Social Robots Market Size 2025-2029

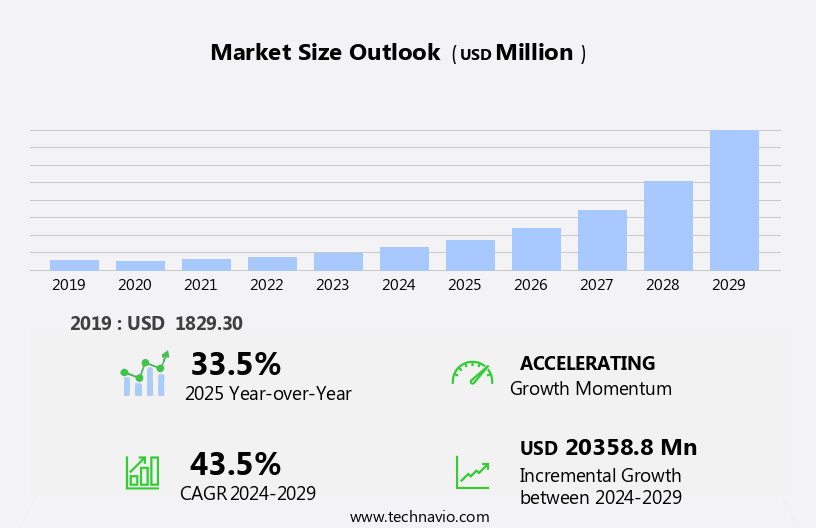

The social robots market size is forecast to increase by USD 20.36 billion, at a CAGR of 43.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the continual advancements in technology that enable these robots to replicate human social behaviors more effectively. This technological progression is leading to increased adoption in various sectors, including healthcare, education, and elder care, where human interaction is essential. However, challenges persist in the form of high costs associated with owning and maintaining social robots. Despite these obstacles, the market's potential remains vast, with organizations recognizing the value of social robots in improving customer engagement, enhancing productivity, and addressing social isolation. Another critical trend shaping the market is the increasing focus on extending battery life, as longer operational hours can significantly expand the applications and utility of social robots.

- Companies seeking to capitalize on these opportunities must address the cost challenge through innovative business models, while also investing in research and development to improve battery life and overall performance. In summary, the market is poised for growth, fueled by technological advancements, but faces challenges in cost and battery life. Companies must navigate these hurdles to effectively tap into the market's potential and deliver value to their customers.

What will be the Size of the Social Robots Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. In the education sector, therapeutic robots are making strides in autism therapy, providing personalized experiences for children. However, privacy concerns persist, necessitating robust data security measures. User interfaces are becoming more intuitive, enabling seamless human-robot interaction. Service robots are increasingly being adopted in the retail industry for remote assistance, task completion, and enhancing the customer experience. Emotional support robots offer companionship and assistance to elderly individuals, while humanoid robots showcase advanced capabilities in humanoid locomotion and dexterous manipulation. The ongoing development of cognitive architectures, machine learning, and natural language processing is driving advancements in robotics software and hardware components.

Navigation systems and motion planning enable autonomous navigation, while safety standards ensure user safety. In the healthcare sector, therapeutic robots are being integrated into smart homes for elderly care, and regulatory compliance is a critical consideration. Cloud integration and API integration enable scalability and flexibility, while gesture recognition and emotion recognition enhance user experience. The hospitality sector is exploring the potential of robotics platforms for automating tasks, and network connectivity enables remote assistance. Ethical considerations and ethical design are becoming increasingly important, as the market continues to evolve.

How is this Social Robots Industry segmented?

