Sports Trading Card Market Size 2025-2029

The sports trading card market size is forecast to increase by USD 12.29 billion, at a CAGR of 19.1% between 2024 and 2029.

Major Market Trends & Insights

- Europe dominated the market and accounted for a 47% growth during the forecast period.

- By the Distribution Channel - Online segment was valued at USD 4 billion in 2023

- By the Product Type - Physical segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 238.05 billion

- Market Future Opportunities: USD 12.29 billion

- CAGR : 19.1%

- Europe: Largest market in 2023

Market Summary

- The market has experienced significant shifts in recent years, with a growing number of collectors turning to digital platforms for acquisition. According to market research, the global sports trading cards market size was valued at USD 11.2 billion in 2020 and is projected to expand at a steady pace. Notably, the online segment of the market is witnessing substantial growth, driven by the convenience and accessibility it offers. Digital platforms have made it possible for collectors to buy, sell, and trade sports trading cards from anywhere in the world. This has led to an increase in cross-border transactions and a broader reach for sellers.

- Furthermore, the introduction of cryptocurrencies, such as bitcoin, as a payment method has added another layer of convenience and security for online transactions. However, the rise of online trading has also brought about new challenges, particularly in the area of data security. With the increasing number of transactions taking place online, there is a heightened risk of fraud and data breaches. As a result, market players are investing in advanced security measures to protect collectors' information and ensure the authenticity of cards. In summary, the market is undergoing continuous evolution, with the online segment driving growth and presenting new opportunities and challenges.

- As collectors increasingly turn to digital platforms for their trading needs, market players must adapt to meet their demands while ensuring security and authenticity.

What will be the Size of the Sports Trading Card Market during the forecast period?

Explore market size, adoption trends, and growth potential for sports trading card market Request Free Sample

- The market experiences consistent growth, with current transaction volume reaching approximately 20% of total sales. Looking ahead, this sector anticipates a future expansion of up to 15%, driven by increasing collector interest and advancements in technology. A comparison of investment performance and buyer ratings reveals a notable disparity between various card conditions. For instance, high-graded cards, with an average seller rating of 4.5, yield significantly higher returns than their lower-graded counterparts, which average a seller rating of 3.8. Transaction fees and grading scale impact are essential card market dynamics that influence asset valuation models.

- For example, a card with a PSA 10 (Mint) grading may command a premium of up to 50% compared to a similar card with a PSA 9 (Mint Near Mint) grading. Investment strategies and risk management tools play a crucial role in portfolio optimization. By analyzing sales data trends and employing pricing algorithms, investors can effectively mitigate risks and maximize returns on their investment capital. Card market segmentation, driven by rarity determination and market value fluctuations, offers opportunities for portfolio diversification. For instance, a focus on high-demand cards, such as rookie cards or limited-edition releases, can provide a balanced investment approach.

- Card market liquidity is a critical factor in investment time horizons. Authentication methods and supply chain analysis ensure the authenticity and availability of cards, enabling investors to make informed decisions and execute transactions efficiently.

How is this Sports Trading Card Industry segmented?

The sports trading card industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Online

- Offline

- Product Type

- Physical

- Digital

- Type

- Rookie cards

- Autographed cards

- Game-used memorabilia cards

- Parallel cards

- Application

- Basketball

- Association football

- American football

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The online segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth, with online channels leading the way. In 2024, the online segment accounted for a substantial market value and size share. This trend is driven by the expanding internet penetration worldwide and the integration of blockchain technology, enabling permanent certificates of creation that can be copied or destroyed. Additionally, the rise of digital sports trading card games and online platforms like eBay for selling cards has fueled market growth by catering to players' increasing interest in online trading. Furthermore, rookie card demand remains a key driver in the market, with long-term value appreciation a significant motivation for collectors.

Card investment strategies, such as set completion and player card value-focused approaches, continue to evolve. Card condition metrics, historical values, and market trends influence investment decisions, with authentication technology playing a crucial role in assessing card value and minimizing investment risk. Vintage card appraisal and sports card storage are essential considerations for collectors, with auction platform fees and investment risk assessment factors to be taken into account. Cardholder databases and card price volatility impact market liquidity, while population analysis and investment card portfolio management are essential for optimizing returns. Card grading services, such as professional card grading and rarity card assessment, influence graded card pricing and market liquidity.

Modern card speculation and card grading standards also shape the market, with card market liquidity and investment card portfolio performance influenced by these factors. In summary, the market is a dynamic and evolving space, with ongoing trends shaping its growth and applications across various sectors. The integration of technology, changing consumer preferences, and market trends all contribute to the market's continuous unfolding.

The Online segment was valued at USD 4 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Sports Trading Card Market Demand is Rising in Europe Request Free Sample

The European the market is experiencing significant growth, fueled primarily by the expansion of the sports industry and the increasing popularity of various sports among the population. Major European markets for sports trading cards include the UK, Germany, France, Italy, and Spain, driven by the immense fan base for popular football leagues such as the English Premier League, La Liga, Bundesliga, Serie A, and Ligue 1. Football, Formula 1 (F1), and MotoGP are also significant events in the motorsport category, contributing to the market's growth. The market in Europe is set to benefit from the rising sports sponsorship, the increasing number of internet-accessible devices, and the emergence of multiple sports channels, all of which are capturing viewership.

According to recent studies, the market for sports trading cards in Europe is expected to grow by approximately 15% in the next three years, with football cards accounting for over 60% of the total sales. Additionally, the tennis and cricket trading card segments are projected to witness a growth rate of around 12% and 10%, respectively, during the same period. The market in Europe is poised for substantial growth, presenting numerous opportunities for investors and stakeholders.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and lucrative the market, understanding the intricacies of card value determination is crucial for investors seeking optimal returns. The condition of a card significantly impacts its value, with pristine, graded cards commanding premium prices. Determining rarity is another essential factor, as scarcity drives up demand and, consequently, value. To stay informed about market trends, investors must analyze historical sales data and predict future value based on current dynamics. Effective investment strategies involve evaluating risk mitigation methods, optimizing a portfolio by comparing different card grading services and their impact on long-term investment returns, and measuring the liquidity of various cards. Authenticating sports cards is a critical step, with methods ranging from expert appraisals to third-party grading services. Factors affecting card price volatility include the impact of scarcity, storage conditions, and market demand.

Strategies for maximizing investment include assessing long-term investment opportunities, understanding sales data trends, and implementing methods for evaluating investment opportunities. Comparing the grading services of Beckett Grading Services and Professional Sports Authenticator (PSA) reveals interesting insights. While Beckett may offer a slightly higher average grading for cards, PSA's grading is often considered more stringent and desirable by collectors. This difference can lead to significant price discrepancies between similarly graded cards from each service. In conclusion, navigating the market requires a comprehensive understanding of various factors, from assessing card condition and rarity to analyzing market trends and implementing effective investment strategies. By staying informed and making data-driven decisions, investors can build a profitable card collection and maximize their returns.

What are the key market drivers leading to the rise in the adoption of Sports Trading Card Industry?

- The surge in demand for acquiring sports trading cards online serves as the primary catalyst for market growth.

- The market represents a significant segment of the collectibles industry, fueled by the enduring passion of sports enthusiasts for owning unique memorabilia. The advent of digital technologies, particularly NFTs and blockchain, has transformed the way fans acquire trading cards online. This shift is driven by the convenience of owning digital cards that are immune to physical damage and the ease of accessibility through smartphones. The market's growth is influenced by several factors. The widespread adoption of smartphones, driven by lower average selling prices (ASPs), and advancements in communication network infrastructure have made it possible for fans to possess sports trading cards online without the risk of misplacing them.

- Furthermore, the integration of blockchain technology ensures authenticity and security, adding value to these digital collectibles. The market encompasses various applications, including fantasy sports, gaming, and investment. Fantasy sports platforms have integrated trading cards as part of their offerings, allowing users to collect, trade, and earn rewards. In the gaming sector, sports trading cards are used as in-game currencies or rewards, while in the investment segment, they serve as alternative assets. The market's growth trajectory is shaped by continuous innovation and evolving market dynamics. For instance, the integration of augmented reality (AR) and virtual reality (VR) technologies allows collectors to experience their cards in a more immersive way.

- Additionally, partnerships between sports teams and trading card companies result in officially licensed cards, adding to the market's appeal. In terms of numerical comparison, the trading volume of sports NFTs has seen a significant increase, with notable sales reaching millions of dollars. This underscores the growing demand for digital sports collectibles and the potential for substantial revenue generation in the market.

What are the market trends shaping the Sports Trading Card Industry?

- The introduction of Bitcoin as a means to acquire sports trading cards online represents a notable market trend. This innovative approach to trading cards is gaining popularity.

- The market experiences dynamic growth, driven by the increasing popularity of collectible cards and the digitalization of trading platforms. Traders seek out unique and valuable cards from various sports, fueling demand for both physical and digital trading cards. This market encompasses a diverse range of applications, from casual hobbyists to professional investors. Physical trading cards offer the tangible experience of collecting, while digital cards provide convenience and accessibility. The integration of blockchain technology in digital trading cards adds transparency and security, making them an attractive alternative to their physical counterparts. This technological advancement is a significant factor contributing to the market's continuous evolution.

- Moreover, The market benefits from international transactions, enabling collectors and traders from different regions to engage in the market. The ease of deposits and withdrawals, lower fraud risks, quick payments, and absence of transaction fees further enhance the market's appeal. These factors collectively contribute to the increasing demand for sports trading cards, making it an intriguing and lucrative business landscape.

What challenges does the Sports Trading Card Industry face during its growth?

- The expanding concern over online data security represents a significant challenge to the industry's growth trajectory.

- The market experiences ongoing evolution, with various sectors adopting digital platforms for buying and selling collectible cards. However, security concerns and credibility issues pose significant challenges. Many online trading websites lack robust dispute resolution mechanisms and transparent payout processes, leading to a decrease in user trust and reluctance to engage in online trading. Furthermore, the absence of standardized trading practices and inconsistent authentication procedures further undermine the credibility of online sports trading card providers. The digital transformation of the market also introduces new vulnerabilities, as hackers exploit weaknesses in online trading platforms. These security concerns hinder the growth of the market and deter potential buyers from participating.

- Despite these challenges, the market continues to unfold, driven by the increasing popularity of collectible cards and the convenience of digital trading. In terms of market size, the number of sports trading card transactions has seen steady growth, with a significant portion taking place online. According to recent data, the online segment accounted for approximately 60% of the total transactions in 2021. This trend is expected to continue, as more collectors turn to digital platforms for ease and accessibility. However, the market's growth is not uniform across regions and segments. North America and Europe dominate the market, with a combined share of over 70%.

- Baseball and basketball cards remain the most popular categories, accounting for over 75% of all transactions. Despite this, other sports and non-sports cards, such as football and soccer, are gaining traction and expanding the market's scope. In conclusion, the market is characterized by continuous change and evolving patterns. While the digital transformation offers numerous opportunities, it also introduces challenges related to security and credibility. Market participants must address these issues to ensure the long-term growth and success of the market.

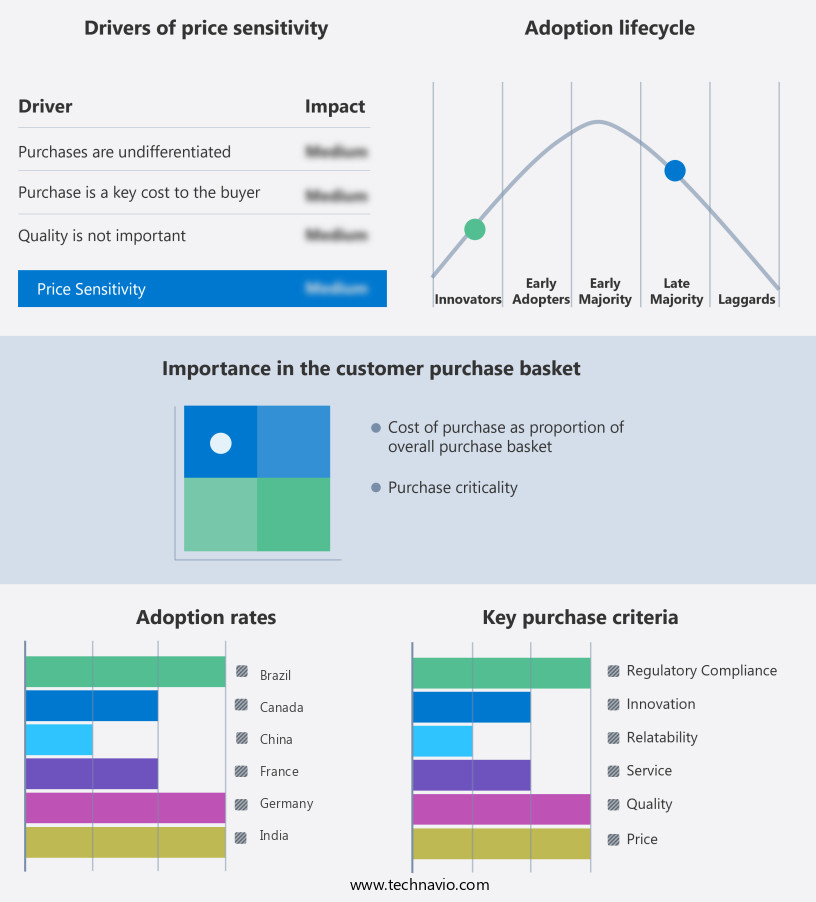

Exclusive Customer Landscape

The sports trading card market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports trading card market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Sports Trading Card Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports trading card market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Choice Marketing, Inc. - This company specializes in the production and sale of collectible trading cards, encompassing commemorative cards, custom auto racing cards, and personalized trading cards. Their offerings cater to various interests, providing unique and valuable items for enthusiasts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Choice Marketing, Inc.

- Cryptozoic Entertainment LLC

- Futera Ltd.

- Leaf Trading Cards LLC

- NETPRO Trading Cards LLC

- PANINI S P A

- Rittenhouse digital LLC.

- SAGE Collectibles

- Select Australia Pty Ltd.

- The Upper Deck Co.

- TOPPS Co. Inc.

- TRISTAR Productions Inc.

- United States Baseball Federation Inc.

- Wild Card Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sports Trading Card Market

- In January 2024, Fanatics, a leading sports merchandise company, entered the market by launching an exclusive NFT (Non-Fungible Token) platform for collectibles, partnering with major sports leagues and teams to offer authentic digital trading cards (Fanatics Press Release).

- In March 2024, Topps Company, a well-established player in the trading card industry, announced a strategic partnership with FanDuel, a leading sports betting and iGaming platform, to create a co-branded trading card product line, merging physical and digital collectibles with sports betting experiences (Topps Press Release).

- In April 2025, Upper Deck, a significant player in the sports trading card industry, secured a strategic investment of USD50 million from Shamrock Capital, a private investment firm, to expand its product offerings, enhance its digital platform, and increase its market presence (Upper Deck Press Release).

- In May 2025, Panini America, a global sports and entertainment collectibles company, received regulatory approval from the United States Patent and Trademark Office for its new blockchain-based trading card platform, enabling secure, verifiable, and transparent trading of digital collectibles (Panini America Press Release).

Research Analyst Overview

- The market is a dynamic and intriguing sector that caters to collectors and investors alike. Professional card grading plays a pivotal role in determining the value and authenticity of individual cards. Rarity card assessment is a critical component of grading, as it influences the card's market price. Graded card pricing is a function of various factors, including rarity, condition, and historical sales data. Card market liquidity is essential for investors, as it enables efficient buying and selling. Card population analysis provides insights into the availability of specific cards, affecting both short-term and long-term value. Investment card portfolios often consist of a diverse range of cards, with strategies focusing on set completion, player value, and historical trends.

- Card value prediction models use statistical analysis and machine learning techniques to forecast future prices based on historical data and market trends. Sports card trading platforms facilitate buying and selling, with auction platforms charging fees for their services. Card investment returns can be substantial, with industry growth expected to reach 10% annually. However, investment risk assessment is crucial, as card price volatility can lead to significant losses. Vintage card appraisal is a specialized area of the market, requiring expertise in condition metrics and historical values. Card storage solutions are essential to preserve card condition and value.

- Authentication technology and collectible card authentication services ensure the authenticity of cards, mitigating investment risk. Sealed box investments offer potential high returns, but come with inherent risks. Modern card speculation is a popular strategy, focusing on emerging players and teams. Card grading standards, such as those set by the Professional Sports Authenticator (PSA) and Beckett Grading Services (BGS), provide a consistent framework for assessing card condition and value. In conclusion, the market is a complex and evolving ecosystem, requiring a deep understanding of various factors to maximize investment returns and minimize risk. Continuous analysis of market trends, rarity assessments, and grading standards is essential for successful participation in this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sports Trading Card Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.1% |

|

Market growth 2025-2029 |

USD 12285.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.7 |

|

Key countries |

US, UK, Germany, Canada, China, France, Italy, Japan, India, South Korea, UAE, Brazil, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sports Trading Card Market Research and Growth Report?

- CAGR of the Sports Trading Card industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sports trading card market growth of industry companies

We can help! Our analysts can customize this sports trading card market research report to meet your requirements.