SMB Software Market Size 2025-2029

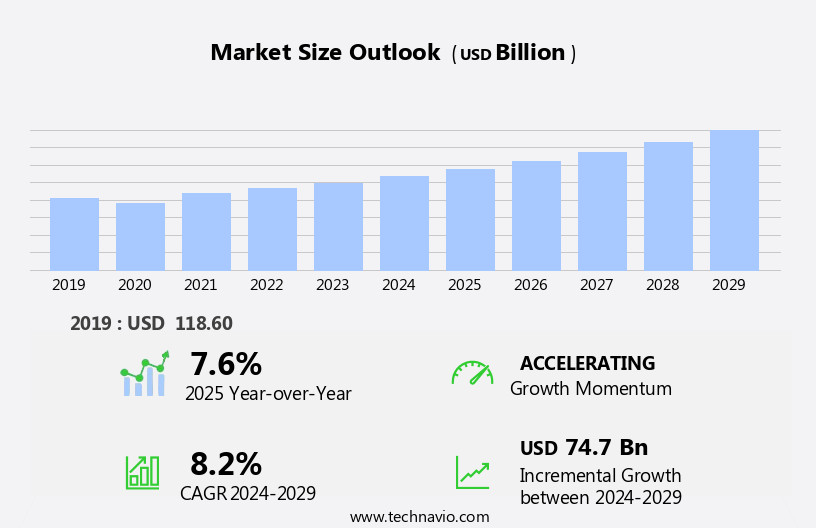

The smb software market size is forecast to increase by USD 74.7 billion, at a CAGR of 8.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of cloud-based applications. This shift towards cloud solutions offers numerous benefits, including cost savings, scalability, and accessibility, making them an attractive option for small and medium-sized businesses. Additionally, the market is witnessing an uptick in mergers and acquisitions, partnerships, and collaborations among key players. These strategic moves aim to expand market reach, enhance product offerings, and strengthen competitive positions. However, the landscape is not without challenges. Open-source SMB software providers pose a threat with their cost-effective and customizable solutions, potentially disrupting the market dynamics.

- Companies seeking to capitalize on opportunities and navigate challenges effectively must stay abreast of these trends and be prepared to adapt to the evolving market conditions.

What will be the Size of the SMB Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The Small and Medium Business (SMB) software market continues to evolve, shaped by ongoing technological advancements and shifting business needs. Mobile accessibility is a key trend, enabling employees to work remotely and increasing productivity. Machine learning and artificial intelligence are transforming HR management, offering predictive analytics for talent acquisition and employee engagement. Workflow automation streamlines business processes, reducing costs and enhancing revenue growth. Cloud-based software adoption is on the rise, providing businesses with scalable solutions and easy access to data mining and business intelligence tools. Customization options cater to the unique requirements of various industry verticals, ensuring customer satisfaction.

Security features, including data encryption and API integration, are essential for safeguarding sensitive information. company selection and implementation services are crucial for successful software adoption. Price comparison and feature comparison are essential elements of the decision-making process. On-premise software remains an option for businesses seeking greater control over their data. Market penetration and industry trends are influenced by the adoption of subscription models and the integration of support services and reporting and dashboards. Payroll software and inventory management solutions are essential for medium businesses, while accounting software is a must-have for small businesses. The ongoing unfolding of market activities reveals a dynamic landscape, with continuous innovation and evolution shaping the future of SMB software solutions.

How is this SMB Software Industry segmented?

The smb software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Application

- Media

- Telecommunication

- Consultants

- Law firms

- Type

- Enterprise resource planning (ERP)

- Customer relationship management (CRM)

- Human resource management (HRM)

