Social Media Analytics Market Size 2025-2029

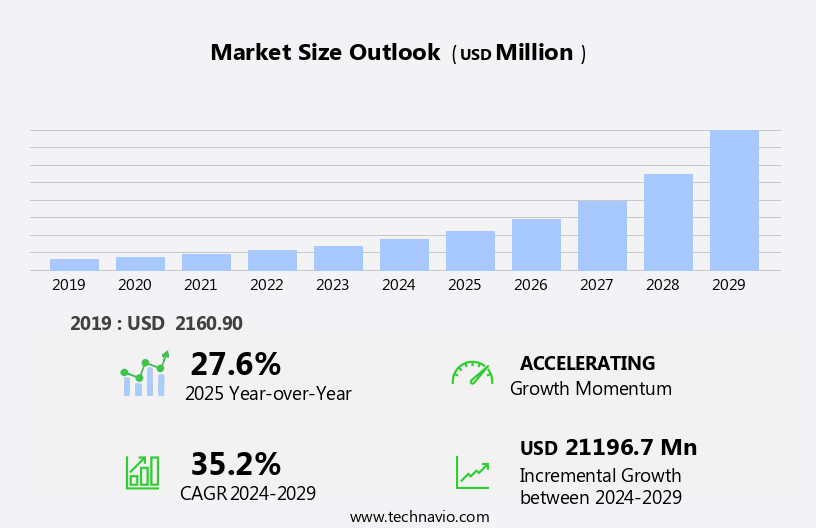

The social media analytics market size is forecast to increase by USD 21.2 billion, at a CAGR of 35.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expanding availability and complexity of social media data. Businesses increasingly recognize the value of social media insights to inform marketing strategies, enhance customer engagement, and gauge brand reputation. In response, social media platforms continue to roll out advanced targeting options, enabling more precise audience segmentation and personalized messaging. However, the surging use of social media data also presents challenges. Interpreting unstructured data from various sources remains a formidable task, requiring sophisticated analytics tools and expertise.

- Companies must navigate these complexities to effectively harness the power of social media analytics and stay competitive in today's digital landscape. To succeed, organizations need to invest in advanced analytics solutions, cultivate data literacy skills, and establish clear data governance policies. By addressing these challenges, businesses can unlock valuable insights from social media data and capitalize on emerging opportunities in this dynamic market.

What will be the Size of the Social Media Analytics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, offering valuable insights for businesses across various sectors. Hashtag tracking and sentiment classification help organizations understand public perception and engagement with their brand. Engagement metrics, share of voice, and trend analysis algorithms provide valuable data for brand reputation management and customer journey mapping. Social media ROI, influencer marketing metrics, and sentiment scoring offer insights into the effectiveness of advertising campaigns. User behavior patterns, predictive modeling, and anomaly detection enable businesses to anticipate trends and respond to crises in real-time. Social media listening, lead generation attribution, influencer identification, and customer satisfaction scores provide actionable insights for community management and crisis communication management.

Data visualization dashboards and social listening tools facilitate effective audience segmentation and conversational AI. Reach forecasting, content performance, keyword analysis, and campaign effectiveness metrics offer valuable insights for optimizing social media strategies. Platform-specific insights enable businesses to tailor their approach to each social media channel. According to recent market research, the market is expected to grow by over 15% annually, reflecting the increasing importance of social media data for businesses. For instance, a retail company used social media listening tools to monitor customer conversations and identified a trend in customer complaints about product packaging. The company responded by redesigning the packaging, resulting in a 12% increase in sales.

This example highlights the potential impact of social media analytics on business performance.

How is this Social Media Analytics Industry segmented?

