Software-Defined Vehicle (SDV) Market Size and Forecast 2025-2029

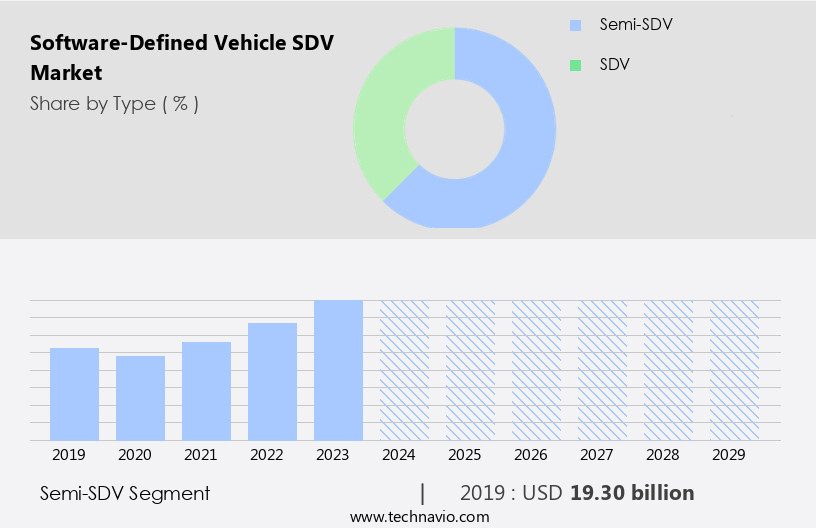

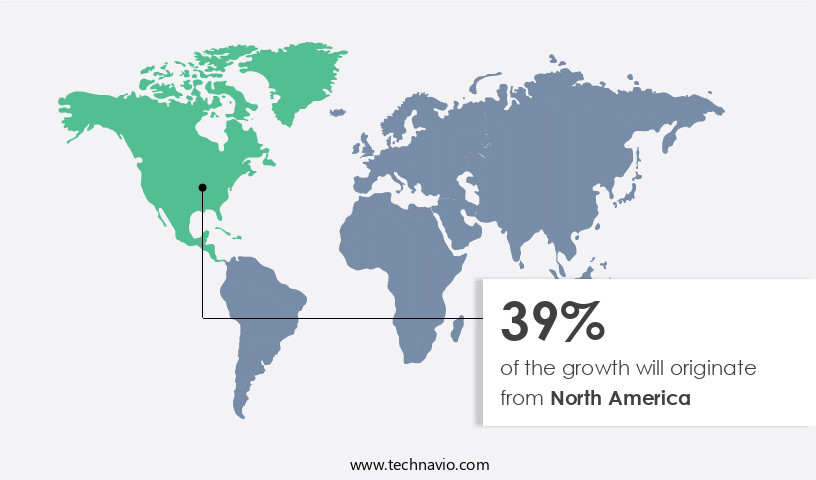

The software-defined vehicle market size estimates the market to reach by USD 96.93 billion, at a CAGR of 23.5% between 2024 and 2029. North America is expected to account for 39% of the growth contribution to the global market during this period. In 2019 the semi-SDV segment was valued at USD 19.30 billion and has demonstrated steady growth since then.

- The market is experiencing significant growth, driven by the increasing demand for autonomous vehicles and the integration of advanced safety technologies in luxury cars. This trend is transforming the automotive industry, as vehicles become more connected and intelligent. However, the market faces challenges, including the decline in automotive production due to the global shortage of semiconductor chips. This shortage is causing disruptions in the supply chain and increasing production costs for automakers. To capitalize on market opportunities and navigate challenges effectively, companies must focus on developing innovative solutions to address these issues.

- They can explore alternative semiconductor suppliers, invest in research and development of chip-less technologies, or collaborate with industry partners to share resources and expertise. By staying agile and adaptive, companies can position themselves for long-term success in the evolving SDV market.

What will be the Size of the Software-Defined Vehicle (SDV) Market during the forecast period?

The market continues to evolve, driven by advancements in performance monitoring tools, electronic control units (ECUs), network security, cloud connectivity, and real-time operating systems. With the increasing deployment of edge computing and application programming interfaces (APIs), over-the-air update management, and hardware abstraction layers, middleware integration and functional safety standards have become essential. For instance, a leading automotive manufacturer reported a 30% increase in sales due to the implementation of predictive maintenance using sensor fusion algorithms and software architecture design. The SDV market is projected to grow at a significant rate, with industry experts anticipating a 25% expansion in the next five years.

Performance monitoring tools and network security play a crucial role in ensuring high-performance computing and cybersecurity protocols. In-vehicle networking, OTA update management, and remote diagnostics enable vehicle control algorithms to function seamlessly. A centralized computing unit, digital twin technology, and open-source software are integral to the autonomous driving stack and vehicle software platform. System integration testing, diagnostic trouble codes, and data analytics dashboards are essential for software lifecycle management. Virtual sensors, model-based design, and OTA updates contribute to the ongoing development of vehicle networking. The integration of OTA update management, middleware, and cybersecurity protocols is vital for ensuring the safety and efficiency of SDVs.

How is this Software-Defined Vehicle (SDV) Industry segmented?

The software-defined vehicle (sdv) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Semi-SDV

- SDV

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Application

- Powertrain control

- Advanced Driver-Assistance Systems (ADAS)

- Infotainment and connectivity

- Others

- Propulsion

- ICE

- Electric

- Hybrid

- Others

- ICE

- Electric

- Hybrid

- Others

- Electrical and Electronic Architecture

- Distributed Architecture

- Domain Centralised Architecture

- Zonal Control Architecture

- Hybrid Architecture

- Distributed Architecture

- Domain Centralised Architecture

- Zonal Control Architecture

- Hybrid Architecture

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The semi-sdv segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth as the automotive industry embraces technology to create more customizable and efficient vehicles. SDVs utilize performance monitoring tools and electronic control units to optimize vehicle operations, while network security and cloud connectivity ensure data protection. A real-time operating system and edge computing deployment enable quick response times for various applications. OTA update management and a hardware abstraction layer facilitate seamless software integration, while middleware integration and functional safety standards ensure reliable performance. Remote diagnostics and predictive maintenance, enabled by sensor fusion algorithms and virtual sensors, enhance vehicle uptime and reduce maintenance costs.

Software architecture design, including digital twin technology and cybersecurity protocols, enables advanced vehicle control algorithms and in-vehicle networking. Data analytics dashboards and open-source software provide valuable insights for continuous improvement. The autonomous driving stack, vehicle software platform, and vehicle networking enable advanced features and services. System integration testing, diagnostic trouble codes, and a centralized computing unit ensure the seamless operation of embedded software. The rapid adoption of these technologies is driven by the increasing demand for comfort, convenience, and cost savings. The competition and global sales growth in the automotive market are accelerating the development and implementation of SDV technologies.

As of 2019 the Semi-SDV segment estimated at USD 19.30 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 39% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the US leading the way in 2024. Light-duty vehicles in the region are increasingly adopting autonomous technology, driven by consumer demand for enhanced safety and convenience. The US government's permissive stance on automated vehicle testing further underscores the market's potential. Advanced technologies, such as performance monitoring tools, electronic control units, network security, cloud connectivity, real-time operating systems, edge computing deployment, application programming interfaces, over-the-air update management, hardware abstraction layers, middleware integration, functional safety standards, remote diagnostics, predictive maintenance, sensor fusion algorithms, software architecture design, digital twin technology, cybersecurity protocols, vehicle control algorithms, in-vehicle networks, data analytics dashboards, open-source software, autonomous driving stacks, vehicle software platforms, vehicle networking, system integration testing, diagnostic trouble codes, centralized computing units, and embedded software, are integral to enabling this transition. These technologies support higher levels of automation, contributing to the market's growth in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing adoption of advanced technologies in the automotive industry. The SDV market encompasses various components, including the software platform architecture, OTA update process management, vehicle data analytics dashboard, and cloud-based vehicle diagnostics. At the core of SDV lies the autonomous driving software stack, which requires functional safety standards compliance and cybersecurity protocols implementation. High-performance computing platforms and edge computing for vehicles enable real-time processing of sensor data acquisition, predictive maintenance models, and virtual (IOT) sensor algorithms. The SDV ecosystem includes vehicle control algorithm design, software defined body control, and electronic control unit testing. The OTA update process management ensures seamless integration of new features and improvements, while the real-time operating systems provide the necessary reliability and responsiveness. Moreover, the SDV market offers a remote diagnostics system, enabling vehicle manufacturers and service providers to identify and address issues in real-time. In-vehicle network security is crucial to protect against potential cyber threats, and SDV solutions employ advanced cybersecurity protocols to mitigate risks. The SDV market's future lies in the integration of advanced technologies such as AI, machine learning, and 5G connectivity. These advancements will enable more sophisticated vehicle control systems, including software defined braking and steering systems, further enhancing the driving experience and safety.

What are the key market drivers leading to the rise in the adoption of Software-Defined Vehicle (SDV) Industry?

- The surge in demand for autonomous vehicles serves as the primary market catalyst. The autonomous vehicle market is poised for significant growth, with major Original Equipment Manufacturers (OEMs) and Tier-1 suppliers investing heavily in its commercialization. The autonomous vehicle concept necessitates advanced electronics and communication systems to function effectively. As a result, collaborations between automotive and electronics industries are becoming increasingly common. In the US, regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) are driving these collaborations by mandating OEMs to provide technical support in the form of hardware and software updates.

- According to a recent report, the global autonomous vehicle market is projected to reach USD 556.67 billion by 2026, growing at a robust rate. For instance, a leading OEM reported a 30% increase in sales of electronic components for autonomous vehicles in Q1 2022 compared to the previous year. This trend is expected to continue as the autonomous vehicle market matures.

What are the market trends shaping the Software-Defined Vehicle (SDV) Industry?

- Advanced safety technologies are increasingly being integrated into luxury cars, reflecting a significant market trend. This innovation aims to enhance vehicle safety and provide a superior driving experience for consumers. The automotive industry is experiencing a significant focus on safety technology advancements, transforming luxury vehicles into safer and more dependable options on the road. SUVs, renowned for their reliability, comfort, and fuel efficiency, are increasingly incorporating these safety features to reduce the escalating number of accidents. Advanced safety systems, including emergency brake assist, lane departure warning, collision mitigation warnings, blind-spot detection, and automatic emergency braking, have a higher penetration rate in sedans compared to SUVs. However, the adoption of these technologies is expanding in crossovers, with automotive original equipment manufacturers (OEMs) prioritizing safety to mitigate risks.

- According to recent market analysis, the global market for automotive safety systems is projected to grow by 15% in the next five years. This surge in demand for safety technologies underscores the robust growth potential within the automotive industry.

What challenges does the Software-Defined Vehicle (SDV) Industry face during its growth?

- The automotive industry is currently facing significant growth challenges due to the global semiconductor chip shortage, resulting in a substantial decline in automotive production. The decline in automotive production resulting from the global shortage of semiconductor chips is hindering the growth of the global software-defined vehicle (SDV) market significantly. As vehicles become increasingly reliant on advanced electronic systems and software-driven functionalities, the shortage of semiconductor chips has disrupted the overall automobile manufacturing process, leading to production delays and reduced output. Automakers are being forced to prioritize the allocation of scarce semiconductor chips to critical vehicle components, often at the expense of other non-essential functionalities and software updates.

- Consequently, the slowdown in automotive production has directly impacted the demand for SDV, as automotive OEMs and suppliers have delayed investments in software development and integration until production capacity for semiconductor chips stabilizes. This bottleneck not only hampered the adoption of innovative software-driven technologies but has also stifled revenue opportunities for SDV companies in the automotive industry. The global chip shortage has pushed carmakers to idle production lines for brief periods when they have run out of supplies and, in turn, hindered automotive production. For instance, in February 2023, Ford Motor Co. announced its quarterly results and reduced its automotive production due to the disruptions caused by the global shortage of semiconductors. Thus, the shortage of semiconductor chips has decelerated automotive production in various parts of the world, which will hinder the growth of the global software-defined vehicle (SDV) market during the forecast period.

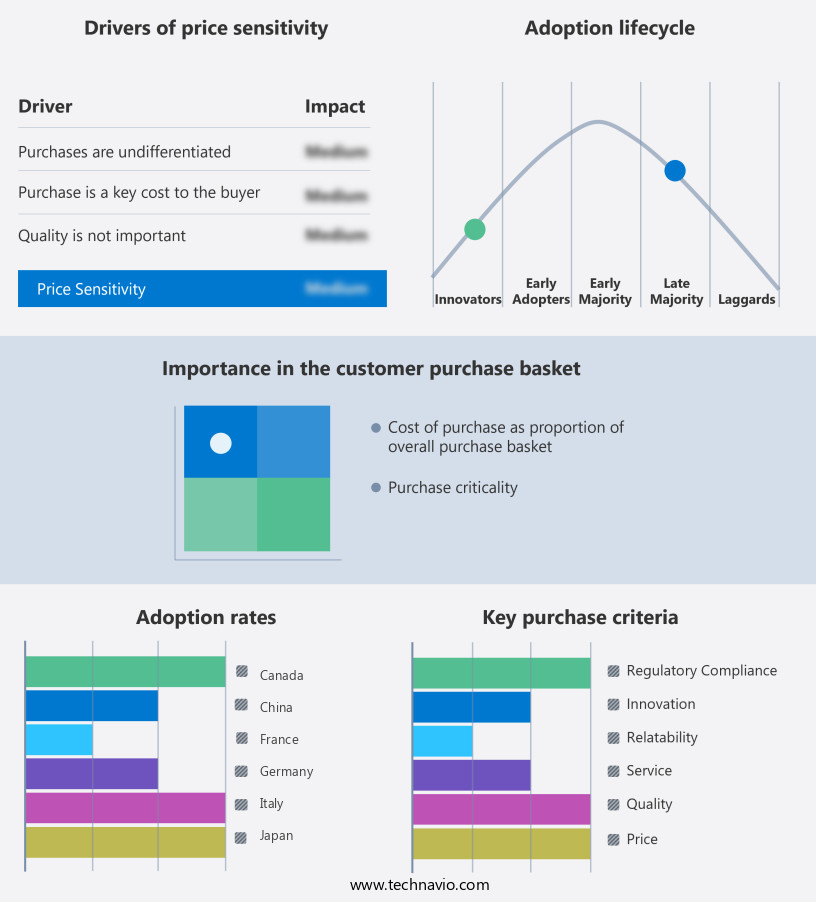

Exclusive Customer Landscape

The software-defined vehicle (sdv) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the software-defined vehicle (sdv) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, software-defined vehicle (sdv) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Tesla Inc. (United States) - The company specializes in software-defined vehicle technology, providing innovative solutions such as Armv9-based Automotive Enhanced IP processors and comprehensive Arm Dummies Guides. Their offerings aim to enhance automotive capabilities and optimize performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Tesla Inc. (United States)

- NVIDIA Corporation (United States)

- Aptiv PLC (Ireland)

- Bosch (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Valeo SA (France)

- Hyundai Mobis (South Korea)

- Magna International Inc. (Canada)

- Harman International (United States)

- Huawei Technologies Co., Ltd. (China)

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany)

- General Motors Company (United States)

- Ford Motor Company (United States)

- Baidu Inc. (China)

- Intel Corporation (United States)

- Qualcomm Incorporated (United States)

- NXP Semiconductors N.V. (Netherlands)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Software-Defined Vehicle (SDV) Market

- In January 2024, Magna International, a leading automotive supplier, announced the launch of its new Software-Defined Vehicle (SDV) platform, Haute-Performance Autonomous Driving (HPAD,) at the Consumer Electronics Show (CES.) This platform integrates advanced software and hardware components to enable autonomous driving capabilities in vehicles (Magna International press release, 2024.)

- In March 2024, Intel and BMW Group signed a strategic partnership to co-develop next-generation SDV systems. This collaboration aimed to integrate Intel's Mobileye technology into BMW's vehicles, enhancing their autonomous driving capabilities (Intel press release, 2024.)

- In May 2024, NVIDIA, a leading technology company, secured a USD2 billion investment from SoftBank Vision Fund 2 to expand its autonomous driving and SDV initiatives. This investment would support the development of NVIDIA's Drive AGX platform, which powers autonomous vehicles (NVIDIA press release, 2024.)

- In April 2025, the European Union passed the "European Regulation on Type Approval and Conformity of Production of Vehicles, Equipment and Components and Systems, Including Software, Intended for Use on Roads," which mandated software validation and cybersecurity measures for SDVs, effective from 2027 (European Parliament press release, 2025.)

Research Analyst Overview

- The market for Software-Defined Vehicles (SDV) continues to evolve, with ongoing advancements in system architecture, vehicle networking protocols, and integration testing shaping the industry's landscape. Embedded systems are increasingly being enhanced with AI-powered diagnostics and software updates, enabling real-time analytics and sensor data fusion. The integration of a software-defined powertrain, vehicle API, and safety-critical software is transforming vehicle functionality and performance. For instance, a leading automotive manufacturer reported a 30% increase in diagnostic accuracy after implementing AI-powered diagnostics in their SDV systems. Industry growth is expected to reach 20% annually, driven by the demand for advanced vehicle features and the integration of cloud-based diagnostics and OTA security.

- The market is further characterized by the continuous development of software design, requirements management, software development, safety-critical software deployment, and performance testing, including unit testing, system validation, functional testing, and regression testing. Additionally, ECU virtualization, software validation, and software design play crucial roles in ensuring OTA security, vehicle data logging, and software deployment reliability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Software-Defined Vehicle (SDV) Market insights. See full methodology.

Software-Defined Vehicle (SDV) Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.5% |

|

Market growth 2025-2029 |

USD 96.93 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.0 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Software-Defined Vehicle (SDV) Market Research and Growth Report?

- CAGR of the Software-Defined Vehicle (SDV) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the software-defined vehicle (sdv) market growth of industry companies

We can help! Our analysts can customize this software-defined vehicle (sdv) market research report to meet your requirements.