Scandium Market Size 2024-2028

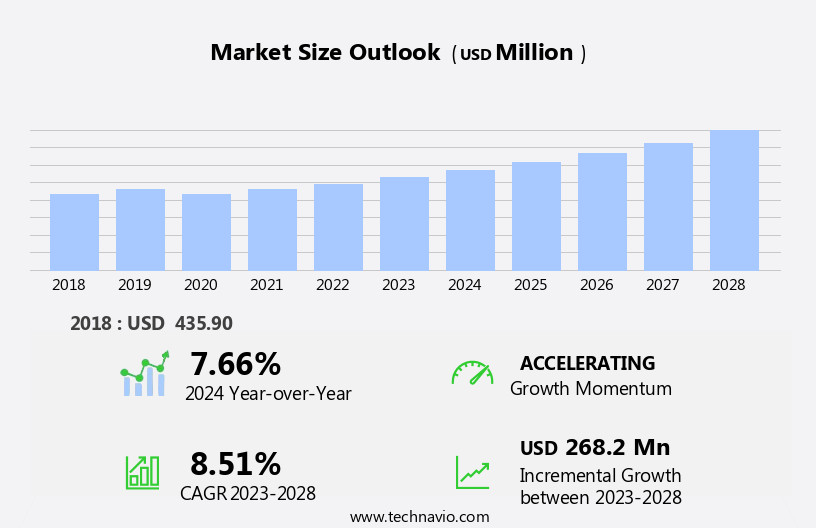

The scandium market size is forecast to increase by USD 268.2 million at a CAGR of 8.51% between 2023 and 2028.

What will be the Size of the Scandium Market During the Forecast Period?

How is this Scandium Industry segmented and which is the largest segment?

The scandium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Solid oxide fuel cells

- Aerospace and defense

- Electronics

- Sporting goods

- Others

- Geography

- North America

- US

- Europe

- Germany

- France

- APAC

- China

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

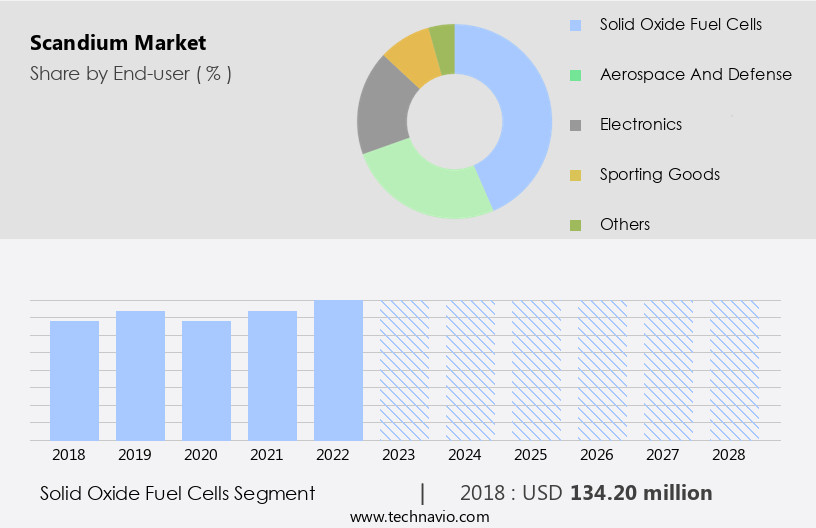

- The solid oxide fuel cells segment is estimated to witness significant growth during the forecast period.

Solid oxide fuel cells (SOFCs) are advanced energy conversion technologies that generate power through the direct reaction of a fuel and an oxidant across an ionic conducting oxide electrolyte. The electrolyte, a solid oxide substance, facilitates the movement of oxygen ions from the anode to the cathode without the requirement for precious metals, corrosive acids, or molten materials. SOFCs are primarily used in energy generation applications, particularly for converting natural gas into electricity. However, the high temperatures needed for catalytic conversion may lead to rapid degradation of the ceramic electrolyte, increasing capital and maintenance costs. SOFCs play a significant role in various industries, including aerospace, defense, and electronics, offering energy efficiency and environmental benefits.

The energy storage technology is gaining traction In the transition to a low-carbon economy, with applications in fuel cells, battery electric vehicles (BEVs), and fuel cell electric vehicles (FCEVs). The Energy Information Administration, Renewable power, and clean energy sectors are also exploring the potential of SOFCs in energy generation from coal, natural gas, nuclear power, and renewable sources. The Inflation Reduction Act and various market research firms, such as Elcogen, Bloom Energy, and Vantage Market Research, are investing in this technology to address the challenges and drive innovation.

Get a glance at the Scandium Industry report of share of various segments Request Free Sample

The Solid oxide fuel cells segment was valued at USD 134.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

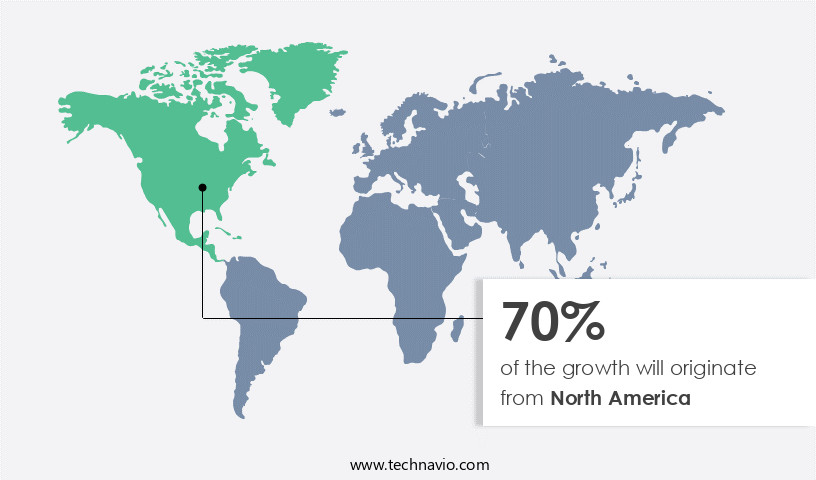

- North America is estimated to contribute 70% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The United States has been a pioneer In the deployment of commercial-scale fuel cells, driven by government funding and growing demand from the automobile industry. SOFC-based fuel cells are poised to revolutionize the transportation sector by enhancing efficiency in light-duty vehicles and forklifts, contributing to the reduction of oil consumption and emissions. By the end of 2022, the transportation sector is expected to witness substantial growth in fuel cell adoption. With over 9,000 fuel cell electric vehicles (FCEVs) in operation by this year, the US maintains its position as a global leader in this technology. The fuel cell market In the US is fueled by the shift towards a low-carbon economy, with applications extending to aircraft manufacturing, electronics production, and energy storage technology.

Key sectors include the aerospace and defense industries, ceramics, electronics, and aluminum-scandium alloys. Energy generation from coal, natural gas, renewable power, and nuclear power also presents significant opportunities for fuel cells in terms of energy efficiency and environmental concerns. The Inflation Reduction Act and various clean energy initiatives further boost the market's growth. Fuel cell companies such as Elcogen, Bloom Energy, and others are at the forefront of this innovation, driving advancements in SOFCs, electrolytes, oxygen ions, anodes, and cathodes. The integration of precious metals and the development of corrosive acid-resistant molten materials are essential for the continued progress of energy storage technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Scandium Industry?

Increasing electronic content in hybrid and electric vehicles is the key driver of the market.

What are the market trends shaping the Scandium Industry?

Imperial development of scandium-modified EV alloy is the upcoming market trend.

What challenges does the Scandium Industry face during its growth?

Need for fuses to sustain challenging and extreme conditions of EVs/HEVs operation is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The scandium market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the scandium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, scandium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Atlantic Equipment Engineers Inc. - Scandium oxide pieces are offerings from the company, catering to the growing demand for this lightweight and high-strength metal in various industries. With superior alloying capabilities, scandium enhances the properties of aluminum, resulting in improved fuel efficiency, increased durability, and heightened corrosion resistance. This versatile material finds applications in aerospace, automotive, and energy sectors, among others. The market is anticipated to expand significantly due to its increasing adoption in advanced materials and alloys.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlantic Equipment Engineers Inc.

- Australian Mines Ltd.

- GFS Chemicals Inc.

- Huizhou Top Metal Material Co. Ltd.

- Lenntech BV

- LB Group Co. Ltd.

- Materion Corp.

- Merck KGaA

- Platina Resources Ltd.

- Stanford Materials Corp.

- Thermo Fisher Scientific Inc.

- Treibacher Industrie AG

- United Company RUSAL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Scandium, a transition metal with a low density and high strength-to-weight ratio, has gained significant attention in various industries due to its unique properties. This metallic element is increasingly being used In the production of alloys, particularly In the aerospace and defense sectors. The demand for scandium is driven by its ability to enhance the performance of materials in high-stress applications. In the aerospace industry, scandium alloys are used to manufacture lightweight and durable aircraft parts. These alloys offer improved fuel efficiency and reduced carbon emissions, making them an essential component In the shift towards a low-carbon economy. Scandium also plays a crucial role In the energy storage technology sector.

It is used In the production of fuel cells, which convert chemical energy into electricity. Scandium-based anodes and cathodes are employed In these fuel cells due to their excellent electrochemical properties, which enable them to store and release energy efficiently. Moreover, scandium is increasingly being used In the electronics industry, particularly In the production of smartphones, TVs, wires, cables, portable computing devices, and gaming systems. Its high electrical conductivity and resistance to corrosive acids make it an ideal material for these applications. Despite its numerous benefits, the production of scandium involves the use of precious metals and energy-intensive processes.

Scandium is primarily extracted from magnesium-nickel-scandium ores, which are processed using high temperatures and corrosive acids. This process is both energy-intensive and environmentally concerning, as it involves the emission of greenhouse gases and the consumption of significant amounts of electricity. The production of scandium alloys also involves the use of other metals, such as titanium and iron ore. These metals are extracted using various methods, including mining and smelting, which can have significant environmental impacts. However, efforts are being made to reduce the environmental footprint of scandium production. For instance, some companies are exploring the use of renewable power sources, such as wind and solar, to power their operations.

Others are investigating alternative methods of scandium extraction, such as the use of electrolytes and oxygen ions, which are less energy-intensive and more environmentally friendly. The demand for scandium is expected to continue growing due to its increasing use in various industries. However, the high production costs and environmental concerns associated with its extraction pose challenges to its widespread adoption. As such, it is essential to explore sustainable production methods and alternative sources of scandium to meet the growing demand while minimizing the environmental impact. In conclusion, scandium is a valuable metallic element with unique properties that make it an essential component in various industries, including aerospace, defense, energy storage technology, and electronics.

However, its production involves the use of precious metals and energy-intensive processes, which can have significant environmental impacts. To meet the growing demand for scandium while minimizing the environmental footprint, it is essential to explore sustainable production methods and alternative sources of this valuable metal.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 268.2 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.66 |

|

Key countries |

US, China, Germany, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Scandium Market Research and Growth Report?

- CAGR of the Scandium industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the scandium market growth of industry companies

We can help! Our analysts can customize this scandium market research report to meet your requirements.