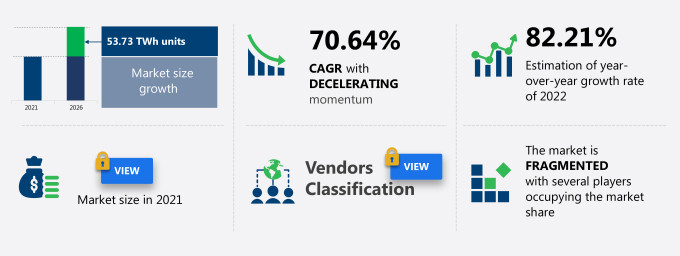

The solar energy market share in Argentina is expected to increase by 53.73 terawatt-hour units from 2021 to 2026, at a CAGR of 70.64%.

This solar energy market in Argentina research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers the solar energy market in Argentina segmentation by end-user (utility and rooftop) and application (grid-connected and off-grid). The Argentina solar energy market segmentation report also offers information on several market vendors, including 360 Energy SA, ABB Ltd., Canadian Solar Inc., Cox Energy SAB de CV, Emesa, Enel Spa, Genneia SA, Huawei Investment and Holding Co. Ltd., Pampa Energia SA, and Trina Solar Co. Ltd. among others.

What will the Solar Energy Market Size in Argentina be During the Forecast Period?

Download the Free Report Sample to Unlock the Solar Energy Market Size in Argentina for the Forecast Period and Other Important Statistics

Solar Energy Market in Argentina: Key Drivers, Trends, and Challenges

The increasing demand for electricity is notably driving the solar energy market growth in Argentina, although factors such as intermittency in solar power generation may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the solar energy industry in Argentina. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Solar Energy Market Driver in Argentina

One of the key factors driving the solar energy market growth in Argentina is the increasing demand for electricity. Concerns about the large carbon footprint of traditional power plants are also projected to increase demand for solar PV to fulfill Argentina's expanding electricity demand. Because more than half of Argentina receives yearly average sunshine of more than 3.5 kWh/m2, solar PV is a technically viable alternative for meeting the increased power demand. Moreover, as part of the RenovAr Program, the country intends to add 10,000 megawatts of renewable energy to the grid by 2025. To achieve this goal, 58 prospective solar projects with a total capacity of 2,834 megawatts were submitted in the first renewable energy tender, propelling the solar PV sector even further. As a result, the country has a lot of solar PV projects in the planning and execution stages, which are expected to propel the growth of the market in focus during the forecast period.

Key Solar Energy Market Trend in Argentina

Another key factor driving the solar energy market growth in Argentina is the increasing investments in renewable energy. Argentina has some of the most abundant renewable energy resources in Latin America, including unobstructed and strong winds in southern Patagonia, year-long sunshine in the distant northwest, and hydropower and biomass supplied by rivers and its vast agricultural and livestock farms, respectively. Argentina's government had designated 2017 as the ‘Year of Renewable Energy,’ with the goal of diversifying the country's energy mix, reducing its reliance on imported fossil fuels, and lowering carbon emissions. Argentina's objective in the future years is to attract USD 35 billion in energy investments, with renewable energy accounting for almost half of that total. Thus, the systematic approach is expected to encourage private sector investments and innovation, which will support the market growth during the forecast period.

Key Solar Energy Market Challenge in Argentina

One of the key challenges to the solar energy market growth in Argentina is the intermittency in solar power generation. Solar PV output is not continuous and depends on several factors, such as the degree of shade, panel efficiency, and solar irradiation, which tends to vary over the duration of the day. Hence, it is not viable to have a power system that is completely reliant on solar power. Furthermore, if the solar panel is not at its peak production, a secondary power system such as a battery, wind power, a hybrid generator, or grid power is needed to provide power, which requires additional investment. Moreover, rainy and cloudy weather also adversely affects the generation of solar power. Though solar power technology is constantly evolving, the conversion rate cannot match that of fossil fuels, which is expected to challenge the growth of the solar energy market in Argentina during the forecast period.

This solar energy market in Argentina analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the solar energy market in Argentina as a part of the global renewable electricity market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the solar energy market in Argentina during the forecast period.

Who are the Major Solar Energy Market Vendors in Argentina?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- 360 Energy SA

- ABB Ltd.

- Canadian Solar Inc.

- Cox Energy SAB de CV

- Emesa

- Enel Spa

- Genneia SA

- Huawei Investment and Holding Co. Ltd.

- Pampa Energia SA

- Trina Solar Co. Ltd.

This statistical study of the Argentina solar energy market encompasses successful business strategies deployed by the key vendors. The solar energy market in Argentina is fragmented and the vendors are deploying growth strategies such as product differentiation to compete in the market.

Product Insights and News

- 360 Energy SA - The company offers renewable electric solar power.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The solar energy market in Argentina forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Solar Energy Market in Argentina Value Chain Analysis

Our report provides extensive information on the value chain analysis for the solar energy market in Argentina, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global renewable electricity market includes the following core components:

- Inputs

- Electricity generation

- Electricity transmission

- Electricity distribution

- End-users

- Innovation

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

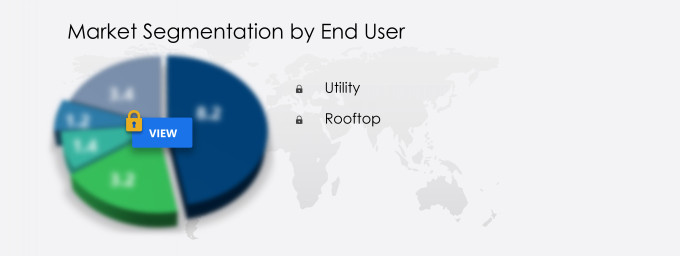

What are the Revenue-generating End-user Segments in the Solar Energy Market in Argentina?

To gain further insights on the market contribution of various segments Request for a FREE sample

The solar energy market share growth in Argentina by the utility segment will be significant during the forecast period. A utility-scale solar power plant provides the benefit of fixed electricity prices, especially when the prices of electricity generated from fossil fuels increase during periods of peak demand. The solar energy generated from these plants can also be stored in energy storage systems for use when there is no sunlight. These factors will drive the adoption of utility-scale solar power in the country.

This report provides an accurate prediction of the contribution of all the segments to the growth of the solar energy market size in Argentina and actionable market insights on post COVID-19 impact on each segment.

You may also be interested in:

Solar Panels market - Market share is expected to increase by USD 44.96 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 7.61%.

&

Residential Solar market - Market share in the US is expected to increase by USD 6.67 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 10.39%.

|

Solar Energy Market Scope in Argentina |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 70.64% |

|

Market growth 2022-2026 |

53.73 TWh units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

82.21 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

360 Energy SA, ABB Ltd., Canadian Solar Inc., Cox Energy SAB de CV, Emesa, Enel Spa, Genneia SA, Huawei Investment and Holding Co. Ltd., Pampa Energia SA, and Trina Solar Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Solar Energy Market in Argentina Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive solar energy market growth in Argentina during the next five years

- Precise estimation of the solar energy market size in Argentina and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the solar energy industry in Argentina

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of solar energy market vendors in Argentina

We can help! Our analysts can customize this report to meet your requirements. Get in touch