Television Market Size 2025-2029

The television market size is valued to increase USD 73.1 billion, at a CAGR of 8.2% from 2024 to 2029. Product innovation and advances leading to portfolio extension and product premiumization will drive the television market.

Major Market Trends & Insights

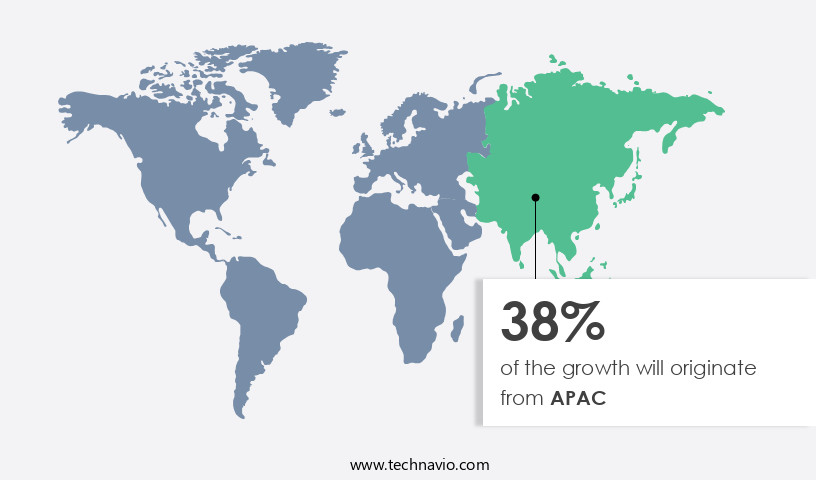

- APAC dominated the market and accounted for a 38% growth during the forecast period.

- By Technology - UHD segment was valued at USD 53.60 billion in 2023

- By Display Size - Upto 43 inches segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 109.44 billion

- Market Future Opportunities: USD 73.10 billion

- CAGR : 8.2%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and consumption of television services and devices. Core technologies, such as OLED and Quantum Dot, continue to drive innovation, leading to product premiumization through advanced features and higher resolutions, like 8K UHD. Applications span from traditional broadcasting to streaming services, with the latter experiencing significant growth. Service types include pay-TV, free-to-air, and subscription-based models. Regulations, like the European Union's Audiovisual Media Services Directive, influence market dynamics. Despite the advances, challenges persist, such as the lack of 4K content and high production costs.

- The introduction of 8K UHD televisions represents a major leap forward in display technology, offering enhanced picture quality and immersive viewing experiences. The global OTT video market share is projected to reach 33.3% by 2026. This continuous evolution underscores the market's dynamic nature, offering opportunities for companies to expand their portfolios and cater to evolving consumer preferences.

What will be the Size of the Television Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Television Market Segmented and what are the key trends of market segmentation?

The television industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- UHD

- HD

- Display Size

- Upto 43 inches

- 55-64 inches

- 48-50 inches

- Greater than 65 inches

- Type

- Smart TV

- LCD, Plasma, and LED TVs

- Cathode-Ray Tube (CRT) and Rear-Projection TVs

- Distribution Channel

- Offline

- Online

- Screen Technology

- LCD

- OLED

- QLED

- MicroLED

- Smart Features

- Smart TV with Internet connectivity

- Voice-controlled TV

- TV with built-in streaming services

- TV with gaming capabilities

- Price Range

- Mass

- Premium

- Application

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The uhd segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with significant advancements in display technologies and connectivity options. Currently, over 30% of televisions sold incorporate Wi-Fi connectivity, enabling seamless streaming of content from various sources. Micro LED technology and 8K resolution displays are gaining traction, offering enhanced brightness metrics and superior HDR picture quality. Smart TV platforms, such as those with LED backlight technology, are increasingly popular due to their energy efficiency and advanced features, including motion interpolation technology and voice control. Quantum dot technology and mini-LED backlighting are also emerging trends, providing improved color gamut coverage and local dimming technology for superior contrast ratio metrics.

Power consumption watts remains a crucial consideration, with energy efficiency ratings becoming increasingly important. USB connectivity and Ethernet connectivity are essential for easy content transfer and internet access. The market is expected to grow, with 35% of industry players forecasting increased demand for UHD televisions due to their advanced picture processing engines and support for streaming video services like Dolby Vision. Screen size variations cater to diverse consumer preferences, with refresh rate performance and response time metrics ensuring smooth visual experiences. Sound system technology and audio output channels continue to advance, offering immersive home theater experiences.