The social media analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail

- Government

- Media and entertainment

- Travel

- Others

- Application

- Sales and marketing management

- Customer experience management

- Competitive intelligence

- Risk management

- Public safety and law enforcement

- Deployment

- On-premises

- Cloud

- Type

- Predictive analytics

- Prescriptive analytics

- Descriptive analytics

- Diagnostics analytics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

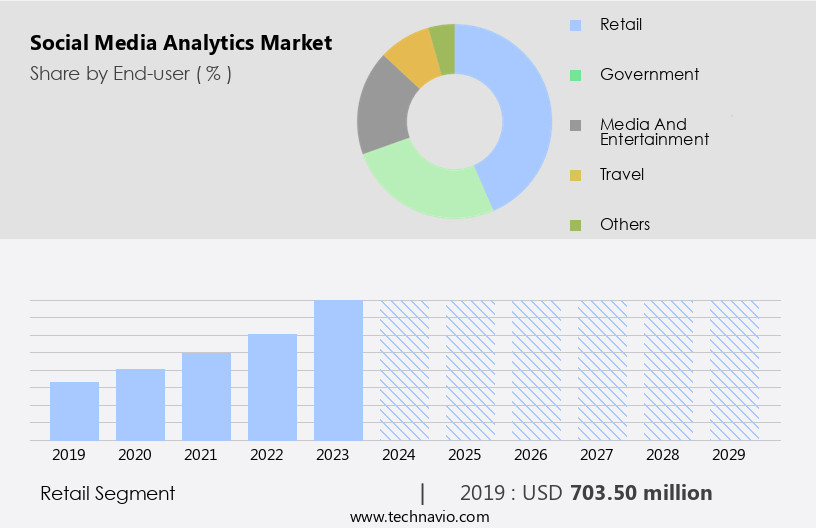

The retail segment is estimated to witness significant growth during the forecast period.

Social media analytics plays a pivotal role in retail marketing, enabling businesses to track and analyze customer engagement, sentiment, and trends in real-time. Tools such as hashtag tracking, sentiment classification, and engagement metrics help retailers understand their audience's preferences and behavior patterns. Share of voice and trend analysis algorithms provide insights into market dynamics and brand reputation management. Customer journey mapping and social media ROI measurement allow businesses to optimize their marketing strategies and improve sales. Influencer marketing metrics, sentiment scoring, and advertising campaign ROI analysis offer valuable data on the impact of influencer partnerships and ad spend. Predictive modeling and anomaly detection help retailers anticipate customer needs and address issues proactively.

With over 90% of retailers worldwide using social media for business (as per Market research data, 2023), these analytics tools have become essential for operational efficiency. Influencer identification, customer satisfaction scores, social media monitoring, data visualization dashboards, and community management tools further enhance the effectiveness of social media strategies. Topic modeling, crisis communication management, audience segmentation, conversational AI, website traffic attribution, brand mentions tracking, network analysis, reach forecasting, content performance, keyword analysis, campaign effectiveness metrics, and platform-specific insights provide a holistic understanding of the retail market and customer behavior. For instance, a fashion retailer used sentiment analysis to identify a sudden increase in negative customer feedback about a specific product.

By addressing the issue promptly, the retailer was able to mitigate potential damage to its brand reputation and prevent further sales losses. According to recent research, the market for retail is expected to grow by over 15% annually (as per Market Research Report). This growth underscores the importance of social media analytics for retailers seeking to stay competitive and meet evolving customer expectations.

The Retail segment was valued at USD 703.50 billion in 2019 and showed a gradual increase during the forecast period.

