Mexico Textile Manufacturing Market Size 2024-2028

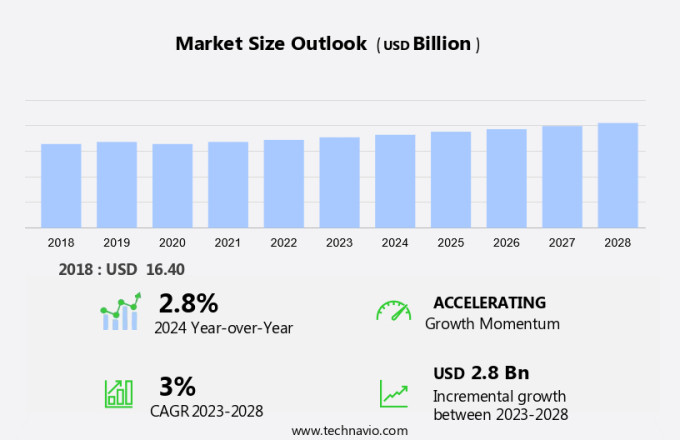

The Mexico textile manufacturing market size is forecast to increase by USD 2.8 billion, at a CAGR of 3% between 2023 and 2028.

- The market is characterized by several key drivers and trends shaping its strategic landscape. Premiumization is a significant trend, with consumers increasingly favoring well-positioned textile brands. This shift towards higher-end textiles is driven by growing disposable income and a desire for improved quality and durability. Another key driver is the increasing demand for textiles in the automotive industry. Mexico's automotive sector is expanding, leading to increased demand for textiles used in vehicle interiors and exterior components. This trend is expected to continue, providing opportunities for textile manufacturers to capitalize on this growing market. However, the market also faces challenges, including the volatility of crude oil prices.

- Mexico is a significant oil producer, and fluctuations in oil prices can impact the cost of raw materials used in textile manufacturing. This price instability can make it challenging for textile manufacturers to maintain profitability and plan for future investments. Additionally, environmental regulations and sustainability concerns are becoming increasingly important, requiring textile manufacturers to invest in eco-friendly production methods and materials to remain competitive. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must stay informed of industry trends and adapt to evolving consumer preferences and regulatory requirements.

What will be the size of the Mexico Textile Manufacturing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The market is characterized by a complex value chain, encompassing textile regulations, exports, digitalization, and various industry clusters. Textile regulations ensure compliance with standards and certifications, while textile transparency and traceability are essential for ethical practices and consumer trust. The apparel industry, a significant sector within textiles, is embracing innovation through textile R&D, automation, and robotics. Textile sustainability initiatives and recycling technologies are driving circularity in the industry, addressing concerns over textile health and environmental impact. Textile social responsibility and workforce development are crucial components of textile entrepreneurship, attracting investment and fostering growth.

- Textile imports and exports are influenced by global market segmentation and industry 4.0 trends, with textile big data and textile safety playing essential roles in optimizing operations and maintaining competitiveness. Textile technology and textile standards continue to evolve, shaping the future of the textile sector.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Natural fibers

- Polyesters

- Nylon

- Others

- Application

- Fashion

- Technical

- Household

- Others

- Geography

- North America

- Mexico

- North America

By Product Insights

The natural fibers segment is estimated to witness significant growth during the forecast period.

The market encompasses various sectors, including technical textiles, industrial textiles, home textiles, and apparel manufacturing. Natural fibers, such as cotton, silk, linen, wool, hemp, and jute, are extensively used in textile production. Wool, obtained from sheep, is valued for its flexibility, resilience, insulation properties, and thermal stability, making it suitable for clothing and construction materials. Silk, a protein filament spun by silkworms, is renowned for its softness, durability, and quick-drying nature, finding applications in clothing, medical dressings, and automotive interiors. The Mexican silk industry is thriving due to silk's versatility and suitability for all climatic conditions.

Textile manufacturing also involves the use of synthetic fibers, fiber blends, and various textile processes like spinning, weaving, knitting, dyeing, printing, and finishing. Digital printing, 3D printing, and textile automation have revolutionized textile production, ensuring higher efficiency and quality control. The fashion industry is increasingly focusing on sustainable practices, such as circular economy, ethical sourcing, and reducing textile waste, to minimize environmental impact. Textile research and innovation continue to drive the development of functional fabrics, smart textiles, and advanced textile technologies. Textile chemicals and textile machinery are essential components of the textile manufacturing process. Textile education and labor standards play a crucial role in ensuring a skilled workforce and ethical manufacturing practices.

The global textile trade is a significant contributor to the economy, with Mexico being an active participant.

The Natural fibers segment was valued at USD 6.80 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Mexico Textile Manufacturing Market drivers leading to the rise in adoption of the Industry?

- Premiumization, achieved through strategic brand positioning, serves as the primary growth engine for the market.

- The market offers a diverse range of textile products, with a growing preference for premium and high-end brands among consumers. These brands are synonymous with quality, style, and status, making them a popular choice for those who can afford superior-priced apparel. Companies like Gap, H&M, Inditex (ZARA), Kering, and LVMH, which have strong brand recognition, cater to this segment. The demand for branded apparel is on the rise in Mexico, with several premium textile manufacturing companies expanding their operations in the country.

