Subsea Umbilicals, Risers, And Flow Lines Market Size 2024-2028

The subsea umbilicals, risers, and flow lines (SURF) market size is forecast to increase by USD 4.9 billion, at a CAGR of 9.53% between 2023 and 2028. The growth of the market is fueled by several factors, including the adoption of new exploration policies, increased energy demand, and declining exploration and production costs in deepwater and ultra-deepwater oil and gas projects. These dynamics encourage further investment and development in the sector, driving exploration activities and bolstering production capabilities. Additionally, technological advancements play a crucial role in enhancing operational efficiencies and reducing costs, contributing to the overall growth and sustainability of the oil and gas industry.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Vital components like umbilicals, risers, and flowlines ensure efficient transportation of produced fluids from subsea wells to processing systems and ultimately to surface systems. This sector also prioritizes energy-efficient solutions and processing plants to cater to the needs of energy production in deep seas. With a focus on both crude oil and gas extraction, SURF technologies contribute significantly to the development of subsea projects and the overall oil and gas production sector.

Market Dynamics and Customer Landscape

The subsea production system plays a pivotal role in subsea oil and gas production, especially in challenging environments like mature fields and deepwater locations. These systems efficiently manage oil reserves through advanced processing systems and flowlines that transport resources from the subsea well to the surface. Floating rigs are often used to access these reserves, accommodating varying water depths. A top-down approach combined with a bottom-up approach ensures comprehensive analysis and management of the subsea infrastructure. The integration of Marine Ports & Services is crucial for supporting these operations, facilitating the transfer of materials and equipment. Effective subsea production systems contribute to optimized extraction processes and extended field life, making them indispensable for the sustainable development of subsea oil and gas production.

Moreover, the market is driven by the demand for surface systems, subsea production systems, and processing systems to handle produced fluids and unprocessed fluids from subsea wells. Particularly in deep and ultra-deep water depths, crude oil producers, especially in regions like Alaska, seek to exploit proved natural gas reserves, measured in trillion cubic feet (Tcf). As offshore oil and gas production projects increasingly target deep-sea developments, capital-intensive techniques and digital technologies enable efficient drilling operations. This market also involves the deployment of high-end deep-water electro-hydraulic umbilicals and steel tube umbilicals, supported by engineering, procurement, construction, and installation services. Energy-efficient solutions, processing plants, and subsea projects are integral components driving growth in the SURF market, catering to the needs of oil and gas production in deep seas.

Key Market Driver

The increase in energy demand is notably driving the Subsea Umbilicals, Risers, and Flow Lines Market growth. Any nation's ability to produce an abundance of energy determines how rapidly it can grow economically. Reliable and affordable energy promotes the expansion of numerous industries, including the production of electricity, ensures increased trade, and enhances transportation for the benefit of the country. Global energy demand has risen as a result of the rising world population and economic development, particularly in Asia.

Moreover, the majority of nations that produce oil do not have many additional capacities. Oil companies will, therefore, need to explore and drill greenfield wells in new and existing oil fields in order to satisfy the high fuel demand. The demand for oilfield equipment like SURF will rise as a result of these new drilling projects, and SURF manufacturers will have tremendous growth potential to boost their profitability. During the forecast period, these factors are anticipated to fuel the global SURF market's expansion, shaping Market forecasting and influencing market research and growth.

Significant Market Trends

The emergence of next-generation automated drilling rigs is an emerging trend in the Subsea Umbilicals, Risers, and Flow Lines Market. Capital investment in exploration activities has decreased due to the recent decline in crude oil prices. The profit margins of upstream companies are continuing to contract due to the drop in crude oil prices, which necessitates increased operational efficiency. The upstream oil and gas industry is using digital technology as a key tool to boost operational efficiency and profit margins. Using sensors in drilling equipment and tools as part of digitalization will present new business opportunities for suppliers of downhole drilling tools. Digitalization will make it easier to record a large amount of data, compare it to data from other fields and drilling rigs, access historical data, and make wise decisions.

Moreover, workers on offshore rigs face significant safety risks, and mistakes could result in fatal accidents and environmental catastrophes. Human error is to blame for the majority of accidents on offshore rigs. As a result, rig operators are introducing automated rigs as a means of ensuring the safety of the workers. The use of sensors in drilling rigs and related apparatus is called rig automation. In order to make informed decisions, vast amounts of data can be gathered and compared with the data from other fields and rigs. The global oil and gas market will benefit from the growing adoption of automation in offshore drilling rigs because it will make the offshore drilling process more accessible. Hence, such factors are expected to drive the growth of the global SURF market during the forecast period, influencing market growth and forecasting in the Subsea Equipment Market and the Offshore Oil and Gas Market.

