Semiconductor Wafer Inspection Equipment Market Size 2025-2029

The semiconductor wafer inspection equipment market size is forecast to increase by USD 3.78 billion at a CAGR of 8.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for Internet of Things (IoT) devices and the shift towards larger-diameter wafer sizes. The global semiconductor industry is known for its cyclic nature, with market trends and demands evolving rapidly. This presents both opportunities and challenges for market participants. The proliferation of IoT devices is fueling the demand for advanced semiconductor components, leading to increased production and inspection requirements. Simultaneously, the move towards larger wafer sizes offers cost savings and improved efficiency for semiconductor manufacturers. However, the cyclic nature of the industry necessitates a flexible and adaptive business strategy.

- Companies must be prepared to navigate market fluctuations and invest in innovative technologies to maintain a competitive edge. In , the market is poised for growth, with key drivers including the expanding IoT market and the adoption of larger wafer sizes. Market participants must remain agile and responsive to industry trends while investing in advanced technologies to capitalize on these opportunities and navigate the challenges of the cyclic semiconductor industry.

What will be the Size of the Semiconductor Wafer Inspection Equipment Market during the forecast period?

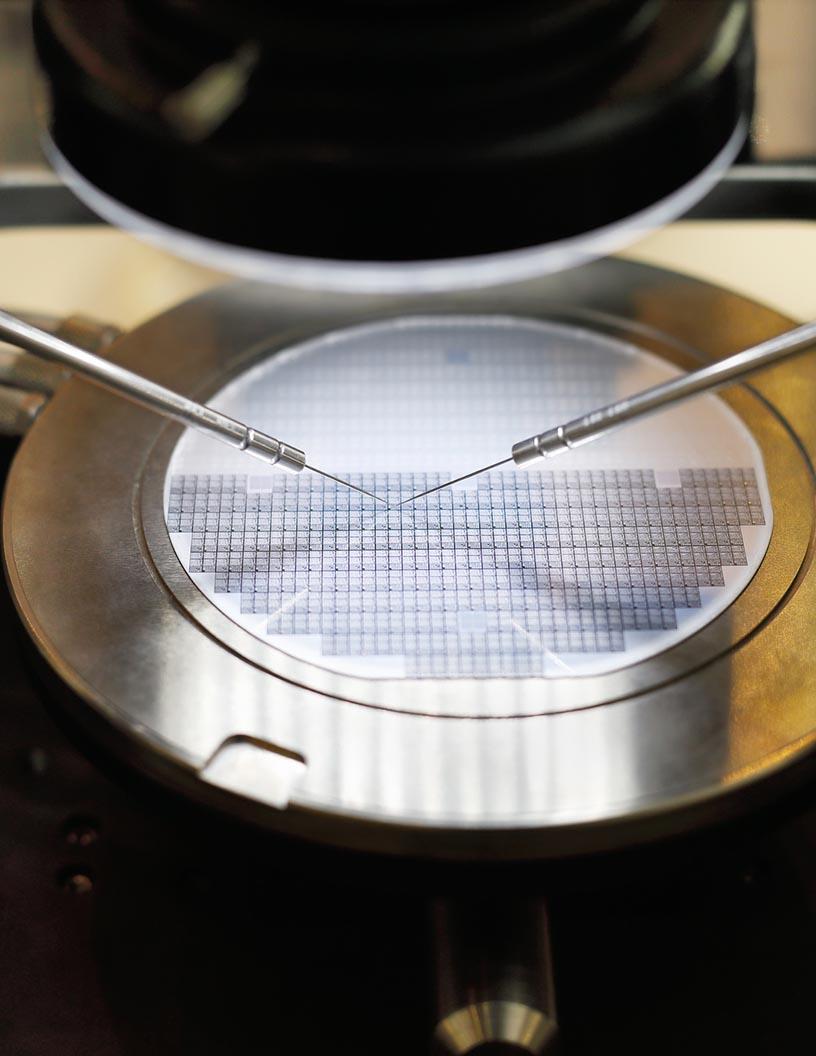

- The market encompasses technologies and solutions designed for the precise examination of semiconductor wafers during the manufacturing process. This market is driven by the increasing demand for reliable semiconductor devices in various sectors, including telecommunication technology, electronic devices, and the Internet of Things (IoT). Yield management is a critical focus area, as even small pattern deviations or wafer edge flaws can significantly impact manufacturing capacity. Advancements in inspection techniques, such as laser scanning inspection, x-ray inspection systems, and differential interference contrast, enable the detection of defects at smaller scales. Machine learning applications and artificial intelligence are increasingly being integrated into wafer inspection systems to enhance defect recognition capabilities.

- Process monitoring and quality control are essential aspects of semiconductor manufacturing, with interconnect layers and chip inspection playing crucial roles. Technological advancements in optical sensors, software algorithms, and industrial automation continue to shape the semiconductor wafer inspection equipment landscape. Wafer cleaning systems and wireless technology are also significant components of this market. The telecom sector and the electronic devices industry are primary consumers of semiconductor wafers, with spin defects and wafer test systems being key concerns for manufacturers. Overall, the market is poised for growth, driven by the increasing complexity and sophistication of semiconductor devices.

How is this Semiconductor Wafer Inspection Equipment Industry segmented?

The semiconductor wafer inspection equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Optical wafer inspection

- E-beam wafer inspection

- Application

- Front-end Process Inspection

- Back-end Process Inspection

- Wafer defect inspection

- Yield management and failure analysis

- End-user

- Foundries

- IDMs

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Taiwan

- North America

- US

- Canada

- Europe

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

The optical wafer inspection segment is estimated to witness significant growth during the forecast period.

Optical wafer inspection equipment is a crucial component in the semiconductor manufacturing industry for ensuring high-quality wafer fabrication. This technology utilizes light reflection to inspect both patterned and un-patterned areas on the silicon wafer. Two primary types of optical wafer inspection exist: brightfield and darkfield. Brightfield inspection, which uses a 193 nm wavelength light source, identifies defects by contrasting the light reflected from the defected surface against non-defective areas. Darkfield inspection, employed in high-volume manufacturing, measures light reflection at lower angles to detect defects. Advanced technologies, such as machine vision, AI-powered defect detection, precision metrology, and predictive maintenance, enhance the capabilities of optical wafer inspection equipment.

These innovations enable real-time defect monitoring, defect classification, and process optimization. Additionally, semiconductor technology advancements, including thin film deposition, advanced semiconductor materials, and next-generation semiconductor devices, necessitate the adoption of advanced wafer inspection solutions. Optical inspection technology continues to evolve, incorporating data analytics, pattern recognition, and IoT devices, to meet the demands of the semiconductor industry.

Get a glance at the market report of share of various segments Request Free Sample

The Optical wafer inspection segment was valued at USD 4.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 75% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is a critical segment of the semiconductor industry, focusing on enhancing yield, ensuring quality, and optimizing processes in wafer fabrication and semiconductor manufacturing. Key technologies include image processing, quality assurance, process control systems, machine vision, automated optical inspection, semiconductor testing, thin film deposition, advanced manufacturing, defect inspection, smart manufacturing, defect detection, precision metrology, dic microscopy, and predictive maintenance. APAC dominates this market due to the high concentration of semiconductor industry players, with China, Taiwan, South Korea, and Japan being the major contributors.

Advanced technologies like AI-powered defect detection, precision wafer mapping, automated defect inspection, and advanced wafer metrology are driving the future of semiconductor manufacturing, focusing on high-performance semiconductor devices, wafer defect detection, and semiconductor process control. Companies invest in research and development to address nanoscale defects and improve semiconductor process optimization, materials, and chip design.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Semiconductor Wafer Inspection Equipment Industry?

- Growing demand for IoT devices is the key driver of the market.

- The semiconductor industry is experiencing significant transformation due to the expanding Internet of Things (IoT) market. IoT devices rely heavily on semiconductor sensor technology for their functionality, making the role of semiconductor inspection systems increasingly important. IoT enables devices to collect, record, and transmit data in real-time without human intervention. The advancements in telecommunication standards, such as 3G, 4G, and 5G, as well as wired communication standards, have accelerated the adoption of IoT devices. As a result, semiconductor inspection systems play a pivotal role in ensuring the production of high-quality sensors for IoT applications.

- The IoT market's growth is driven by various factors, including the increasing demand for smart homes, industrial automation, and wearable devices. Semiconductor inspection systems are essential in maintaining the quality and reliability of these sensors, ensuring optimal performance and longevity.

What are the market trends shaping the Semiconductor Wafer Inspection Equipment Industry?

- Increasing focus on large-diameter wafer size is the upcoming market trend.

- The semiconductor industry has witnessed significant growth over the past 40 years, with a notable expansion in wafer sizes from the initial 23 mm in 1960 to the current 300 mm. This development is attributed to the economies of scale that come with larger wafer sizes. A larger wafer diameter increases the surface area, enabling the production of a higher number of chips at lower manufacturing costs. The shift to larger wafer sizes can lead to a reduction in manufacturing costs by approximately 30% and device costs by 20%-50%.

- Major memory manufacturers, including Samsung, Micron Technology, and SK Hynix, are at the forefront of this trend, investing in the optimization of their 300 mm wafer fabs to enhance IC production. These companies are the primary consumers of these wafers, making their adoption widespread within the semiconductor industry.

What challenges does the Semiconductor Wafer Inspection Equipment Industry face during its growth?

- Cyclic nature of semiconductor industry is a key challenge affecting the industry growth.

- The semiconductor industry experiences significant volatility, marked by periods of growth and retracement. Factors contributing to market fluctuations include excess production capacity, obsolescence of products, and price erosion of ICs. These conditions can result in excess inventory during periods of low demand and insufficient inventory during times of high demand. For example, the worldwide oversupply of NAND memory devices from 2014 to 2016 led to excess inventory and decreased demand for semiconductor wafer inspection equipment.

- This industry instability necessitates the need for effective supply chain management and market forecasting to mitigate risks and optimize operations.

Exclusive Customer Landscape

The semiconductor wafer inspection equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the semiconductor wafer inspection equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, semiconductor wafer inspection equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Applied Materials Inc. - The company specializes in providing advanced semiconductor wafer inspection equipment, including the Vericell solar wafer inspection system. This fully automated tool is designed for crystalline silicon photovoltaic (PV) wafer and cell production. Its capabilities ensure superior quality control and increased efficiency in the manufacturing process. The Vericell system delivers precise inspection results, enhancing overall productivity and reducing waste. By utilizing state-of-the-art technology, this equipment aligns with our commitment to innovation and excellence in the semiconductor industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applied Materials Inc.

- ASML

- Bruker Corp.

- Camtek Ltd.

- Carl Zeiss AG

- Cognex Corp.

- Hitachi Ltd.

- JEOL Ltd.

- KLA Corp.

- Lam Research Corp.

- Lasertec Corp

- Nanometrics Inc.

- Nikon Corp.

- Nova Measuring Instruments Ltd

- NXP Semiconductors NV

- Onto Innovation Inc.

- Synopsys Inc.

- Teradyne Inc.

- Toray Industries Inc.

- TSI Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The semiconductor wafer inspection market encompasses a range of technologies and equipment designed to enhance yield, ensure quality, and optimize processes in the manufacturing of semiconductor devices. Image processing, machine vision, and precision metrology play significant roles in this domain, enabling defect detection and classification with high accuracy. Yield enhancement is a critical objective in semiconductor manufacturing, and advanced manufacturing techniques, such as thin film deposition and wafer cleaning solutions, contribute to this goal. Process control systems employing predictive maintenance and real-time defect monitoring are essential for maintaining optimal semiconductor manufacturing conditions. These systems utilize data analytics, pattern recognition, and defect prevention strategies to minimize downtime and improve overall efficiency.

The integration of artificial intelligence (AI) and IoT devices further enhances the capabilities of semiconductor inspection equipment, allowing for advanced semiconductor process control and next-generation semiconductor technology advancements. Semiconductor materials and chip design are intricately linked to the semiconductor wafer inspection market. Wafer fabrication and semiconductor manufacturing rely on advanced semiconductor materials to create high-performance semiconductor devices. Wafer surface inspection is crucial to ensure the quality of these materials and to detect nanoscale defects that could impact device reliability. Semiconductor inspection equipment includes various technologies, such as automated optical inspection, electron microscopy, and focused ion beam systems, all of which contribute to the overall goal of maintaining high manufacturing yields and producing defect-free semiconductor devices.

Semiconductor process optimization is a continuous effort, with defect detection and prevention strategies being essential components of this process. The semiconductor industry is constantly evolving, with new technologies and materials emerging to address the demands of advanced semiconductor devices. The future of semiconductor manufacturing lies in the integration of AI, smart manufacturing, and advanced wafer metrology, enabling non-destructive defect inspection and precision wafer mapping. These advancements will contribute to the development of next-generation semiconductor devices, driving innovation and growth in the semiconductor wafer inspection market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 3780.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

China, Taiwan, US, South Korea, Germany, Japan, Canada, India, Brazil, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Semiconductor Wafer Inspection Equipment Market Research and Growth Report?

- CAGR of the Semiconductor Wafer Inspection Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the semiconductor wafer inspection equipment market growth of industry companies

We can help! Our analysts can customize this semiconductor wafer inspection equipment market research report to meet your requirements.