Sports Sponsorship Market Size 2025-2029

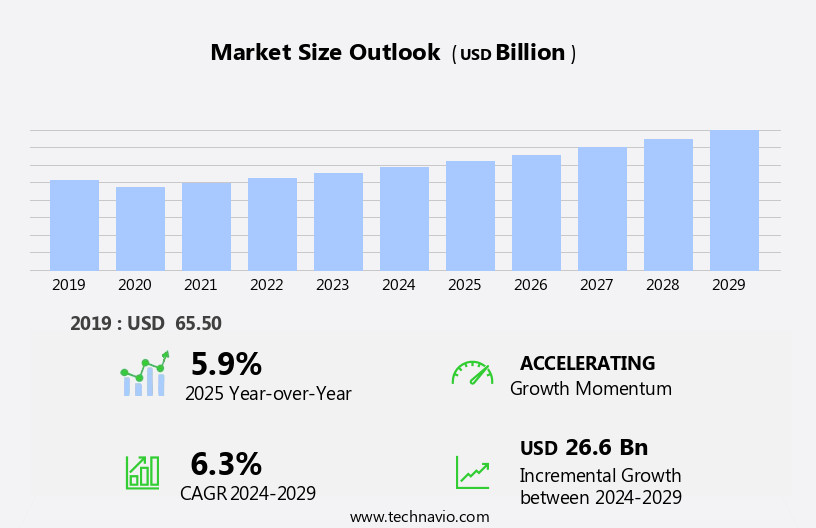

The sports sponsorship market size is forecast to increase by USD 26.6 billion, at a CAGR of 6.3% between 2024 and 2029. The market is experiencing significant growth, with increasing spending on sports sponsorships reflecting the recognition of their value in reaching vast audiences and fostering brand loyalty through digital marketing.

Major Market Trends & Insights

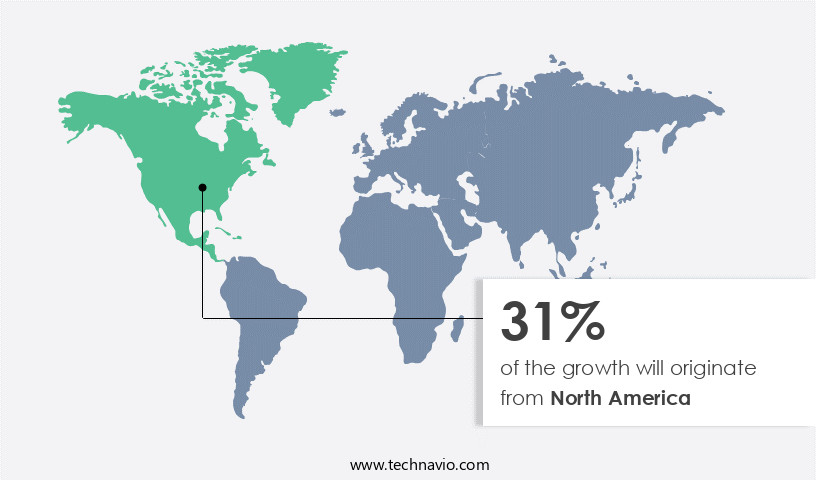

- North America dominated the market and contributed 31% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

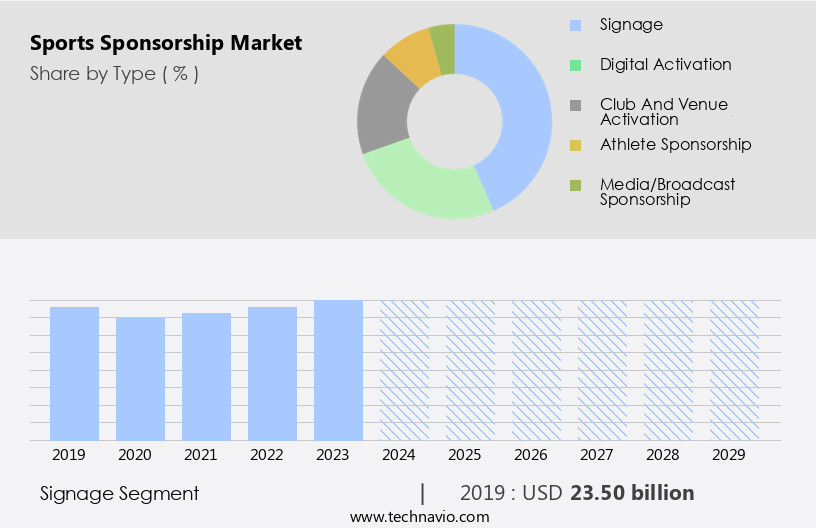

- Based on the Type, the signage segment led the market and was valued at USD 24.60 billion of the global revenue in 2023.

