Soldier Systems Market Size 2024-2028

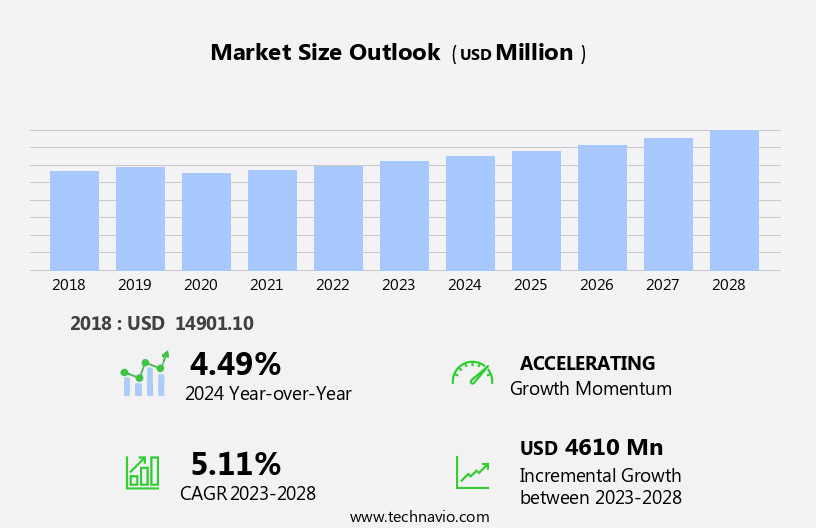

The soldier systems market size is forecast to increase by USD 4.61 billion at a CAGR of 5.11% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by increased military deployment and the integration of directed-energy weapons (DEWs) into soldier systems. The military segment continues to be the largest consumer of soldier systems due to the ongoing need for advanced technology to ensure the safety and effectiveness of troops in the field. Additionally, the integration of DEWs, such as lasers and microwaves, into soldier systems is revolutionizing battlefield capabilities by enabling non-lethal incapacitation, precision engagement, and situational awareness. Another key trend shaping the market is the growing connectivity of soldier systems. The integration of advanced communication and computing technologies is enabling real-time data sharing and collaboration between soldiers, improving situational awareness and enabling faster decision-making.

- This trend is expected to continue as military forces seek to enhance their operational capabilities and maintain a technological edge over potential adversaries. However, the market is not without challenges. The development and integration of these advanced technologies into soldier systems comes with significant costs and complexities. Ensuring interoperability between different systems and components, as well as addressing cybersecurity concerns, are major challenges that must be addressed to fully realize the potential of these advanced soldier systems. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must prioritize research and development, focus on interoperability and cybersecurity, and collaborate with military and technology partners to stay ahead of the competition.

What will be the Size of the Soldier Systems Market during the forecast period?

- The market encompasses advanced technologies designed to enhance the capabilities of military personnel in various operational scenarios. This market is driven by defense organizations' ongoing modernization initiatives and increasing defense spending. Key technologies include C4I systems, radars, scopes, and situational awareness tools, which provide force multiplication and improve combat effectiveness. Military funds are also allocated towards soldier safety and counterinncy, urban warfare, and special operations. Quick technology advancements in nanotechnology, such as nanofibers, jammers, and survivability solutions, further bolster the market's growth.

- Military modernization programs prioritize soldier system technologies to address asymmetric warfare challenges and counter asymmetric threats. The defense sector's focus on improving survivability, situational awareness, and communication systems in the battlefield continues to fuel market expansion. Law enforcement agencies also contribute to the market's growth, adopting similar technologies for their operational needs.

How is this Soldier Systems Industry segmented?

The soldier systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Military

- Homeland security

- Type

- Personal protection

- Communication

- Power and data transmission

- Surveillance and target acquisition

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

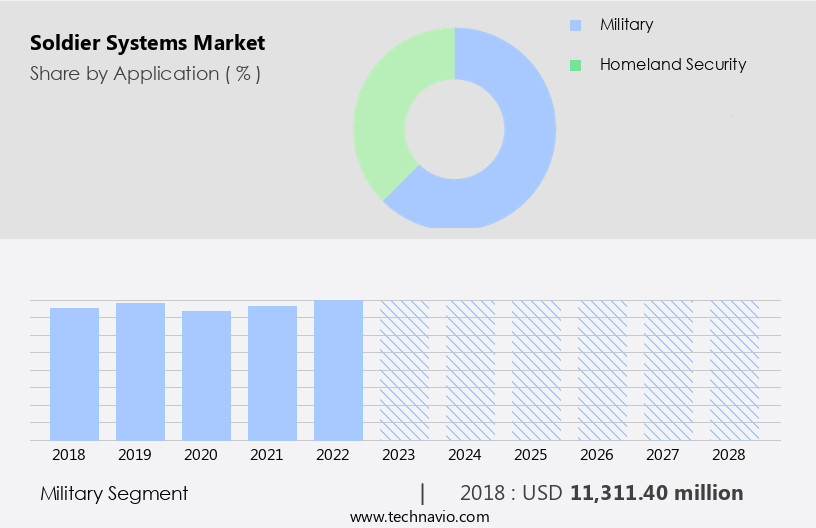

The military segment is estimated to witness significant growth during the forecast period.

The Soldier Systems Industry encompasses advanced technologies designed to enhance the capabilities of military forces in various national defense applications. Key components include Night Vision Devices, Protection Systems, and Communication Systems. The Vision segment dominates the market, driven by the need for Enhanced Situational Awareness in combat situations. Ruggedized Tablets, C4I technology, and SATCOM Systems are integral to soldier modernization programs, addressing Mobility Issues and Integration challenges. Technological complexity, such as nanofibers and nanocomposite materials, is a governing factor in the development of lightweight, high-performance protective clothing and exoskeletons. Soldier safety is paramount, with a focus on Personal Protective Equipment, including Ballistic Eyewear, Hearing Protection, and respiratory protective equipment.

Market dynamics are influenced by qualitative aspects, such as Mission Effectiveness, Force Multiplication, and Mission Adaptability. Quantitative factors include defense spending, budgetary restrictions, and energy efficiency. Asymmetric threats, such as terrorist attacks, require advanced solutions for survivability and counter operations. The military segment holds a significant share of the market due to the continuous modernization of military forces. Technological advancements, including quick technology adoption and regulatory compliance, are essential to addressing the challenges of asymmetric warfare, urban warfare, and counterinncy. The demand for integrated solutions, such as smartphone technology and GPS devices, is increasing to improve communication and navigation on the battlefield.

Cybersecurity and data protection are crucial considerations in the defense sector, with the need for secure C4I technology and SATCOM systems to ensure mission success. Market Research Future predicts steady growth in the soldier systems industry, driven by military modernization initiatives and the increasing importance of soldier safety and mission effectiveness.

Get a glance at the market report of share of various segments Request Free Sample

The Military segment was valued at USD 11.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the national defense sector's emphasis on enhancing situational awareness and mission effectiveness for military forces. Night Vision Devices, Protection Systems, and Communication Systems are key components of this industry. Technological complexity, such as C4I technology, cybersecurity, and surveillance, plays a significant role in the market's growth. Mobility Issues, weight reduction, and energy efficiency are governing factors in the development of soldier systems. In the Vision segment, advancements in nanofibers, nanocomposite materials, and nanotechnology contribute to the integration of enhanced situational awareness systems, including ballistic eyewear and hearing protection. Market Research Future reports that the Soldier System Industry is expected to grow significantly due to military modernization programs, soldier safety, and mission adaptability.

Market dynamics include quick technology advancements, asymmetric threats, and regulatory compliance. Soldier systems include Ruggedized Tablets, GPS Devices, Headsets, and C4I technology. Integration challenges and budgetary restrictions are ongoing concerns. The market caters to various applications, including combat, training and simulation, and law enforcement agencies. Key opinion leaders in the defense sector, such as General Dynamics and Homeland Security, are investing in soldier system technologies, including exoskeletons, personal protective equipment, and smartphone technology. Soldier systems are essential for force multiplication and mission effectiveness in international conflicts and urban warfare. The market is influenced by military modernization initiatives, military funds, and macroeconomic factors.

SATCOM Systems, radars, jammers, and power management are also critical components of soldier systems. The market faces challenges such as export controls, survivability, and data protection. Market Research Future anticipates that the market will grow at a steady pace due to the increasing demand for integrated solutions and the need for enhanced situational awareness in counter operations and health monitoring.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Soldier Systems Industry?

- Increased deployment by military segment is the key driver of the market.

- The market is experiencing significant growth due to the integration of advanced technologies, particularly Virtual Reality (VR) and Augmented Reality (AR), into military training and operations. The military segment is a primary end-user of these systems, utilizing them primarily for training and simulation purposes. Head-mounted displays, a type of AR technology, are increasingly being adopted by ground force troops for enhanced situational awareness. AR technology is being deployed across various military, defense, and aviation applications. For instance, the US Army is implementing a new AR heads-up display technology, making modern warfare more and effective.

- The increasing government spending on military training and technology development is further fueling the market growth. These advancements are revolutionizing army readiness and enhancing operational efficiency.

What are the market trends shaping the Soldier Systems Industry?

- Integration of directed-energy weapons (DEWs) is the upcoming market trend.

- The global military technology landscape is witnessing significant advancements, with a focus on developing advanced weapon capabilities. Two leading nations, the US and Russia, are at the forefront of this race, introducing technologies such as hypersonic missiles, rail guns, and Directed Energy Weapons (DEWs). DEWs are energy-emitting devices, including lasers, microwaves, electromagnetic radiation, radio waves, sound, or particle beams. Originating from laser-guided munitions, DEWs are limited by the fuel capacity of armored vehicles and can store thousands of shots, maintaining operational efficiency until the electronics' power source or fuel is depleted.

- DEWs offer immense potential for military applications, potentially reducing the cost of developing and operating both offensive and defensive weaponry. These technologies are revolutionizing the military sector by offering enhanced capabilities and efficiency.

What challenges does the Soldier Systems Industry face during its growth?

- Growing connectivity of soldier systems is a key challenge affecting the industry growth.

- The integration of soldier systems with networks and devices presents a significant challenge for The market. While advanced technologies and connectivity enhance soldier capabilities, they also introduce cybersecurity risks. Sensitive data, such as personal information, mission-critical data, and classified information, are common in soldier systems. A security breach could compromise soldier safety and jeopardize military operations. Cyber threats can also impact the performance of soldier systems, leading to mission failure and potential harm to soldiers.

- Ensuring the security of soldier systems is crucial to maintaining military effectiveness and protecting personnel.

Exclusive Customer Landscape

The soldier systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the soldier systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, soldier systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASELSAN AS - The company specializes in providing advanced soldier systems, including Thermal imagers, SkeetIR thermal vision, and Laser Rangefinders, enhancing situational awareness and operational effectiveness for military personnel. These technologies enable users to detect, identify, and engage targets with precision, improving mission success and survivability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASELSAN AS

- BAE Systems Plc

- BERETTA HOLDING SA

- Cisco Systems Inc.

- Elbit Systems Ltd.

- General Dynamics Corp.

- L3Harris Technologies Inc.

- Leonardo Spa

- Mayflower Communications Co. Inc.

- Northrop Grumman Corp.

- RTX Corp.

- Rheinmetall AG

- Saab AB

- Shoghi Communications Ltd.

- Singapore Technologies Engineering Ltd.

- Stumpp Schuele and Somappa Springs Pvt. Ltd.

- Teledyne Technologies Inc.

- Thales Group

- Trijicon Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The soldier system market encompasses a range of advanced technologies designed to enhance the capabilities and safety of military personnel in various operational environments. This dynamic industry is driven by the need for superior protection, communication, and situational awareness to enable effective mission execution and force multiplication. The vision segment within the soldier system industry has witnessed significant advancements, with night vision devices playing a crucial role in enhancing situational awareness during nighttime operations. Protection systems, including nanofibers and personal protective equipment, are essential components of soldier systems, ensuring survivability in the face of asymmetric threats. Technological complexity is a governing factor in the soldier system industry, with key opinion leaders continually pushing for the integration of C4I technology, cybersecurity, and surveillance systems.

Mobility issues and combat scenarios necessitate the use of ruggedized tablets, GPS devices, and headsets for effective communication and navigation. Training and simulation are integral aspects of soldier system modernization programs, allowing military forces to prepare for various mission scenarios effectively. Smartphone technology and other systems have also found applications in the military segment, offering weight reduction and energy efficiency. Modularity and weight reduction are essential considerations in the design of soldier systems, with the need to minimize encumbrance without compromising mission effectiveness. Regulatory compliance and budgetary restrictions are also key challenges in the procurement processes for these systems.

The defense sector is undergoing significant modernization initiatives, with military funds allocated towards the development of advanced soldier systems. Macroeconomic factors, such as international conflicts and terrorism, continue to drive defense spending and the need for enhanced soldier capabilities. The soldier system industry is characterized by rapid technological advancements, with nanocomposite materials, satcom systems, and scopes being among the latest innovations. The integration of these technologies, however, poses challenges in terms of weight reduction, power management, and regulatory compliance. Market dynamics in the soldier system industry are influenced by various factors, including technological factors, military modernization programs, and mission adaptability.

The industry is also subject to export controls and force multiplication, with military organizations seeking to enhance situational awareness and survivability in the face of asymmetric threats. In , the soldier system market is a critical component of national defense, with ongoing technological advancements and modernization initiatives driving the development of advanced systems for military personnel. The need for enhanced protection, communication, and situational awareness continues to be a key focus, with the industry addressing challenges related to technological complexity, weight reduction, and regulatory compliance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.11% |

|

Market growth 2024-2028 |

USD 4610 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.49 |

|

Key countries |

US, Russia, China, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Soldier Systems Market Research and Growth Report?

- CAGR of the Soldier Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the soldier systems market growth of industry companies

We can help! Our analysts can customize this soldier systems market research report to meet your requirements.