The social robots industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Services

- End-user

- Healthcare

- Media and entertainment

- Education

- Retail

- Others

- Technology

- Machine learning

- Computer vision

- Context awareness

- Natural language processing

- Mobility Type

- Mobile robots

- Fixed robots

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

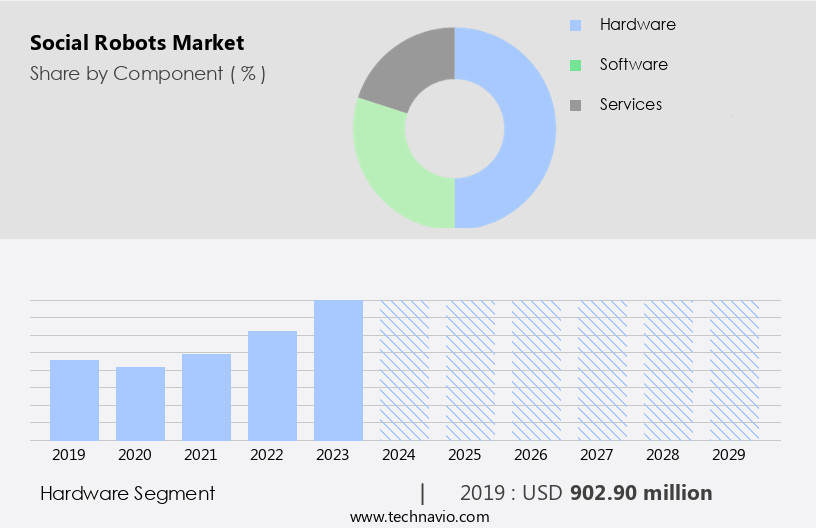

The hardware segment is estimated to witness significant growth during the forecast period.

The market encompasses advanced technologies such as cognitive architectures, autonomous navigation, and machine learning, which enable robots to interact socially with humans. Quality control is ensured through rigorous testing and adherence to safety standards. Cognitive architectures facilitate natural language processing, emotion recognition, and behavioral modeling, enhancing human-robot interaction. Autonomous navigation relies on advanced sensors and mapping systems, enabling robots to navigate complex environments. Robot programming languages, including Python and C++, are utilized for software development. Battery technology plays a crucial role in power management, with advancements in lithium-ion batteries extending operational hours. Healthcare applications, such as elderly care and autism therapy, are significant markets, with cloud integration and API integration facilitating remote assistance and data security.

Supply chain management and motion planning are essential for efficient manufacturing and task completion. Hardware components, including processors, sensors, cameras, and robotic arms, are miniaturized for compact designs. Advanced vision systems, such as computer vision and facial recognition, are integrated for object recognition and human-robot interaction. Development kits and software development tools are utilized for creating custom applications, while robotics platforms streamline the development process. Obstacle avoidance and natural language processing enable robots to navigate and communicate effectively. Ethical considerations, privacy concerns, and network connectivity are addressed through regulatory compliance and secure data handling. The hospitality sector, home automation, and retail industry are adopting social robots for enhanced customer experiences and task completion.

Emotional support and educational applications are also gaining popularity, with smart homes and AI assistants integrating social robots for personalized experiences. The market's growth is driven by technological advancements, regulatory compliance, and the increasing demand for personalized and efficient solutions.

The Hardware segment was valued at USD 902.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

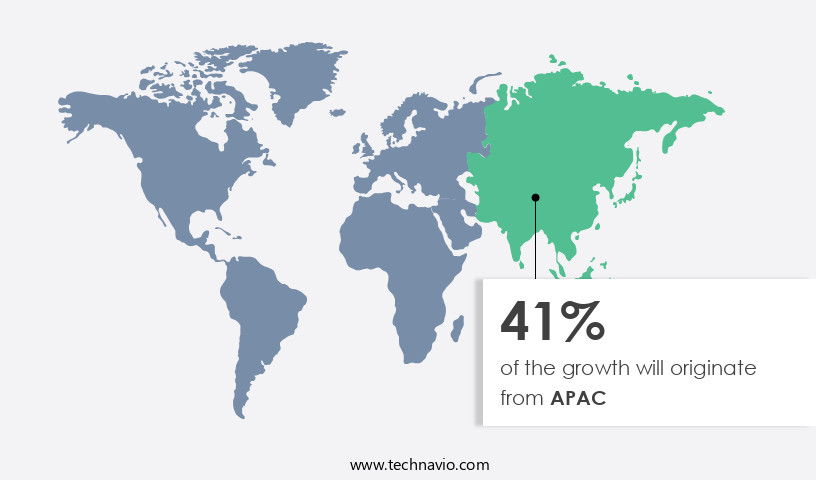

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Social robots are gaining popularity in the Asia Pacific (APAC) region, with Japan, China, Singapore, and South Korea leading the market. The aging population in Japan and Singapore is a significant factor driving adoption, as the number of individuals aged 65 years and above has risen substantially. In Japan, long-term care providers face a shortage of skilled professionals, leading to increased demand for social robots to support elderly care. In China, the availability of affordable social robots and the growing number of high net worth individuals are key growth factors. Advancements in cognitive architectures, autonomous navigation, and machine learning enable social robots to offer personalized experiences, emotion recognition, and natural language processing.

Cognitive architectures help robots understand and respond to human emotions, while autonomous navigation allows them to move around obstacles and navigate complex environments. Machine learning algorithms enable social robots to learn and adapt to new situations. Battery technology plays a crucial role in social robot design, as long operating hours are essential for continuous use in healthcare applications and elderly care. Regulatory compliance, safety standards, and data security are critical considerations for the adoption of social robots in various industries, including healthcare, education, hospitality, and retail. Cloud integration and API integration enable social robots to access vast amounts of data and improve their functionality.

Robot programming languages, such as Python and C++, facilitate the development of software for social robots. Motion planning, object grasping, and voice synthesis are essential features for social robots, enhancing their interaction with humans. Development kits, hardware components, and software development tools are essential for building custom social robots. Companion robots, humanoid robots, and service robots cater to various applications, from emotional support and education to retail and hospitality. Power management, wireless communication, and network connectivity are essential for seamless operation and remote assistance. Therapeutic robots, such as those used in autism therapy, offer significant benefits for individuals with special needs.

Ethical considerations, such as privacy concerns and user interface design, are essential aspects of social robot development. The integration of computer vision, facial recognition, gesture recognition, and speech recognition enhances social robots' ability to interact with humans. In conclusion, the social robot market in APAC is experiencing significant growth, driven by the aging population, the availability of affordable robots, and the need for long-term care solutions. Advancements in cognitive architectures, autonomous navigation, and machine learning enable social robots to offer personalized experiences and improve human-robot interaction. Regulatory compliance, safety standards, and data security are crucial considerations for the adoption of social robots in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Global Cold Chain Logistics Market: Trends, Technologies, Sustainability, Segments, Challenges, and Solutions (2025-2030) The Global Cold Chain Logistics Market is a critical sector that ensures the safe and efficient transportation and storage of temperature-sensitive goods, including food, pharmaceuticals, and other perishable items. This market is expected to grow significantly between 2025 and 2030, driven by various factors such as increasing consumer demand for fresh and high-quality products, the rise of e-commerce, and the growing trend towards sustainable and efficient supply chains. Key Technologies and Trends: The cold chain logistics market is witnessing several technological advancements, including the use of automated storage and retrieval systems (ASRS), temperature-controlled containers, and real-time monitoring systems. The integration of IoT and AI technologies is also transforming the industry by enabling predictive maintenance, optimized inventory management, and improved supply chain visibility. Sustainability Practices: Sustainability is becoming a key focus area for the cold chain logistics industry, with companies adopting various practices such as the use of renewable energy sources, reduction of food waste, and implementation of circular economy models. These initiatives not only help reduce the carbon footprint of the industry but also enhance brand reputation and customer loyalty. Market Segments: The global cold chain logistics market can be segmented based on temperature control (refrigerated, frozen, and controlled atmosphere), mode of transport (road, rail, air, and sea), and end-use industries (food and beverage, pharmaceuticals, and others). Challenges and Solutions: The cold chain logistics industry faces several challenges, including high operational costs, complex supply chain networks, and the need for stringent regulatory compliance. To address these challenges, companies are adopting various strategies such as outsourcing, partnerships, and the use of advanced technologies to optimize operations and reduce costs. B2B and Procurement Strategies: In the B2B context, cold chain logistics providers are adopting various procurement strategies such as strategic sourcing, supplier consolidation, and the use of technology platforms to streamline the procurement process and improve supplier relationships. These strategies help companies reduce costs, improve supply chain efficiency, and ensure compliance with regulatory requirements. Regional Context: The Asia-Pacific region is expected to be the fastest-growing market for cold chain logistics between 2025 and 2030, driven by the increasing demand for temperature-sensitive goods, the growth of e-commerce, and the increasing focus on sustainability. North America and Europe are also significant markets, with a well-established infrastructure and a strong focus on technology adoption. In conclusion, the global cold chain logistics market is a dynamic and evolving industry that is expected to grow significantly between 2025 and 2030. With a focus on sustainability, technological advancements, and efficient supply chain management, companies in this sector are well-positioned to meet the growing demand for temperature-sensitive goods while reducing costs and enhancing customer satisfaction. Long-tail keywords: cold chain logistics market, temperature-controlled logistics, refrigerated logistics, frozen logistics, controlled atmosphere logistics, supply chain optimization, sustainability practices, IoT in cold chain logistics, AI in cold chain logistics, strategic sourcing, supplier consolidation, circular economy models, Asia-Pacific cold chain logistics market, North American cold chain logistics market, European cold chain logistics market.

