced costs for manufacturers.

The Table and cooking sauces segment was valued at USD 51.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

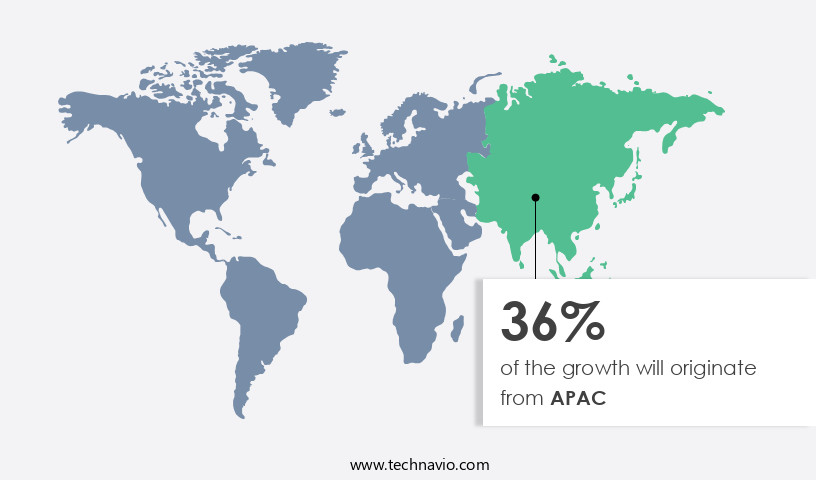

APAC is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is a significant revenue generator, with China and Japan leading the consumer base. The region's robust economic growth and the convenience offered by sauces and dressings are key growth drivers. The Indian and Chinese economies' anticipated expansion during the forecast period indicates higher consumer disposable incomes, enabling them to purchase more sauces and dressings products. The preference for home-cooked meals over dining out is another growth factor. The APAC market is marked by an increasing number of new product launches, including all-natural, herb blends, and flavor enhancers. Regulatory compliance and quality control are essential in production processes, ensuring food safety for consumers.

Grocery stores and convenience stores are the primary sales channels, while restaurant chains and food service also contribute significantly. Consumer preferences for various flavor profiles, such as ranch dressing, Worcestershire sauce, hot sauce, soy sauce, Caesar dressing, French dressing, honey mustard, Thousand Island dressing, Italian dressing, BBQ sauce, and Hollandaise sauce, influence market trends. Online retailers are gaining popularity, and supply chain efficiency is crucial to meet consumer demand. Tomato paste and tomato puree are essential ingredients, while spice blends add unique flavors. Nutritional information is a critical consideration for consumers, and companies employ marketing strategies to cater to these preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B tortilla supply solutions leverage advanced tortilla production technologies for quality. Tortilla market growth opportunities 2025 include gluten-free tortilla products and organic tortillas for retail, meeting demand. Tortilla supply chain software optimizes operations, while tortilla market competitive analysis highlights players like Mission Foods. Sustainable tortilla manufacturing aligns with eco-friendly food trends. Tortilla regulations 2024-2028 shape tortilla demand in North America 2025. Premium tortilla solutions and tortilla market insights boost adoption. Tortillas for foodservice and customized tortilla formulations target niches. Tortilla market challenges and solutions address shelf life, with direct procurement strategies for tortillas and tortilla pricing optimization enhancing profitability. Data-driven tortilla market analytics and ethnic snack trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Sauces And Dressings Industry?

- The introduction of new products serves as the primary catalyst for market growth. The market experiences growth due to the continuous introduction of new products by market participants. These new product launches contribute significantly to a company's revenue and market presence. For instance, in April 2023, The Kraft Heinz Company unveiled a new line of Spicy Ketchup flavors, including Chipotle (medium), Jalapeno (hot), and Habanero (hotter), as well as the first-ever HEINZ Hot 57 Sauce, which offers unique pepper bases and diverse flavors, catering to the preferences of spice enthusiasts. Quality control and supply chain management are crucial aspects of the sauces and dressings industry. Manufacturers prioritize using high-quality ingredients, such as tomato paste and herb blends, to maintain consistency in their products' flavor profile.

- Online retailers have also emerged as significant distribution channels, providing consumers with convenient access to a wide range of sauces and dressings. Production processes are continually evolving to meet the changing demands of consumers, who increasingly seek all-natural and healthier options.

What are the market trends shaping the Sauces And Dressings Industry?

- Private label brands are gaining increasing popularity in the market, signifying a notable trend in consumer preferences. Your request for a professional and grammatically correct response is noted and understood.