- Accounting and finance software

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

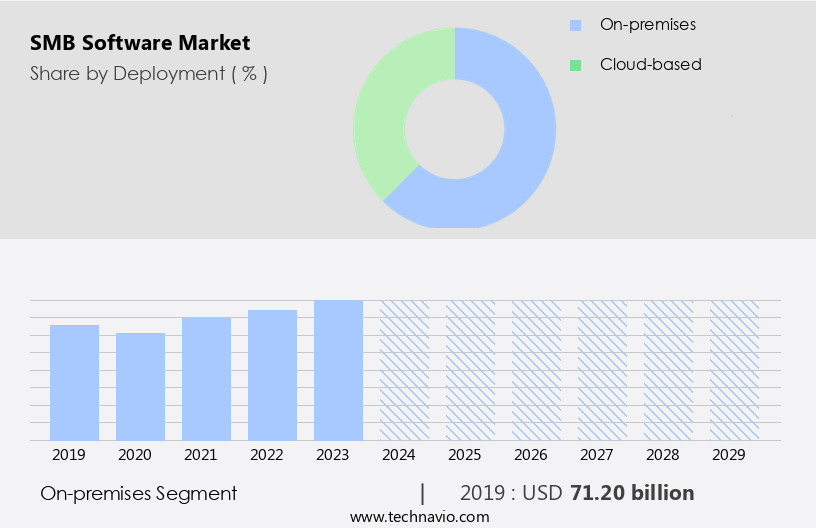

The on-premises segment is estimated to witness significant growth during the forecast period.

The market encompasses various solutions, including project management, customer relationship management, inventory management, payroll software, and enterprise resource planning. Subscription models, such as Software-as-a-Service (SaaS), offer flexibility and affordability for small and medium-sized businesses (SMBs). However, on-premises software, which includes business management software, ERP software, customer relationship management software, logistics services software, and debt collection software, remains popular due to its superior system security and control over data. This model requires a robust IT infrastructure and includes a perpetual license fee with recurring costs for support, training, and software updates. Cloud-based software, including project management tools, customer relationship management systems, and inventory management solutions, offers mobility and accessibility, making it suitable for remote teams and businesses with multiple locations.

Business process optimization, machine learning, and workflow automation are essential technology trends, enhancing productivity and efficiency. Data encryption, security features, and predictive analytics are crucial elements in software selection for SMBs. company selection involves considering customization options, cost reduction, ROI analysis, training programs, customer satisfaction, and support services. Industry verticals, such as healthcare, education, and non-profit organizations, have unique requirements and may prefer specific software solutions. Integration with third-party apps, reporting and dashboards, and accounting software are essential features for businesses. User experience, employee engagement, and productivity enhancement are critical factors in software adoption. Market penetration, feature comparison, and revenue growth are essential considerations for medium businesses.

Price comparison, API integration, and implementation services are essential elements in software selection. HR management, payroll software, and accounting software are vital for businesses of all sizes. Data mining and business intelligence provide valuable insights, enabling informed decision-making. Customization options, cost reduction, and ROI analysis are essential factors in software selection. Training programs, customer satisfaction, and support services are crucial for successful implementation. Security features, data analytics, and predictive analytics are essential elements in software selection for businesses.

The On-premises segment was valued at USD 71.20 billion in 2019 and showed a gradual increase during the forecast period.

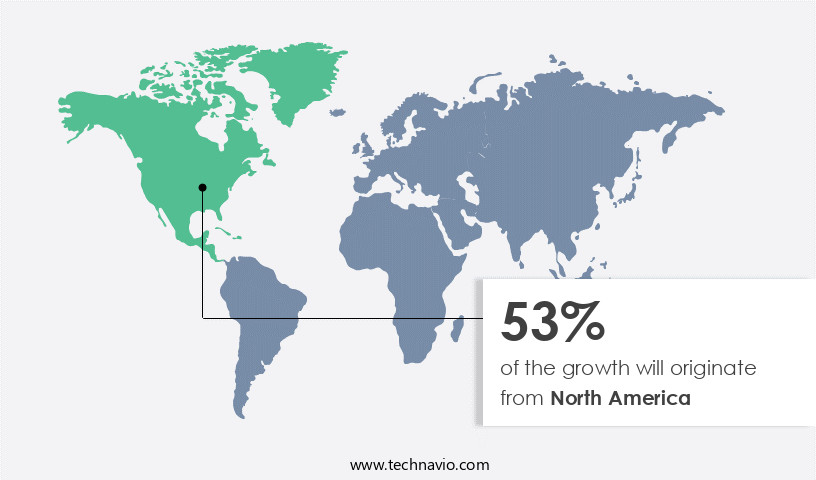

Regional Analysis

North America is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Small and Medium Business (SMB) software market in North America is experiencing significant growth due to the region's robust IT infrastructure, enabling organizations to optimize business processes and enhance customer satisfaction. This trend is particularly noticeable in industries that prioritize supply chain efficiency and effectiveness, leading to increased demand for SMB software solutions, such as supply chain management software. Furthermore, the adoption of cloud-based software and machine learning technologies is transforming the market, allowing businesses to streamline operations, automate workflows, and make data-driven decisions. Medium businesses are also adopting these solutions to gain a competitive edge, while small businesses benefit from cost reduction and productivity enhancement.

