Surgical Site Infection Control Market Size 2024-2028

The surgical site infection control market size is forecast to increase by USD 1.69 billion at a CAGR of 5.8% between 2023 and 2028.

- The Surgical Site Infection (SSI) Control Market is experiencing significant growth due to the increasing number of surgical procedures performed worldwide. The trend presents a substantial opportunity for market participants, as SSIs are a common complication following surgical procedures, affecting an estimated 3-5% of all surgical patients. Another key driver for the market is the growing consumer interest in eco-friendly green products. With an increasing focus on reducing healthcare's carbon footprint, there is a rising demand for SSI prevention solutions that minimize the use of single-use disposable products.

- This trend is expected to encourage the development and adoption of reusable and recyclable SSI prevention devices. However, the market is not without challenges. Stringent regulatory frameworks, particularly in developed markets, can pose significant barriers to entry for new market devices entrants. Compliance with these regulations can be costly and time-consuming, requiring extensive research and development efforts and significant financial resources. Additionally, the high cost of SSI prevention solutions, particularly for low-income patients and healthcare systems, can limit market penetration. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must stay abreast of regulatory requirements, invest in research and development, and explore innovative pricing models to make their solutions accessible to a broader audience.

What will be the Size of the Surgical Site Infection Control Market during the forecast period?

- The surgical site infection (SSI) control market encompasses a range of products and services aimed at preventing infections following surgical procedures. This market spans various types of ries, including cataract ry, gastric bypass, caesarean section, and dental restoration, among others. SSI prevention is crucial for patient safety, particularly in the context of non-emergent ries and elective procedures. Key market trends include the adoption of advanced infection prevention measures, such as hand hygiene protocols, surgical scrubs, and skin preparation solutions. Antimicrobial technologies, including antimicrobial coatings and irrigation solutions, are also gaining traction. Innovative sterilization techniques and infection control protocols are essential in addressing the challenge of hospital-acquired infections.

- Chronic diseases, such as diabetes and obesity, increase the risk of SSIs during surgical operations. Antibiotic resistance poses a significant threat, necessitating the development of alternative infection control strategies. The market is driven by the growing focus on patient safety and the increasing number of surgical procedures performed annually. Superficial and deep incisional SSIs, as well as infections following organ transplants, remain key concerns. Hospitals and healthcare providers continue to invest in infection control measures to minimize the risk of SSIs and ensure optimal patient outcomes.

How is this Surgical Site Infection Control Industry segmented?

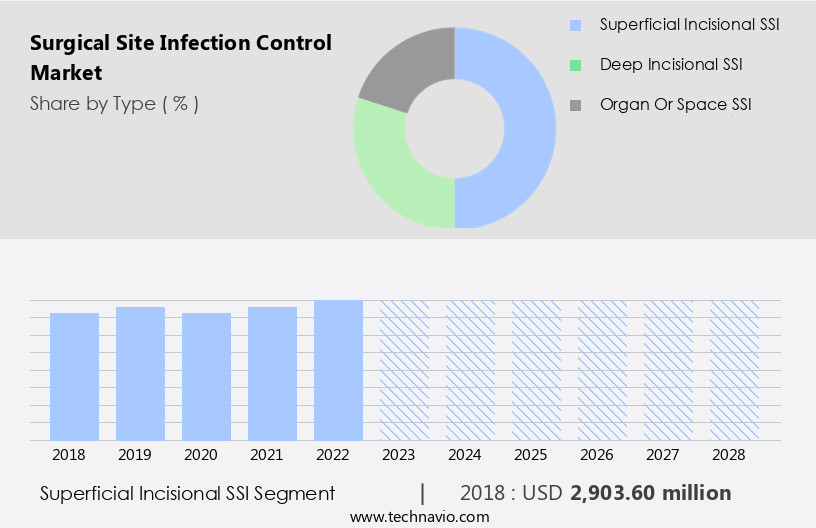

The surgical site infection control industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Superficial incisional SSI

- Deep incisional SSI

- Organ or space SSI

- Product Type

- Disinfectants

- Surgical drapes

- Gloves

- Procedure Type

- Cesarean section

- Gastric bypass

- End-User

- Hospitals

- Ambulatory surgical centers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The superficial incisional ssi segment is estimated to witness significant growth during the forecast period.

