Sparkling Water Market Size 2025-2029

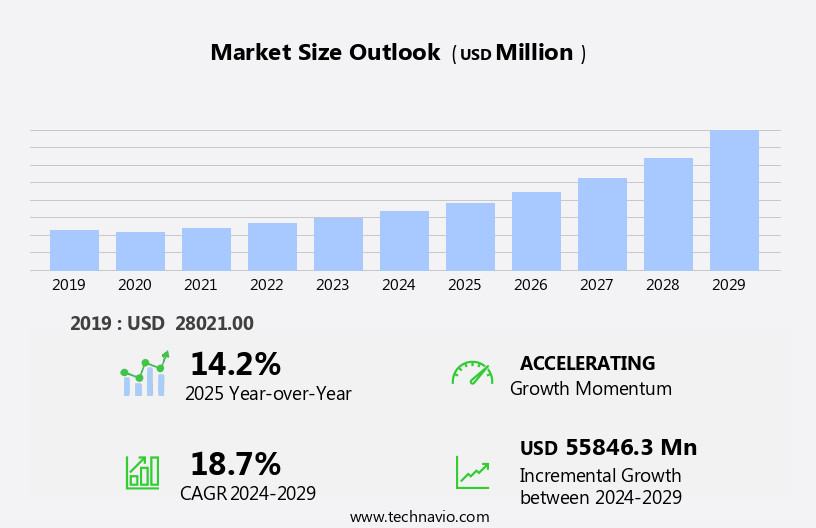

The sparkling water market size is forecast to increase by USD 55.85 billion at a CAGR of 18.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the frequent product launches and the changing consumer lifestyle preferences towards healthier beverage options. Consumers are increasingly seeking out low-calorie, sugar-free, and functional beverages, leading to a in demand for sparkling water. However, this market is not without challenges. Stringent safety and quality regulations for sparkling water production pose significant hurdles for market entrants. Compliance with these regulations requires substantial investment in research and development, as well as production facilities that meet the highest standards. Companies seeking to capitalize on this market opportunity must navigate these regulatory requirements while also differentiating themselves through product innovation and effective marketing strategies.

- Additionally, the market is becoming increasingly competitive, with established players and new entrants vying for market share. To succeed in this dynamic market, companies must stay abreast of consumer trends and adapt quickly to changing market conditions. Overall, the market presents significant growth opportunities for companies that can navigate regulatory challenges and differentiate themselves through product innovation and effective marketing strategies.

What will be the Size of the Sparkling Water Market during the forecast period?

- The market in the United States has experienced significant growth in recent years, driven by increasing consumer interest in healthier alternatives to traditional sugary beverages such as soda. This trend is fueled by a growing health consciousness among Americans, leading to a rise in demand for non-alcoholic, low-calorie, and flavored beverages. Sparkling water, with its refreshing bubbles and various natural and artificial flavors, has become a popular choice for consumers seeking a tasty and hydrating alternative to soda. The market size is substantial, with an estimated value of over USD3 billion in 2021. Key factors contributing to this growth include the convenience of sparkling water being readily available in various formats, such as cans, bottles, and even reusable glass bottles, as well as the airtight sealing that ensures the beverage remains fresh.

- Brands like Dasani Sparkling, Dash Water, and San Pellegrino have gained popularity, offering consumers a range of options to suit their preferences. The market is expected to continue growing, as more consumers turn to sparkling water as a healthier alternative to sodas and alcoholic beverages like Topo Chico. However, trade restrictions and consumer preferences may impact the market's direction in the future.

How is this Sparkling Water Industry segmented?

The sparkling water industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Hypermarkets

