Smart Railway Systems Market Size 2025-2029

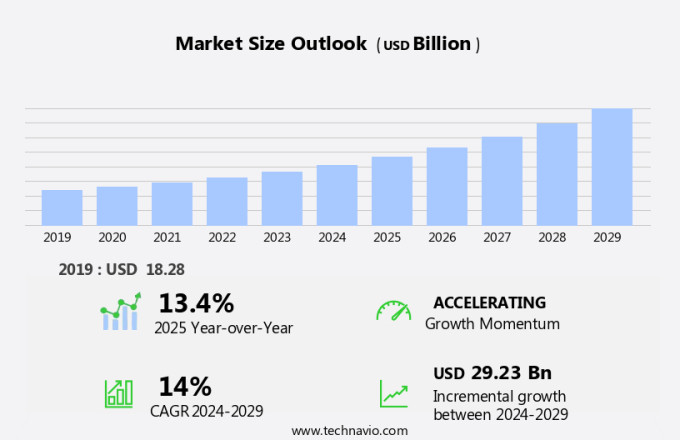

The smart railway systems market size is forecast to increase by USD 29.23 billion, at a CAGR of 14% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. One major factor driving market expansion is the increasing emphasis on addressing efficiency and environmental concerns by expanding railway networks. Another trend is the adoption of the Internet of Things (IoT) and big data technologies, which enhance operational efficiency and enable predictive maintenance. Furthermore, substantial investments in initial infrastructure development are fueling market growth. These trends are shaping the future of the market and positioning it for continued expansion in the coming years.

What will be the Size of the Smart Railway Systems Market During the Forecast Period?

- The market encompasses technology-driven solutions for enhancing train services and optimizing rail-based assets. Key components include rail analytics systems, freight information systems, and smart ticketing and passenger information systems. These solutions facilitate real-time data collection and analysis, enabling improved scheduling, maintenance, and digitalization of railway systems. Societal changes, such as urbanization and evolving commuting requirements, have driven the demand for more efficient and reliable public transport. Smart railway components, including high-speed sensors and logistical activity management systems, enable real-time monitoring and optimization of passenger and freight capacity. The integration of these advanced technologies is transforming railway projects, streamlining operations, and enhancing the overall passenger experience.

How is this Smart Railway Systems Industry segmented and which is the largest segment?

The smart railway systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Solutions

- Components

- Services

- Type

- Passenger information system

- Rail and freight OMS

- Smart ticketing system

- Rail analytics system

- Others

- Geography

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Brazil

- Europe

By Product Insights

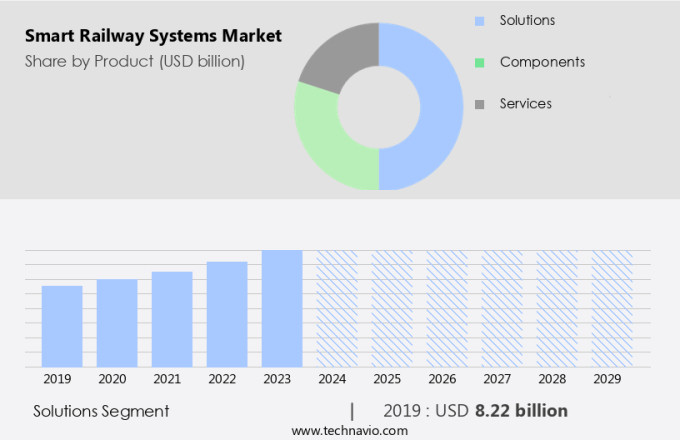

- The solutions segment is estimated to witness significant growth during the forecast period.

Smart railway systems incorporate advanced technologies to enhance the efficiency and performance of railways infrastructure and assets. These systems encompass rail analytics, which process data from various sources, including rail assets such as trains, tracks, and stations, to optimize operations and maintenance. Sensors and devices, including video surveillance cameras, smart cards, multimedia displays, and networking and connectivity devices, play a crucial role in collecting and transmitting data. For instance, sensors monitor train locations and infrastructure conditions, while smart cards record commuter entry and exit data. These devices contribute to improved safety, operational efficiency, and passenger experience in railway systems.

Get a glance at the Smart Railway Systems Industry report of share of various segments Request Free Sample

The solutions segment was valued at USD 8.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

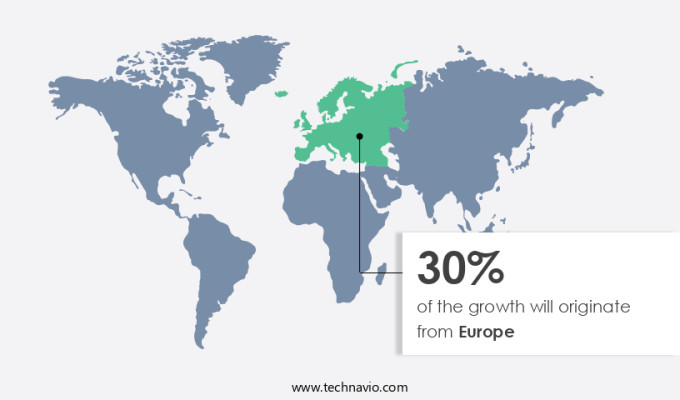

- Europe is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is experiencing significant growth due to increasing urbanization, decarbonization, and the need for more efficient transportation modes. With three-quarter of the EU population residing in urban areas, the demand for high-quality transportation services has escalated, particularly in response to growing traffic congestion. Environmental concerns are also driving the industry, as decarbonization becomes a priority. Factors such as aging infrastructure, increasing commuting requirements, and stringent regulatory frameworks are necessitating modernization and innovation. Technological advancements, including the adoption of AI, biometric systems, and asset management software, are key to addressing these challenges. Capital investment in 5G networks and consulting services are also crucial for implementing contactless, efficient, and reliable railway systems.

Market Dynamics

Our smart railway systems market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Smart Railway Systems Industry?

The expansion of railways to address efficiency and environmental concerns is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for efficient transportation and the adoption of technology to modernize aging infrastructure. With the rise of 5G Networks, railways are integrating digitalization, real-time data, and IoT to enhance passenger experience, optimize resource utilization, and improve safety. Freight railroads and metro rail networks are implementing intelligent railway systems, including condition-based maintenance, predictive analytics, and asset management software, to increase passenger and freight capacity. The integration of biometric systems, smart ticketing, and contactless payment solutions further streamlines commuting requirements. Moreover, the societal changes brought about by urbanization and the need for sustainable transportation have accelerated the modernization activities of railway stations and the adoption of green technologies, such as energy conservation and sustainable electric locomotives.

- Rail operators are investing in IT solutions, consulting services, and system integration to improve train operations, scheduling, and traffic management. The implementation of intelligent computing equipment, high-speed sensors, and rail analytics systems enables real-time monitoring, safety, and efficiency. The global railway systems market is expected to grow substantially due to the increasing demand for smart communication solutions, digital indoor systems, and the integration of artificial intelligence and noise pollution reduction technologies. The market is also driven by the need for energy efficiency, the safety of passengers, and the optimization of logistical activities. The investment in railway projects and the modernization of railway infrastructure will further fuel the market's growth.

What are the market trends shaping the Smart Railway Systems Industry?

The adoption of IoT and big data driving efficiency is the upcoming trend in the market.

- The market encompasses the adoption of advanced technologies such as 5G Network, Artificial Intelligence (AI), and Internet of Things (IoT) to modernize and optimize railway operations. With the aging infrastructure of Legacy Railway Systems, there is a growing need for Capital Investment in IT solutions and consulting services to enhance Passenger Experience, increase Passenger & freight capacity, and improve safety. Smart communication solutions, including Contactless ticketing systems and Passenger Information Systems, are essential components of intelligent railway systems. Real-time Data and Predictive maintenance through Condition based maintenance and Sensor based Technology enable efficient Resource utilization and reduce Energy consumption.

- Freight Information Systems and Digital Indoor Systems are essential for logistical activities, while High speed Railways and Sustainable electric locomotives contribute to reducing Noise pollution and promoting Energy Efficiency. Modernization Activities, including the Integration of Intelligent computing equipment and Virtualization, are crucial for enhancing the Capacity of Metro Rail Networks and ensuring the Safety of passengers. Rail Analytics System and Rail based Assets are integral to optimizing Railway projects and Railway Stations, ensuring optimal Railway technology and Networking & Connectivity Devices. The adoption of these advanced technologies contributes to the Digitalization of railway systems and enhances the overall efficiency of railways infrastructure.