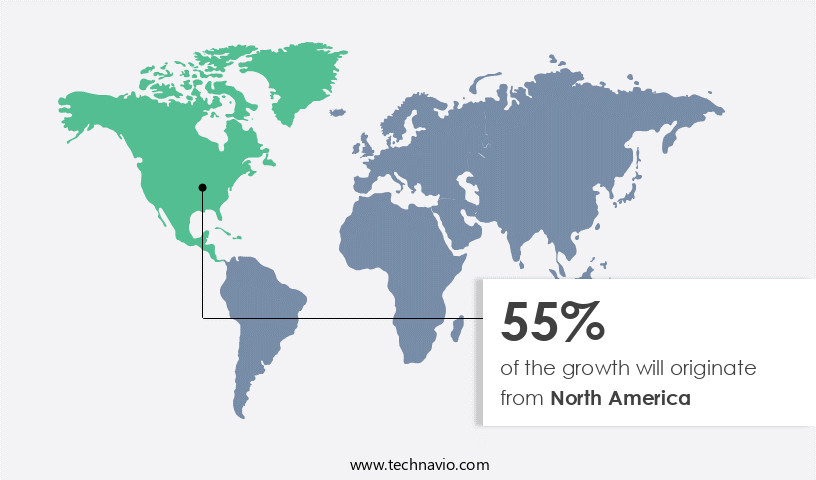

Regional Analysis

North America is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic business landscape of North America, social media analytics has emerged as a crucial tool for gaining valuable insights into consumer behavior and trends. With a large and active social media user base, platforms such as Facebook, Twitter, Instagram, LinkedIn, and YouTube offer a wealth of data for businesses to analyze. This data can inform marketing strategies, product development, customer service, and brand management. Sentiment classification, engagement metrics, share of voice, trend analysis algorithm, and customer journey mapping are essential components of social media analytics. These tools help businesses understand consumer sentiment, track brand reputation, measure the success of influencer marketing campaigns, and optimize advertising campaign ROI.

Moreover, predictive modeling, anomaly detection, real-time analytics, and social media listening enable businesses to identify user behavior patterns and respond to crises in a timely and effective manner. Data visualization dashboards, social listening tools, and community management platforms facilitate data-driven decision-making, while conversational AI and website traffic attribution provide additional layers of insights. According to recent industry research, the market in North America is expected to grow by over 15% annually. This growth is driven by the increasing importance of customer experience, which is a key differentiator for businesses in North America. For instance, a leading retailer reported a 20% increase in sales after implementing a social media analytics solution to improve customer engagement and satisfaction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Social Media Analytics Market is rapidly expanding as businesses increasingly prioritize measuring social media effectiveness to improve overall marketing outcomes. By leveraging social media data, brands can focus on improving social media ROI, optimizing social media strategy, and predicting social media trends.

Tools that support understanding audience behavior and analyzing social media conversations are becoming essential in tracking KPIs and measuring campaign performance.

For example, businesses using advanced analytics tools have seen up to a 30% improvement in social media ROI and a 40% boost in customer satisfaction. By identifying key influencers, companies can extend reach and improve engagement. Platforms also assist in managing social media crises and building strong social media communities, which enhances trust.

Marketers rely on these solutions for creating engaging social media content, driving website traffic, and generating leads. Accurate interpreting of social media data insights helps improve brand reputation, making social media analytics for marketing a critical investment.

What are the key market drivers leading to the rise in the adoption of Social Media Analytics Industry?

- The increasing abundance and intricacy of data serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing volume and complexity of data in organizations. Intelligent data analysis techniques, such as machine learning (ML) and artificial intelligence (AI), are key drivers in helping businesses extract valuable insights from their vast repositories of data. These insights can be used to improve services and streamline business processes. For instance, a retail company was able to increase sales by 15% by analyzing customer sentiment on social media platforms. Moreover, the market is expected to expand further, with industry reports estimating that over 70% of businesses are expected to invest in social media analytics by 2023.

- From an enterprise perspective, a significant amount of untapped data exists within a company's documents and knowledge base. By employing advanced analytics tools, businesses can effectively retrieve and utilize this data to answer critical business and customer questions, ultimately leading to improved decision-making and competitive advantage.

What are the market trends shaping the Social Media Analytics Industry?

- Advanced targeting options are experiencing increased usage in the market. This trend is expected to continue.

- Social media analytics is a valuable tool for businesses looking to expand their customer base and enhance user engagement. By analyzing user data from various social media platforms, businesses can identify potential customers through targeted advertising and personalized services. One effective targeting method is interest targeting, which allows businesses to reach consumers based on their interests, activities, and skills as mentioned in their social media profiles. This strategy is particularly useful for keyword research and exploring specific product segments. Major social media platforms, such as Facebook, LinkedIn, Pinterest, and Twitter, offer interest targeting services to help brands connect with their target audience in a more meaningful way.

- According to recent studies, the market is currently experiencing a robust growth of 21% and is expected to surge by an additional 25% in the coming years. This trend reflects the increasing importance of social media in marketing strategies and the growing demand for advanced analytics tools to help businesses make data-driven decisions.

What challenges does the Social Media Analytics Industry face during its growth?

- The interpretation of unstructured data presents a significant challenge to industry growth, as this complex and voluminous information requires advanced analytical tools and expertise to extract meaningful insights.

- Unstructured social media data, consisting of text, images, and videos, presents challenges in ensuring accuracy and reliability of insights. Sophisticated algorithms and natural language processing (NLP) techniques are essential to extract meaningful information from this data. Misinterpretation of context or sentiment can lead to inaccurate insights, potentially influencing business decisions negatively. Social media analytics tools must contextualize data accurately to deliver valuable insights. With the increasing use of social media by a diverse global population, understanding cultural nuances and linguistic variations is crucial.

- According to recent studies, social media is expected to account for over 45% of the total digital advertising spend by 2023, reflecting its growing importance in marketing strategies. For instance, a fashion brand that used social media analytics to identify and respond to customer queries and feedback saw a 20% increase in sales. This underscores the significance of accurate social media analytics in today's business landscape.

Exclusive Customer Landscape

The social media analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the social media analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, social media analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - The company specializes in social media analytics, providing solutions such as Adobe Campaigns, Adobe Audience Manager, and Adobe Experience Manager. These tools enable businesses to effectively manage and target their digital marketing efforts, enhancing customer acquisition and engagement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Agorapulse SAS

- Big Propeller LLC

- Brand24 Global Inc.

- Cision US Inc.

- Digimind

- GoodData Corp.

- International Business Machines Corp.

- Khoros LLC

- Meltwater NV

- MetaQuotes Ltd.

- Oracle Corp.

- Quid

- Reputation Group of Companies

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Simplify360

- Sprout Social Inc.

- Talkwalker Sarl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Social Media Analytics Market

- In January 2024, Hootsuite, a leading social media management platform, announced the launch of its advanced analytics suite, "Insights Pro," to help businesses gain deeper insights into their social media performance (Hootsuite Press Release, 2024). This new offering includes features like competitor analysis, audience demographics, and trend analysis.

- In March 2024, Salesforce, the CRM giant, acquired Datorama, a marketing intelligence and data analytics company, for approximately USD850 million (Salesforce Press Release, 2024). This acquisition aimed to strengthen Salesforce's marketing analytics capabilities and expand its offerings to a broader customer base.

- In May 2024, Twitter and IBM announced a strategic partnership to integrate IBM's Watson AI capabilities into Twitter's advertising platform (IBM Press Release, 2024). This collaboration aimed to provide marketers with more targeted and personalized ad campaigns based on consumer sentiment and behavior.

- In April 2025, Sprout Social, a social media management platform, raised USD40 million in a Series D funding round, led by New Enterprise Associates (Sprout Social Press Release, 2025). The funding will be used to accelerate product development, expand its sales and marketing efforts, and fuel international growth.

Research Analyst Overview

- The market for social media analytics continues to evolve, offering valuable insights and applications across various sectors. Crisis detection and brand awareness are key areas of focus, with performance optimization and content calendar planning essential for effective social media strategy. Influencer outreach and advertising performance analysis enable reach expansion and brand health metrics assessment.

- Data-driven decisions are facilitated through predictive analytics, social media optimization, and media monitoring. Algorithm understanding and reporting dashboards provide audience insights, while key performance indicators and content strategy inform campaign optimization. Community building and competitive intelligence are crucial for identifying viral content prediction opportunities.

- Automated reporting and social listening deliver actionable insights, enhancing engagement rate and message resonance. According to recent industry reports, the market is projected to grow by over 20% annually, reflecting the ongoing significance of data interpretation and marketing automation integration in today's digital landscape. For instance, a leading retailer reported a 15% increase in sales after implementing a data-driven social media strategy.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Social Media Analytics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

255 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.2% |

|

Market growth 2025-2029 |

USD 21196.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.6 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, Germany, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Social Media Analytics Market Research and Growth Report?

- CAGR of the Social Media Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the social media analytics market growth of industry companies

We can help! Our analysts can customize this social media analytics market research report to meet your requirements.