- On-trade and independent retailers

- Convenience stores

- Online

- Product

- Unflavored drinking water

- Flavored drinking water

- Packaging

- Bottles

- Cans

- Pouches

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

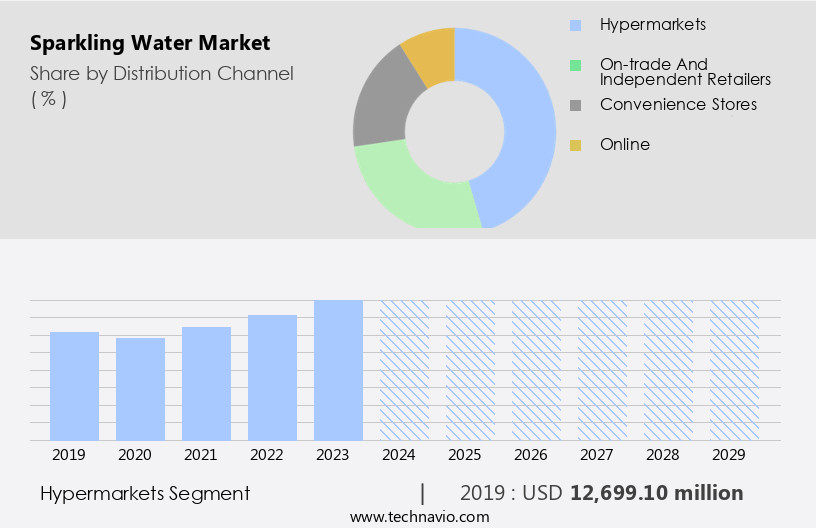

By Distribution Channel Insights

The hypermarkets segment is estimated to witness significant growth during the forecast period.

In the global beverage landscape, hypermarkets held a significant share in the market in 2024. These retail channels, known for their extensive product offerings and affordability, are the preferred choice for consumers seeking a wide variety of alcoholic and non-alcoholic beverages, including sparkling water. Brands like Nestle Plc, Danone SA, and Coca-Cola are commonly found in hypermarkets and supermarkets, catering to the growing demand for premium packaged sparkling water. Consumer preferences for convenience, competitive pricing, and attractive promotions drive sales in this segment. Hypermarkets' ability to offer a vast selection of brands and flavors, such as Triple Berry, Mango Passion Fruit, Citrus Cherry, and Soda Water, caters to the diverse tastes and health consciousness of conscious consumers.

Furthermore, sustainable packaging initiatives and airtight sealing ensure the preservation of product quality and freshness. Brand endorsements from celebrities like Curtis Stone and product innovation, such as Coffee drinks, Alcoholic Infused, and Sparkling Juice, contribute to brand visibility and consumer interest. However, challenges like shipping costs, domestic taxes, and trade restrictions may impact the distribution channel's growth in certain regions. Despite these hurdles, the market continues to thrive, offering alternatives to sugary carbonated drinks and non-alcoholic beverages, including flavored versions, mineral water, and carbonated water. The market dynamics are influenced by factors like energy levels, dental health, and consumer preferences for natural/mineral water, sweetened teas, and caffeinated segment offerings.

As consumers increasingly seek healthier alternatives to regular water and alcohol consumption, the demand for sparkling water continues to grow.

Get a glance at the market report of share of various segments Request Free Sample

The Hypermarkets segment was valued at USD 12.7 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for Sparkling Water has witnessed significant growth due to the increasing consciousness among consumers towards healthier beverage choices. This market caters to diverse preferences with a variety of offerings, including flavored and unflavored options. Key market drivers include health consciousness, environmental sustainability, and innovative product launches. For example, in October 2024, Flow introduced a new Sparkling Mineral Spring Water in Canada. This product comes in 300ml aluminum bottles and offers flavors like OG, Blackberry + Hibiscus, Lemon + Ginger, and Cucumber + Mint. It is free of sugar, calories, and boasts sustainable packaging using 70% recycled aluminum.

Other popular brands include Dasani Sparkling, LaCroix, San Pellegrino, and Topo Chico. Consumers also show interest in alternative beverages like Coffee drinks, Sparkling Juice, and Sugary carbonated drinks with added sugar, artificial sweeteners, or caffeine. The market dynamics are further influenced by distribution channels, consumer preferences, and energy levels. However, lack of awareness and trade restrictions can pose challenges to market growth. Brands are focusing on product endorsements, sustainable packaging, and airtight sealing to enhance brand visibility and consumer appeal. Additionally, there is a growing trend towards alcoholic infused and exotic packaging to cater to the caffeinated segment and consumer interest in flavored versions like Triple berry, Mango passion fruit, Citrus cherry, and Blueberry pomegranate.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Sparkling Water Industry?

- Frequent product launches is the key driver of the market.

- The market has experienced significant growth due to the rising preference for low-alcohol beverages with health benefits. Consumers are increasingly seeking out low-carb options and expressing concerns regarding the ingredients in their beverages. Sparkling water has emerged as a popular choice among health-conscious individuals and those following specific dietary trends, such as the keto diet or intermittent fasting. The market has witnessed substantial expansion in recent years, fueled by numerous product launches from both global and regional players.

- Companies are focusing on innovation and new product development to meet the escalating demand for sparkling water.

What are the market trends shaping the Sparkling Water Industry?

- Changing consumer lifestyle is the upcoming market trend.

- The global market for sparkling water is experiencing significant growth due to the increasing health-conscious consumer trend. Consumers are increasingly opting for beverages made from natural and health-benefiting ingredients, leading to a in demand for low-carbohydrate and no-sugar sparkling water. Manufacturers are catering to this demand by introducing new natural flavors in their product offerings, expanding the range of options for consumers. The convenience and refreshing nature of sparkling water make it an attractive alternative to traditional still water, particularly for those seeking on-the-go hydration solutions.

- As consumers continue to prioritize health and wellness, the market for sparkling water is poised for continued growth. This trend is not limited to specific regions but is a global phenomenon, making it an exciting opportunity for businesses in the beverage industry.

What challenges does the Sparkling Water Industry face during its growth?

- Stringent safety and quality regulations for sparkling water is a key challenge affecting the industry growth.

- The market growth is influenced by several factors, including regulatory requirements. Strict regulations imposed by regulatory bodies, such as the US Food and Drug Administration (FDA), pose challenges for manufacturers. The FDA enforces Current Good Manufacturing Practices (CGMPs) for bottled water, which mandate that the water be processed, bottled, held, and transported under sanitary conditions. Water sources must be protected from contaminants, and the bacteriological and chemical safety of the water should be ensured through quality control processes.

- Both the source water and the final product must be sampled and tested for contaminants to meet these regulations. Compliance with these regulations adds to the manufacturing costs and may impede market growth.

Exclusive Customer Landscape

The sparkling water market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sparkling water market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sparkling water market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anheuser Busch InBev SA NV - The company introduces Hiball, its line of effervescent waters, catering to health-conscious consumers seeking refreshing alternatives. Hiball's offerings are infused with natural flavors and functional ingredients, setting them apart in the market. These sparkling beverages provide a unique blend of taste and nutrition, appealing to those seeking a more vibrant and invigorating hydration experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser Busch InBev SA NV

- Aqua Maestro Inc.

- Boca Foods and Beverages Pvt. Ltd.

- Carpathian Springs SA

- Cloud Water Brands

- Danone SA

- Keurig Dr Pepper Inc.

- National Beverage Corp.

- Nestle SA

- PepsiCo Inc.

- Primo Water Corp.

- RHODIUS Mineralquellen und Beverages GmbH and Co. KG

- Shepley Spring Ltd.

- Talking Rain Beverage Co.

- The Coca Cola Co.

- Volay Brands LLC

- WakeWater Beverage Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for premium packaged sparkling water has experienced significant growth in recent years, driven by the increasing preferences of conscious consumers for healthier and more natural beverage options. This trend is particularly evident in the coffee drinks segment, as many consumers seek out sparkling water as a refreshing alternative to traditional coffee or sugary beverages. One factor contributing to the growth of the market is the increasing focus on sustainable packaging. Many consumers are becoming more environmentally conscious and prefer bottled water with airtight sealing to ensure freshness and reduce waste. This has led to an increase in demand for reusable glass bottles and other eco-friendly packaging solutions.

Another trend in the market is the development of flavored versions of sparkling water. Triple berry, mango passion fruit, citrus cherry, and other exotic flavors have gained popularity among consumers, particularly in the foodservice outlets and convenience store channels. The caffeinated segment of the market has also seen growth, with some brands offering alcoholic infused and energy-boosting options. Despite these trends, the market faces several challenges. One challenge is the lack of awareness and education among consumers about the health benefits of sparkling water compared to regular water or sugary carbonated drinks. Another challenge is the rising costs of shipping and distribution, which can impact the profitability of brands and retailers.

Brand visibility and competition are also key factors in the market. Some brands, such as San Pellegrino and Lacroix, have established strong market presence through commercial advertisements and product endorsements. However, new entrants and alternative beverages continue to emerge, leading to increased competition and pressure to differentiate through innovative flavors and packaging. The market dynamics are further influenced by trade restrictions and domestic taxes, which can impact the availability and pricing of certain brands and products in different regions. Additionally, consumer preferences for natural/mineral water and the growing trend towards reducing added sugar in beverages have led to a shift towards carbonated drinks with natural sweeteners or no added sweeteners at all.

In , the premium packaged the market is experiencing significant growth driven by consumer preferences for healthier and more natural beverage options. The market is influenced by various factors, including sustainable packaging, flavored versions, caffeinated segment, and competition. However, challenges such as lack of consumer awareness, shipping costs, and trade restrictions continue to impact the market dynamics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.7% |

|

Market growth 2025-2029 |

USD 55846.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.2 |

|

Key countries |

US, Canada, Germany, UK, China, India, Italy, Japan, France, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sparkling Water Market Research and Growth Report?

- CAGR of the Sparkling Water industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sparkling water market growth of industry companies

We can help! Our analysts can customize this sparkling water market research report to meet your requirements.