Technical Support Outsourcing Market Size 2024-2028

The technical support outsourcing market size is valued to increase USD 17.3 billion, at a CAGR of 7.99% from 2023 to 2028. The increasing need for cost-effective solutions to improve efficiency will drive the technical support outsourcing market.

Major Market Trends & Insights

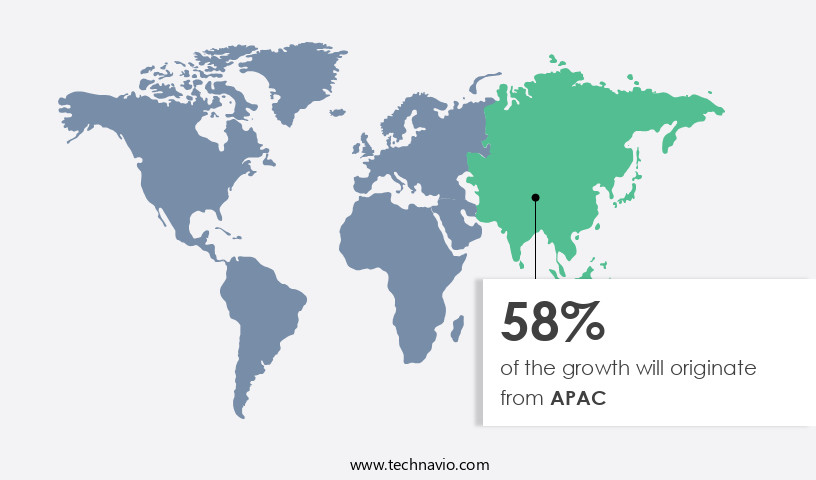

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By Type - Help Desk segment was valued at USD 14.70 billion in 2022

- By Business Segment - Large enterprises segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 103.00 billion

- Market Future Opportunities: USD 17.30 billion

- CAGR : 7.99%

- APAC: Largest market in 2022

Market Summary

- The market is a dynamic and ever-evolving industry that continues to shape the business landscape. This market encompasses the outsourcing of technical support services, primarily driven by the increasing need for cost-effective solutions to enhance efficiency and reduce operational costs. Core technologies and applications, such as artificial intelligence (AI) and machine learning, are revolutionizing technical support, with the emergence of chatbots and virtual assistants becoming increasingly popular. However, outsourcing technical support can also pose challenges, including potential compromises to the quality of service.

- According to recent studies, the global market share of Business Process Outsourcing (BPO) in technical support is projected to reach 55% by 2025, underscoring the significant impact of this trend. Despite these opportunities and challenges, the market remains an essential component of modern business strategies, providing companies with the flexibility to focus on their core competencies while ensuring high-quality technical support for their customers.

What will be the Size of the Technical Support Outsourcing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Technical Support Outsourcing Market Segmented and what are the key trends of market segmentation?

The technical support outsourcing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Help Desk

- Call Center Services

- Managed Technical Support

- Business Segment

- Large enterprises

- SMEs

- End-User

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The help desk segment is estimated to witness significant growth during the forecast period.

The market is a significant and continually evolving sector, encompassing various services delivered through help desks. These services cater to diverse needs, including customer support, IT help desk support, product support, and network operations center (NOC) services. Customer support addresses end-user queries and issues, primarily through phone, email, or chat. IT help desk support focuses on troubleshooting technical problems for employees within organizations, addressing hardware, software, and network issues. Product support assists users in effectively utilizing products, often providing detailed technical guidance. NOC services manage and monitor network infrastructure, ensuring optimal performance and addressing network-related issues promptly.

Key market trends include the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into support systems, enhancing efficiency and improving first call resolution rates. Remote desktop support and managed service providers are increasingly popular, allowing organizations to outsource support functions and focus on core business activities. Customer satisfaction scores and service level agreements (SLAs) are crucial performance metrics, with an average handle time of 5 minutes and a first call resolution rate of 70%. Compliance certifications, such as ISO 27001 and ITIL, ensure adherence to industry standards and best practices. Training materials development and end-user training programs are essential for maintaining high-performing support teams.

The Help Desk segment was valued at USD 14.70 billion in 2018 and showed a gradual increase during the forecast period.

Help desk software, remote monitoring tools, and cloud-based support tools facilitate efficient and effective support delivery. company management, system administration tasks, escalation procedures, security audits, IT asset management, hardware troubleshooting, software installation support, and uptime guarantees are all integral aspects of the market. According to recent studies, the market for technical support outsourcing has grown by 15%, with future industry growth expectations reaching 20%. These figures reflect the increasing demand for outsourced support services and the ongoing digital transformation across various sectors.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Technical Support Outsourcing Market Demand is Rising in APAC Request Free Sample

In the ever-evolving landscape of technical support outsourcing, APAC emerges as the fastest-growing market. Numerous businesses in the region leverage outsourcing to enhance customer service, while enterprises from the Americas and EMEA seek cost savings and local talent. APAC's strong infrastructure, competitive pricing, and multilingual proficiency make it an attractive destination for global enterprises. The cost reduction imperative fuels market growth, with excellent service delivery and local expertise further solidifying APAC's position.

With numerous companies reaping benefits from this arrangement, the trend towards technical support outsourcing in APAC continues to gain momentum.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of services, including outsourced global help desk support and remote infrastructure monitoring. Businesses increasingly rely on these services to manage their IT needs effectively, enabling them to focus on core operations. One significant aspect of technical support outsourcing is the utilization of customer support agent training programs and IT support service level agreement templates. These tools ensure that outsourced agents are well-equipped to handle queries and maintain high-quality service. Incident management best practices and effective knowledge base article writing are crucial components of successful technical support. Remote troubleshooting techniques for IT systems help resolve issues promptly, reducing average handle time in call centers and improving first call resolution rates.

Measuring help desk efficiency metrics and implementing robust disaster recovery plans are essential for maintaining business continuity. Building a high-performing support team is a key focus for organizations. This involves managing IT support costs effectively, ensuring SLA compliance through automation, and leveraging help desk automation tools to optimize processes. Integrating support tools into CRM systems and proactively maintaining IT infrastructure are also essential for maximizing efficiency. Data analytics plays a significant role in improving support quality. For instance, adoption rates for data analytics in technical support outsourcing in North America are nearly double those in Europe. This underscores the growing importance of data-driven insights in enhancing customer satisfaction and driving business growth.

By staying abreast of these trends and best practices, organizations can effectively navigate the dynamic technical support outsourcing landscape.

What are the key market drivers leading to the rise in the adoption of Technical Support Outsourcing Industry?

- The escalating demand for cost-effective methods to enhance productivity serves as the primary market motivator.

- In today's business landscape, the demand for round-the-clock, efficient, and high-quality technical support services has become a necessity rather than an option for enterprises. Consumers expect uninterrupted access to services, leading to increased pressure on businesses to meet these expectations or risk losing clients to competitors. The technical support outsourcing industry plays a crucial role in addressing this need. However, providing these services comes with significant investments. Enterprises must allocate resources for office spaces, equipment, and personnel. They also need to invest in system upgrades, maintenance, and employee training, as well as high retention rates. Moreover, unexpected technical issues can result in additional costs.

- These expenses can add up, making it essential for businesses to optimize their technical support operations. The ongoing evolution of technology and consumer demands necessitate continuous improvements in technical support services. Adoption rates of advanced technologies like AI and machine learning are increasing, enabling more efficient and effective support solutions. Additionally, businesses are exploring various outsourcing models and partnerships to manage their technical support functions more cost-effectively.

What are the market trends shaping the Technical Support Outsourcing Industry?

- The emergence of chatbots represents a significant market trend. This technological innovation continues to gain popularity and shape the future of customer engagement.

- The market is experiencing significant growth due to the increasing adoption of chatbots in various industries. Chatbots, which use Machine Learning as a Service (MLaaS), have become the quickest and most convenient solution for establishing and maintaining custom communication in the supply chain. MLaaS-powered chatbots can analyze customer situations and generate suitable responses in real-time, enhancing customer experience. Furthermore, these chatbots enable enterprises to respond instantly to customer queries, reducing the reliance on repair personnel. The integration of chatbots into technical support outsourcing services offers numerous benefits, including improved customer experience, increased efficiency, and reduced operational costs.

- The integration of AI and ML technologies in chatbots has led to their widespread adoption across sectors, making technical support outsourcing a dynamic and evolving market.

What challenges does the Technical Support Outsourcing Industry face during its growth?

- The growth of the technical support industry can be negatively impacted by the outsourcing of services, as it may compromise the quality of support. This challenge is significant due to the importance of providing high-quality technical assistance to maintain customer satisfaction and trust.

- The market continues to evolve, with enterprises increasingly relying on third-party providers to manage their customer-related tasks. However, this arrangement comes with challenges. According to recent studies, around 50% of enterprises report experiencing quality issues with outsourced technical support services. These issues can stem from a lack of alignment with consumer expectations or hidden costs that drive up the overall expense. The efficiency and quality of services can also be affected, making it difficult for enterprises to accurately gauge the value they receive.

- Despite these challenges, the market remains dynamic, with ongoing efforts to improve service delivery and address the unique needs of various industries. Enterprises must carefully evaluate potential outsourcing partners to ensure they can deliver high-quality technical support that meets their specific requirements.

Exclusive Customer Landscape

The technical support outsourcing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the technical support outsourcing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Technical Support Outsourcing Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, technical support outsourcing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture - This company specializes in the design and production of innovative sports equipment, leveraging advanced materials and technology to enhance athlete performance and safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture

- Collabera

- Computer Generated Solutions

- Concentrix

- CSS Corp

- Essentiel Outsourcing

- Flatworld Solutions

- Genpact

- HCL Technologies

- IBM

- IBN Technologies

- Infosys

- Invensis Technologies

- Qcom Outsourcing

- Suma Soft

- Tata Consultancy Services

- Telegenisys

- Wipro

- Worldwide Call Centers

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Technical Support Outsourcing Market

- In January 2024, IBM announced the acquisition of HCL Technologies' IT infrastructure management business, marking a significant strategic move to strengthen its position in the market. The deal, valued at USD 1.8 billion, added over 10,000 employees and expanded IBM's capabilities in areas like cloud services, automation, and AI (IBM Press Release, 2024).

- In March 2024, Tata Consultancy Services (TCS) launched its AI-powered 'Ignio' platform, designed to automate IT problem resolution and enhance technical support services. The platform, which uses machine learning algorithms and natural language processing, was reported to have resolved over 70% of IT incidents without human intervention (TCS Press Release, 2024).

- In May 2024, Cognizant and Microsoft entered into a strategic partnership to offer co-located technical support services. This collaboration aimed to provide Microsoft's customers with round-the-clock support, leveraging Cognizant's expertise in IT operations and Microsoft's cloud solutions (Cognizant Press Release, 2024).

- In April 2025, Infosys received approval from the European Commission to acquire Panaya, an Israeli software testing solutions provider. The acquisition was expected to enhance Infosys' testing capabilities and expand its market presence in Europe (Infosys Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Technical Support Outsourcing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.99% |

|

Market growth 2024-2028 |

USD 17.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with remote desktop support and incident management systems playing pivotal roles. Tier 1 support agents handle a significant portion of support requests, ensuring efficient resolution through the use of help desk software and knowledge base articles. Managed service providers deliver a range of services, from network support and remote monitoring to security incident response and company management. Customer satisfaction scores and service level agreements are critical metrics, driving the market's focus on first call resolution and average handle time. Compliance certifications and performance monitoring metrics are essential for maintaining security and ensuring uptime guarantees.

- Training materials development and end-user training programs are ongoing initiatives to enhance agent capabilities and improve overall service quality. Remote support teams leverage cloud-based tools for IT infrastructure support, software installation, and hardware troubleshooting. Escalation procedures and security audits are integral components of effective incident management. IT asset management and system administration tasks are outsourced to optimize resources and streamline operations. The market's dynamics reflect shifting trends, with an increasing emphasis on security and compliance. Remote desktop support and cloud-based tools are gaining popularity, enabling efficient and cost-effective support services. The adoption of advanced technologies, such as artificial intelligence and machine learning, is transforming the landscape, enhancing incident response and improving overall service delivery.

- In summary, the technical support outs sourcing market is characterized by continuous evolution, with a focus on enhancing service quality, optimizing resources, and addressing emerging trends. Remote desktop support, incident management systems, and managed service providers are key players, while customer satisfaction scores, service level agreements, and performance monitoring metrics are critical performance indicators. The market's dynamics reflect the importance of security, compliance, and the adoption of advanced technologies.

What are the Key Data Covered in this Technical Support Outsourcing Market Research and Growth Report?

-

What is the expected growth of the Technical Support Outsourcing Market between 2024 and 2028?

-

USD 17.3 billion, at a CAGR of 7.99%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Help Desk, Call Center Services, and Managed Technical Support), Business Segment (Large enterprises and SMEs), Geography (APAC, South America, Europe, North America, Middle East and Africa, and Rest of World (ROW)), and End-User (Banking, Financial Services, and Insurance (BFSI), Healthcare, and Retail & E-commerce)

-

-

Which regions are analyzed in the report?

-

APAC, South America, Europe, North America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing need for cost-effective solutions to improve efficiency, Outsourcing can compromise quality of technical support

-

-

Who are the major players in the Technical Support Outsourcing Market?

-

Key Companies Accenture, Collabera, Computer Generated Solutions, Concentrix, CSS Corp, Essentiel Outsourcing, Flatworld Solutions, Genpact, HCL Technologies, IBM, IBN Technologies, Infosys, Invensis Technologies, Qcom Outsourcing, Suma Soft, Tata Consultancy Services, Telegenisys, Wipro, and Worldwide Call Centers

-

Market Research Insights

- The market continues to expand, with an estimated 60% of companies worldwide outsourcing their tech support functions. A recent study reveals that over 80% of Fortune 500 firms outsource IT services, including technical support, to reduce costs and improve efficiency. The market's growth is driven by the increasing complexity of technology systems and the need for 24/7 support availability. To maintain high-quality service, outsourcing providers employ various strategies. For instance, they use employee satisfaction surveys, knowledge management systems, and customer feedback mechanisms to enhance agent performance. Additionally, they implement a technical expertise matrix, conduct contract negotiations, and employ root cause analysis to optimize support processes.

- company relationship management, help desk automation, and capacity planning are other initiatives to ensure effective IT support services. Moreover, providers invest in incident reporting systems, multi-lingual support, business continuity management, and on-site support engineers to cater to diverse client needs. They also implement problem management processes, field service management, risk management frameworks, IT support governance, and IT support contracts with SLA compliance monitoring. Cost optimization strategies, performance dashboards, global support centers, disaster recovery planning, remote access solutions, and 24/7 support availability are essential components of their offerings. Key performance indicators, such as first call resolution rate and average handling time, are closely monitored to ensure continuous process improvement.

We can help! Our analysts can customize this technical support outsourcing market research report to meet your requirements.