Smart TV Market Size 2025-2029

The smart TV market size is valued to increase USD 149.5 billion, at a CAGR of 16.8% from 2024 to 2029. Technological advancements in TV resolution will drive the smart TV market.

Major Market Trends & Insights

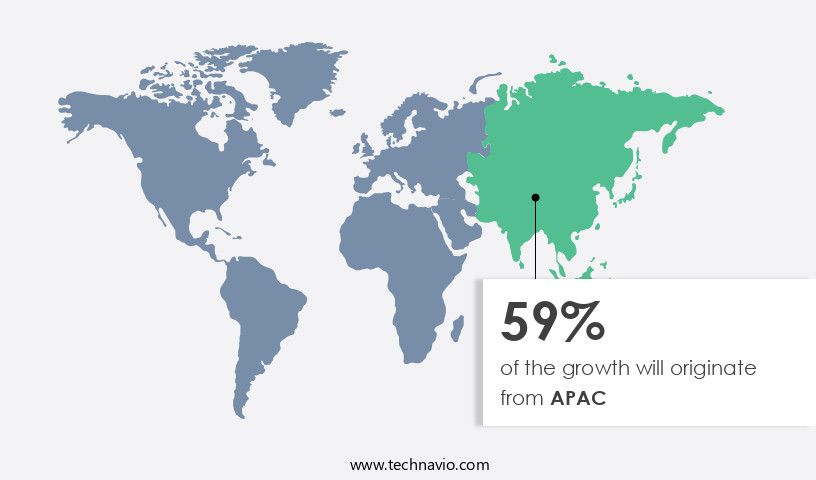

- APAC dominated the market and accounted for a 59% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 61.50 billion in 2023

- By Application - Below 32 inches segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 248.80 billion

- Market Future Opportunities: USD 149.50 billion

- CAGR from 2024 to 2029 : 16.8%

Market Summary

- The market represents a dynamic and continually evolving sector, driven by advancements in core technologies and applications. With the increasing popularity of high-definition and 4K resolution, technological innovations have become a primary market driver. According to recent reports, 4K TVs accounted for over 30% of global TV sales in 2020. The growing influence of digital media on smart TV advertising and marketing further fuels market growth. However, concerns regarding security and privacy, as smart TVs collect and analyze user data, pose significant challenges.

- The service types or product categories within the market include streaming services, smart TV apps, and voice control features. Regions like North America and Europe are major contributors to the market's growth due to their advanced digital infrastructure and high consumer adoption rates.

What will be the Size of the Smart TV Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Smart TV Market Segmented ?

The smart tv industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Below 32 inches

- 32 to 45 inches

- 46 to 55 inches

- 56 to 65 inches

- Above 65 inches

- Type

- 4K

- Full HD

- HD

- 8K

- Display Type

- LED

- OLED

- QLED

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with high-end smart TVs gaining increasing popularity due to the proliferation of OTT streaming services in key regions like the US, India, and China. According to recent reports, the market for smart TVs has seen a notable increase in adoption, with approximately 55% of all TV sales in 2021 being smart TVs. Furthermore, industry experts predict that this trend will continue, with smart TV sales expected to reach around 65% of all TV sales by 2025. Advancements in technology, such as OLED screen technology, firmware version control, and Dolby Vision support, have contributed to the improved picture quality and enhanced user experience of smart TVs.

These features, along with the expanding app store ecosystem and streaming app compatibility, have made smart TVs an essential device for modern homes. Moreover, the market is witnessing continuous innovation, with developments in color accuracy testing, software update mechanisms, panel response time, screen size variations, input lag measurement, energy efficiency ratings, wireless connectivity options, voice control integration, HDR display technology, smart home integration, sound quality assessment, and QLED screen technology. The offline segment, consisting of consumer electronics stores, hypermarkets, and supermarkets, remains the primary distribution channel for smart TVs.

Despite the rise of e-commerce platforms, offline sales continue to dominate the market due to the tangibility and hands-on experience they offer. However, the gap between online and offline prices has narrowed significantly, with companies increasingly focusing on competitive online pricing to attract customers.

The Offline segment was valued at USD 61.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 59% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Smart TV Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, India and China emerged as significant consumers in the market by 2024. The surge in consumer preference for smart TVs, particularly in emerging economies like India and Southeast Asian countries such as Thailand, Vietnam, and Hong Kong, has fueled the market's expansion. This trend can be attributed to the growing disposable income and the increasing willingness to invest in advanced technology.

Moreover, the availability of a vast array of Over-The-Top (OTT) content subscriptions and technologically sophisticated smart TVs have further bolstered the market's growth. Notably, there has been a marked increase in the penetration of established international OTT platforms, including Netflix and Amazon Prime, in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by advancements in display technology and consumer demand for enhanced viewing experiences. One of the key features fueling this growth is the integration of OLED TV screens, which offer superior color accuracy and reduced risk of burn-in compared to traditional LCD displays. Another critical factor is the increasing adoption of High Dynamic Range (HDR) content, which boasts expanded dynamic range mapping for more vivid colors and improved contrast. Furthermore, high refresh rate gaming benefits have gained traction, particularly among avid gamers seeking smoother visuals and reduced lag. Smart TVs also prioritize user convenience through advanced voice control accuracy and intuitive user interface designs, undergoing extensive usability testing to ensure optimal user experiences.