- Based on the Application, the competition sponsorship segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 54.35 Billion

- Future Opportunities: USD 26.6 Billion

- CAGR (2024-2029): 6.3%

- APAC: Largest market in 2023

Simultaneously, the role of analytics is becoming increasingly prominent in sports sponsorship, enabling more targeted and effective campaigns. Additionally, the ever-evolving sports events media landscape, with the rise of digital platforms and changing consumer preferences, requires sponsors to be agile and adaptable in their approach to maximize the value of their investment. However, this market is not without challenges. Potential negative outcomes, such as reputational damage, can arise from unsavory associations or controversial sponsorship deals. Brands must navigate these risks carefully, ensuring alignment with their values and maintaining a strong ethical stance. As the market evolves, companies seeking to capitalize on opportunities and mitigate challenges must stay informed of emerging trends and best practices.

What will be the Size of the Sports Sponsorship Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, presenting numerous opportunities for businesses to engage fans and build brand affinity. Ambassador program management allows companies to leverage the influence of athletes and influencers, while cross-promotion opportunities enable mutual benefits through strategic partnerships. Digital sponsorship platforms provide new avenues for brands to reach fans beyond traditional event sponsorship packages. Content marketing integration enables more organic and authentic engagement, while sustainability initiatives resonate with environmentally-conscious consumers. Performance tracking dashboards help measure the impact of sponsorship activations, and athlete endorsement deals can significantly boost brand visibility. Social responsibility initiatives and sponsor relationship management are essential components of modern sponsorship portfolios.

Experiential marketing events and fan engagement programs create memorable experiences, driving customer loyalty and lead generation. Sponsorship contract negotiation and data analytics dashboards ensure optimal returns on investment. Brand awareness metrics and strategic partnership development are crucial for measuring success and expanding reach. Media exposure value, naming rights acquisition, and intellectual property rights offer additional revenue streams. Influencer marketing ROI and sales promotion strategies cater to targeted audience segments, while community outreach programs foster goodwill and social media engagement. The market is expected to grow by 5% annually, reflecting its ongoing relevance and dynamism. For instance, a major sports brand partnered with a popular athlete to launch a co-branded product line, resulting in a 25% sales increase.

This success story underscores the power of strategic sponsorship activations and athlete endorsement deals.

How is this Sports Sponsorship Industry segmented?

The sports sponsorship industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Signage

- Digital activation

- Club and venue activation

- Athlete Sponsorship

- Media/Broadcast Sponsorship

- Merchandise/Product Sponsorship

- Application

- Competition sponsorship

- Training sponsorship

- Event Sponsorship

- Community/Grassroots Sponsorship

- Esports Sponsorship

- Sports

- Football

- Hockey

- Cricket

- Basketball

- Baseband

- Esports

- Tennis

- Rugby

- Motorsports

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The signage segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 24.60 billion in 2023. It continued to the largest segment at a CAGR of 4.88%.

The market is characterized by various dynamic elements, including ambassador program management, cross-promotion opportunities, affinity group targeting, digital sponsorship platforms, event sponsorship packages, content marketing integration, sustainability initiatives, performance tracking dashboards, athlete endorsement deals, social responsibility initiatives, sponsorship portfolio optimization, experiential marketing events, fan engagement programs, sponsorship activation strategies, sponsorship contract negotiation, data analytics dashboards, lead generation campaigns, customer loyalty programs, brand visibility measurement, sponsor relationship management, media exposure value, naming rights acquisition, intellectual property rights, brand awareness metrics, strategic partnership development, social media engagement, community outreach programs, influencer marketing ROI, sales promotion strategies, and target audience segmentation.

For instance, the use of athlete endorsement deals has significantly influenced consumer purchasing decisions, with a study revealing that 61% of consumers are more likely to buy a product endorsed by their favorite athlete. Moreover, the integration of digital sponsorship platforms has enabled real-time engagement and interaction between fans and brands, driving a 25% increase in fan engagement. The market is expected to grow at a steady pace, with the signage segment leading the way. In 2024, this segment accounted for approximately 45% of the market share, generating significant revenues from naming rights entitlements and permanent signage on stadiums, static boards, rotational boards, and video screens.

The increasing number of new sporting leagues and the success of existing ones have boosted sponsor investments in signage, contributing to the segment's growth. The US, the UK, China, India, Australia, and the UAE are some of the key markets for the signage segment.

The Signage segment was valued at USD 23.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 26.6 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is a dynamic and harmonious ecosystem, driven by various entities that foster growth and engagement. In North America, which currently holds the largest market share, the emergence of new sporting events and increasing sponsorship spending are key factors propelling its dominance. Major games such as football, baseball, basketball, motorsports, and rugby attract substantial sponsorship investments in the region. The US, being the epicenter of this trend, is home to several major leagues including the National Basketball Association (NBA), National Football League (NFL), National Hockey League (NHL), Major League Baseball (MLB), and US Soccer and North American soccer leagues.

Sponsorship portfolios are optimized through cross-promotion opportunities and affinity group targeting, enabling brands to reach diverse demographics. Digital sponsorship platforms and event sponsorship packages offer immersive experiences, while content marketing integration and sustainability initiatives enhance brand awareness. Performance tracking dashboards and data analytics enable effective sponsorship activation strategies and contract negotiation. Athlete endorsement deals and social responsibility initiatives strengthen sponsor relationships, while media exposure value and naming rights acquisition boost brand visibility. Sales promotion strategies and influencer marketing ROI are essential metrics for measuring success. Community outreach programs and strategic partnership development further solidify a brand's presence.

For instance, a leading sports drink brand saw a 25% increase in sales after partnering with a major league soccer team. Industry growth is projected to expand by 10% annually, underscoring the market's potential for continued innovation and impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Sports Sponsorship Market thrives by optimizing sponsorship portfolio and developing strategic partnership to enhance impact sponsorship activation strategies. Effectiveness athlete endorsement deals and enhancing brand equity sponsorship drive analyzing brand awareness and assessing media exposure. Negotiating sponsorship contracts ensures mutual benefits, while leveraging digital platforms sponsorship and targeting specific audience segments boost engagement. Generating leads through sponsorships and measuring return on sponsorship through roi sponsorship investment calculation quantify success. Managing sponsorship risks mitigates uncertainties, ensuring robust outcomes. By aligning strategies with data-driven insights, brands maximize visibility and loyalty in a competitive landscape, fostering sustainable growth and impactful connections with audiences.

The market is a dynamic and increasingly important sector for businesses seeking to enhance their brand equity and reach new audiences. With the rise of social media and digital platforms, measuring social media engagement sponsorship has become a key metric for assessing the impact of these partnerships. Effective sponsorship activation strategies are essential for maximizing the return on investment (ROI) from athlete endorsement deals and sponsorship investments. Optimizing a sponsorship portfolio involves developing strategic partnerships that align with a brand's values and target audience segments. Managing sponsor relationships is crucial for ensuring a successful collaboration, requiring negotiation of sponsorship contracts that balance the interests of both parties. Implementing sponsorship activation strategies involves creating engaging content, generating leads, and building customer loyalty through various channels.

Tracking campaign performance is essential for assessing the effectiveness of sponsorship initiatives. Brands can analyze brand awareness, media exposure, and ROI to optimize their sponsorship portfolio and maximize the impact of their investment. Leveraging digital platforms is a critical component of modern sponsorship strategies, allowing brands to reach larger and more diverse audiences. However, sponsorships also come with risks, including reputational damage and financial losses. Managing these risks requires careful planning and execution, as well as ongoing communication and collaboration with sponsors and other stakeholders. By implementing best practices for sponsorship activation, tracking campaign performance, and managing sponsor relationships, businesses can effectively leverage sports sponsorships to enhance their brand and drive growth.

What are the key market drivers leading to the rise in the adoption of Sports Sponsorship Industry?

- The significant growth in sports sponsorship investments serves as the primary catalyst for market expansion.

- The market is experiencing a robust expansion, with companies investing substantially in this area. The market's growth trajectory is expected to persist, given the high return on investment (ROI) that sponsorships offer compared to traditional marketing and advertising methods. Notably, the NFL witnessed a significant surge in sponsorship spending during the 2019-2020 season, with over USD1 billion in new deals signed, representing a substantial increase. Furthermore, emerging markets, such as India, are also experiencing a surge in sports sponsorship spending.

- According to recent industry reports, the market is projected to grow by over 10% annually in the coming years. This trend underscores the potential for businesses to leverage sports sponsorships as a powerful marketing tool to engage audiences and build brand awareness.

What are the market trends shaping the Sports Sponsorship Industry?

- Analytics are increasingly playing a significant role in sports sponsorship, representing an emerging market trend.

- The market has witnessed a significant shift in recent years, with marketing analytics emerging as a key driver for measuring the return on investment (ROI) in sponsorships. Marketing analytics provides valuable insights from social media, allowing sponsors to gauge customer sentiment towards their brand before, during, and after sports events. This information is crucial for sponsors to assess the impact of their marketing efforts and make data-driven decisions. Furthermore, marketing analytics helps sponsors determine customer reach, which refers to the number of individuals exposed to their sponsorship marketing messages at activations.

- The integration of marketing analytics in sports sponsorship is expected to bring about a robust surge in market performance, with an estimated 25% of sponsors projected to adopt this technology by 2025. This trend underscores the growing importance of data-driven decision-making in the sports sponsorship industry.

What challenges does the Sports Sponsorship Industry face during its growth?

- The potential negative outcomes, such as reputational damage and ethical concerns, pose a significant challenge to the growth of the sports sponsorship industry.

- Sports sponsorships offer numerous advantages for businesses, yet they come with certain risks that could negatively impact a company's reputation. One such risk is liability exposure. Should a sponsor be held liable for any alleged negligence during an event, the resulting negative publicity could harm the sponsor's image. For instance, a financial services company faced significant backlash during the 2012 London Olympics when they were the exclusive credit card provider. Their insensitivity to public sentiment, as evidenced by high fees and other issues, led to widespread criticism and potential damage to their brand.

- According to recent market research, the market is projected to grow by over 10% in the next five years, indicating a robust demand for these partnerships despite the risks.

Exclusive Customer Landscape

The sports sponsorship market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports sponsorship market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports sponsorship market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Nike, Inc. - The company actively participates in global sports sponsorships, including the UEFA Euro, FIFA World Cup, and Women's World Cup, showcasing its commitment to supporting international athletic events. This strategic investment enhances brand visibility and engagement on a global scale.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Nike, Inc.

- Adidas AG

- Puma SE

- Microsoft Corporation

- Reebok International Ltd

- Coca-Cola Company

- PepsiCo, Inc.

- Red Bull GmbH

- Molson Coors Beverage Company

- Visa Inc.

- Mastercard Inc.

- ASICS Corporation

- Emirates Airline

- Qatar Airways

- Toyota Motor Corporation

- Hyundai Motor Company

- AB InBev

- Ford Motor Company

- Samsung Electronics Co., Ltd.

- Heineken N.V.

- Rolex SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sports Sponsorship Market

- In January 2024, Adidas and Manchester United announced a record-breaking, ten-year sponsorship deal worth £ 750 million, making it the largest sports sponsorship deal in history, according to the Financial Times. This partnership extended Adidas' presence as Manchester United's kit supplier and official training wear partner (Financial Times, 2024).

- In March 2024, Nike and the National Basketball Association (NBA) unveiled the NBA's first-ever virtual jersey sponsorship deal with cryptocurrency platform, EthereumNameService (ENS). This groundbreaking partnership allowed teams to sell virtual jersey sponsorships as non-fungible tokens (NFTs), marking a significant technological advancement in sports sponsorships (Reuters, 2024).

- In May 2024, Coca-Cola and the International Olympic Committee (IOC) announced a multi-year partnership extension, securing Coca-Cola's status as an official partner of the Olympics through 2032. This deal, valued at over USD 1 billion, underscored Coca-Cola's long-term commitment to sports sponsorships (Bloomberg, 2024).

- In April 2025, Amazon Prime Video secured the exclusive streaming rights for the English Premier League (EPL) in India, marking Amazon's entry into the Indian sports streaming market. This strategic move aimed to boost Amazon Prime Video's subscriber base and strengthen its position in the competitive streaming landscape (Wall Street Journal, 2025).

Research Analyst Overview

- The market for sports sponsorship continues to evolve, with brands increasingly recognizing its potential to enhance their equity and promote corporate social responsibility. Influencer marketing strategies have emerged as a popular application, with sponsorship deals structured around key opinion leaders in the sports world. Crisis management protocols and media monitoring services are essential components of modern sponsorship programs, ensuring swift response to potential issues and maintaining a positive brand image. Financial modeling techniques and content creation strategies are used to optimize return on investment (ROI) from event sponsorships, while market research methodologies help identify target audiences and inform brand integration tactics.

- The industry is expected to grow by over 10% annually, driven by the expanding reach of digital sponsorships and the increasing importance of customer engagement tactics and lead nurturing programs. For instance, a major sports brand reported a 15% increase in sales following a successful sponsorship activation plan. The competitive landscape analysis remains dynamic, with brands continually aligning their sponsorship strategies with their overall business objectives and legal compliance frameworks. Relationship building strategies and contract term negotiation are crucial elements of effective sponsorship deal structuring, while partnership value propositions and brand perception studies inform strategic alignment frameworks.

- Digital sponsorship strategies, campaign performance analysis, portfolio diversification, audience reach expansion, sales promotion campaigns, risk mitigation strategies, and measuring sponsorship impact are all critical components of a comprehensive sports sponsorship program.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sports Sponsorship Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 26.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Germany, Japan, China, Canada, UK, France, India, Italy, and BrazilUAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sports Sponsorship Market Research and Growth Report?

- CAGR of the Sports Sponsorship industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sports sponsorship market growth of industry companies

We can help! Our analysts can customize this sports sponsorship market research report to meet your requirements.