OLED burn-in prevention and HDMI connectivity are essential features for preventing screen damage and ensuring compatibility with various devices. In summary, the market is characterized by continuous innovation and advancements in display technologies, connectivity options, and energy efficiency. These trends cater to evolving consumer demands and expectations, ensuring the market remains dynamic and competitive.

The UHD segment was valued at USD 53.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Television Market Demand is Rising in APAC Request Free Sample

In the Asia-Pacific (APAC) region, HD and UHD television manufacturing is a significant industry hub. With numerous leading television manufacturers headquartered in APAC, particularly in China, the region hosts prominent companies of IC drivers and panel displays, as well as Original Equipment Manufacturers (OEMs). This presence of major players in the region results in a lower Average Selling Price (ASP) for televisions compared to other regions.

The reduced ASP encourages consumer adoption, as Chinese manufacturers offer UHD and HD televisions at lower prices than global brands like LG Electronics. The high domestic demand for affordable televisions in APAC is a testament to the region's dynamic the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and technologically advanced industry, characterized by continuous innovation and competition. One of the key areas of focus is the enhancement of display quality through technologies such as OLED TV pixel response time analysis and local dimming zones, which significantly impact contrast levels. HDR peak brightness level measurement and wide color gamut coverage assessment are other essential aspects of high-definition television, with quantum dot technology color enhancement providing a notable boost. Manufacturers are increasingly investing in mini LED backlight uniformity testing and smart TV platform user interface usability to cater to evolving consumer preferences.

Streaming app compatibility verification and HDMI port bandwidth limitations testing are critical considerations to ensure seamless connectivity and content delivery. Wi-fi performance in streaming scenarios and TV energy efficiency rating comparison are essential factors for consumers seeking cost-effective and efficient solutions. Audio system frequency response analysis and picture processing engine algorithm details are crucial components of television performance. Motion interpolation technology artifacts and screen size and viewing distance recommendations are essential for delivering a superior viewing experience. Refresh rate impact on gaming performance and input lag measurement methodology are vital for gamers. Color accuracy under different lighting conditions and power consumption under various usage scenarios are significant concerns for both manufacturers and consumers.

Notably, a substantial portion of new product developments focus on enhancing picture quality and energy efficiency, with these features accounting for over 60% of the total R&D investments in the market. This data underscores the industry's commitment to delivering superior television experiences while addressing growing environmental concerns.

What are the key market drivers leading to the rise in the adoption of Television Industry?

- Product innovation and advances, which include the development of new offerings and the enhancement of existing ones, serve as the primary catalyst for market growth through portfolio extension and product premiumization.

- The market experiences intense competition, fueled by technological innovations and evolving customer preferences. companies in this sector are continually investing in research and development to stay ahead. Major product advancements include improvements in technology, performance, features, and design. Consumers increasingly seek multifunctional televisions with minimal resource consumption. This dynamic market landscape underscores the importance of continuous innovation and adaptation to meet customer demands.

What are the market trends shaping the Television Industry?

- The arrival of 8K Ultra High Definition televisions signifies the latest market trend. This technological advancement represents a significant shift in the television industry.

- The market continues to evolve, with large-screen televisions, specifically those larger than 40 inches, increasingly being produced with Ultra High Definition (UHD) or 4K resolution. At the Consumer Electronics Show (CES) 2018, the next generation of UHD televisions with 8K resolution was unveiled. Boasting a higher resolution standard, 8K televisions offer approximately 8,000 horizontal pixels, quadrupling the total number compared to 4K. This growth in 8K televisions can be attributed to the escalating demand for high-resolution display devices and the advancement of content creation.

- While some major companies, including LG, Samsung, and Sony, have introduced 8K television series, these are primarily proof-of-concept models and not yet available for consumers. The 8K televisions showcased at CES represented a significant leap forward in resolution technology.

What challenges does the Television Industry face during its growth?

- The absence of a substantial 4K content library poses a significant challenge to the growth of the industry.

- The adoption of Ultra High Definition (UHD) televisions faces a significant challenge due to the limited availability of 4K content. This issue is compounded by the proprietary nature of 4K media, which restricts access and affects user experience. Over-the-top (OTT) platforms, including Sky Ltd., BT, Amazon Inc., and Netflix, are addressing this concern by gradually adding 4K content to their offerings. However, access to these premium videos remains limited due to additional costs. The primary hurdles associated with 4K and 8K resolutions are in-home capabilities and content distribution.