Local dimming zones have a significant impact on contrast, enabling deeper blacks and more vibrant colors. As 4K content becomes increasingly prevalent, 8K resolution is poised to revolutionize visual detail, offering four times the pixel count of 4K. Streaming app load times are a critical consideration for consumers, with faster load times becoming a competitive differentiator. Manufacturers are also addressing energy efficiency standards, with power consumption varying significantly between different modes. HDMI port bandwidth limitations and wi-fi performance optimization are essential considerations for seamless connectivity and uninterrupted streaming. Bluetooth audio codec compatibility and input lag compensation techniques are essential for delivering high-quality audio and minimizing latency.

Screen reflectivity in bright environments and color accuracy at different brightness levels are crucial factors impacting overall viewing experience. The viewing angle's impact on color shift and HDR peak brightness consistency are essential factors for manufacturers to address, as these issues can significantly affect user satisfaction. In terms of market dynamics, more than 60% of new product developments focus on enhancing visual quality and user experience, underscoring the industry's commitment to innovation.

What are the key market drivers leading to the rise in the adoption of Smart TV Industry?

- The significant advancements in TV resolution technology serve as the primary catalyst for market growth.

- Smart TVs have witnessed significant advancements in software and display technologies, with industry leaders like Samsung, Apple, and Sony introducing application-loaded models emphasizing visual perfection. The increasing preference for 4K Ultra High Definition TVs (UHDTVs) has driven content providers, such as streaming services and cable platforms, to offer high-resolution content. With a display resolution of 3840 x 2160 pixels, 4K UHD TVs offer four times the resolution of traditional sets. Furthermore, high dynamic range (HDR) technology, in conjunction with 4K, enhances color and contrast, providing a more lifelike viewing experience.

- Advanced display technologies, including OLED and QLED, ensure superior color, lighting, sharpness, and contrast for displayed imagery. The continuous evolution of smart TVs and their applications across various sectors underscores their growing importance in the modern media landscape.

What are the market trends shaping the Smart TV Industry?

- The growing influence of digital media on smart TV advertising and marketing represents a significant market trend. This development reflects the increasing importance of digital platforms in modern advertising strategies.

- The market witnesses a significant shift towards digital media as a primary communication and marketing channel for manufacturers. In developed regions like the US and the UK, companies are intensifying their social media presence for product promotions and broader reach. Digital media offers valuable data insights and customer attribution, enabling targeted marketing strategies. For instance, LG's Smart TV advertising, exclusive to the Middle East and North Africa (MENA) region, utilizes device-level data and consent-based user information to enhance the consumer viewing experience.

- This data-driven approach allows companies to tailor their marketing efforts and engage customers more effectively. Smart TV manufacturers are continually exploring innovative ways to leverage digital media to meet evolving consumer preferences and market demands.

What challenges does the Smart TV Industry face during its growth?

- The growth of the smart TV industry is being significantly impacted by concerns surrounding security and privacy. These issues, which are of paramount importance to consumers and industry professionals alike, must be addressed to ensure the continued adoption and expansion of this technology.

- Smart TVs, integrated with advanced features and internet connectivity, have revolutionized home entertainment. However, their internet connectivity exposes them to significant security risks, making security a top concern in The market. One of the primary risks is privacy. With camera-enabled smart TVs featuring popular social media applications, an active internet connection raises privacy concerns. In 2024, a notable privacy incident involved VIZIO, which agreed to pay a substantial settlement due to allegations of false advertising regarding certain TV models' refresh rates. Another security risk is malware attacks. In 2023, a malware attack on a major smart TV manufacturer led to the theft of user data, including email addresses and passwords.

- Furthermore, smart TVs are susceptible to man-in-the-middle attacks, where hackers intercept and modify data transmitted between the TV and other devices. Moreover, smart TVs are vulnerable to DDoS (Distributed Denial of Service) attacks, which can disrupt their functionality. In 2022, a DDoS attack on a leading streaming service caused widespread disruption to smart TV users. To mitigate these risks, manufacturers are implementing various security measures, such as encryption, multi-factor authentication, and regular software updates. Additionally, users can take precautions, like enabling strong passwords, disabling unnecessary features, and keeping software up-to-date. In conclusion, The market continues to evolve, offering advanced features and convenience.

- However, the security challenges, particularly privacy and malware risks, necessitate ongoing efforts from manufacturers and users to ensure the secure use of smart TVs.

Exclusive Technavio Analysis on Customer Landscape

The smart tv market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart tv market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Smart TV Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, smart tv market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The Apple TV 4K is a cutting-edge smart TV solution from a leading technology company. It provides access to Apple TV+, Apple Music, and Apple Arcade, alongside various streaming apps, all in high definition picture and audio quality. This device represents a significant advancement in home entertainment technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- BBK Electronics Corp. Ltd.