Surgical site infections (SSIs) remain a significant concern in healthcare, particularly superficial incisional SSIs that can lead to pus infections in the wound area. To prevent these infections, stringent surveillance is required for 30 days post-ry for all surgical procedures. The superficial incisional SSI segment encompasses wound care dressing, disinfectants, and surgical drapes. The demand for these products is driven by their superior resistance to infection-causing pathogens, lower risk of contamination, and enhanced sterilization. However, the increasing volume of medical waste negatively impacts the adoption of disposable surgical drapes. Antimicrobial coatings, gloves, and solutions are integral to infection control in various surgical procedures, including dental restoration, cataract ry, gastric bypass, cesarean sections, and non-emergent ries.

Diabetes, compromised immunity, overweight, geriatric population, and chronic diseases increase the risk of SSIs. Innovative disinfectants and sterilization techniques are being explored to combat infection-causing biofilms and antibiotic resistance. Preventive care, such as hand hygiene, skin preparation solutions, and surgical irrigation, plays a crucial role in reducing the risk of SSIs. Hospital-acquired infections, including deep incisional SSIs, can lead to unplanned readmissions and extended hospital stays, resulting in increased healthcare costs. Infection prevention remains a priority in hospitals and ambulatory surgical centers to ensure patient safety.

Get a glance at the market report of share of various segments Request Free Sample

The Superficial incisional SSI segment was valued at USD 2.9 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Surgical Site Infection (SSI) control market in North America is driven by the high number of surgical procedures performed in hospitals, clinics, and ambulatory surgical centers. The US, in particular, is a significant contributor to the regional market due to its large population undergoing various surgical procedures, including elective ries, Caesarean sections, cataract ry, gastric bypass, dental restoration, and non-emergent ries. The increasing awareness of infection control and preventive care among patients and healthcare providers has led to the adoption of antimicrobial solutions, coatings on Hair Clippers and Surgical Gloves, skin preparation solutions, and innovative sterilization techniques. Additionally, chronic diseases such as diabetes, compromised immunity, and the geriatric population increase the risk of SSI and hospital-acquired infections, further fueling the demand for SSI control products.

Innovative disinfectants and medical nonwovens are also gaining popularity due to their effectiveness in preventing pathogenic contamination and reducing symptoms of infection. The use of antimicrobial technologies and hand hygiene practices are essential in maintaining patient safety during surgical procedures and preventing unplanned readmissions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surgical Site Infection Control Industry?

- Increasing number of surgical procedures worldwide is the key driver of the market.

- The global surgical site infection (SSI) control market is experiencing significant growth due to the increasing number of surgical procedures. In the US, for instance, aesthetic surgical procedures saw a 54% increase in 2021 compared to 2020, with abdominoplasty being a major contributor. This trend was driven by the high demand for cosmetic ries. The number of cosmetic surgical procedures in the US rose by 22% between 2000 and 2020. Consequently, the growing number of surgical procedures will positively impact the expansion of the market during the forecast period. SSIs are common complications in patients undergoing hospitalization for aesthetic ries or outpatient surgical procedures, despite advancements in preventive measures.

- According to , SSIs accounted for approximately 1.5% of all surgical site infections in the US in 2019. The importance of SSI control in ensuring patient safety and reducing healthcare costs makes it a crucial market to watch. The market growth is driven by factors such as the increasing awareness of patient safety, the growing number of surgical procedures, and the development of advanced antiseptic and disinfectant products.

What are the market trends shaping the Surgical Site Infection Control Industry?

- Growing consumer interest in eco-friendly green products is the upcoming market trend.

- Hand sanitizers, which efficiently remove microbes from the skin without the need for water and soap, have become increasingly important as a complementary measure to handwashing with soap and water. These cleansing agents come in two types: alcohol-free and alcohol-based. Alcohol-based sanitizers, in particular, are preferred when traditional handwashing is unfeasible. They work by stripping the skin of its natural oils, thereby eliminating any pathogens present. In , eco-friendly, green sanitizers containing renewable plant-based ingredients have emerged in The market.

- These sustainable options cater to the growing demand for environmentally conscious products without compromising effectiveness. Alcohol-free sanitizers, though less common, are gaining traction due to their ability to provide protection against a broad spectrum of microbes without the use of alcohol. The market's evolution reflects the ongoing efforts to improve infection control practices and ensure patient safety.

What challenges does the Surgical Site Infection Control Industry face during its growth?

- Stringent regulatory framework is a key challenge affecting the industry growth.

- The Food and Drug Administration (FDA) in the US enforces regulations on the use of chemical ingredients in antiseptics, disinfectants, and personal care products. Compliance with these regulations is essential for companies to ensure product safety and proper labeling. Failure to adhere to FDA guidelines may result in health hazards due to improper use or exposure to excessive chemical ingredients. companies are required to list all ingredients on product labels, including their quantities, and provide instructions for safe use and storage of antiseptics and disinfectants. These regulations aim to protect consumers and promote transparency in the market.

- By adhering to these guidelines, companies can build trust and confidence with their customers, ensuring the safety and efficacy of their products. Proper adherence to FDA regulations is crucial for companies in the personal care product industry to maintain a strong market presence and avoid potential legal issues. With increasing consumer awareness and demand for safe and effective products, companies that prioritize regulatory compliance are likely to succeed in this competitive market.

Exclusive Customer Landscape

The surgical site infection control market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical site infection control market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical site infection control market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in surgical site infection control solutions, utilizing innovative products such as 3M Ioban 2 Antimicrobial Incise Drapes, 3M Comply SteriGage, and 3M Tegaderm Absorbent Clear Acrylic Dressings. These offerings enhance infection prevention efforts in healthcare settings, ensuring optimal patient outcomes. The 3M Ioban 2 drape inhibits bacterial growth, while 3M Comply SteriGage provides secure wound closure. Lastly, 3M Tegaderm Absorbent Clear Acrylic Dressings promote effective wound healing through moisture management. These advanced solutions contribute to the overall success of infection control strategies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- B.Braun SE

- Becton Dickinson and Co.

- BioMerieux SA

- Covalon Technologies Ltd.

- Getinge AB

- Johnson and Johnson Inc.

- Kimberly Clark Corp.

- Medline Industries LP

- Medtronic Plc

- Metall Zug AG

- Molnlycke Health Care AB

- Paul Hartmann AG

- Prescient Surgical

- Sotera Health Co.

- STERIS plc

- Stryker Corp.

- Winner Medical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The surgical site infection (SSI) market encompasses a range of products and services designed to prevent and manage infections that occur at the site of a surgical incision. SSIs can lead to significant patient morbidity, prolonged hospital stays, and increased healthcare costs. The market for SSI prevention and management solutions is driven by several factors, including the increasing number of surgical procedures performed annually, the growing prevalence of chronic diseases, and the rising awareness of the importance of infection control. SSIs can occur as superficial or deep incisional infections. Superficial incisional SSIs affect the skin and subcutaneous tissue, while deep incisional SSIs penetrate deeper into the tissue, potentially leading to more severe complications.

Factors that increase the risk of SSIs include compromised immunity, diabetes, and obesity. Preventive measures for SSIs include strict adherence to infection control protocols, such as proper surgical site preparation, use of sterile equipment, and appropriate use of antibiotics. Innovative disinfectants and sterilization techniques are also being developed to reduce the risk of pathogenic contamination. The use of antimicrobial coatings on surgical gloves, drapes, and other medical textiles is a growing trend in SSI prevention. These coatings can help reduce the risk of infection by providing an additional barrier against microorganisms. Medical nonwovens, which are porous materials used in surgical drapes and gowns, are also being developed with antimicrobial properties to enhance infection control.

The use of antibiotics in surgical procedures is a contentious issue in infection control. While antibiotics are effective in preventing SSIs, overuse and misuse can lead to antibiotic resistance. Innovative antimicrobial technologies, such as silver-ion coatings and biodegradable antimicrobial agents, are being explored as alternatives to traditional antibiotics. SSIs can occur in various types of surgical procedures, including dental restoration, cataract ry, gastric bypass, and cesarean sections. Ambulatory surgical centers and clinics are also at risk for SSIs, particularly in procedures that require extended hospital stays or additional procedures. Hospitals and healthcare facilities are under increasing pressure to reduce hospital-acquired infections, including SSIs.

This has led to the development of new infection control protocols and the implementation of innovative sterilization techniques. Patient safety is a top priority, and healthcare providers are focusing on hand hygiene, skin preparation solutions, and surgical irrigation to reduce the risk of SSIs. The geriatric population and patients with compromised immunity are particularly vulnerable to SSIs. Smoking and obesity are also risk factors for SSIs, and efforts are being made to educate patients about the importance of maintaining a healthy lifestyle to reduce the risk of infection. In , the surgical site infection market is a dynamic and evolving field, driven by the need to reduce the risk of SSIs and improve patient safety.

Innovative solutions, such as antimicrobial coatings and sterilization techniques, are being developed to address the challenges of infection control in various surgical procedures and healthcare settings. The focus on prevention and early detection of SSIs is crucial in reducing morbidity, healthcare costs, and improving patient outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2024-2028 |

USD 1687 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Key countries |

US, Canada, China, Germany, UK, Japan, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Site Infection Control Market Research and Growth Report?

- CAGR of the Surgical Site Infection Control industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical site infection control market growth of industry companies

We can help! Our analysts can customize this surgical site infection control market research report to meet your requirements.