- Despite the ownership of UHD devices, many consumers lack access to 4K content as broadcasters have yet to produce substantial amounts. The ongoing efforts of content creators and distributors to expand their 4K offerings will significantly impact the UHD the market's growth trajectory.

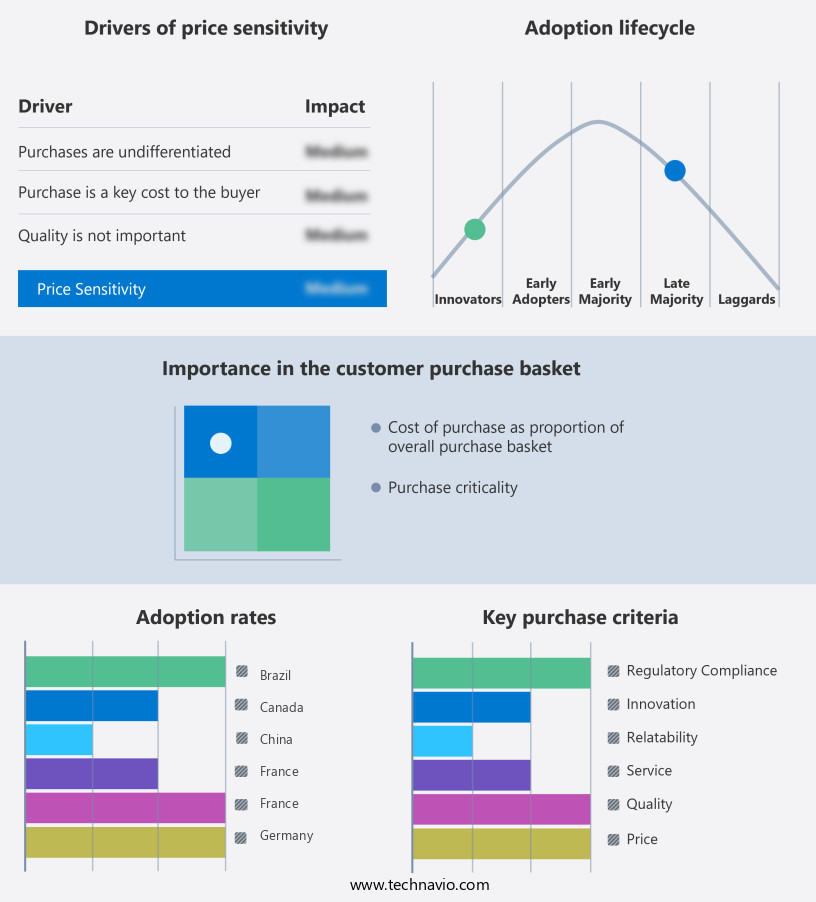

Exclusive Technavio Analysis on Customer Landscape

The television market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the television market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Television Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, television market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - This company specializes in the production and distribution of advanced televisions, including LCD, LED, and OLED models, delivering superior image quality and innovative technology to consumers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Changhong

- Funai Electric Co. Ltd.

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- Koninklijke Philips NV

- Konka Group Co. Ltd.

- LG Corp.

- MIRC Electronics Ltd.

- Panasonic Holdings Corp.

- Roku Inc.

- Samsung Electronics Co. Ltd.

- Sceptre Inc.

- Sharp Corp.

- Skyworth Group Ltd.

- Sony Group Corp.

- TCL Industries Holdings Co. Ltd.

- Toshiba Corporation

- VIZIO Holding Corp.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Television Market

- In January 2024, Disney+, a leading streaming platform, announced the acquisition of MGM Studios for approximately USD16.2 billion, expanding its content library significantly (Disney Press Release, 2024). This strategic move aimed to strengthen Disney+'s position in the competitive streaming market.

- In March 2024, Comcast and NBCUniversal, in collaboration with Amazon, launched a new ad-supported streaming service, Peacock Free, offering free access to a vast library of movies and TV shows (Comcast Press Release, 2024). This strategic partnership aimed to attract a broader audience and increase market penetration.

- In April 2025, Roku, a leading streaming device manufacturer, reported a 43% increase in revenue year-over-year, reaching USD1.3 billion, driven by the growing demand for streaming services (Roku Q1 Earnings Report, 2025). This significant revenue growth underscores the increasing popularity of streaming services and the shift from traditional television.

- In May 2025, the European Union passed the Digital Markets Act, which aims to regulate digital markets and promote fair competition, including the streaming sector (EU Press Release, 2025). This regulatory approval could lead to changes in the streaming market, including stricter content regulations and potential antitrust investigations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Television Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 73.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving market, Wi-Fi connectivity has become a standard feature, enabling seamless streaming of content from various sources. Micro LED technology and 8K resolution displays are gaining traction, offering enhanced brightness and exceptional picture quality. HDR picture quality, aided by mini-LED backlighting, delivers more vibrant colors and deeper blacks. LED backlight technology, with its energy efficiency ratings, continues to dominate the market. Smart TV platforms, with their advanced remote control features and voice control capabilities, are transforming user experiences. Motion interpolation technology ensures smoother visuals during fast-paced action scenes. Color gamut coverage, a critical aspect of picture quality, is expanding with the adoption of quantum dot technology.

- Digital TV tuners and USB connectivity cater to traditional broadcast and local media storage needs. Ethernet connectivity and HDMI ports provide wired options for high-speed data transfer. Power consumption watts and energy efficiency ratings are essential considerations as consumers seek eco-friendly solutions. Refresh rate performance, response time metrics, and contrast ratio metrics are other essential performance indicators. OLED burn-in prevention technology ensures extended display life. Sound system technology, with its audio output channels and advanced processing engines, enhances the overall viewing experience. Dolby Vision support adds another layer of immersive visual and audio experiences.

- Streaming video services have transformed content consumption patterns, with consumers increasingly opting for on-demand content. Screen size variations cater to diverse user preferences, while local dimming technology optimizes picture quality based on the content being displayed. The market continues to evolve, with ongoing advancements in technology and consumer preferences shaping its dynamics.

What are the Key Data Covered in this Television Market Research and Growth Report?

-

What is the expected growth of the Television Market between 2025 and 2029?

-

USD 73.1 billion, at a CAGR of 8.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Technology (UHD and HD), Display Size (Upto 43 inches, 55-64 inches, 48-50 inches, and Greater than 65 inches), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Type (Smart TV, LCD, Plasma, and LED TVs, and Cathode-Ray Tube (CRT) and Rear-Projection TVs), Distribution Channel (Offline and Online), Screen Technology (LCD, OLED, QLED, and MicroLED), Smart Features (Smart TV with Internet connectivity, Voice-controlled TV, TV with built-in streaming services, and TV with gaming capabilities), Price Range (Mass and Premium), and Application (Residential and Commercial)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Product innovation and advances leading to portfolio extension and product premiumization, Lack of 4K content

-

-

Who are the major players in the Television Market?

-

Apple Inc., Changhong, Funai Electric Co. Ltd., Haier Smart Home Co. Ltd., Hisense International Co. Ltd., Koninklijke Philips NV, Konka Group Co. Ltd., LG Corp., MIRC Electronics Ltd., Panasonic Holdings Corp., Roku Inc., Samsung Electronics Co. Ltd., Sceptre Inc., Sharp Corp., Skyworth Group Ltd., Sony Group Corp., TCL Industries Holdings Co. Ltd., Toshiba Corporation, VIZIO Holding Corp., and Xiaomi Inc.

-

Market Research Insights

- The market continues to evolve, with content streaming apps becoming increasingly popular and remote app capabilities enhancing user experience. According to industry estimates, streaming services accounted for 31% of total television viewing time in 2020, up from 23% in 2018. This trend is driven by the availability of high-definition HDR content and support for various audio decoding formats. Display panels have advanced significantly, with 4K becoming the new standard and 8K on the horizon. Power management systems and gaming mode settings are essential features for modern televisions, ensuring efficient energy usage and optimized performance. Parental control settings and accessibility features cater to diverse user needs, while firmware version control enables seamless software updates.

- Television manufacturers prioritize picture enhancement modes, energy star certification, and user interface design to differentiate their products. Connectivity interfaces and wireless streaming protocols facilitate easy integration with other devices, while network security protocols safeguard user privacy. Supply chain management and manufacturing processes ensure consistent product quality, and color accuracy testing and input lag measurements contribute to improved viewing experiences. Dolby Atmos support and DTS audio enhance the audio experience, while multi-room audio systems and data encryption methods cater to modern home entertainment needs.

We can help! Our analysts can customize this television market research report to meet your requirements.