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- Koninklijke Philips NV

- LG Corp.

- MIRC Electronics Ltd.

- OnePlus Technology Co. Ltd.

- Panasonic Holdings Corp.

- Roku Inc.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Skyworth Group Ltd.

- Sony Group Corp.

- TCL Industries Holdings Co. Ltd.

- Toshiba Corp.

- Videocon Industries Ltd.

- VIZIO Holding Corp.

- Westinghouse Electric Corp

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart TV Market

- In January 2024, Samsung Electronics, the world's leading TV manufacturer, unveiled its new line of Neo QLED Smart TVs, integrating mini-LED technology for enhanced contrast and picture quality (Samsung Press Release, 2024).

- In March, LG Display and Google announced a strategic partnership to co-develop and manufacture OLED TVs, aiming to strengthen LG's market position and Google's smart TV offerings (LG Display Press Release, 2024).

- In April 2025, Sony Corporation raised the bar in the market with the launch of its Bravia XR Master Series, featuring Cognitive Processor XR technology for more natural and lifelike images (Sony Press Release, 2025).

- Additionally, in May 2025, Amazon and Comcast reached a significant agreement, allowing Amazon Fire TV to be integrated into Comcast's Xfinity X1 platform, expanding Amazon's reach in the smart TV ecosystem (Comcast Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart TV Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.8% |

|

Market growth 2025-2029 |

USD 149.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.7 |

|

Key countries |

US, China, Japan, UK, Canada, India, Germany, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of smart TVs, several key features distinguish market leaders and shape consumer preferences. The importance of picture quality metrics, such as brightness and contrast, cannot be overstated. Advanced OLED and QLED screen technologies offer superior color accuracy and contrast ratios, enhancing the viewing experience. The app store ecosystem plays a pivotal role in the market. Consumers increasingly demand access to a wide range of streaming apps, ensuring compatibility with popular services is a crucial factor. Firmware version control and software update mechanisms enable continuous improvements and enhance user experience.

- Picture quality metrics extend beyond brightness and contrast. HDR display technology, including Dolby Vision support, delivers more vibrant colors and improved contrast. HDR peak brightness and viewing angle performance are essential for optimal visual experience. Screen size variations, panel response time, and input lag measurement are other essential factors. Energy efficiency ratings and wireless connectivity options are also significant considerations for modern consumers. Voice control integration, local dimming technology, and smart home integration are among the advanced features that set high-end smart TVs apart. Sound quality assessment, screen resolution scaling, and gaming features support are additional features that cater to diverse consumer needs.

- In the realm of user interface design, the ease of use and intuitiveness of the interface are critical. Audio output channels, HDMI connectivity, and remote control features complete the comprehensive feature set of modern smart TVs.

What are the Key Data Covered in this Smart TV Market Research and Growth Report?

-

What is the expected growth of the Smart TV Market between 2025 and 2029?

-

USD 149.5 billion, at a CAGR of 16.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Application (Below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, and Above 65 inches), Type (4K, Full HD, HD, and 8K), Display Type (LED, OLED, and QLED), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Technological advancements in TV resolution, Security and privacy concerns related to smart TV

-

-

Who are the major players in the Smart TV Market?

-

Apple Inc., BBK Electronics Corp. Ltd., Haier Smart Home Co. Ltd., Hisense International Co. Ltd., Koninklijke Philips NV, LG Corp., MIRC Electronics Ltd., OnePlus Technology Co. Ltd., Panasonic Holdings Corp., Roku Inc., Samsung Electronics Co. Ltd., Sharp Corp., Skyworth Group Ltd., Sony Group Corp., TCL Industries Holdings Co. Ltd., Toshiba Corp., Videocon Industries Ltd., VIZIO Holding Corp., Westinghouse Electric Corp, and Xiaomi Inc.

-

Market Research Insights

- The market continues to evolve, with advancements in user interface navigation, image processing algorithms, and voice assistant capabilities driving growth. According to recent industry estimates, the global market for smart TVs is projected to reach USD150 billion by 2025, up from USD80 billion in 2020. This represents a compound annual growth rate of 10%. Device compatibility testing and digital rights management are key considerations for consumers, with many seeking TVs that support the latest wireless network protocols and offer resolution upscaling technology. Power consumption details and input device compatibility are also important factors, as is screen reflectivity and viewing distance guidelines.

- In terms of technology, mini-LED backlight and panel manufacturing processes are gaining traction, while quantum dot technology and wi-fi standards support continue to be popular features. Energy Star certification and Bluetooth connectivity are also essential for many buyers. Smart TVs offer various picture settings adjustments, audio equalizer settings, and software security features to enhance the user experience. USB port specifications and audio decoding technologies are other key features that influence purchasing decisions. With ongoing advancements in motion interpolation technology and content delivery networks, the market for smart TVs is poised for continued growth.

We can help! Our analysts can customize this smart tv market research report to meet your requirements.