Inverter Market Size 2024-2028

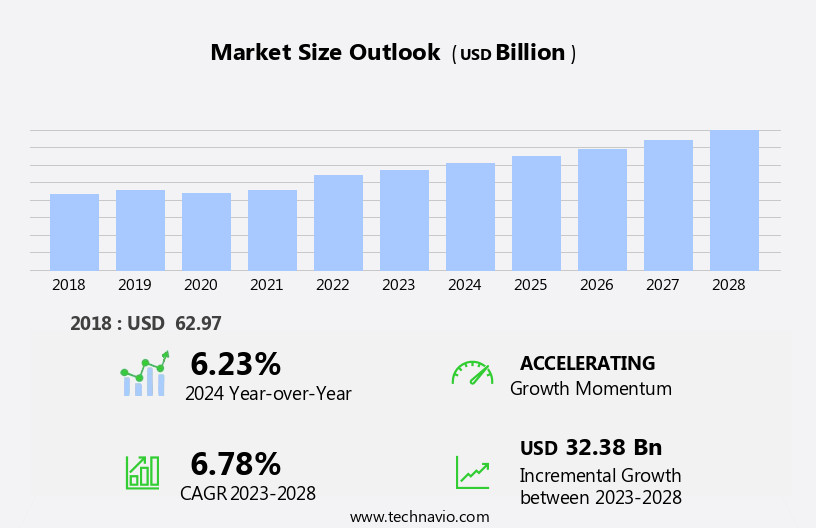

The inverter market size is forecast to increase by USD 32.38 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is witnessing significant growth, driven primarily by the rise in wind energy consumption and the increasing demand for clean power. Renewable energy sources, particularly wind energy, are becoming increasingly popular due to their environmental benefits and decreasing costs. However, the intermittent nature of renewable energy poses a significant challenge for market growth. Inverters play a crucial role in converting direct current (DC) power from renewable energy sources into alternating current (AC) for grid connection and distribution. The market's growth is further fueled by advancements in inverter technology, enabling higher efficiency, larger capacity, and more flexibility.

- However, the intermittency of renewable energy sources necessitates the development of energy storage solutions to ensure a consistent power supply. This presents both an opportunity and a challenge for market participants. Companies that can effectively address the energy storage issue and provide reliable, efficient, and cost-effective solutions will be well-positioned to capitalize on the growing demand for renewable energy and clean power. Conversely, those that fail to address this challenge may struggle to compete in the market. Overall, the market is poised for growth, with key drivers including the increasing adoption of renewable energy sources and the demand for clean power.However, the intermittency of these sources and the need for energy storage solutions present significant challenges that market participants must address to succeed.

What will be the Size of the Inverter Market during the forecast period?

- The market continues to evolve, driven by the increasing adoption of renewable energy sources and the push for carbon emissions reduction. Grid-tied inverters play a crucial role in converting photovoltaic (PV) energy into usable AC power for residential and commercial applications. Efficiency optimization is a key focus, with data analytics and energy management systems enabling real-time monitoring and adjustments. Power factor correction, data security, and smart grid integration are also essential components. Predictive maintenance, voltage regulation, and energy efficiency are increasingly important for ensuring system reliability and cost reduction. Power electronics and energy storage solutions, such as battery backup and DC-to-AC conversion, are also gaining traction.

- The market dynamics are shaped by various factors, including utility-scale applications, demand response, safety standards, and grid integration. Renewable energy sources, including wind power and solar energy, continue to drive market growth, with hybrid inverters offering flexibility and improved power system stability. The ongoing integration of artificial intelligence (AI) and cloud computing is transforming the industry, enabling advanced monitoring, control, and fault detection capabilities.

How is this Inverter Industry segmented?

The inverter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Solar PV

- Automotive

- Industrial

- Residential

- Type

- On-grid

- Off-grid

- Technology

- Pure Sine Wave

- Modified Sine Wave

- Square Wave

- Product

- String Inverters

- Micro Inverters

- Central Inverters

- Hybrid Inverters

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The solar pv segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the grid-tied inverter segment, driven by the increasing adoption of renewable energy sources, such as solar and wind power, for residential and commercial applications. Grid-tied inverters enable the conversion of direct current (DC) electricity from photovoltaic (PV) panels into alternating current (AC) for grid integration. This market trend aligns with the global push towards reducing carbon emissions and increasing energy efficiency. In the residential sector, energy management and data analytics are crucial for optimizing energy consumption and costs. Smart grid technology and predictive maintenance enable real-time monitoring and control of energy usage, ensuring power quality and stability.

Central inverters are increasingly being used in utility-scale applications for grid integration, while battery backup systems provide energy storage solutions for renewable energy. Power factor correction and voltage regulation are essential for optimizing grid performance and ensuring power system stability. Harmonic distortion and frequency regulation are critical considerations for grid integration, with inverters playing a vital role in mitigating these issues. Demand response and demand side management are also becoming increasingly important for grid management and cost reduction. The integration of artificial intelligence (AI) and data analytics in inverters enables advanced monitoring and control, including fault detection, predictive maintenance, and demand response.

Safety standards and monitoring and control systems are essential for ensuring grid safety and preventing islanding. Off-grid inverters are used in remote locations where grid connection is not available, providing a sustainable energy solution for powering homes and businesses. Hybrid inverters, which combine solar and battery storage systems, offer increased energy independence and cost savings. The market for inverters is expected to continue growing, driven by the increasing adoption of renewable energy sources, the need for energy efficiency and cost savings, and the integration of advanced technologies such as AI and data analytics. The future of the market lies in the development of more efficient, intelligent, and cost-effective solutions for grid integration and energy management.

The Solar PV segment was valued at USD 27.94 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

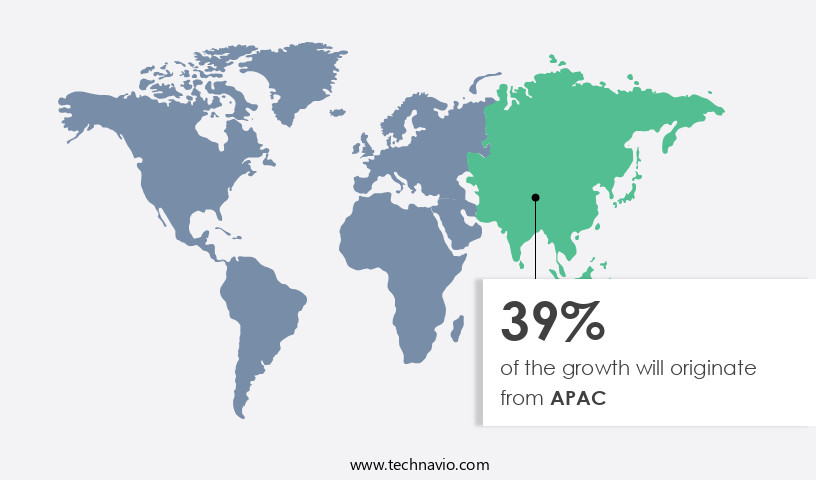

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Asia-Pacific region, the market is experiencing significant growth due to the increasing adoption of inverters in various sectors, including electric vehicles and railways, wind and solar energy, and manufacturing and industrial applications. Countries such as Japan, China, Australia, India, South Korea, Taiwan, and Singapore are driving this growth. The rising population and improving standards of living in APAC have led to a surging demand for energy, which in turn is fueling the focus on renewable energy sources. China and India are expected to account for a large portion of the installations in the region, given their substantial wind energy potential and robust government support.

Efficiency optimization is a key trend in the market, with photovoltaic (PV) systems increasingly being integrated with energy management systems and data analytics for better power usage. Grid-tied inverters are being used to improve power quality and reduce carbon emissions. Power factor correction and voltage regulation are essential features for grid integration. Smart grids and predictive maintenance are also gaining traction, with cloud computing enabling remote monitoring and fault detection. Central inverters and string inverters are being used for utility-scale applications, while hybrid inverters are being adopted for renewable energy systems that combine solar and wind power. Safety standards and monitoring and control systems are crucial for ensuring power system stability and preventing islanding.