- Consequently, the price of premium apparel is higher than that of non-branded regular apparel. In conclusion, the market dynamics in Mexico's textile manufacturing sector indicate a strong consumer inclination towards premium and high-end brands, driving demand for superior-quality textiles and apparel.

What are the Mexico Textile Manufacturing Market trends shaping the Industry?

- The automotive industry's growing requirement for textiles represents a significant market trend. This demand stems from the increasing use of textiles in vehicle production for upholstery, insulation, and other applications.

- The market encompasses various segments, including technical textiles and home textiles. Among these, technical textiles hold significant market share, primarily driven by their extensive usage in the automotive industry. Mexico's automotive sector is projected to expand moderately, creating a steady demand for technical textiles. These textiles are utilized in manufacturing automobile components, such as composites, sound insulation, and vibration control for interiors. Synthetic fibers like nylon, polyester, wool, and polypropylene are commonly used to produce seat covers, seatbelts, and carpets.

- The properties of these fibers, including high abrasion resistance, superior strength, low extensibility, and excellent UV resistance, make them suitable for automotive applications. Additionally, functional fabrics and industrial textiles cater to various sectors, such as construction, healthcare, and agriculture, further expanding the market scope. Textile testing and printing machines are essential tools in the manufacturing process, ensuring product quality and design innovation.

How does Mexico Textile Manufacturing Market face challenges during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market is significantly influenced by the global trends in fast fashion and the growing emphasis on environmental sustainability and circular economy. Synthetic textiles, which are a major segment of this market, are derived from crude oil through the polymerization process. The price volatility of crude oil, being a crucial raw material, directly impacts the cost structure of textile manufacturing in Mexico. In 2022, the crude oil market was projected to have an average price of USD 60 per barrel with a production volume of 1.9 million barrels per day. This price instability can lead to operational challenges for textile manufacturers in Mexico, particularly in areas like supply chain management and textile research.

- Apparel manufacturing, fiber blends, and spinning machines are integral parts of this market, with fashion trends continually driving innovation and development. The industry's focus on sustainability and circular economy is also leading to advancements in textile production techniques and technologies.

Exclusive Mexico Textile Manufacturing Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquasea Inc.

- Calzado Industrial Duramax SA de CV

- CS TECH CONTRACT MANUFACTURING

- Delta Apparel Inc

- El Grande Group

- Grupo Denim

- Grupo Industrial Miro S.A de C.V

- Grupo Kaltex S.A.de C.V.

- Grupo Siete Leguas

- Industrias Piagui SA de CV

- JUEGOS DIVERTIDOS SA DE CV

- LAVARTEX SAPI de CV

- lululemon athletica Inc.

- M and O knits

- Rio Sul SA de CV

- Roma Mills

- ROMANZZINO SA DE CV

- Toray Industries Inc.

- Ubaya Textile

- Vertical Knits S.A de C.V

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Textile Manufacturing Market In Mexico

- In February 2023, Mexican textile manufacturer, Fashion Textiles, announced the launch of its new sustainable denim production line, using recycled water and eco-friendly dyes, aiming to reduce water consumption by 30% and carbon emissions by 25% (Fashion Textiles press release).

- In May 2024, Mexican textile giant, Solo Textiles, entered into a strategic partnership with German textile machinery manufacturer, Karl Mayer Textilmaschinenfabrik, to expand its production capacity and modernize its manufacturing processes (Solo Textiles press release).

- In August 2024, Mexican textile manufacturer, Textil Mexicano, secured a USD50 million investment from private equity firm, KKR, to expand its production capabilities and increase its market share in the United States (Bloomberg).

- In January 2025, the Mexican government launched the Textile Industry Development Program, providing tax incentives and grants to attract foreign investment and modernize existing textile manufacturing facilities, aiming to double the industry's exports by 2028 (Mexico's Ministry of Economy press release).

Research Analyst Overview

The market continues to evolve, with dynamic market trends shaping the industry's landscape. Fast fashion brands seek agile supply chains, driving the need for efficient spinning machines and textile production processes. Sustainability and the circular economy are increasingly important, influencing the use of natural fibers and textile research in the development of functional fabrics and eco-friendly fiber blends. Textile testing and quality control play crucial roles in ensuring ethical sourcing and adherence to labor standards. Digital printing technology advances, enabling the production of intricate designs on various textiles, from industrial to home and apparel. Textile machinery innovations, including automation and textile engineering, streamline manufacturing processes and reduce textile waste.

The fashion industry embraces sustainable fashion trends, with a focus on reducing environmental impact through textile chemicals management and the adoption of smart textiles. Textile education and training programs foster skilled workforces, ensuring the industry remains competitive in the global textile trade. Functional fabrics, spinning machines, and textile research are integral components of this continuously unfolding market, as they cater to diverse applications across sectors. The market remains a dynamic and evolving industry, with ongoing innovations and trends shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Textile Manufacturing Market in Mexico insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2024-2028 |

USD 2.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Mexico

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch