Qatar Solid Waste Management Market Size 2024-2028

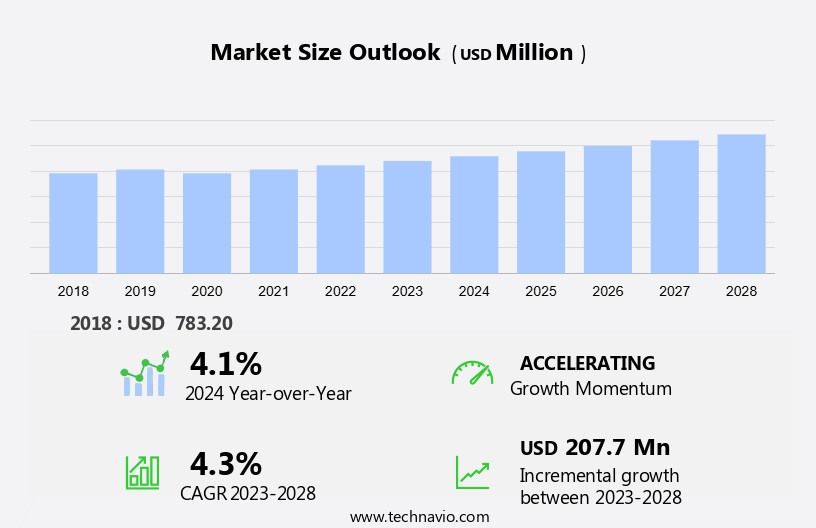

The Qatar solid waste management market size is forecast to increase by USD 207.7 million at a CAGR of 4.3% between 2023 and 2028.

- In the dynamic landscape of Solid Waste Management (SWM) in Qatar, several key trends and challenges are shaping the industry. The growing awareness of environmental sustainability and the need to reduce the risks of pollution have fueled the adoption of advanced solutions. One such trend is the increasing use of data analytics in waste management operations, enabling efficient resource utilization and optimizing waste disposal processes. However, the high cost associated with implementing smart waste management systems, such as those incorporating sensors, software, and renewable energy solutions, poses a significant challenge. Additionally, the construction sector's continuous expansion drives the demand for steel, asphalt, and other materials, contributing to the generation of substantial waste.

- Furthermore, the use of bioplastics and greenhouse-friendly packaging is gaining traction as an eco-friendly alternative to traditional plastic. Mercury, iron, and steel are among the materials that require specialized handling due to their hazardous nature. As the market evolves, the integration of smart trash bins and landfill gas utilization for energy generation is expected to become more prevalent. Overall, the SWM market in Qatar presents both opportunities and challenges, requiring a strategic approach to remain competitive and sustainable.

What will be the size of the Qatar Solid Waste Management Market during the forecast period?

- The market is experiencing significant growth due to increasing awareness of sustainability and the need to mitigate environmental and social challenges. Key trends include a focus on waste hierarchy principles, such as waste reduction, reuse, and recycling, as well as the adoption of smart waste management systems and technologies. Waste processing, including the management of metal, glass, and biodegradable materials, is a priority to minimize air and water pollution. Environmental benefits, including the reduction of greenhouse gases and the promotion of a circular economy, are driving the market. Waste management regulations and standards are becoming more stringent, leading to increased investment in waste management infrastructure and financing.

- Training and education are essential to ensure effective implementation of waste management solutions and to promote environmental justice. Waste audit and waste diversion strategies are critical to optimizing waste management systems and reducing the carbon footprint. The market is also addressing the challenges of e-waste management and the growing issue of food waste through innovative circular economy solutions. The use of bioplastics and compostable packaging is increasing, as is the adoption of sustainable packaging and community composting initiatives. However, challenges remain, including the need to address entanglement issues and the potential for greenwashing. The market is expected to continue growing as the country works towards a more sustainable and resource-efficient future.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Industrial