Battery backup and dc-to-ac conversion are essential for ensuring energy storage and reducing costs. Artificial intelligence (AI) is being used to optimize energy efficiency and improve power system performance. Harmonic distortion is a concern for power quality, and inverters are being designed to minimize it. In conclusion, the market in APAC is witnessing robust growth due to the increasing demand for energy and the focus on renewable energy sources. The market is being driven by trends such as efficiency optimization, smart grids, predictive maintenance, and energy storage. Inverters are being used in various sectors, including EV and railways, wind and solar energy, and manufacturing and industrial applications. The market is expected to continue growing as countries in the region invest in sustainable energy and improve their power infrastructure.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Inverter Market advances with inverters for solar energy and string inverters for residential use. Inverter market trends 2024 emphasize smart inverters for grids and hybrid inverters for energy storage. Inverters for industrial applications and microinverters for rooftop solar fuel demand, per inverter market forecast. High-efficiency inverters leverage inverters with IoT connectivity, while inverters for commercial buildings ensure reliability. Inverters for renewable energy and inverters for automotive EVs drive scalability. Inverters for sustainable energy, advanced inverter technologies, and inverter supply chain optimize performance. Inverters for regulatory compliance, inverters for global markets, inverters for energy efficiency, inverters for grid stability, and inverters for B2B sectors propel growth through 2028.

What are the key market drivers leading to the rise in the adoption of Inverter Industry?

- The significant increase in wind energy consumption serves as the primary market driver. The global market for grid-tied inverters, a crucial component in the conversion of photovoltaic (PV) energy into usable AC power for residential applications, is experiencing significant growth. This expansion is driven by the increasing emphasis on energy efficiency optimization and the integration of renewable energy sources into the power grid. With carbon emissions becoming a major concern, countries worldwide are turning to renewable energy to reduce their carbon footprint. Among all renewable energy sources, wind power is the most abundant and efficient for power generation. In 2020, China led the world in cumulative installed wind power capacity, followed closely by the US and Europe.

- The ongoing efforts to harness wind energy's potential in these regions are expected to fuel market growth. For instance, in 2021, offshore wind installations accounted for approximately one-fifth of the annual gross wind installations in Europe. The integration of advanced technologies like energy management, data analytics, power factor correction, smart grid, and data security is further enhancing the market's growth prospects.

What are the market trends shaping the Inverter Industry?

- The trend in the market is shifting towards an increased demand for clean power. This growing requirement for renewable energy sources is a significant development in the industry.

- The global power demand is projected to grow significantly due to population expansion and economic development, reaching approximately 34,454 TWh by 2035 according to The World Bank. This increasing demand necessitates the adoption of efficient and sustainable power solutions. In response, the market for inverters, which facilitate dc-to-ac conversion, voltage regulation, and energy efficiency, is experiencing substantial growth. Inverters play a crucial role in various applications, including renewable energy systems, data centers, and off-grid installations. Advanced technologies, such as predictive maintenance, artificial intelligence (AI), and fault detection, are enhancing the performance and reliability of inverters.

- These features enable cost reduction by minimizing downtime and optimizing energy usage. Off-grid inverters are gaining popularity in remote areas and developing countries, providing power solutions for those without access to the main grid. Central inverters, which manage large-scale power generation, are essential for utility-scale renewable energy projects. In conclusion, the market is driven by the growing demand for power and the shift towards low-carbon technologies. Technological advancements, such as predictive maintenance and AI, are improving the efficiency and reliability of inverters, making them an essential component of the global power infrastructure.

What challenges does the Inverter Industry face during its growth?

- The intermittent nature of renewable energy poses a significant challenge to the industry's growth, requiring continuous research and development to ensure a reliable and sustainable energy supply.

- The solar photovolvoltaic (PV) market is experiencing significant growth due to decreasing installation costs and favorable government regulations. However, the intermittent nature of solar energy poses a challenge to market expansion. Solar energy production is inconsistent due to the variable nature of sunlight, which affects the power system stability and requires effective grid integration. To address these challenges, advanced technologies such as cloud computing, remote monitoring, and hybrid inverters are being adopted. Hybrid inverters, capable of managing multiple energy sources, offer improved power quality and harmonic distortion mitigation. These inverters ensure the efficient integration of renewable energy into the power grid, enhancing the reliability and stability of the power system.

- Moreover, the increasing focus on sustainable energy and wind power is driving the demand for advanced inverter solutions. Inverter manufacturers are investing in research and development to create more efficient and effective solutions, ensuring the consistent production of renewable energy. This innovation is crucial to maintaining a stable power grid and reducing reliance on fossil fuels. In conclusion, the solar PV market is growing rapidly, but the intermittent nature of solar energy presents challenges to market expansion. Advanced technologies, such as cloud computing, remote monitoring, and hybrid inverters, are being adopted to address these challenges and ensure the efficient integration of renewable energy into the power grid. This focus on innovation is essential to maintaining power system stability and reducing reliance on fossil fuels.

Exclusive Customer Landscape

The inverter market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the inverter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, inverter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

SMA Solar Technology AG - The company specializes in providing advanced inverter solutions, including the HES880 model. Our offerings prioritize efficiency and reliability, enhancing the performance of renewable energy systems. By utilizing cutting-edge technology, we ensure optimal energy conversion and maximize system output. Our commitment to innovation and sustainability sets US apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- SMA Solar Technology AG

- Fronius International GmbH

- ABB Power Grids

- Schneider Electric SE

- Siemens AG

- Delta Electronics Inc.

- TMEIC Corporation

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Omron Corporation

- Sungrow Power Supply Co. Ltd.

- Huawei Technologies Co. Ltd.

- GoodWe Power Supply Technology Co. Ltd.

- Ginlong Technologies

- Enphase Energy Inc.

- SolarEdge Technologies Inc.

- OutBack Power Technologies

- Victron Energy

- KACO new energy GmbH

- Eaton Corporation plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Inverter Market

- In May 2022, Huawei Technologies partnered with Trina Solar to advance smart photovoltaic (PV) solutions, focusing on innovative inverter technologies. This collaboration aimed to integrate Huawei's advanced string inverters with Trina Solar's PV modules, enhancing efficiency for commercial and utility-scale solar projects by leveraging AI and cloud technology for optimized power generation.

- In July 2023, WEG S.A. acquired Regal Rexnord's industrial motors and generators business, strengthening its position in the inverter market. This acquisition, valued at approximately USD400 million, expanded WEG's portfolio of energy-efficient motor solutions, including those paired with inverters for renewable energy applications, boosting its global market presence.

- In January 2025, Lithuania implemented legislation banning Chinese-manufactured inverters from remotely accessing sites exceeding 100 kW due to cybersecurity concerns. This policy shift, driven by national security priorities, is expected to limit foreign inverter deployments while supporting local manufacturers in competing within the European market.

- In May 2025, Solis Inverters' Indian subsidiary achieved a 6 GW shipment milestone and launched new 350 kW and 150 kW string inverters, alongside a 50 kW hybrid inverter, targeting India's commercial and industrial solar market. These product launches address growing demand for high-capacity, efficient inverters in one of the world's fastest-growing solar markets.

Research Analyst Overview

The market is experiencing significant growth and innovation, driven by the increasing adoption of distributed generation, green energy, and energy efficiency standards. Battery management systems and MPPT algorithms are key components of this shift, optimizing energy storage technologies like flow batteries and hydrogen energy. Distributed generation, including solar and wind, is transforming energy markets through net metering and feed-in tariffs. Smart metering and demand side management are enhancing grid stability and energy resilience, while carbon pricing and energy subsidies influence market dynamics. Power surge protection and voltage sag mitigation are crucial for grid synchronization and power conditioning. Multilevel inverters and modular inverters are advancing energy transition, enabling energy independence and energy trading.

Climate change mitigation and grid stability enhancement are primary objectives, with electric vehicles (EVs) and fuel cells contributing to the energy infrastructure evolution. Energy optimization and energy trading are becoming essential strategies for businesses in the face of energy markets' volatility.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Inverter Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 32.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Inverter Market Research and Growth Report?

- CAGR of the Inverter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the inverter market growth of industry companies

We can help! Our analysts can customize this inverter market research report to meet your requirements.