- The market is experiencing growth due to the rising popularity of private label brands. Supermarkets and grocery stores are capitalizing on this trend by introducing their own private label brands of sauces and dressings. These products are often priced lower than mainstream brands, making them attractive options for budget-conscious consumers. For instance, Walmart offers a range of sauces under its private label brand, Great Value. The demand for private label brands is expected to continue growing during the forecast period, with more supermarket chains likely to enter the market. Additionally, classic dressings such as French dressing, honey mustard, and thousand island dressing remain popular choices in both food service and at home.

- Spice blends and flavor enhancers are also gaining traction as consumers seek to add variety and depth of flavor to their meals. Overall, the market is poised for continued growth as consumers seek convenient and affordable options to enhance their culinary experiences.

What challenges does the Sauces And Dressings Industry face during its growth?

- The volatility of raw material prices poses a significant challenge to the industry's growth trajectory. The market is subject to the volatility of raw material prices, particularly in sectors like oyster sauces and pasta sauces. Ingredients such as sugar, salt, and oysters in oyster sauces, and condiments and vegetables in pasta sauces, undergo price fluctuations based on availability. These price variations impact manufacturing costs and profit margins for businesses in the market. For instance, in the oyster sauce sector, the price instability of key ingredients like sugar, salt, and oysters can significantly increase manufacturing costs, thereby reducing profitability. To counteract these rising costs, companies may explore alternative, cost-effective ingredients to maintain competitiveness. The pasta sauce industry also grapples with similar challenges due to fluctuating prices of essential ingredients.

- This market trend underscores the importance of effective ingredients sourcing strategies and marketing initiatives to mitigate the impact of raw material price fluctuations. Companies must stay agile and adapt to these market dynamics to ensure continued success in the market.

Exclusive Customer Landscape

The sauces and dressings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sauces and dressings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sauces and dressings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Campbell Soup Co. - This company specializes in a diverse selection of sauces for various culinary applications. Notable offerings include Southern BBQ Slow and Thai Curry Chicken Sauce, among others. These high-quality condiments cater to diverse taste preferences and culinary traditions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Campbell Soup Co.

- Coles Group Ltd.

- Conagra Brands Inc.

- General Mills Inc.

- Haven Row LLC

- Hope Foods LLC

- Hormel Foods Corp.

- Kikkoman Corp.

- Kinneret Farm LTD

- Lee Kum Kee

- Mars Inc.

- McCormick and Co. Inc.

- Nandos Group

- Nestle SA

- PepsiCo Inc.

- Sabra Dipping Co. LLC

- SAJJ Mediterranean

- Sweet Baby Rays

- The Kraft Heinz Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sauces And Dressings Market

- In January 2024, H.J. Heinz Company, a leading player in the market, announced the launch of its new line of organic ketchups in the United States. This expansion aimed to cater to the growing consumer demand for organic and natural food products (Heinz Press Release, 2024).

- In March 2024, Unilever, another major player, entered into a strategic partnership with a local Indian company, MTR Foods, to expand its reach in the Indian the market. This collaboration allowed Unilever to leverage MTR's strong distribution network and local expertise (Unilever Press Release, 2024).

- In May 2024, Kraft Heinz, a global food company, completed the acquisition of Primal Kitchen, a leading maker of avocado oils and dressings in the United States. This acquisition was a significant step for Kraft Heinz to strengthen its presence in the fast-growing segment of healthier sauces and dressings (Kraft Heinz Press Release, 2024).

- In April 2025, the European Commission approved the merger of Danone and WhiteWave Foods, creating a leading player in The market. This merger brought together Danone's dairy and plant-based offerings with WhiteWave's plant-based brands, allowing the combined entity to cater to a wider consumer base (European Commission Press Release, 2025).

Research Analyst Overview

- The market is characterized by a dynamic interplay of various factors, including advancements in food technology and flavor chemistry, consumer behavior, and import/export regulations. Spice extraction and sensory analysis are crucial components of product innovation, ensuring authentic flavors and consumer satisfaction. Contract manufacturing enables smaller businesses to produce bulk quantities, while herb cultivation and chili pepper farming remain essential for raw material sourcing. Food technology and flavor chemistry continue to shape the market, with manufacturers focusing on manufacturing efficiency, waste reduction, and shelf-stable products. Consumer preferences for refrigerated, frozen, and single-serve packets are driving demand for new packaging materials and portion control solutions.

- International markets present both opportunities and challenges, with private label brands gaining popularity and ingredient costs influencing pricing strategies. Vinegar types and oil types are key ingredients, with manufacturers exploring various options to cater to diverse consumer tastes. E-commerce platforms are transforming sales channels, while environmental impact and import/export regulations are critical considerations for businesses operating in this sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sauces And Dressings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 32.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Canada, Japan, India, UK, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sauces And Dressings Market Research and Growth Report?

- CAGR of the Sauces And Dressings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sauces and dressings market growth of industry companies

We can help! Our analysts can customize this sauces and dressings market research report to meet your requirements.