Major Market Challenge

Environmental problems in the offshore oil and gas industry are major challenges impeding the subsea umbilicals, risers, and flow lines market growth. Expanded offshore drilling raises the possibility of oil spills, which could ruin beaches and the coastline and harm people who live, work, and visit there, as well as vital habitats for wildlife and flora. Acid rain, a heightened greenhouse effect, and tainted drinking water are a few examples of environmental effects. Rarely, the oil and gas sector may also be a factor in ecosystem collapse and the decline of biodiversity.

In addition, drilling operations, oil spills and leaks are the leading causes of water pollution. For instance, the Deepwater Horizon oil spill in 2010 damaged the northern Gulf of Mexico ecosystem on a large scale. Many aquatic creatures, including plankton, invertebrates, fish, birds, and sea mammals, suffered damage from the 3.19 million barrels of oil that leaked into the ocean. The disaster's oil severely accelerated land erosion along hundreds of miles of the US coastline surrounding the Gulf of Mexico. Environmental activists had doubts about the future of offshore drilling and its overall effects on the environment after the massive oil spill. Hence, offshore drilling is facing challenges due to the environmental impact of oil leakage. Such factors are expected to hinder the growth of the global SURF market during the forecast period.

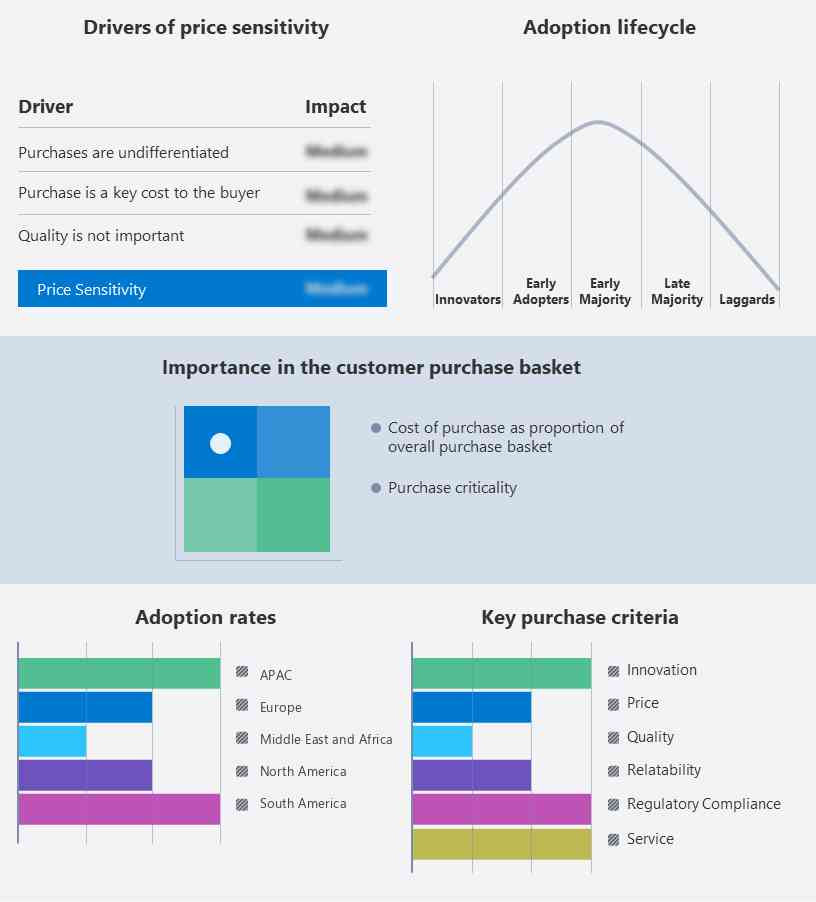

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd. - The key offerings of the company include subsea umbilicals, risers, and flow line solutions such as long step-out systems, direct electrical heating systems, subsea transformers, and subsea power substations.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Aker Solutions ASA

- Baker Hughes Co.

- Bureau Veritas SA

- Dril Quip Inc.

- FIRST Exploration and Petroleum Development Co. Ltd.

- Havfram

- McDermott International Ltd.

- Nexans SA

- NOV Inc.

- Oceaneering International Inc.

- Parker Hannifin Corp.

- Prysmian Spa

- SAIPEM SpA

- Schlumberger Ltd.

- Subsea 7 SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Product

The market share growth by the flowlines segment will be significant during the forecast period. Flexible or rigid pipes that are used to transport lift gas, petrochemicals, injection water, and chemicals are known as flow lines. Flow lines can be made using a single pipe or a group of pipes bundled inside a carrier pipe. When pigging is necessary, flow lines are connected by valves and crossover spools that are set up to allow the circulation of pigs.

Get a glance at the market contribution of various segments View the PDF Sample

The flowlines segment was valued at USD 3.60 billion in 2018 and continued to grow until 2022. High temperatures and pressures are present when subsea flow lines are in operation. Technical difficulties arise due to these circumstances, such as providing pipe with a high material grade. Additionally, high temperatures can cause pipeline corrosion and a reduction in yield strength. Due to the high fluid temperature and high internal pressure that increase as a result of the restrained flow line, flow lines exposed to high pressure and high-temperature conditions produce an effective axial compressive force. Operators are restarting their stalled offshore projects as a result of the consistently rising demand for oil and gas. In addition, drilling operations have been simplified, and crude prices are expected to be close to USD 30 per barrel in April 2020, which forced exploration companies to take calculated risks and invest in offshore drilling. This will drive offshore development, resulting in higher demand for flow lines during the forecast period.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Oil is in high demand in APAC due to the region's growing consumption in nations like China, Japan, India, South Korea, and Indonesia. Pressure to supply the rising demand has been exerted on these nations and the rest of the world. This necessitates expanding exploration efforts in the area, which will fuel the SURF market during the forecast period. Moreover, the expansion of deep-water and ultra-deepwater oil and gas projects in China and a few South-Eastern Asian nations is the major factor driving the SURF market in APAC. According to the IEA, the Stated Policies Scenario, which simulates the effects of the current policy frameworks and the current policy intentions, predicts that the oil demand in APAC will increase from 32 million barrels per day (MBPD) in 2018 to 38 MBPD by 2030. The market in APAC is expanding due to the high potential energy demand and strong government support in nations like China, India, and Indonesia. Additionally, there are more deep-water and ultra-deepwater projects being developed off the coast of China. Hence, such factors are expected to drive the growth of the market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Flowlines

- Umbilicals

- Risers

- Type Outlook

- Shallow water

- Deep water

- Ultra deep water

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

In the SURF industry, subsea umbilicals, risers, and flowlines (SURF) are crucial for efficient subsea production systems. These subsea systems facilitate the transportation of unprocessed fluid from deep water explorations to surface processing systems. The industry, characterized by capital intensive techniques, involves managing unconventional sources and unexplored subsea reserves in areas like the southern Barents Sea. FPSO units and riser pipelines play vital roles in oil and gas exploration and offshore environments. Oil and gas automation and oilfield service automation enhance drilling efficiencies and new build capital expenditure. Electric power and telecommunications are critical for the Umbilical Termination Structure (UTS) and overall subsea production systems (SPS). Environmental conditions, climate change, and geopolitical influence affect the economic impact and supply chain. Companies like SkyQuest leverage risk analysis and competitive rivalry to navigate legal scenarios, demographic changes, and trade & economic policies. Their product portfolio and region coverage are shaped by social & ethnic concerns, total revenue growth, and product launches.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.53% |

|

Market growth 2024-2028 |

USD 4.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.24 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

China, US, Russia, United Arab Emirates, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Aker Solutions ASA, ArcelorMittal SA, Baker Hughes Co., Bureau Veritas SA, Dril Quip Inc., FIRST Exploration and Petroleum Development Co. Ltd., Havfram, Kongsberg Gruppen ASA, McDermott International Ltd., Nexans SA, NOV Inc., Oceaneering International Inc., Parker Hannifin Corp., Prysmian Spa, Saipem S.p.A., Schlumberger Ltd., Subsea 7 SA, TechnipFMC plc, and Vallourec SA |

|

Market dynamics |

Parent market analysis, Market forecasting growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies.

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch

_market_size_abstract_2023_v1.jpg)

_market_segments_abstract_2023_v2.jpg)

_market_regions_abstract_2023_geo_v2.jpg)