Soft Drink Concentrates Market Size 2024-2028

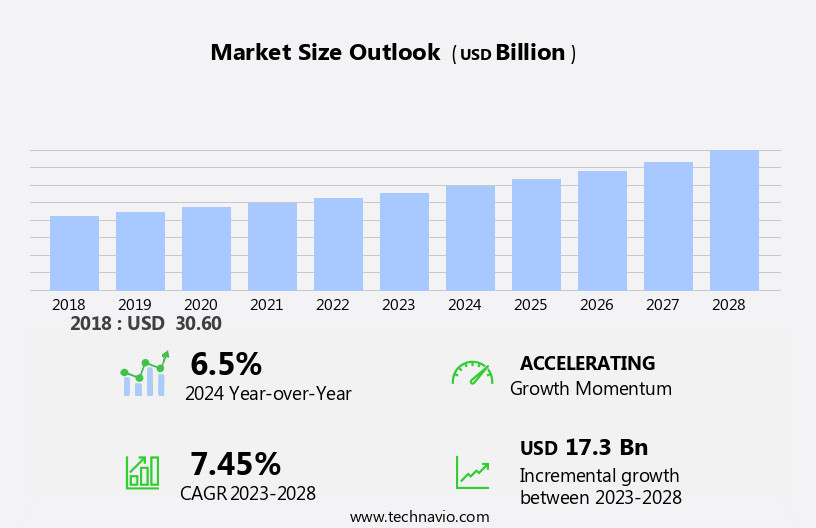

The soft drink concentrates market size is forecast to increase by USD 17.3 billion, at a CAGR of 7.45% between 2023 and 2028.

- The market is driven by a robust distribution network that ensures the uninterrupted supply of these essential ingredients to various beverage manufacturers. This extensive reach enables market participants to cater to the increasing demand for soft drinks, both conventional and craft varieties, worldwide. However, the market faces challenges due to growing health concerns, particularly the rise in obesity rates and other related issues. Consumers are increasingly turning to healthier alternatives, leading manufacturers to innovate and develop healthier soft drink options or fortify their existing product lines with functional ingredients.

- To navigate these challenges, companies must stay abreast of evolving consumer preferences and regulatory requirements while maintaining a strong focus on product development and strategic partnerships. Effective marketing strategies and collaborations with key industry players can also help mitigate these challenges and capitalize on the market's growth potential.

What will be the Size of the Soft Drink Concentrates Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The soft drink concentrate market exhibits a continuous and evolving dynamics, shaped by various factors. Consumption trends are influenced by shifting consumer preferences towards healthier options, leading to the rise of zero-sugar drinks and functional beverages. Ingredient sourcing plays a crucial role, with a growing emphasis on natural and organic ingredients, fair trade, and sustainable practices. Food safety remains a top priority, driving the adoption of advanced technologies like high-pressure processing (HPP) and aseptic processing. Marketing strategies evolve to cater to these trends, with brands positioning themselves as health-conscious and eco-friendly. Carbon dioxide is increasingly used in the production of both carbonated and non-carbonated beverages, while regulatory compliance and pricing strategies continue to shape the beverage industry.

Consumer behavior influences product development, with energy drinks, sports drinks, and plant-based options gaining popularity. Quality control is paramount, with concentrate blending systems ensuring consistency and shelf life. Fruit purees and juice concentrates are in high demand, while carbonated water and vegetable purees add variety to the market. Prices fluctuate based on supply chain management and FDA regulations. The beverage industry's product lifecycle management is a constant process, with drinking habits and consumer preferences shaping the market. Artificial sweeteners and natural sweeteners like phosphoric acid and citric acid continue to be used, while supply chain management and aluminum cans remain essential components of the industry.

How is this Soft Drink Concentrates Industry segmented?

The soft drink concentrates industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Carbonated

- Non-carbonated

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

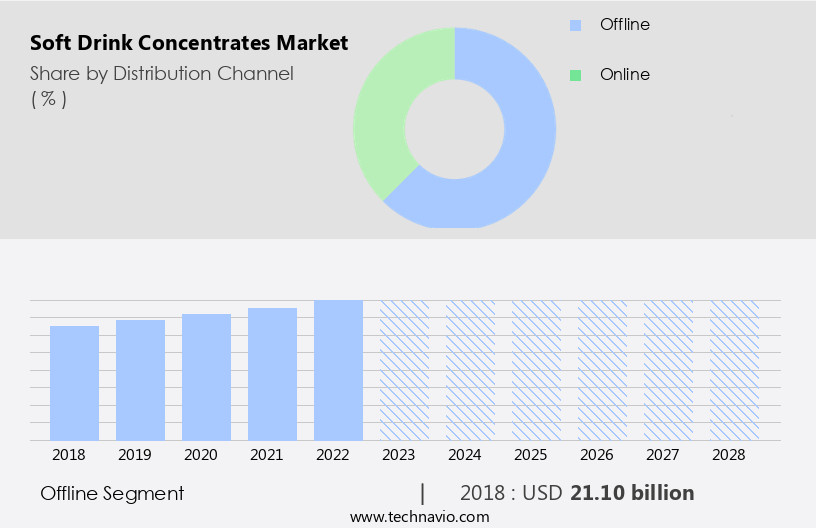

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic beverage industry, soft drink concentrates continue to be a significant revenue generator. Product diversification is a key trend, with manufacturers offering zero-sugar drinks, functional beverages, and non-carbonated options to cater to evolving consumer preferences. Food safety remains a top priority, with regulatory compliance and quality control measures ensuring the production of safe and high-quality concentrates. Carbon dioxide is widely used in carbonated beverages, while high-pressure processing and aseptic processing extend shelf life. Marketing strategies focus on brand positioning and consumer behavior, with players leveraging health and wellness trends. Juice concentrates and fruit purees are popular, with a growing preference for organic and natural ingredients.

Pricing strategies vary, with players adopting competitive pricing and promotional offers to attract customers. Ingredient sourcing is crucial, with fair trade and sustainable practices gaining importance. Manufacturers invest in concentrate blending systems and advanced packaging technologies like fill-seal packaging machines to improve efficiency and product quality. Non-carbonated beverages, including flavored water, are gaining popularity, with energy drinks, sports drinks, and plant-based options leading the charge. Regulatory bodies, such as the FDA, enforce strict regulations on food safety and labeling. The beverage industry's supply chain management is complex, with players managing logistics, inventory, and distribution through various channels, including pet bottles, food service, and e-commerce.

Aluminum cans and PET bottles are popular packaging options, with the former gaining favor due to their recyclability and lightweight properties. Phosphoric acid and citric acid are common ingredients used for flavoring and preservation. Consumer drinking habits continue to evolve, with a growing preference for convenient and portable options. Artificial sweeteners remain a contentious issue, with natural sweeteners gaining popularity due to health concerns. Manufacturers invest in product development, focusing on innovation and sustainability. Overall, the soft drink concentrate market is a dynamic and competitive landscape, with players constantly adapting to changing consumer preferences and regulatory requirements.

The Offline segment was valued at USD 21.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing growth due to the rising demand for ready-to-drink beverages in urbanized areas, particularly in countries like Germany and Italy. Consumers' shifting preferences towards natural beverages, free from artificial sweeteners, is leading to a maturing market in established regions. However, the market's growth potential remains strong, driven by ongoing research and development and the introduction of new, innovative concentrated flavors. Food safety and regulatory compliance are crucial factors shaping the market, with fill-seal packaging machines and high-pressure processing (HPP) techniques ensuring product quality and shelf life. In the beverage industry, carbonation continues to be a popular trend, with both carbonated and non-carbonated beverages gaining traction.