What are the key market drivers leading to the rise in the adoption of Social Robots Industry?

- The market's growth is primarily attributed to the technological advancements in social robots, which continue to drive innovation and demand in this sector.

- Social robots are experiencing growing adoption worldwide, particularly in developed countries with significant aging populations. These robots offer physical assistance, entertainment, communication, and comfort to the elderly, improving their quality of life. Companies in the market provide social robots tailored to this demographic. For example, Intuition Robotics offers ElliQ, a companion robot designed for the elderly. Advancements in object recognition, humanoid locomotion, and natural language processing enable social robots to interact more effectively with humans. Robotics software and software development tools facilitate the creation of sophisticated robotics platforms. Obstacle avoidance and network connectivity are essential features, ensuring safe and efficient operation.

- Ethical considerations are crucial in the development and deployment of social robots. The hospitality sector and home automation are other sectors adopting social robots. They offer personalized services, enhancing customer experiences. Social interaction is a key aspect of social robots, making them valuable in various applications. API integration and advanced robotics platforms enable seamless integration with other systems, expanding their capabilities. In conclusion, the market is driven by the increasing aging population and the need for personalized services. Companies focus on developing advanced social robots with object recognition, natural language processing, and obstacle avoidance capabilities.

- The market's growth is fueled by the adoption of social robots in various sectors, including healthcare, hospitality, and home automation.

What are the market trends shaping the Social Robots Industry?

- The emphasis on improving battery life is a significant market trend. It is essential for businesses and consumers alike to prioritize this aspect in their technology investments.

- Social robots, which include service robots, humanoid robots, and educational robots, are increasingly being integrated into various industries, including the education sector and retail industry, to enhance user experience and task completion. In the education sector, social robots are being used for autism therapy and emotional support, while in retail, they are employed for remote assistance and customer engagement. However, privacy concerns and data security are major challenges in the adoption of social robots. Human-robot interaction and user interface design are crucial factors that influence the acceptance of these robots. Research and development in the field of artificial intelligence and human-robot interaction are driving the advancements in social robots.

- For instance, AI assistants are being used to provide smart home solutions, and emotional support robots are being developed to provide companionship and assistance to the elderly and disabled. However, the battery life of social robots remains a significant concern, with engineers focusing on developing high-performance batteries that last longer and occupy less space. For example, researchers at the University of Michigan are working on biomorphic batteries that can provide up to 72 times more energy for robots. Despite these challenges, the market for social robots is expected to grow significantly due to their potential to improve efficiency, productivity, and user experience.

- The integration of social robots in various industries is set to revolutionize the way we live and work.