company selection, feature comparison, and implementation services are crucial factors in the decision-making process, with customer relationship management, inventory management, and project management being key functional areas of focus. Security features, data analytics, and predictive analytics are also essential, as businesses seek to protect their data and gain insights to drive revenue growth. The market penetration of SMB software is expanding across various industry verticals, including accounting, HR management, and non-profit organizations, with customization options and third-party app integration being critical to meeting diverse business needs. Ultimately, the market's evolution is driven by the need to improve user experience, employee engagement, and business intelligence, with ROI analysis, training programs, and support services playing a vital role in ensuring customer satisfaction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of SMB Software Industry?

- The surge in demand for cloud-based applications serves as the primary catalyst for market growth.

- Cloud-based SMB software, including enterprise resource planning (ERP) solutions, is experiencing significant growth due to their cost-effective and time-efficient implementation. These solutions offer numerous advantages, such as process alignment, business consistency, and remote access to applications for users, employees, and partners. Cloud-based software eliminates the need for a dedicated IT team for maintenance and updates, as well as the need for servers, storage, and computing resources for global organizations. By utilizing cloud-based software, businesses can execute their strategies effectively and focus on core operations without incurring increased IT costs. Moreover, advanced features such as predictive analytics and artificial intelligence are increasingly being integrated into cloud-based SMB software, providing valuable insights for data-driven decision-making.

- API integration enables seamless data exchange between applications, further enhancing operational efficiency. Implementation services ensure a smooth transition to cloud-based software, reducing implementation time and minimizing disruption to business operations. Security features are a critical consideration for organizations of all sizes, and cloud-based software providers prioritize robust security measures to protect sensitive data. Market penetration and feature comparison are essential for businesses when selecting the right cloud-based SMB software solution for their unique needs. In conclusion, the adoption of cloud-based SMB software is a strategic move for medium businesses seeking to streamline operations, reduce costs, and gain a competitive edge in today's dynamic business landscape.

What are the market trends shaping the SMB Software Industry?

- Market trends indicate a rise in mergers and acquisitions, as well as partnerships and collaborations. These strategic moves are increasingly common in various industries.

- The market is experiencing significant growth due to the increasing adoption of technology solutions that offer mobile accessibility, software customization, and workflow automation. Machine learning, data mining, business intelligence, and HR management are among the key areas driving revenue growth in this market. Companies are investing in these technologies to improve operational efficiency, reduce costs, and enhance business intelligence. Moreover, the focus on ROI analysis and training programs is also propelling the market forward. Machine learning algorithms are being integrated into HR management systems to streamline recruitment processes and improve employee performance. Workflow automation is enabling businesses to streamline their operations and reduce manual labor, leading to cost savings.

- Software companies are leveraging partnerships and collaborations to expand their offerings and gain a competitive edge. For instance, Microsoft's acquisition of Fungible in 2023 was aimed at enhancing its data center infrastructure and cloud services. Cisco's acquisition of Isovalent Inc. In December 2023 was focused on building multicloud security and networking capabilities. These strategic moves will positively impact the growth of the market during the forecast period. In conclusion, the market is witnessing a surge in growth due to the increasing adoption of mobile-accessible, customizable, and intelligent software solutions. The integration of machine learning, data mining, business intelligence, and HR management technologies is enabling businesses to streamline operations, reduce costs, and enhance operational efficiency.

- The focus on ROI analysis and training programs is also driving market growth. Strategic partnerships and acquisitions by key players are further fueling the market's expansion.

What challenges does the SMB Software Industry face during its growth?

- The expansion of open-source Small and Medium Business (SMB) software providers poses a significant challenge to the industry's growth trajectory.

