Storage And Warehousing Leasing Market Size 2024-2028

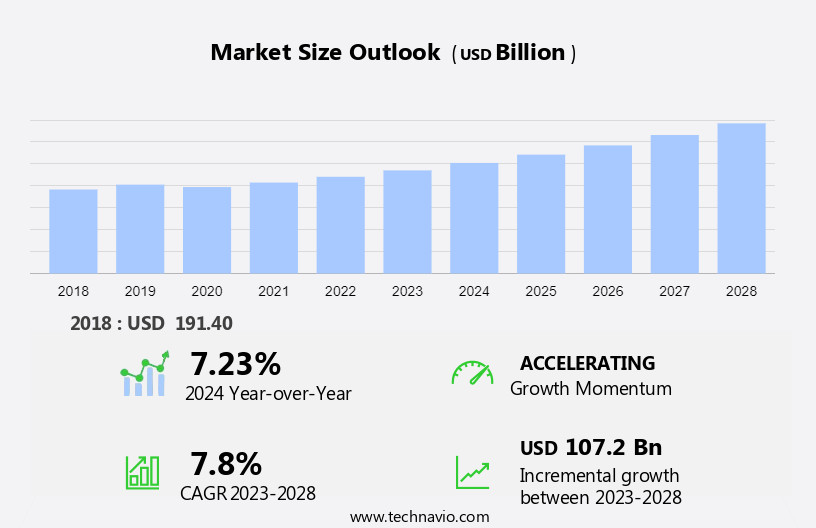

The storage and warehousing leasing market size is forecast to increase by USD 107.2 bn at a CAGR of 7.8% between 2023 and 2028.

What will be the Size of the Storage And Warehousing Leasing Market during the Forecast Period?

How is this Storage And Warehousing Leasing Industry segmented and which is the largest segment?

The storage and warehousing leasing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Non-climate controlled

- Climate controlled

- End-user

- Manufacturing

- Retail

- Consumer goods

- Food and beverages

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

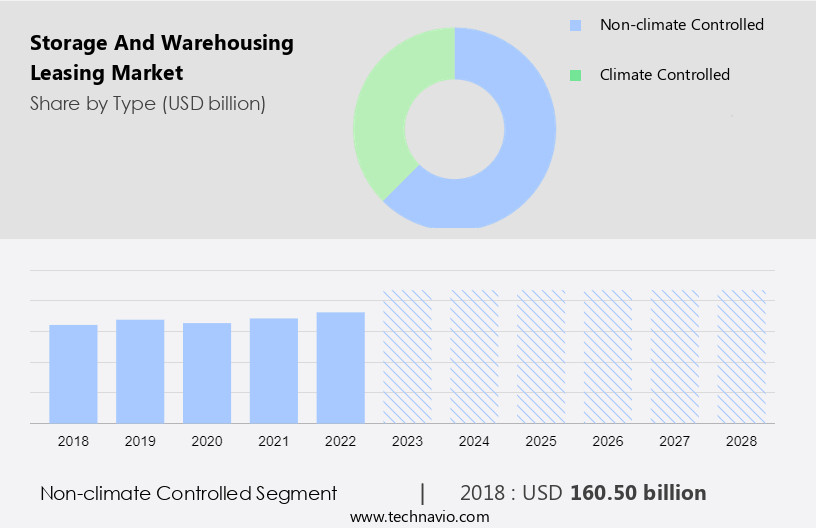

The non-climate controlled segment is estimated to witness significant growth during the forecast period. The non-climate-controlled storage market caters to the demand for outdoor self-storage units, primarily used for storing certain household items and non-perishable goods. The growth of this segment is significantly influenced by the expanding e-commerce sector. According to the World Bank, as of 2022, Internet penetration in major economies like China reached 76%, enabling a substantial consumer base to engage with online retail platforms. Consequently, the surge in e-commerce sales is projected to fuel the growth of the non-climate-controlled storage market. Additionally, the increasing trend of homeownership and business sentiment, as indicated by the Industrial Production Index, contributes to the market expansion.

The implementation of automation, robotics, and sustainable warehousing solutions, along with big data analytics and multi-story warehouses, enhances inventory management and streamlines the supply chain. The e-commerce boom, driven by online retail, electronic commerce, and the omnichannel model, further boosts the market demand. SMEs and industries dealing with manufactured products, food and beverage, healthcare, and essential household goods are key consumers of non-climate-controlled warehouses.

Get a glance at the market report of various segments Request Free Sample

The Non-climate controlled segment was valued at USD 160.50 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

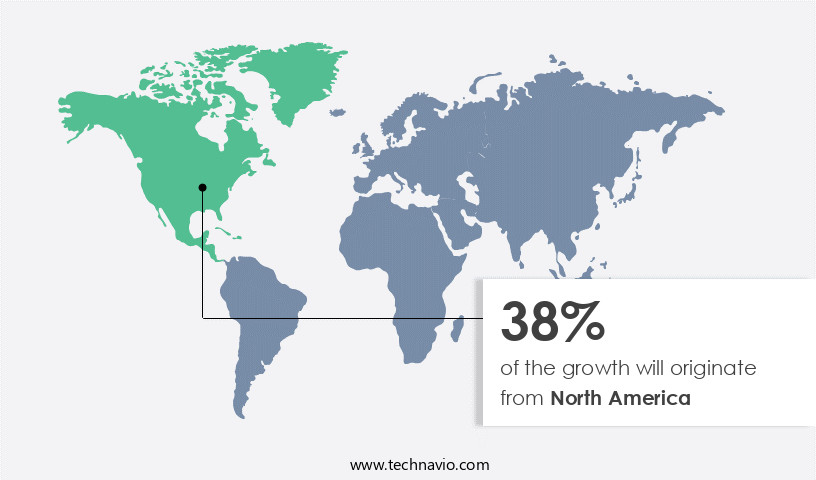

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is primarily driven by the US, Mexico, and Canada. The US is the largest consumer and producer of services offered by storage and warehousing companies In the region, accounting for the largest market share in 2022. Industries such as manufacturing, food and beverages, chemical, and e-commerce are key growth drivers, with the US expected to continue fostering market expansion due to increasing trade and production. The low industrial space vacancy rate, ranging from 3%-6%, has led to rising rent prices for storage and warehouse facilities In the US. Other factors influencing market growth include the e-commerce boom, online retail, and the omnichannel distribution model.

Warehouse management systems, including GPS, RFID, VoIP devices, digital voice, imaging technology, and inventory management software, are essential for optimizing operations and meeting the demands of various industries. Sustainable warehousing, big data analytics, automation, and robotics are also trends shaping the market. The healthcare, food and beverage, and general warehousing sectors, including perishable goods and private warehouses, are significant markets for climate-controlled storage solutions such as refrigerated warehouses and controlled rooms for temperature-sensitive products like insulins, antibiotic liquids, injections, eye drops, and creams.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Increase in global demand for warehousing and storage services is the key driver of the market.The market caters to various sectors, including automotive, chemical, food and beverage, pharmaceuticals, FMCG, and electronics. Businesses and individuals require physical spaces to store their goods, leading to increased demand for leased storage and warehouse facilities. Manufacturers, importers, exporters, and logistics providers utilize these facilities for finished and semi-finished products. The global warehousing and storage market's expansion is driving the need for leased solutions due to the high capital investment required for constructing new facilities and escalating real estate prices. Leased warehouses enable end-users to achieve economies of scale, making them an attractive option. The e-commerce boom, particularly in online retail, has further fueled the demand for climate-controlled storage solutions, such as refrigerated warehouses and cold storage rooms, for perishable products like food, pharmaceuticals, and essential household goods.

Additionally, the integration of automation, robotics, sustainable warehousing, big data analytics, and warehouse management systems in modern warehouses enhances their functionality and efficiency. Inventory management and omnichannel distribution models have become essential for businesses to cater to the online buying trend and maintain a competitive edge. The growth of the market is influenced by factors such as the industrial production index, homeownership rate, and business sentiment. The use of technologies like GPS, RFID, VoIP devices, digital voice, imaging technology, and warehouse management systems streamlines operations and optimizes storage capacity. SMEs and large enterprises alike benefit from the flexibility and cost savings offered by leased storage and warehouse solutions.

What are the market trends shaping the Storage And Warehousing Leasing market?

Increased use of technology for the modernization of warehouses is the upcoming market trend.The market is experiencing significant growth due to the increasing demand for physical spaces to store goods. Businesses and individuals require climate-controlled storage solutions for various items, including manufactured products, essential household goods, furniture, food products, and perishable items. Lease durations vary based on business needs, with some opting for short-term arrangements and others for long-term commitments. The e-commerce boom and online retail trend have led to an increase in demand for warehousing services. The omnichannel model, which integrates online buying trends with offline stores, necessitates efficient inventory management and logistics services. Sustainable warehousing practices, such as the use of renewable energy and energy-efficient technologies, are gaining popularity.

The industrial production index and business sentiment are essential indicators of market demand. Automation and robotics are transforming warehousing operations, making them more efficient and cost-effective. Warehouse management systems (WMS) and digital technologies, including GPS, RFID, VoIP devices, imaging technology, and big data analytics, are essential tools for managing inventory and optimizing warehouse operations. The globalization trend has led to an increase In the number of small and medium-sized enterprises (SMEs) requiring warehousing services. The healthcare sector, particularly for food and beverage and pharmaceutical products, requires specialized warehousing solutions, such as refrigerated warehouses and controlled rooms for temperature-sensitive items like insulins, antibiotic liquids, injections, and eye drops.

The use of automation, robotics, and sustainable warehousing practices is crucial for meeting the demands of this sector while ensuring product safety and quality.

What challenges does the market face during its growth?

Increasing warehouse rent driving buyers to invest in storage and warehouse facilities is a key challenge affecting the industry growth.The market is influenced by several factors, impacting businesses and individuals alike. The price of physical spaces for storing goods is a significant consideration for operators. Rising lease durations and increased rental vacancy rates pose challenges for businesses, leading some to consider constructing new facilities or forming strategic alliances to enhance operational efficiency. The manufacturing sector, e-commerce boom, and omnichannel model have driven the demand for various types of warehouses, including climate-controlled and refrigerated facilities. Sustainable warehousing, automation, and robotics are emerging trends, as businesses seek to minimize costs and optimize inventory management. The e-commerce industry's growth, driven by online retail and electronic commerce, has led to a surge in demand for logistics services.

This trend, coupled with the globalization trend, has increased the importance of inventory management and warehouse management systems. The inventory management sector benefits from the online buying trend, which has led to an increase in demand for essential household goods, furniture, and perishable products. Food and beverage industries require specialized facilities like cold storage rooms to maintain specific temperatures for products such as insulins, antibiotic liquids, injections, and eye drops. The implementation of advanced technologies like GPS, RFID, VoIP devices, digital voice, imaging technology, and warehouse management systems has streamlined operations and improved efficiency In the sector. Small and medium-sized enterprises (SMEs) have also adopted these technologies to remain competitive.

In conclusion, the market's dynamics are influenced by factors such as rising lease durations, rental vacancy rates, and the e-commerce boom. The adoption of advanced technologies and sustainable warehousing practices is essential for businesses to remain competitive in this market.

Exclusive Customer Landscape

The storage and warehousing leasing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the storage and warehousing leasing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, storage and warehousing leasing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adwise Realty LLP - The company specializes in providing leasing solutions for storage and industrial warehousing needs. With a focus on flexibility and customization, this business caters to various industries requiring large-scale space for inventory management and logistics operations. By offering competitive lease terms and maintaining high-quality facilities, the company attracts clients seeking reliable and efficient storage solutions. The warehousing market continues to grow, driven by the increasing demand for streamlined supply chain management and the expansion of e-commerce businesses. This company's strategic positioning In the market enables it to cater to these evolving needs, ensuring long-term growth and success.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adwise Realty LLP

- Agility Public Warehousing Co. K.S.C.P

- American Warehouses

- Avison Young

- CBRE Group Inc.

- Central Storage and Warehouse Co.

- Colliers International Property Consultants Inc.

- CubeSmart LP

- Foster Van Lines

- Lee and Associates Licensing and Administration Co. LP

- Prologis Inc.

- Public Storage

- Radius Commercial Real Estate

- Royal Commercial Real Estate LLC

- Safestore Holdings plc

- Saltbox

- TransWestern Commercial Services LLC

- W. T. Young LLC

- Ward North American

- Warehouses Plus

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the rental of physical spaces for the storage of various goods, catering to the needs of businesses and individuals alike. This market is influenced by several factors, including the climate controlled storage demand, lease duration, and the manufacturing and e-commerce sectors. Climate controlled storage is a significant segment withIn the market, as it provides optimal conditions for the preservation of temperature-sensitive goods. These goods can include manufactured products, food and beverage items, essential household goods, perishable products, and healthcare supplies such as insulins, antibiotic liquids, injections, and eye drops. The demand for climate controlled storage is driven by the growing trend towards online buying and the omnichannel distribution model, which requires efficient and effective storage and distribution solutions.

Lease duration is another critical factor influencing the market. Long-term leases are often preferred by manufacturing businesses due to their need for large, consistent storage space. On the other hand, e-commerce businesses and small and medium-sized enterprises (SMEs) may opt for shorter lease terms due to their more flexible business models and inventory management requirements. The manufacturing sector's health is a significant indicator of the market's performance. A positive business sentiment and robust industrial production index are typically associated with increased demand for warehousing space. Automation, robotics, and sustainable warehousing are also gaining traction In the market, as businesses seek to optimize their operations and reduce costs.

The e-commerce boom, driven by the internet and the online retail sector, is another major factor influencing the market. The e-commerce industry's growth is leading to an increased demand for multi-story warehouses, inventory management systems, and logistics services. Refrigerated warehouses are also in high demand to ensure the timely and efficient distribution of perishable goods. The homeownership rate is another factor to consider when analyzing the market. A low homeownership rate can lead to an increase in demand for public storage solutions, as individuals may opt to rent storage space instead of purchasing a larger home. The globalization trend is also impacting the market, as businesses seek to expand their operations and reach new markets.

This trend is leading to an increased demand for warehouse management systems, GPS tracking, RFID technology, VoIP devices, and digital voice and imaging technology to optimize their supply chain operations. In conclusion, the market is influenced by various factors, including climate controlled storage demand, lease duration, the manufacturing and e-commerce sectors, and the globalization trend. Businesses and individuals alike are seeking efficient and effective storage solutions to meet their inventory management needs and optimize their supply chain operations. The market is expected to continue growing as the e-commerce industry expands and businesses seek to reduce costs and improve operational efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2024-2028 |

USD 107.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.23 |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Storage And Warehousing Leasing Market Research and Growth Report?

- CAGR of the Storage And Warehousing Leasing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the storage and warehousing leasing market growth of industry companies

We can help! Our analysts can customize this storage and warehousing leasing market research report to meet your requirements.