- Municipal

- Method

- Landfills

- Incineration

- Recycling

- Geography

- Qatar

By Source Insights

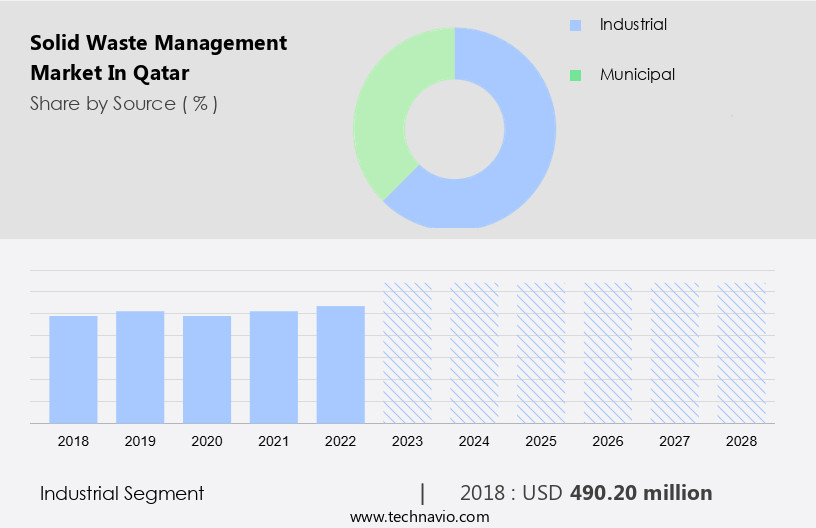

- The industrial segment is estimated to witness significant growth during the forecast period.

Industrial solid waste, a byproduct of various manufacturing processes and commercial activities, poses environmental and health risks if not managed properly. In Qatar, the Ministry of Municipality regulates solid waste management to ensure compliance with environmental standards and public health concerns. Industrial sectors, such as construction, demolition, and renovation, generate significant amounts of solid waste, including asphalt, petroleum distillates, and used oil. Proper identification and management of these wastes are crucial to prevent vector-borne diseases, soil pollution, and air pollution. Waste collection vehicles and bins facilitate the efficient transport and disposal of solid waste, while regulations limit carbon monoxide emissions from waste disposal sites.

Waste treatment and waste-to-energy technologies convert organic matter into valuable resources, reducing the need for virgin resources and minimizing greenhouse gas emissions. Sustainable waste management practices, such as material recycling and composting, further contribute to environmental sustainability and resource conservation. Key environmental concerns include pollution from hazardous gases, such as methane and carbon dioxide, and marine debris. Waste management services and products, including AI recycling robots and smart waste bins, facilitate the efficient and cost-effective management of waste volumes. Government initiatives, such as extended producer responsibility and regulations, encourage businesses to adopt circular economy principles and reduce waste production.

Get a glance at the market share of various segments Request Free Sample

The Industrial segment was valued at USD 490.20 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Qatar Solid Waste Management Market?

Increasing need to reduce risks of growing environmental pollution is the key driver of the market.

- Solid waste management involves the collection, treatment, and disposal of everyday items like appliances, packaging, food scraps, and newspapers. This waste originates from various sectors, including urban residential areas, institutions such as schools and hospitals, and commercial establishments like restaurants and small businesses. However, a significant concern is the potential toxic substances in these waste materials, which can seep into the soil and contaminate groundwater. Electronic waste, in particular, contains hazardous metals like cadmium, lead, mercury, and chromium, posing a considerable environmental risk. Additionally, waste materials decompose, producing methane, carbon monoxide, and other harmful gases, contributing to air pollution and climate change.

- Waste management services employ various methods, including waste-to-energy, composting, material recycling, and landfilling, to mitigate these issues. Regulations play a crucial role in ensuring public health and preventing vector-borne diseases. Waste collection vehicles and smart waste bins equipped with waste level sensors facilitate efficient collection and reduce illegal dumping. Businesses, governments, and institutions must prioritize sustainable waste management practices to minimize pollution, protect natural resources, and promote environmental sustainability.

What are the market trends shaping the Qatar Solid Waste Management Market?

Increasing use of data analytics in waste management operations is the upcoming trend in the market.

- In Qatar's urban areas, solid waste management is a critical concern, with regulations focusing on waste collection, public health, and environmental sustainability. Waste collection vehicles and bins are essential components of these services, ensuring the efficient transportation and disposal of solid waste. However, the improper disposal of waste, including plastic products and industrial waste, can lead to soil pollution, vector-borne diseases, and air pollution. To mitigate these issues, waste-to-energy and waste treatment solutions have gained popularity. These practices include material recycling, composting, and resource recovery, reducing the volume of waste and minimizing the harmful effects on the environment.

- Waste management campaigns promote personal hygiene and waste separation to minimize waste production and encourage a circular economy. Data analytics plays a crucial role in waste management operations, enabling users to make data-driven decisions and optimize waste collection rates. These solutions, such as AI recycling robots and landfill waste level sensors, provide valuable insights into waste production, material recycling, and disposal services. Governments and businesses can use this information to develop sustainable waste management practices and reduce greenhouse gas emissions. Regulations and norms continue to evolve, focusing on reducing pollution from waste formation, including hazardous gases like carbon monoxide and methane.

What challenges does Qatar Solid Waste Management Market face during the growth?

High cost associated with implementation of smart waste management solutions is a key challenge affecting the market growth.

- The market is growing, with a focus on implementing advanced solutions to address urban challenges. Regulations aim to mitigate health risks from vector-borne diseases and ensure public health, driving the demand for waste collection and treatment. Waste plastic products pose significant environmental concerns, leading to the adoption of waste-to-energy and recycling technologies. The services are essential for managing industrial waste, protecting water resources, and promoting personal hygiene. Sustainable practices, such as composting and material recovery, are gaining popularity to reduce soil pollution and minimize carbon monoxide emissions. Operating costs and waste collection rates vary, making it crucial for businesses to consider material recycling and resource recovery as part of their strategies.

- Waste production and pollution are key environmental concerns, necessitating the development of recycling infrastructure and disposal services. Governments are implementing regulations to address hazardous gases, harmful compounds, and climate change, promoting the use of landfills with waste level sensors and transfer stations. The circular economy is driving innovation in waste management, with AI recycling robots and smart waste bins offering cost-effective solutions for businesses.

Exclusive Qatar Solid Waste Management Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Alee Services and Maintenance Facility Management

- AL HAYA ENVIRO

- Averda

- Dulsco LLC

- Green Waste Management Sewerage Services LLC

- Hamad Bin Khalid Contracting Co. W.L.L.

- Industries Qatar Q.P.S.C

- ISOBAR Group

- Keppel Corp. Ltd.

- Lokhandwala Qatar W.L.L

- New International Technology Co. W.L.L

- Power Waste Management and Transport Co. WLL

- Ramky Enviro Engineers Ltd.

- Shalimar Trading and Transport Co. W.L.L.

- Surbana Jurong Pvt. Ltd.

- Sustainable Waste Management

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market in urban areas is a critical issue of concern for numerous governments and institutions worldwide. With the increasing population growth and rapid urbanization, the generation of solid waste has become a significant challenge. This challenge is particularly acute in urban areas due to the high density of the population and the resulting high volume of waste production. They encompasses various activities, including waste collection, treatment, and disposal. Effective management of solid waste is essential for maintaining public health, preventing environmental pollution, and promoting sustainable practices. Regulations play a crucial role in solid waste management.

Governments implement regulations to ensure that waste is collected, treated, and disposed of in an environmentally responsible manner. Failure to adhere to these regulations can result in negative consequences, such as vector-borne diseases, soil pollution, and air and water pollution. One area of focus is the reduction of waste plastic products. Plastic waste poses a significant threat to the environment, with negative impacts on both land and marine ecosystems. Waste-to-energy technologies, such as incineration and composting, offer a potential solution for managing plastic waste while reducing greenhouse gas emissions. Another area of focus is the promotion of sustainable practices.

Furthermore, this includes the separation of waste at the source, material recycling, and the implementation of circular economy principles. The use of smart waste bins and AI recycling robots can help improve waste collection rates and reduce operating costs. Environmental concerns are a significant driver of innovation in the market. Technologies such as decomposition technologies and landfill gas collection systems help reduce the environmental impact of waste disposal. Additionally, governments and businesses are increasingly implementing policies to promote extended producer responsibility and reduce the production of waste. The market is dynamic, with ongoing developments in waste treatment and disposal technologies, regulations, and waste reduction initiatives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

129 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2024-2028 |

USD 207.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Qatar

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch