Solar Central Inverters Market Size 2024-2028

The solar central inverters market size is forecast to increase by USD 3.68 billion at a CAGR of 14.99% between 2023 and 2028.

- The market is experiencing significant growth due to the rising investment in renewable energy sources and the increasing demand for clean energy technologies. This trend is driven by governments and businesses seeking to reduce their carbon footprint and reliance on fossil fuels. However, the market also faces challenges from alternative sources of energy, such as wind and hydroelectric power, which can offer competitive pricing and energy production capabilities. To remain competitive, solar central inverter manufacturers must focus on improving efficiency, reducing costs, and offering flexible solutions to meet the diverse needs of customers. Additionally, the integration of energy storage systems and the development of smart grid technologies are expected to provide new opportunities for market growth. Overall, the market is poised for continued expansion as the global shift towards renewable energy gains momentum.

What will be the Size of the Market During the Forecast Period?

- Solar inverters play a crucial role in the conversion of direct current (DC) power generated by solar panels into alternating current (AC) electricity suitable for industrial, commercial, and residential applications. Central inverters, also known as utility-scale or string inverters, are a popular choice for large-scale solar photovoltaic (PV) systems. Central inverters are designed to handle DC power from multiple solar panels and convert it into AC power for grid connection. In utilities applications, both PV inverter and central inverter are commonly used to convert solar energy into electricity, with string inverter providing a more modular solution, while pure sine wave technology ensures smooth and efficient power delivery for on-grid solar systems. They are typically used in on-grid solar systems and can support various applications, including home appliances and utilities. Central inverters offer several advantages, such as high efficiency, cost-effectiveness, and ease of installation.

- On the other hand, microinverters are used in smaller residential solar systems and are installed at the individual solar panel level. They convert DC power from each panel into AC power independently, providing maximum power point tracking for each panel and reducing the impact of shading and other performance issues. Both central and micro inverters have their unique advantages and applications. Central inverters are suitable for industrial and commercial solar installations, while microinverters are ideal for residential solar systems. The market is expected to grow significantly due to the increasing demand for renewable energy sources and the ongoing shift towards decentralized power generation.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Utility

- Non-utility

- Geography

- APAC

- China

- Japan

- Vietnam

- Europe

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

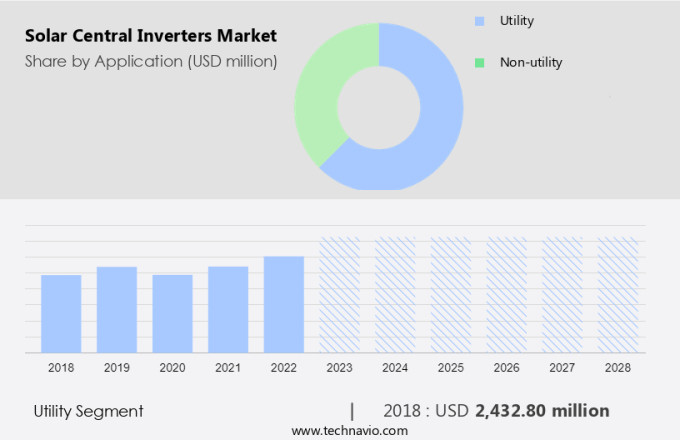

- The utility segment is estimated to witness significant growth during the forecast period.

The utility segment dominated the market in 2023. Utility-scale solar projects, defined as those with a generation capacity of 1 MW or more, accounted for a significant share of the installed solar power capacity worldwide. These projects are driven by government policies and corporate initiatives to expand power generation capacity, meet increasing energy demand, and decrease reliance on the grid. Central inverters are a crucial component of utility-scale solar photovoltaic systems, converting direct current (DC) power from solar panels into alternating current (AC) for grid connection. Key components of central inverters include maximum power point trackers, low-frequency transformers, and BOS (balance of system) components.

Furthermore, input voltage and grid connection standards also play a role in their design and functionality. Central inverters come in various forms, including monolithic and modular designs, with multi-MPPT trackers and master-slave control approaches. Energy storage systems are increasingly being integrated with utility-scale solar projects to ensure continuous power supply and improve grid stability.

Get a glance at the market report of share of various segments Request Free Sample

The utility segment was valued at USD 2.43 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

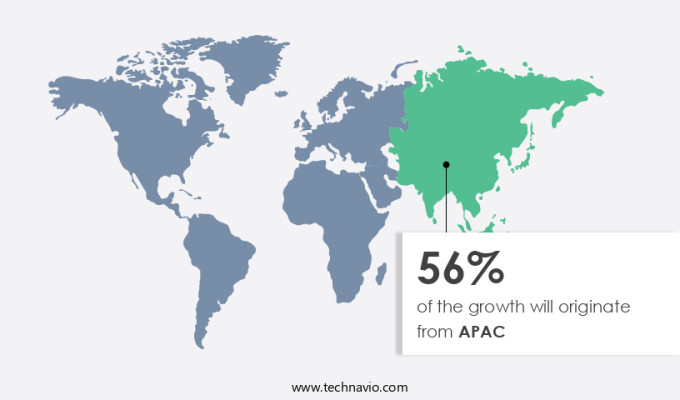

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is projected to expand substantially over the forecast period. Key factors fueling this growth include increasing environmental consciousness, escalating energy demand, population growth, and enhancing living standards. Major contributors to the market's expansion will be India, China, and Japan. Government initiatives, such as Feed-in Tariffs (Fit) in China, Japan, India, South Korea, and Thailand, will further propel market growth. China aims to reach a total installed solar energy capacity of up to 90 GW by 2022. This growth is expected to continue as the region's economies develop and prioritize renewable energy sources.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Solar Central Inverters Market?

Rising investment in renewables is the key driver of the market.

- In the evolving energy landscape, solar inverters have emerged as a crucial component in the conversion of solar electricity from DC to AC for both industrial, commercial, and residential applications. Solar inverters are integral to the functioning of photovoltaic (PV) systems, enabling the integration of solar power into the electric grid or providing power backup in off-grid systems. Central inverters, string inverters, and micro inverters are the primary types of solar inverters, each catering to specific requirements. The renewable energy sector's expansion is driven by environmental concerns, government support, and economic incentives. Large buildings, home loans, and home renovation projects offer tax benefits for solar power installation.

- Business owners are increasingly adopting solar power to reduce electricity bills and ensure reliable power supply, especially in hot-prone regions and rural electrification projects. The solar inverter market is witnessing significant expansion activities, with new product innovations, phase-shift solutions, and panel-level monitoring technologies. Utility-scale solar power plants, solar parks, and solar structures are increasingly adopting large-sized solar inverters for efficient power generation and transmission. The transition to renewable energy is essential for decarbonization and reducing greenhouse gas emissions. Solar energy is becoming increasingly competitive with traditional power sources, with solar capacity expected to reach 1,000 GW in the US by 2030.

What are the market trends shaping the Solar Central Inverters Market?

Growing demand for clean energy technologies is the upcoming trend in the market.

- The market is experiencing significant growth due to the increasing demand for renewable energy sources and the need for reliable power supply, particularly in the industrial and commercial sectors. Solar inverters, which convert DC power from solar panels into AC power for electricity usage, play a crucial role in the renewable energy sector. Central inverters, which convert DC power from multiple solar panels into AC power, are commonly used in large-scale solar power plants and industrial applications. In the residential sector, homeowners are increasingly adopting solar power for economic and environmental reasons. Solar power reduces carbon emissions and greenhouse gas emissions, making it an attractive option for those concerned about the environment.

- Solar panels installed on rooftops can provide backup power during power outages, making solar power an essential component of home renovation projects and new home constructions. Homeowners can also benefit from tax incentives and subsidies, making solar power an economically friendly solution. In the commercial sector, businesses are investing in solar power to reduce electricity costs and improve their bottom line. Solar power is also an attractive option for large buildings that require significant power backup. Infrastructural development and government support for renewable energy projects are also driving growth in the Solar Inverter market. The Solar Inverter market is also witnessing expansion activities and new product innovations.

What challenges does the Solar Central Inverters Market face during the growth?

Challenges posed by alternative sources of energy is a key challenge affecting the market growth.

- The market encompasses the production, sales, and installation of central inverters, a crucial component of solar photovoltaic (PV) systems. Central inverters convert DC power from solar panels into AC power for electricity transmission and distribution. In the US, the solar inverter market is driven by the growing demand for renewable energy, environmental concerns, and government support. Solar power is becoming increasingly economic-friendly for residential and commercial users, with home loans and tax benefits incentivizing home renovation projects. Industrial and commercial buildings, particularly those in hot-prone regions, seek reliable power supply and backup power solutions, further expanding the market. Central inverters support both on-grid and off-grid applications, with on-grid inverters connected to the utility grid and off-grid inverters providing power backup and electrification in rural areas.

- The market is segmented into single-phase and three-phase, with large-sized solar inverters used in utility-scale applications. String inverters and micro inverters are alternative technologies, but central inverters offer advantages such as panel-level monitoring, lower installation costs, and higher efficiency. The solar inverter market is influenced by several factors, including the expansion of solar power generation, the transmission sector's development, and the growth of renewable energy capacity. Decarbonization efforts and increasing electricity demand are driving the market, as solar energy becomes more competitive with traditional energy sources. Solar parks and solar structures are being constructed, and solar power is being integrated into the electric grid, necessitating the use of central inverters for grid connection and maximum power point tracking.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Delta Electronics Inc.

- Eaton Corp. Plc

- Fimer SpA

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- Ingeteam Corp. S.A.

- OCI Co. Ltd.

- Shenzen Growatt New Energy Technology Co. Ltd.

- Siemens AG

- Sineng Electric Co. Ltd.

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Sungrow Power Supply Co. Ltd.

- Toshiba Corp.

- Yaskawa Solectria Solar

- Zhejiang CHINT Electrics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Solar central inverters play a pivotal role in the conversion of direct current (DC) electricity generated by solar panels into alternating current (AC) electricity that can be used by homes, industries, and commercial establishments. This transition is crucial for the effective integration of solar power into the electrical grid and the reduction of carbon emissions and greenhouse gas (GHG) releases. Central inverters, also known as utility-scale or large-sized solar inverters, are designed to handle high power output and are typically used in industrial, commercial, and utility-scale solar power installations.

Moreover, these inverters are capable of converting DC electricity from multiple solar panels or strings into AC electricity, making them an essential component of solar power generation systems. The renewable energy sector has witnessed significant growth in recent years due to increasing environmental concerns, economic benefits, and government support. Solar power, in particular, has gained immense popularity as a clean and sustainable energy source. Central inverters are a key enabler for this transition, providing reliable power supply and continuous power generation, even in hot, prone regions. Central inverters are also essential for off-grid applications, such as rural electrification projects, where the electrical grid is not available.

Furthermore, these inverters help ensure a stable power supply, enabling businesses and households to operate efficiently and reducing their reliance on traditional energy sources. The expansion of solar power generation capacity has led to the development of new product innovations in the solar inverter market. These include monolithic and modular inverters, multi-MPPT trackers, and master-slave control approaches. These advancements have improved the efficiency and reliability of solar power systems, making them more economically viable for businesses and homeowners. The use of solar inverters is not limited to residential and commercial applications. They are also used in large-scale solar power generation projects, such as solar parks and power plants.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.99% |

|

Market Growth 2024-2028 |

USD 3.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.22 |

|

Key countries |

US, China, Vietnam, Japan, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch