Sea Salt Market Size 2024-2028

The sea salt market size is forecast to increase by USD 3.64 billion at a CAGR of 3.7% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for processed foods, particularly in the foodservice and retail industries. The market is also driven by advancements in packaging technologies, particularly in the textiles and paper sectors, which enable better preservation of salt. Strict regulatory and compliance standards, especially in the oil and gas industry for de-icing applications, further fuel market growth. Renewable energy sources, such as solar evaporation, are gaining popularity in the production of solar salt, contributing to the market's expansion. Waste management and chemical processing are other areas where sea salt finds applications, making it a versatile commodity. Ion exchange resins are increasingly being used in the market, offering opportunities for innovation and efficiency. Overall, the market is witnessing steady growth, driven by its diverse applications and the need for high-quality, sustainable salt production.

What will be the Size of the Market During the Forecast Period?

Sea salt, a natural mineral product obtained from the evaporation of seawater, holds a significant position in various industries, including food, agriculture, and manufacturing. The market in the United States is driven by several factors, including the demand for healthier alternatives, increasing applications in diverse sectors, and the focus on sustainable solutions. The food industry is a major consumer of sea salt. With the transitioning lifestyles and growing health consciousness, consumers are increasingly opting for natural and unprocessed food items. Sea salt, with its natural minerals and trace elements, is gaining popularity as a healthier alternative to refined table salt.

Moreover, sea salt's unique flavor profile is highly sought after in the culinary industry, further boosting market growth. Apart from human food applications, sea salt is also used extensively in animal feed, water treatment, cosmetics, and agriculture. In animal feed, sea salt serves as a natural source of essential minerals and inorganic compounds. In water treatment, it acts as a natural coagulant, improving water quality. In cosmetics, sea salt's antimicrobial properties make it an effective ingredient in various personal care products. In agriculture, sea salt is used as a soil conditioner and fertilizer, enhancing crop growth and yield. Logistics costs and events are two significant challenges impacting the market in the United States.

Furthermore, the high logistics costs associated with the transportation of sea salt from production sites to consumers can affect market growth. Additionally, seasonal events, such as hurricanes and typhoons, can disrupt sea salt production and supply, leading to price fluctuations. To mitigate these challenges, several sustainable solutions are being adopted. Mechanical vapor recompressors (MVR) are being used to reduce energy consumption and cost in sea salt production. These systems help in the efficient recovery of heat and energy, making the production process more sustainable and cost-effective. Furthermore, proper labeling and mandatory certifications are essential to ensure the quality and safety of sea salt..

Market Segmentation

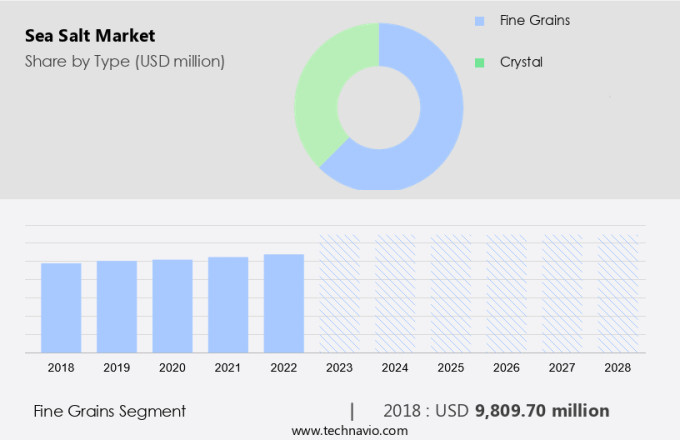

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fine grains

- Crystal

- Application

- Food

- Industrial

- Geography

- APAC

- China

- India

- Europe

- Germany

- France

- North America

- South America

- Middle East and Africa

- APAC

By Type Insights

The fine grains segment is estimated to witness significant growth during the forecast period. Sea salt, particularly in its fine grain form, has gained significant traction in various industries, including the HORECA sector. The fine texture of this salt, which is achieved through careful pulverization, offers several advantages. Its small granules ensure even distribution, making it an excellent choice for experimental cuisine and enhancing the flavors of dishes such as vegan cheese, pasta, bagels, and spice shop blends. Beyond the culinary realm, fine sea salt has also found a place in the cosmetics industries. Sea salt-based cosmetics have become increasingly popular due to their natural origin and potential health benefits. Seasoning companies and agriculture sectors also utilize fine sea salt for its preservative properties, extending the shelf life of packaged rice and other food products.

Furthermore, the convenience-driven lifestyle of North American consumers has fueled the demand for ready-to-eat items. As a result, fine sea salt, with its extended shelf life, has become a preferred ingredient for seafood restaurants and other food service establishments. The versatility of this salt, combined with its ability to enhance flavors and preserve food, has made it an essential component in various industries. Fine sea salt is available in bags with resealable closures, ensuring that it remains fresh and ready for use.

Get a glance at the market share of various segments Request Free Sample

The fine grains segment accounted for USD 9.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing notable growth due to the increasing demand for this natural seasoning in various industries and food consumption. The expansion is mainly fueled by the rapid industrialization in countries like India and China, which has led to an increase in demand from sectors such as food processing, chemical production, and gourmet food products. In particular, industries like pulp and paper, leather, and chemical processing heavily rely on sea salt for their operations, using it as a raw material for the production of inorganic compounds and minerals. China is the leading producer of sea salt in the APAC region, supplying a significant portion of the global demand.

Furthermore, this trend is expected to continue as consumers increasingly prefer clean label products and seek low sodium alternatives, further boosting the demand for sea salt in the region. The health benefits associated with sea salt, including its rich mineral content and absence of additives, also contribute to its popularity. Food consumption remains a major application area for sea salt, with its use extending beyond the kitchen to various industries for diverse purposes. However, it is important to note that while sea salt is a natural product, it still contains sodium and chloride, which can pose health concerns if consumed in excess. Therefore, it is essential to maintain proper consumption levels to reap the benefits while minimizing potential health risks.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for processed foods is the key driver of the market. The demand for sea salt is on the rise due to its extensive usage in various industries, particularly in the food sector. Sea salt is extracted from seawater through a process known as brine extraction. This process involves the evaporation of seawater, leaving behind the salt crystals. Sea salt is also derived from rock salt through mining. In the food industry, sea salt is used as a seasoning and a preservative. It is also preferred over table salt due to the healthier eating trend, as sea salt contains more minerals and less processed additives. In addition, sea salt is used as a de-icing product during winter months.

Furthermore, the production of chlorine-alkali chemicals, such as caustic soda and soda ash, involves the use of sea salt as a catalyst and a drying agent. These chemicals are essential in various industries, including water treatment and textiles. Sea salt is also used in the industrial sector for various applications, including as a purification process agent. The market is expected to grow due to the increasing demand for processed foods and the expanding industrial sector. In the US, the food processing industry is a significant consumer of sea salt. The growing preference for convenience foods and the increasing population are driving the demand for sea salt.

Additionally, the increasing awareness of healthier eating habits is leading to a rise in demand for natural and organic sea salt. In conclusion, sea salt is a versatile product with numerous applications across various industries. Its demand is expected to grow due to the expanding food and industrial sectors and the increasing trend towards healthier eating.

Market Trends

Cutting-edge packaging innovations is the upcoming trend in the market. The market in the United States is experiencing a notable trend towards innovative packaging solutions, which are increasingly influencing consumer purchasing decisions. Packaging serves as the initial contact between consumers and the product, making it a significant element of marketing strategies. Innovative packaging not only improves the visual appeal of sea salt products but also plays a vital role in brand differentiation and shelf presence. One notable advancement in this area is the integration of resealable packaging. This type of packaging preserves product freshness and prevents caking, thereby extending the product's shelf life.

Market Challenge

Strict regulatory and compliance standards related to sea salt is a key challenge affecting the market growth. The market in the United States faces regulatory hurdles that necessitate strict adherence to consumer safety and product quality standards. These regulations, imposed by various industry oversight bodies such as the Food and Drug Administration (FDA), influence the production, distribution, and utilization of sea salt. In the food industry, the FDA sets specific guidelines for the application of food additives, including sea salt. Beyond food applications, sea salt is employed in various industries, including textiles, paper manufacturing, solar evaporation for renewable energy, waste management, de-icing, solar salt, processed foods, vacuum pan salt, chemical processing, oil and gas, and flavoring agent.