What challenges does the Social Robots Industry face during its growth?

- The high cost of owning social robots represents a significant challenge to the industry's growth trajectory.

- Social robots, characterized by cognitive architectures, autonomous navigation, and advanced sensors, are revolutionizing industries such as healthcare, elderly care, and supply chain management. These robots utilize robot programming languages, voice synthesis, and gesture recognition to deliver a personalized experience. However, the integration of these advanced technologies comes with a cost, which may hinder adoption among middle-class consumers in emerging economies. Regulatory compliance and power management are also critical considerations. To address these challenges, companies invest heavily in research and development, pushing the boundaries of battery technology and cognitive architectures.

- Cloud integration and object grasping capabilities further enhance the functionality of social robots. As the market evolves, the focus on quality control, cognitive architectures, and regulatory compliance will continue to shape the market landscape.

Exclusive Customer Landscape

The social robots market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the social robots market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, social robots market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aethon Inc. - The company specializes in social robots, including TUG, an autonomous mobile hospital logistics robot, featuring minimal social interaction capabilities. This robot streamlines operations through advanced autonomy and technology integration.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aethon Inc.

- Aldebaran

- BLUE FROG ROBOTICS SAS

- Boston Dynamics Inc.

- Diligent Robotics Inc.

- Engineered Arts Ltd.

- Furhat Robotics AB

- Haapie SAS

- Hitachi Ltd.

- Intuition Robotics Ltd.

- Knightscope Inc.

- Kompai Robotics

- MOVIA Robotics Inc.

- Moxie Robot

- Navel robotics GmbH

- PAL Robotics

- Relay Robotics Inc.

- Toyota Motor Corp.

- UBTECH Robotics Inc.

- Yukai Engineering Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Social Robots Market

- In January 2024, SoftBank Robotics, a leading social robotics company, announced the global launch of their latest humanoid robot, Pepper 2.0, designed for customer engagement and emotional intelligence (SoftBank Robotics Press Release). In March 2024, Boston Dynamics and Hyundai Motor Group formed a strategic partnership to commercialize Boston Dynamics' robots, including the social robot, Spot, for various industries, such as logistics and hospitality (Boston Dynamics Press Release).

- In April 2024, iRobot Corporation, a household robotics company, raised USD744 million in an initial public offering (IPO), marking a significant milestone for the market as investors showed increased interest in the sector (Bloomberg). In May 2025, the European Union approved the deployment of social robots in healthcare facilities, paving the way for their widespread use in elder care and rehabilitation services (European Commission Press Release). These developments underscore the growing importance of social robots in various industries, from customer engagement to healthcare, and the increasing investment and collaboration within the market.

Research Analyst Overview

- The market is experiencing significant advancements in real-time systems, user interface (UI), and user experience (UX), integrating social psychology principles to create more engaging and effective interactions. Sensor fusion, computer graphics, and cloud computing enhance robots' capabilities, while mechanical design and electrical engineering ensure their functionality. Human factors, IoT integration, and virtual reality offer new applications, and speech synthesis and natural language generation improve communication. Data analytics, path planning algorithms, artificial intelligence, big data, and robotics engineering drive innovation, with deep learning and predictive modeling enabling advanced capabilities. Reinforcement learning, affective computing, and control systems enable robots to learn and respond to emotions, improving robot-assisted therapy.

- Ethical frameworks, data privacy, and robotics ethics are crucial considerations, with embedded software addressing these concerns. Haptic feedback and augmented reality add a new dimension to the user experience, while software engineering ensures robustness and scalability. Overall, the market is transforming the way we interact with technology, offering endless possibilities for businesses and consumers alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Social Robots Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 43.5% |

|

Market growth 2025-2029 |

USD 20358.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

33.5 |

|

Key countries |

US, China, UK, Japan, Canada, India, Germany, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Social Robots Market Research and Growth Report?

- CAGR of the Social Robots industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the social robots market growth of industry companies

We can help! Our analysts can customize this social robots market research report to meet your requirements.