Pricing strategies, ingredient sourcing, and supply chain management are essential elements influencing market dynamics. Health and wellness trends have led to the increasing popularity of zero-sugar drinks, functional beverages, energy drinks, and plant-based alternatives. Consumer behavior and brand positioning play a significant role in market success, with concentrate blending systems and flavored water offerings catering to diverse preferences. Juice concentrates, fruit purees, and citric acid are essential ingredients, while phosphoric acid and artificial sweeteners face growing consumer skepticism. Marketing strategies and product development are key focus areas, with companies investing in fair trade and organic ingredients to cater to evolving consumer preferences.

Beverage offerings continue to expand, with sports drinks, diet sodas, and ready-to-drink beverages catering to various consumer segments. The market's success also depends on adhering to FDA regulations and ensuring product safety and quality control. In conclusion, the European the market is experiencing growth, driven by consumer preferences, innovation, and regulatory compliance. The market's future success will depend on companies' ability to cater to evolving consumer trends and preferences while ensuring product quality and safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Soft Drink Concentrates Industry?

- A robust distribution network serves as the primary catalyst for market growth.

- The market has experienced significant growth due to product diversification, with companies introducing zero-sugar drinks and functional beverages to cater to changing consumption trends. Food safety remains a top priority, leading companies to implement rigorous quality control measures and regulatory compliance. Marketing strategies have evolved, with an emphasis on carbon dioxide infusion and fill-seal packaging machines to enhance product appeal and shelf life. Non-carbonated beverages are also gaining popularity, offering companies new opportunities for innovation. Pricing strategies are crucial in this competitive landscape, with companies balancing costs and consumer demand to maintain market share.

- Rapid infrastructure development in the beverage industry, particularly organized retail, has facilitated easy accessibility and availability of soft drink concentrates for consumers. companies are collaborating to market their products more efficiently and effectively, contributing to the market's growth.

What are the market trends shaping the Soft Drink Concentrates Industry?

- The trend in the beverage industry is shifting towards an increased demand for craft soft drinks. This emerging market preference reflects a growing appreciation for artisanal and authentic beverage options.

- The market for soft drink concentrates in the US is witnessing significant growth due to the increasing demand for healthier and more natural beverage options. Ingredient sourcing for these concentrates focuses on high-quality, locally-sourced fruits and natural flavors, aligning with the health and wellness trend. Craft soft drinks, including juice concentrates, fruit purees, and flavored water, are gaining popularity among consumers. These beverages are produced in small batches using concentrate blending systems and carbonated water, often using high-pressure processing (HPP) for preservation. Consumer behavior is shifting towards experimentation with unique flavors and brand positioning that emphasizes natural and sustainable production methods.

- Supermarket chains are responding to this trend by allocating more shelf space to these products. Companies such as Jones Soda, Reed's Brooklyn Soda Works, Dry Sparkling, and Cool Mountain Beverages are among those catering to this market. These beverages are available to US consumers through various retail and online channels.

What challenges does the Soft Drink Concentrates Industry face during its growth?

- The escalating prevalence of obesity and associated challenges pose a significant threat to the industry's growth trajectory.

- The market faces a significant challenge due to rising health concerns and changing consumer preferences. According to the World Health Organization (WHO), over a billion people worldwide were obese in March 2022, with 650 million being adults, 340 million adolescents, and 39 million children. By 2025, the WHO estimates that approximately 167 million adults and children will suffer from health issues related to being overweight or obese. Consumer trends lean towards healthier options, such as aseptic processing, plant-based drinks, and energy drinks with natural sweeteners. Product lifecycle management and shelf life are critical factors in the soft drink industry.

- FDA regulations mandate strict adherence to food safety standards, particularly for beverages containing artificial sweeteners like diet sodas. Food service and pet bottles are popular packaging formats for soft drinks. Energy drinks, which have gained popularity due to their caffeine content and functional benefits, are a significant segment of the market. The market dynamics are influenced by consumer drinking habits, product innovation, and regulatory requirements. Companies must prioritize these factors to remain competitive and cater to evolving consumer preferences.

Exclusive Customer Landscape

The soft drink concentrates market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the soft drink concentrates market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, soft drink concentrates market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - This company specializes in producing soft drink concentrates, catering to the ice cream and dessert industries. Their offerings enhance food and beverage creations with unique flavors and consistent quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Batory Foods

- Dohler GmbH

- Fab Flavour and Frangrances Pvt. Ltd.

- Infinity Additives And Foods

- Kerry Group Plc

- Keurig Dr Pepper Inc.

- LEMONCONCENTRATE SLU

- Maharaja SDC

- MARUTI AROMATICS and FLAVOURS

- Monster Energy Co.

- National Beverage Corp.

- PepsiCo Inc.

- RASNA PVT. LTD.

- Refresco Group BV

- Shree Khodiyar Enterprise

- Soda Press Co.

- Sugam Products

- The Coca Cola Co.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Soft Drink Concentrates Market

- In January 2024, Coca-Cola, the world's leading beverage company, announced the launch of new fruit-infused soft drink concentrates under its Minute Maid brand. These concentrates, which include flavors like Strawberry Banana and Mango Pineapple, aim to cater to the growing demand for healthier and more flavorful beverage options (Coca-Cola Company Press Release).

- In March 2024, PepsiCo and Nestlé entered into a strategic partnership to co-manufacture and distribute ready-to-drink (RTD) beverages based on Nestlé's Nesquik brand. This collaboration marks an expansion of PepsiCo's portfolio and strengthens Nestlé's distribution network (PepsiCo Inc. Press Release).

- In April 2025, Tetra Pak, a leading food processing and packaging solutions company, announced the acquisition of Dole Food Company's concentrate business. This acquisition significantly expands Tetra Pak's presence in the market, adding Dole's extensive fruit portfolio and processing capabilities to its offerings (Tetra Pak Press Release).

- In May 2025, the European Union approved the use of stevia as a sweetener in all types of soft drinks, marking a major regulatory milestone for the industry. This approval is expected to drive growth in the low-calorie and sugar-free the market, as companies look to cater to the increasing health-conscious consumer base (European Commission Press Release).

Research Analyst Overview

- The soft drink concentrate market experiences dynamic market activity and trends, with retail displays playing a crucial role in driving sales. Labeling requirements, including nutritional information and health claims, influence consumer preferences and purchasing decisions. Ethical sourcing and sustainability initiatives are increasingly important for financial performance and brand loyalty. Inventory management, can manufacturing, and warehouse management are key areas for operational efficiency. Natural flavors and color additives are popular choices for formulation innovation, while competitive intelligence helps companies stay ahead of industry trends. Water usage and waste management are critical sustainability concerns, with water treatment and bottle recycling initiatives gaining traction.

- Supply chain risk, including potential product recalls, requires effective crisis management strategies. Profit margins are influenced by factors such as raw material costs, including beet sugar and artificial flavors, as well as supply chain disruptions and price competition. Customer satisfaction and social responsibility are essential for long-term business success. Sodium benzoate and potassium sorbate are commonly used preservatives, but their use raises concerns about health and safety. Effective risk management and crisis communication are essential for addressing consumer feedback and maintaining brand reputation. Business strategy and profitability depend on careful consideration of carbon footprint and sustainability initiatives.

- Transparency and open communication with stakeholders are essential for managing supply chain risks and building consumer trust.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Soft Drink Concentrates Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.45% |

|

Market growth 2024-2028 |

USD 17.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Soft Drink Concentrates Market Research and Growth Report?

- CAGR of the Soft Drink Concentrates industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the soft drink concentrates market growth of industry companies

We can help! Our analysts can customize this soft drink concentrates market research report to meet your requirements.