Furthermore, the market for sea salt is driven by its use in the food industry, particularly in the production of processed foods and as a flavoring agent. Additionally, the market for sea salt is expanding in the renewable energy sector due to its application in solar evaporation for the production of solar salt. Furthermore, the market is expected to grow in the waste management sector due to the increasing focus on sustainable wastewater treatment methods that utilize sea salt.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ahir Salt Industries: The company offers a variety of sea salt products which includes Food Grade and Industrial Grade sea salt, animal feed coarse salt, textile grade salt and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cape Ann Sea Salt Co

- Cargill Inc.

- Cheetham Salt Ltd

- Compania Espanola de Investigacion y Fomento Minero S A

- Cornish Sea Salt Co. Ltd.

- GURAVE Trade LLP

- Isle of Skye Sea Salt Co Ltd

- Israel Chemicals Ltd.

- Ittefaq Trading Co

- Jagannath Halogen Pvt Ltd

- Maldon Crystal Salt Co Ltd

- Misr Salt

- Morton Salt Inc.

- S.K.S.C. Nadarajan and Bror

- Salt of the Haaretz Ltd

- Sankhs and Surya Products

- SKC Industries LLP

- Tata Consumer Products Ltd.

- True Salt LLC

- V.A.S. Palappa Nadar Sons

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sea salt, derived from seawater or mineral-rich brines, is a valuable commodity in various industries, including food, animal feed, and cosmetics. Proper labeling and fortifications are essential for sea salt to cater to diverse consumer needs, such as health-conscious individuals and those following specific diets like paleo. The transitioning lifestyles and events have led to increased demand for sea salt in the culinary industry, horeca sector, and experimental cuisine. Sea salt, a natural product obtained from the evaporation of seawater, holds a significant market position due to its various applications in human food, animal feed, agriculture, industrial water treatment, cosmetics, and the culinary industry. Logistics costs and de-carbonization efforts have driven the adoption of sustainable solutions like mechanical vapor recompressors (MVR) and electric boilers. Sea salt finds applications in human food, such as packaged rice, vegan cheese, pasta, bagels, spice shops, and seafood restaurants.

Furthermore, it is also used in animal feed and water treatment for its antimicrobial properties and natural coagulant capabilities. In the cosmetics industries, sea salt-based cosmetics offer mineral-infused flavors and health benefits, including digestion aid, immunity boost, and nourishing creams. Antimicrobial properties and use as a natural coagulant in water treatment add to its versatility. Its applications extend to animal feed, agriculture, and even luxury cosmetics. Sea salt's nutritional value and flavor enhancement properties make it an essential ingredient in food processing and chemical production. Its mineral content, including calcium, magnesium, and potassium, makes it an essential ingredient in animal feed. Sustainable production methods, such as solar evaporation and renewable energy, are gaining popularity to reduce costs and minimize environmental impact. Sea salt is also used in de-icing applications, water quality remineralization, and as a natural alternative to inorganic compounds in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2024-2028 |

USD 3.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 55% |

|

Key countries |

China, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ahir Salt Industries, Cape Ann Sea Salt Co, Cargill Inc., Cheetham Salt Ltd, Compania Espanola de Investigacion y Fomento Minero S A, Cornish Sea Salt Co. Ltd., GURAVE Trade LLP, Isle of Skye Sea Salt Co Ltd, Israel Chemicals Ltd., Ittefaq Trading Co, Jagannath Halogen Pvt Ltd, Maldon Crystal Salt Co Ltd, Misr Salt, Morton Salt Inc., S.K.S.C. Nadarajan and Bror, Salt of the Haaretz Ltd, Sankhs and Surya Products, SKC Industries LLP, Tata Consumer Products Ltd., True Salt LLC, and V.A.S. Palappa Nadar Sons |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch