Shipbuilding Market Size 2025-2029

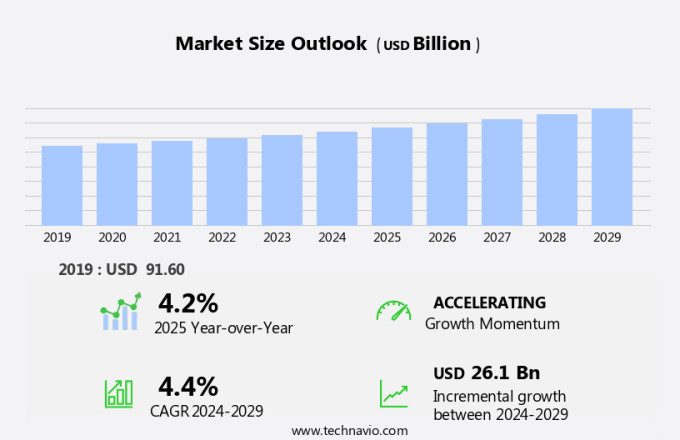

The shipbuilding market size is forecast to increase by USD 26.1 billion at a CAGR of 4.4% between 2024 and 2029.

- The market is growing rapidly, driven by rising seaborne trade and the increasing demand for new vessels. Additionally, the shift toward eco-friendly ships is gaining traction, shaping the future of the maritime industry.

- However, fluctuations in raw material prices pose a challenge for shipbuilders, as they can significantly impact production costs. The shipping industry's technological advancements, such as designing with 3D printing technology, implementing big data and drones for production planning, and developing autonomous ships, have revolutionized the manufacturing process. To mitigate this risk, companies are exploring alternative materials and sourcing strategies. Overall, the market is expected to continue its growth trajectory, driven by these trends and the ongoing demand for efficient and sustainable shipping solutions.

What will be the Shipbuilding Market Size During the Forecast Period?

- The market encompasses the manufacturing process of designing and constructing floating vessels for various trading activities and maintenance purposes. This industry plays a pivotal role in international seaborne trade, facilitating the transportation of commodities and goods across the globe. Technological improvement and upgradation are key drivers in the market, with a focus on fuel efficiency and the adoption of multi-fuel engines. Shipping companies continue to deploy modern fleets to meet the demands of growing international trade. However, overcapacity in the market poses a challenge, leading to intense competition and price pressures. The market caters to various vessel types, including container ships, LNG carriers, and specialized carriers.

- Moreover, the manufacturing process of these vessels involves intricate designing and engineering, ensuring they meet the latest regulatory requirements and industry standards. Trading activities, such as imports and exports, are major consumers of shipping services, driving the growth of the market. Industrialization in emerging economies and the increasing importance of fuel efficiency in shipping are also significant factors influencing the market. The aging oil tanker fleet and the rise of commodity ship types, such as bulk carriers and tankers, further add to the market dynamics. Trade-related agreements and international regulations play a crucial role in shaping the market, with countries implementing policies to support their domestic industries and promote sustainable shipping practices. The industry continues to evolve, with a focus on innovation and technological advancements to meet the changing needs of global trade.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Defense

- Type

- Oil tankers

- Bulk carriers

- Cargo ships

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- UK

- France

- South America

- Brazil

- North America

- US

- Middle East and Africa

- APAC

By Application Insights

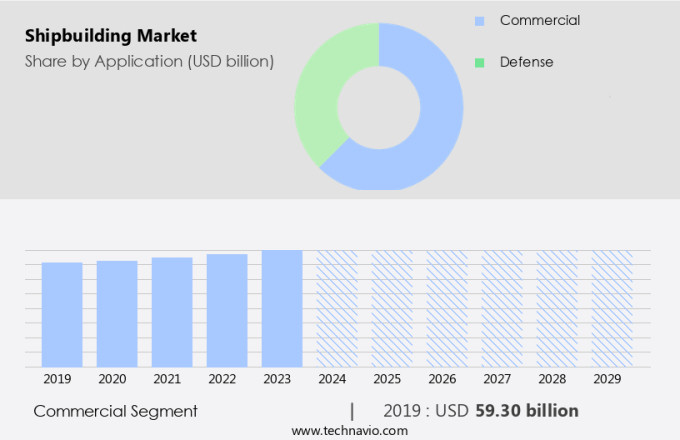

- The commercial segment is estimated to witness significant growth during the forecast period.

The commercial market is experiencing growth due to the expanding international trade and maritime logistics. The rise in container handling operations at marine ports is driving the demand for commercial ships and vessels, particularly containerships, which are crucial for global trade. New seaports in emerging economies in Asia Pacific are further fueling the need for new container vessels, contributing to the expansion of the commercial shipbuilding sector. This segment encompasses various types of ships, including containerships, bulkers, tankers, cruise ships, and ferries. Containerships, which carry cargo in intermodal containers, have significantly influenced the development of global trade routes. The economic cycles and geopolitical tensions can impact the demand for commercial ships, but the overall trend remains positive.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 59.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

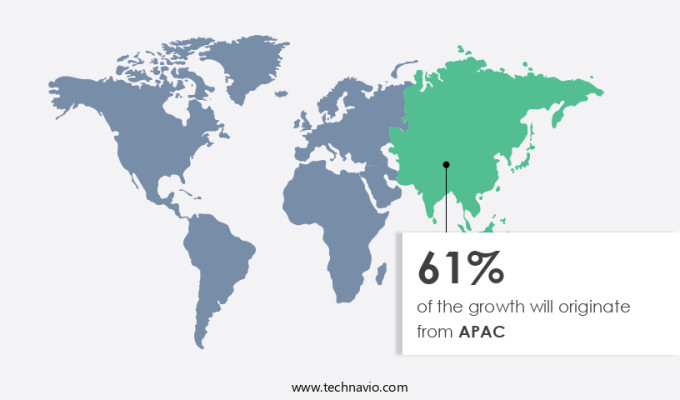

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) market is experiencing growth due to the expanding maritime transportation sector in the region. Countries such as China, Japan, South Korea, Singapore, Hong Kong, Thailand, and Malaysia are significant contributors to seaport transportation of goods, driving the shipbuilding industry's growth. These nations have numerous seaport hubs with high commercial container and vessel traffic. Furthermore, advancements in naval shipbuilding are fueling market expansion in the APAC region. Additionally, increasing population pressures in APAC countries necessitate governments to provide power for domestic and industrial use, leading to increased demand for shipbuilding. The APAC market encompasses designing, manufacturing, and maintaining floating vessels for trading activities and technical improvement or upgradation purposes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Shipbuilding Market?

Increasing seaborne trading is the key driver of the market.

- The market has witnessed significant growth over the past few decades, driven by the expanding international seaborne trade and industrialization. Economic activities, such as foreign direct investments and increasing consumer purchasing power, have fueled the demand for transportation of goods via sea. Advanced technologies, including fuel-efficient multi-fuel engines and 3D printing, have made shipping an eco-friendly and cost-effective transportation method. Furthermore, the growth of the cruise industry and maritime tourism sector have added to the demand for new vessel construction.

- However, economic cycles and geopolitical tensions can impact the market's growth. The market dynamics include the production planning process, which includes cutting and processing, assembling and launching, outfitting, and cargo vessel manufacturing. Various vessel types, such as container, tanker, multipurpose, and specialized carriers, are in high demand due to the increasing trade in goods. Trade-related agreements and free trade agreements have also influenced the shipping industry's growth. The market outlook remains positive, with ongoing technical improvements, upgradation of aging vessels, and the increasing importance of waterway transportation.

What are the market trends shaping the Shipbuilding Market?

An increase in demand for eco-friendly ships is the upcoming trend in the market.

- The market encompasses the manufacturing process of designing, constructing, and outfitting floating vessels for trading activities and maintenance purposes. This industry plays a significant role in industrialization and international seaborne trade, as ships serve as a crucial transportation method for goods and commodities. With the focus on technical improvement and upgradation, the market is witnessing advancements such as the adoption of 3D printing technology, design standards, and big data analysis.

- Furthermore, the industry outlook is positive, with the emergence of maritime tourism industry, autonomous ships, and multi-fuel engines. However, economic cycles and geopolitical tensions can impact the production planning and fleet deployment, leading to overcapacity and vessel types such as container ships, LNG tankers, and specialized carriers facing aging and trade-related challenges. Regulations, including those related to ballast water management and reducing greenhouse gas emissions, are essential in mitigating the environmental impact of the industry.

What challenges does Shipbuilding Market face during the growth?

Fluctuations in raw material prices are key challenges affecting the market growth.

- The market is a significant sector in international seaborne trade and industrialization, encompassing the designing, manufacturing, and trading activities related to the construction of floating vessels. The manufacturing process involves various stages such as cutting and processing, assembling and launching, outfitting, and production planning. The market growth is influenced by several factors, including technical improvement, upgradation, imports, and exports. Raw materials, particularly steel and iron, play a crucial role in shipbuilding. Their costs and availability can impact the market's growth. For instance, the price of steel has shown considerable fluctuations since 2016, and this trend is expected to continue during the forecast period.

- However, this volatility may pose challenges for the shipbuilding industry. Technical advancements, such as 3D printing technology, are transforming the industry. Design standards are evolving, with the integration of big data, drones, autonomous ships, and 3D printing in the design and production process. Vessel types, including container ships, tankers, multipurpose ships, and specialized carriers, are subject to economic cycles, geopolitical tensions, and trade-related agreements. Fuel efficiency and the adoption of multi-fuel engines are essential considerations for shipping companies, as they seek to optimize their transportation method. The cruise industry and cargo vessel manufacturers are focusing on the development of larger and more efficient vessels to cater to the growing demand for waterway transportation in goods trade.

- In conclusion, the outlook for the shipbuilding industry is positive, with opportunities in LNG trade, fleet deployment, and overcapacity management. However, aging oil tankers and commodity ship types pose challenges for the market. In conclusion, the market is a dynamic and complex industry, influenced by various factors such as raw material costs, technological advancements, economic cycles, and geopolitical tensions. The market's growth is essential for the transportation of goods and the development of maritime tourism. Adapting to these trends and challenges will be crucial for the success of players in the shipbuilding industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BAE Systems Plc - The company specializes in providing comprehensive shipbuilding solutions for the United States military, encompassing the construction of Naval vessels, Submarines, and Maritime services.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAE Systems Plc

- Cheoy Lee Shipyards Ltd.

- Conrad Industries Inc.

- Damen Shipyards Group

- Derecktor Shipyards

- Fincantieri Spa

- Fr. Fassmer GmbH and Co. KG

- General Dynamics Corp.

- Huntington Ingalls Industries Inc.

- Hyundai Heavy Industries Group

- IHI Corp.

- Imabari Shipbuilding Co. Ltd.

- International Maritime Industries

- Mitsubishi Heavy Industries Ltd.

- Oshima Shipbuilding Co. Ltd.

- Paramount Maritime Holdings

- Samsung Heavy Industries Co. Ltd.

- Sumitomo Heavy Industries Ltd.

- Ulstein Group ASA

- Uzmar Shipbuilding and Trade Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical sector that plays a significant role in the international seaborne trade. This industry involves the manufacturing process of designing, building, and maintaining floating vessels for various trading activities and purposes. The market's growth is influenced by several factors, including industrialization, fuel efficiency, and technological advancements. Floating vessels are essential for transportation method in the global economy, facilitating the movement of goods and raw materials across the world. The shipbuilding industry's outlook remains positive, driven by the increasing demand for cargo vessels, including container, tanker, multipurpose ships, and specialized carriers. Designing and manufacturing ships is a complex process that involves several stages. These stages include cutting and processing, assembling and launching, outfitting, and maintenance purposes. The production planning for each stage is crucial to ensure the timely delivery of vessels to meet the needs of shipping companies and the maritime tourism industry. Technical improvement and upgradation are essential aspects of the market.

Furthermore, fuel efficiency is a significant concern for shipping companies, leading to the adoption of multi-fuel engines and other energy-saving technologies. Additionally, the use of 3D printing technology in the manufacturing process is gaining popularity due to its potential to reduce production time and costs. The international maritime industry is subject to economic cycles and geopolitical tensions that can impact the market. Global trade routes and fleet deployment are critical factors that influence the demand for new vessels. Overcapacity and aging oil tankers are challenges that the industry faces, leading to the need for trade-related agreements and the transportation of goods via waterway transportation. The cargo vessel manufacturing sector is a significant contributor to the market's growth. Container carriers and cargo vessels play a vital role in the goods trade, with container ships being the largest segment. Liquefied natural gas (LNG) trade is also a growing segment, with specialized carriers in high demand due to the increasing use of LNG as a fuel source.

In summary, the shipping industry's outlook remains positive, with the cruise industry and other sectors continuing to drive demand for new vessels. The use of big data, drones, and autonomous ships is transforming the industry, with advancements in design standards and augmented reality technology set to revolutionize the shipbuilding process. In conclusion, the market is a dynamic and evolving industry that plays a crucial role in the global economy. The manufacturing process of designing, building, and maintaining floating vessels is a complex process influenced by several factors, including fuel efficiency, technological advancements, and economic cycles. The industry's outlook remains positive, with the demand for cargo vessels, particularly container ships and specialized carriers, driving growth. The use of innovative technologies, such as 3D printing and autonomous ships, is set to transform the industry and create new opportunities for growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 26.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

China, South Korea, Japan, The Philippines, Poland, UK, US, France, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, South America, North America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch