Subsea Desalination Market Size 2025-2029

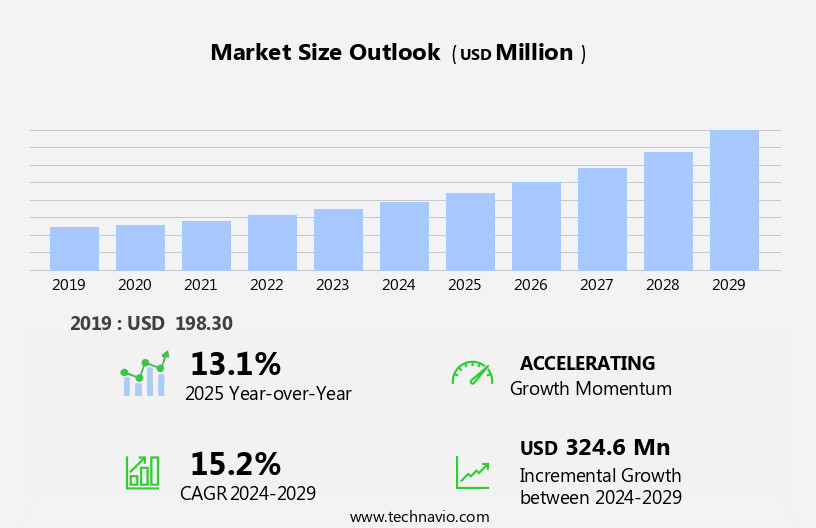

The subsea desalination market size is forecast to increase by USD 324.6 million at a CAGR of 15.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing global population and the subsequent rise in demand for consumable water. According to the United Nations, the world population is projected to reach nearly 10 billion by 2050, necessitating a substantial increase in water supply to meet the growing demand. Subsea desalination offers a promising solution to this challenge, as it allows for the production of large volumes of clean water while minimizing the impact on local ecosystems and reducing land use. Another key driver for the market is the increasing use of renewable power sources.

- With the shift towards sustainable energy, subsea desalination plants are being integrated with renewable energy sources such as wind and solar power, making them more environmentally friendly and cost-effective. However, the market also faces significant challenges. The market is increasingly leveraging artificial intelligence(AI) and IoT technologies to optimize water production, improve system efficiency, and enable real-time monitoring and maintenance of desalination processes. Additionally, the complex nature of subsea desalination technology and the need for specialized expertise and equipment can make project implementation challenging and time-consuming. To capitalize on the opportunities presented by the market, companies must carefully consider the initial investment costs and explore innovative financing models to reduce the financial burden.

- Collaborating with renewable energy companies and leveraging their expertise can help reduce costs and improve efficiency. Furthermore, investing in research and development to improve the technology and reduce complexity can help streamline project implementation and make subsea desalination a more viable and attractive solution for meeting the world's growing water demand.

What will be the Size of the Subsea Desalination Market during the forecast period?

- The market continues to evolve, driven by the growing demand for sustainable water supply solutions in various sectors. Membrane desalination technologies, such as reverse osmosis (RO), remain a key focus due to their energy efficiency and ability to treat brackish and seawater. Membrane fouling control is a critical aspect of plant engineering, ensuring optimal plant performance and reducing water treatment costs. Desalination economics plays a significant role in market dynamics, with ongoing research to improve plant efficiency and reduce energy consumption. Brackish water desalination is gaining popularity in arid regions due to its lower water source salinity and energy requirements compared to seawater desalination.

- Water security is a major concern in many regions, leading to increased investment in desalination plants and water reuse strategies. Innovations in plant design, automation, and renewable energy integration are shaping the future of desalination. Desalination research is also exploring new technologies, such as subsea desalination, to address water scarcity in remote communities and offshore water supply needs. Desalination services, including financing, construction, and operations, are essential to the market's growth. Plant regulations and policies are evolving to support sustainable desalination practices and minimize the water footprint. Desalination technology trends include energy-efficient designs, plant optimization, and the integration of desalination with other water treatment technologies.

- Desalination applications extend beyond drinking water to agriculture, industry, humanitarian aid, and aquaculture. Plants are being designed to address specific challenges, such as plant automation for emergency response and plant environmental considerations. Desalination is an essential component of sustainable water supply strategies in emerging economies and industrial use applications. Plant feasibility studies and water treatment solutions are crucial to the successful implementation of desalination projects.

How is this Subsea Desalination Industry segmented?

The subsea desalination industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Reverse osmosis

- Electrodialysis

- Others

- Type

- Floating desalination platform

- Deep sea desalination platform

- End-user

- Municipal

- Industrial

- Agricultural

- Geography

- North America

- US

- Europe

- UK

- South America

- Argentina

- Brazil

- Middle East and Africa

- Egypt

- Oman

- Qatar

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Technology Insights

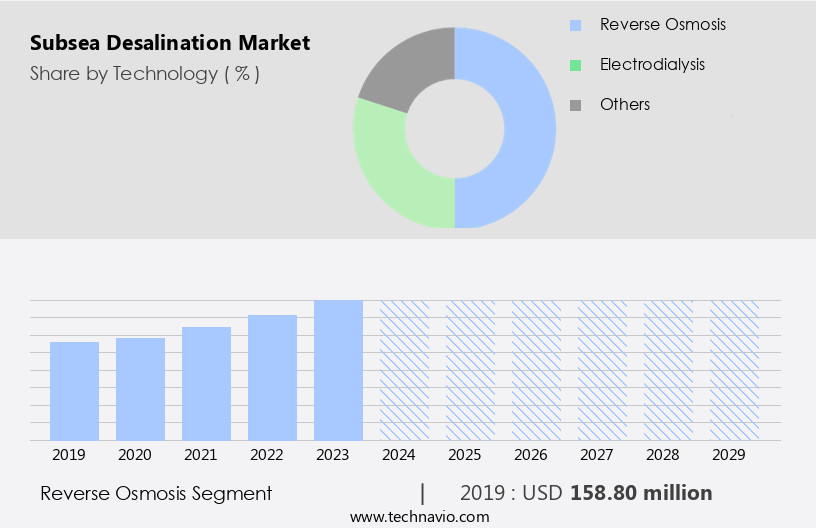

The reverse osmosis segment is estimated to witness significant growth during the forecast period.

Desalination, a process that transforms seawater or brackish water into freshwater, has gained significant attention due to increasing water scarcity and population growth. Reverse osmosis (RO) desalination, an efficient and scalable technology, has emerged as a dominant solution. RO systems use semipermeable membranes to purify water, removing dissolved salts and organic molecules. These systems have seen a surge in capacity, driven by the need for sustainable water supplies in arid regions and islands. The desalination industry also caters to agriculture, humanitarian aid, and industrial use. Energy-efficient RO desalination and renewable desalination technologies are at the forefront of innovation, reducing the water footprint and addressing climate change concerns.

Plant maintenance, automation, optimization, and research are crucial for improving plant performance and addressing challenges such as membrane fouling control. Desalination policy and regulations play a vital role in plant installation and cost, while desalination services and construction companies support plant feasibility studies and emergency response. The future of desalination lies in plant engineering, innovation, and water reuse strategies, ensuring sustainable water security for remote communities and off-grid areas.

The Reverse osmosis segment was valued at USD 158.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

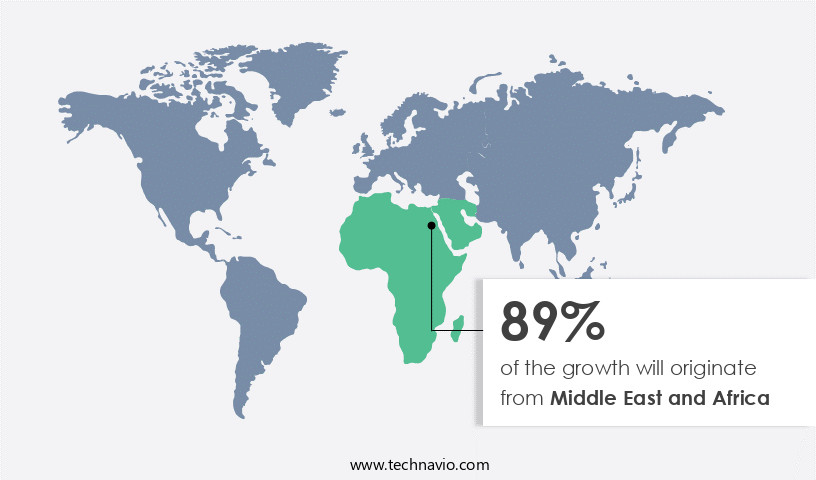

Middle East and Africa is estimated to contribute 89% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Middle East and Africa (MEA) region, despite abundant fossil fuel resources, water scarcity is a pressing issue, driving the demand for desalination plants to provide clean and sterilized water. This need is further fueled by the increasing use of desalination in various sectors, including agriculture and humanitarian aid, to mitigate water footprint and ensure water security. Renewable desalination technologies, such as reverse osmosis (RO), are gaining popularity due to their energy efficiency and sustainability. Despite the challenges of plant maintenance, membrane fouling control, and plant cost, innovation in desalination research and plant optimization continues to advance RO desalination technology.

Plant engineering and construction companies are investing in the region to meet the growing demand for desalination services, with a focus on off-grid and subsea desalination technologies for remote communities and offshore water supply. Moreover, desalination policy and regulations are evolving to support the expansion of desalination plants, particularly in arid regions and emerging economies. Industrial use of desalinated water is also on the rise, as companies seek sustainable water supply solutions. In response, desalination technology trends include plant automation, water reuse strategies, and membrane desalination for brackish water desalination. Despite these advancements, desalination faces challenges, including plant challenge, plant environmental impact, and desalination economics.

However, with continued research and innovation, desalination is poised to play a crucial role in addressing water scarcity and ensuring sustainable water supply for industries, agriculture, and communities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Subsea Desalination Industry?

- The primary drivers of the market are the escalating population growth and the subsequent rise in demand for consumable water.

- The market is experiencing significant growth due to the increasing global population and the resulting demand for safe consumable water. By 2050, the world population is projected to reach 9.73 billion, with only 2.2 billion people having access to safe water as of the first half of 2023. Freshwater reserves are unevenly distributed, making desalination an essential solution to address water scarcity, particularly in islands and agricultural regions. Subsea desalination, which involves the process of extracting drinking water from ocean water, is an energy-efficient and sustainable alternative to traditional desalination methods. This technology is particularly advantageous for islands and remote locations where access to traditional power sources is limited.

- Furthermore, the integration of renewable energy sources, such as wind and solar, in subsea desalination plants enhances their energy efficiency and sustainability. Plant maintenance and automation are crucial aspects of the market, ensuring the reliable and continuous production of drinking water. Plant financing is another significant factor, with various financing models, such as public-private partnerships and government subsidies, being employed to fund these projects. Humanitarian aid organizations also rely on subsea desalination plants to provide clean water to communities in need, making it a vital solution for addressing water footprint and the plant challenge of providing access to safe water in various parts of the world.

- Reverse osmosis desalination is a widely used technology in the market, but renewable desalination, such as solar and wind-powered desalination, is gaining popularity due to its environmental benefits and cost-effectiveness. Shipping and transportation of desalination plants are also crucial aspects of the market, enabling the deployment of these solutions in remote and underserved areas.

What are the market trends shaping the Subsea Desalination Industry?

- The increasing reliance on renewable power sources is a prominent trend in today's market. This shift towards sustainable energy solutions is mandatory for both environmental and economic reasons.

- Subsea desalination, utilizing reverse osmosis technology, is gaining traction due to the focus on renewable energy sources. The energy-intensive desalination process is expected to undergo a significant transformation in terms of energy consumption. With the global energy demand on the rise, driven by manufacturing sector activities, population growth, and industrialization and urbanization, energy has emerged as a critical concern. Renewable power sources offer a promising solution to reduce energy consumption in subsea desalination plants. Key players are investing in this area to establish subsea desalination plants that operate on renewable energy.

- Plant optimization, water quality analysis, climate change mitigation, supplying offshore water to remote communities, emergency response, and plant environmental considerations are some of the key factors driving the growth of the market. Additionally, the integration of desalination with aquaculture is an emerging trend in the industry.

What challenges does the Subsea Desalination Industry face during its growth?

- The high initial investment costs associated with subsea desalination plants represent a significant challenge that hinders industry growth. Subsea desalination, an innovative approach to water treatment, faces this financial hurdle as a key impediment to its expansion and broader adoption.

- Subsea desalination, a membrane desalination technology, has gained attention due to its potential to address water security challenges, particularly in areas with limited water resources. However, the high capital expenditure (CAPEX) associated with setting up a desalination plant remains a significant barrier. The cost of desalinated water production depends on various factors, including energy efficiency, plant capacity, energy sources, and project funding. Membrane fouling control is a critical aspect of desalination economics, as it directly impacts the operational cost. Brackish water desalination, an alternative to seawater desalination, is gaining traction due to its lower energy requirements. Plant innovation and research in water reuse strategies are essential to reducing the future cost of desalination.

- Subsea desalination technology, which involves placing desalination plants underwater, is an emerging trend that offers potential cost savings by reducing energy consumption and water transportation costs. Water conservation and desalination services are crucial for off-grid communities and remote locations, making desalination an essential component of sustainable water management strategies. Despite the challenges, the desalination industry continues to evolve, with advancements in plant engineering and water treatment technologies driving cost reductions and efficiency improvements.

Exclusive Customer Landscape

The subsea desalination market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subsea desalination market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, subsea desalination market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aquatech International LLC - The company specializes in subsea desalination technologies, pioneering advanced solutions through low energy seawater reverse osmosis and multiple effect distillation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquatech International LLC

- Baker Hughes Co.

- Deep Ocean Water Co. LLC

- DuPont de Nemours Inc.

- EnviroNor

- Flocean Green

- ForeverPure Corp.

- IDE Water Technologies

- Makai Ocean Engineering Inc.

- Marine Water Production AS

- Nereo Technologies

- Parker Hannifin Corp.

- Sep Pro Systems Inc.

- SUEZ SA

- Sulzer Ltd.

- Toray Industries Inc.

- Waterise AS

- Worley Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Subsea Desalination Market

- In February 2024, McDermott International and Mitsubishi Heavy Industries (MHI) announced a strategic collaboration to deliver integrated engineering, procurement, construction, and installation (EPCIC) services for seawater desalination projects using MHI's Membrane Seawater Desalination System (MSDS). This partnership signifies a significant step towards enhancing the competitiveness of subsea desalination technology in the global water market (MHI press release, 2024).

- In July 2025, IDE Technologies, a leading desalination technology provider, unveiled its new Seawater Reverse Osmosis (SWRO) desalination plant in Saudi Arabia, with a capacity of 60 million gallons per day (mgd). This project marks a major milestone in the market, as it is the largest subsea SWRO plant in the world, demonstrating the potential of this technology to address the growing water scarcity challenges (IDE Technologies press release, 2025).

- In November 2024, Siemens Energy secured a â¬1.1 billion (USD1.2 billion) contract from the Abu Dhabi National Oil Company (ADNOC) to build a seawater desalination plant with a capacity of 300 mgd. This strategic investment in the market reflects the growing demand for sustainable water solutions in the oil and gas industry (Siemens Energy press release, 2024).

- In March 2025, the European Investment Bank (EIB) approved a â¬150 million (USD170 million) loan to finance the expansion of the Soreq Desalination Plant in Bahrain. This financing is a key regulatory approval that supports the growth of the market in the Middle East and North Africa region, where water scarcity remains a significant challenge (EIB press release, 2025).

Research Analyst Overview

In the market, membrane-based desalination processes, specifically reverse osmosis systems, dominate the sustainable production of potable water from seawater in remote offshore regions. High-performance membrane-based desalination, utilizing semi-permeable membranes, effectively purifies water in maritime environments, addressing water scarcity and population growth. Technological advancements in desalination and water treatment, such as energy recovery devices and innovative engineering, enhance the efficiency of these systems. Research and development in solar desalination and advanced monitoring technologies further contribute to reliable operation in marine environments. Maritime operations, including maritime vessels, also benefit from desalination systems, providing ultrapure water for both drinking and bathing, mitigating salt-clogging and ensuring reliable operation.

Manufacturing technology continues to evolve, addressing challenges like solute concentration and energy consumption in distillation processes. Climate change intensifies the need for efficient water purification, making desalination a vital water supply solution in remote islands and offshore regions. Engineering pumps and engineering solutions continue to play a crucial role in the desalination industry, ensuring the reliable delivery and treatment of water.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Subsea Desalination Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2025-2029 |

USD 324.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

Saudi Arabia, Oman, United Arab Emirates, Qatar, Egypt, China, US, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Subsea Desalination Market Research and Growth Report?

- CAGR of the Subsea Desalination industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, Europe, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the subsea desalination market growth of industry companies

We can help! Our analysts can customize this subsea desalination market research report to meet your requirements.