What challenges does the Smart Railway Systems Industry face during its growth?

Investments in initial infrastructure are a key challenge affecting the industry growth.

- Smart railway systems have gained significant attention due to societal changes, urbanization, and the need for efficient, sustainable, and safe transportation. The integration of advanced technologies, such as 5G Network, Artificial Intelligence (AI), and the Internet of Things (IoT), is transforming railway systems. These technologies enable real-time data, predictive maintenance, and resource utilization, leading to energy conservation, noise pollution reduction, and improved passenger experience. The aging infrastructure of legacy railway systems necessitates modernization activities, including the adoption of technology-based solutions. Rail operators are investing in intelligent railway systems, including passenger information systems, asset management software, and freight information systems. Consulting services and system integration are essential for the successful implementation of these systems.

- The deployment of smart railway components, such as high-speed sensors, GPS sensors, and digital indoor systems, enhances safety, efficiency, and capacity. Smart ticketing systems and contactless payment solutions provide convenience for commuters. Rail analytics systems help optimize train operations, scheduling, and logistical activities. Despite the benefits, the high capital investment required for smart railway systems implementation can hinder adoption. Railways infrastructure modernization projects, which include railway stations, railway systems, and railway technology, are typically funded through government sanctions and can be a significant financial burden. However, the long-term payback period and substantial cash inflow make these projects attractive for governments and private entities.

Exclusive Customer Landscape

The smart railway systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company offers smart railway system solutions such as Contactors and Motor Protection, Breakers, DC Break Circuit breaker, Miniature Circuit Breakers, and Residual Current Circuit Breaker.

The smart railway systems industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALSTOM SA

- Atos SE

- Bosch Engineering GmbH

- Capgemini Services SAS

- Cisco Systems Inc.

- Digi International Inc.

- General Electric Co.

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- Indra Sistemas SA

- International Business Machines Corp.

- Mitsubishi Electric Corp.

- Nokia Corp.

- Schneider Electric SE

- Siemens AG

- Teleste Corp.

- Thales Group

- Trimble Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The future of rail transportation railway systems have been an essential part of the global transportation infrastructure for decades. As societal changes and technological advancements continue to shape commuting requirements, the railway industry is embracing smart solutions to enhance efficiency, safety, and passenger experience. The adoption of technology in railway systems is a significant trend driving growth in the market. From asset management software and condition-based maintenance to predictive analytics and real-time monitoring, intelligent computing equipment is revolutionizing the way rail operators manage their networks. One of the primary focuses of this digitalization is enhancing passenger capacity and experience.

Passenger information systems provide real-time updates on train schedules, delays, and platform information. Smart ticketing systems offer contactless payment options and personalized services, while digital indoor systems ensure seamless connectivity within stations. Freight transportation is also benefiting from these technological developments. Freight information systems enable real-time tracking of shipments, optimizing logistical activities and reducing traffic congestion. GPS sensors on trains and railway assets provide accurate data for resource utilization and energy conservation. Safety is another critical aspect of intelligent railway systems. High-speed sensors and advanced safety systems ensure the safety of passengers and freight. Biometric systems offer secure access to stations and trains, while noise pollution is minimized through the integration of green technologies and sustainable electric locomotives.

Further, modernization activities are ongoing, with railway stations undergoing significant upgrades. Networking & connectivity devices are being installed to provide seamless communication solutions for passengers and rail operators. Consulting services are being engaged to ensure system integration and optimal performance. Capital investment in railway projects is increasing as governments and private entities recognize the benefits of smart railway systems. The integration of artificial intelligence (AI) and IoT technologies is expected to further enhance the capabilities of these systems, leading to increased efficiency, improved passenger experience, and reduced maintenance costs.

|

Smart Railway Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14% |

|

Market Growth 2025-2029 |

USD 29.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.4 |

|

Key countries |

US, Germany, China, France, UK, India, Japan, Canada, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Smart Railway Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.