- The market faces a notable challenge from the abundance of open-source software providers. Free, open-source alternatives exist for various applications, including CRM, ERP, and SCM. For instance, Bitrix24, Flowlu CRM, and HubSpot CRM offer businesses CRM functionality at no cost. Moreover, numerous open-source companies provide a range of SMB software tools and applications. By combining multiple products from these companies, small businesses can access capabilities comparable to those offered by on-premises or cloud-based enterprise application software providers. Customer satisfaction is a crucial factor in this market, with support services playing a vital role in ensuring it.

- Industry verticals, such as healthcare, retail, and manufacturing, have unique requirements that necessitate specialized software solutions. Reporting and dashboards, accounting software, user interface, employee engagement, and productivity enhancement are essential features for SMB software. Third-party apps extend the functionality of these software solutions, further enhancing their value. In conclusion, the market is dynamic, with open-source software posing a significant challenge while also offering opportunities for businesses seeking cost-effective solutions. Customer satisfaction, industry-specific requirements, and the availability of various features and integrations are key market drivers.

Exclusive Customer Landscape

The smb software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smb software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smb software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company specializes in providing Small and Medium Businesses (SMBs) with innovative software solutions, specifically Cloud Enterprise Resource Planning (ERP) systems like Acumatica. Our offerings are designed to streamline business operations, enhance productivity, and improve financial management. By leveraging advanced technologies, we aim to deliver a user-friendly, scalable, and cost-effective solution that caters to the unique needs of SMBs. Our software solutions are engineered to seamlessly integrate various business functions, enabling real-time data access and analysis. By implementing our technology, businesses can make informed decisions, optimize resources, and ultimately, drive growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Acumatica Inc.

- Alfresco Software Ltd.

- Cisco Systems Inc.

- Epicor Software Corp.

- IFS World Operations AB

- Infor Inc.

- International Business Machines Corp.

- Microsoft Corp.

- Newgen Software Technologies Ltd.

- Open Text Corp.

- Oracle Corp.

- Roper Technologies Inc.

- Sage Group Plc

- SAP SE

- SYSPRO Pty. Ltd.

- TOTVS S.A.

- Unit4 Group Holding B.V.

- Workday Inc.

- Xero Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in SMB Software Market

- In February 2024, Microsoft announced the launch of Microsoft 365 Business Basic, a new affordable subscription plan designed specifically for small and medium-sized businesses (SMBs). This offering includes essential business apps like Office, Teams, and business web and mobile applications, aiming to streamline digital transformation for SMBs (Microsoft Press Release).

- In May 2024, Salesforce and Google Cloud entered into a strategic partnership, integrating Salesforce Customer 360 and Google Workspace to provide a seamless experience for businesses. This collaboration aims to help SMBs improve customer engagement and productivity by combining Salesforce's CRM capabilities with Google's productivity tools (Salesforce Press Release).

- In August 2024, Intuit completed the acquisition of Mailchimp, a leading marketing platform, for approximately USD12 billion. This acquisition enables Intuit to expand its offerings and cater to SMBs' marketing needs, further strengthening its position in the market (Intuit Press Release).

- In November 2025, Zoom announced the launch of Zoom App Marketplace for Small Businesses, offering a curated selection of apps designed to enhance productivity and collaboration for SMBs. This marketplace includes integrations with popular business tools like Google Workspace, Microsoft Teams, and Salesforce, among others (Zoom Press Release).

Research Analyst Overview

- In the dynamic the market, real-time analytics and sales force automation are increasingly prioritized for business process optimization. Integration capabilities are crucial, allowing seamless data flow between applications and enabling user interface designs that cater to various user needs. Cloud computing facilitates scalability and performance, while customer support and disaster recovery ensure business continuity. Marketing automation and social media integration enhance outreach efforts, and budgeting and forecasting tools help manage finances. Software licensing models vary, with open source software gaining traction for cost-effective solutions.

- Compliance and auditing, data security, and data backup are essential components for maintaining data integrity. API management, customizable reporting, invoice management, workflow automation, and data visualization further streamline operations. Mobile device management and collaboration tools foster remote productivity. Businesses seek user training and data backup solutions to maximize software adoption and minimize potential data loss. Hybrid deployment models offer flexibility in implementation.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled SMB Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 74.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, UK, Canada, Germany, China, Japan, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this SMB Software Market Research and Growth Report?

- CAGR of the SMB Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smb software market growth of industry companies

We can help! Our analysts can customize this smb software market research report to meet your requirements.