Thermochromic Paint Market Size 2025-2029

The thermochromic paint market size is forecast to increase by USD 619.7 million at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth due to increasing applications in various industries, particularly in the food and beverage sector, where temperature-sensitive labels and signs are becoming increasingly popular. Another key driver is the adoption of cool roofing technology, which uses thermochromic paint to reflect sunlight and reduce energy consumption in buildings. However, market growth is not without challenges. The volatility in raw material prices, primarily titanium dioxide and other pigments, poses a significant threat to market stability and profitability for manufacturers. Companies seeking to capitalize on this market's opportunities must carefully manage their supply chains and explore alternative raw material sources to mitigate price risks.

- Additionally, investing in research and development to create more cost-effective and energy-efficient thermochromic paint formulations can help companies differentiate themselves from competitors and gain a competitive edge. Overall, the market offers significant potential for growth, driven by increasing demand from various industries and technological advancements, but requires careful management of raw material costs and strategic innovation to navigate challenges effectively.

What will be the Size of the Thermochromic Paint Market during the forecast period?

- Thermochromic paints, a type of reversible thermochromic material, have gained significant attention in various industries due to their unique ability to change color based on temperature. One of the primary sectors experiencing growth in this market is knowledge and education, where innovative branding using vibrant thermochromic colors enhances learning environments. Economic growth and eco-consciousness have driven the demand for thermochromic paints with eco-friendly ingredients. Manufacturers continue to develop thermochromic pigments with improved hiding power and durability, addressing industry trends. The medical field also benefits from thermochromic materials, as temperature sensitivity plays a crucial role in various applications.

- Specialty pigments and technological developments are propelling advancements in the thermochromic paints market. Durability issues have been a concern for some industries, particularly in the automobile sector. However, ongoing research and manufacturing procedure improvements aim to address these challenges. Thermochromic paints offer a wide color range, making them an attractive choice for various applications. The economic potential of this market is significant, with key players focusing on innovation and technological advancements to meet the growing demand.

How is this Thermochromic Paint Industry segmented?

The thermochromic paint industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Irreversible

- Reversible

- Application

- Automotive

- Building and construction

- Textile

- Packaging

- Others

- Variant

- Low-temperature thermochromic paints

- Medium-temperature thermochromic paints

- High-temperature thermochromic paints

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- South America

- North America

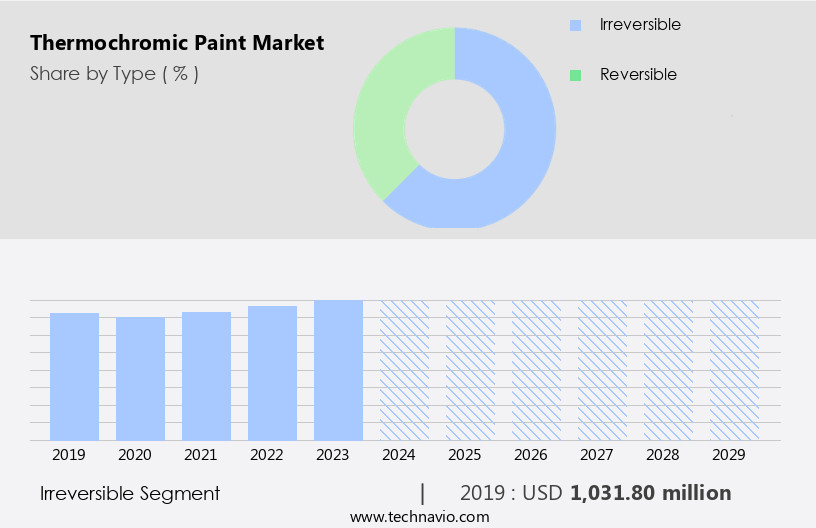

By Type Insights

The irreversible segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the irreversible segment. Irreversible thermochromic paints are widely used in various industries, including packaging, security inks, and medical applications. In the packaging sector, these paints are utilized to create unique and customizable products, such as flexographic screens. The demand for such paints is increasing due to the growing trend of personalized apparel and consumer goods. Moreover, the medical field is another major contributor to the market's growth. Irreversible thermochromic paints are used in medical applications to create temperature-sensitive coatings, which can be crucial for various diagnostic and therapeutic purposes.

The specialty chemical industry is also leveraging these paints to develop eco-friendly organic pigments and color-changing pigments, which are gaining popularity due to their eco-friendly ingredients. The manufacturing procedures for thermochromic paints involve the use of reversible and irreversible thermochromic pigments, which respond differently to temperature changes. Reversible thermochromic pigments change color when heated and return to their original color when cooled, while irreversible thermochromic pigments undergo a permanent color change when exposed to specific temperatures. The automobile sector is also exploring the use of thermochromic paints for automotive coatings, offering innovative branding opportunities. The plastics industry is another potential market for thermochromic paints, as they can be used to create temperature-sensitive coatings for various applications.

However, the durability issues associated with thermochromic paints can be a challenge for manufacturers. To address this, research and development efforts are focused on improving the hiding power and overall performance of these paints. The publishing industry is another potential market for thermochromic paints, offering opportunities for creative and interactive books and magazines. In , The market is expected to continue growing due to the increasing demand for irreversible thermochromic paints in various industries, including packaging, medical, automotive, and plastics. The use of these paints in innovative applications, such as temperature-sensitive coatings and eco-friendly organic pigments, is driving the market's growth.

However, addressing the durability issues associated with these paints remains a key challenge for manufacturers.

Get a glance at the market report of share of various segments Request Free Sample

The Irreversible segment was valued at USD 1031.80 million in 2019 and showed a gradual increase during the forecast period.

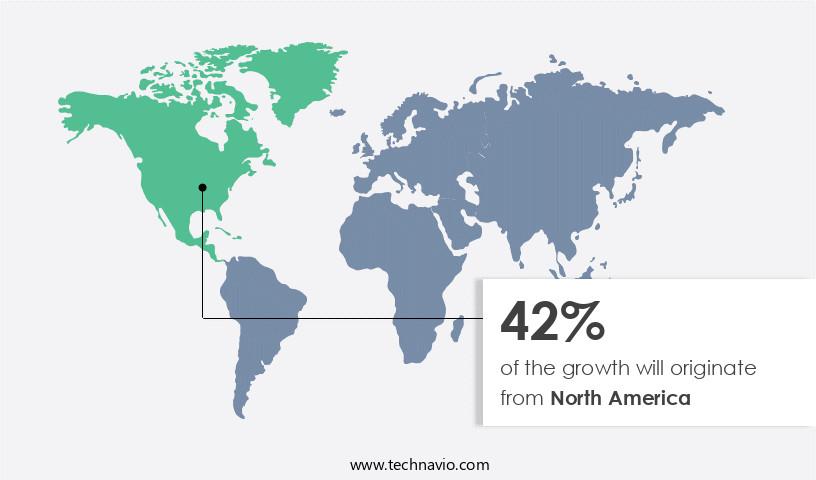

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to various factors. One of the primary drivers is the stringent industrial safety regulations and the presence of thriving manufacturing hubs in countries like the US and Canada. This has led to an increase in the usage of thermochromic paints in various industries, including printing and coatings, packaging, and the medical sector. In the US, the demand for thermochromic paints is particularly high in the packaging industry, where they are used to create innovative branding and design. The printing industry is also witnessing a in the use of thermochromic pigments for applications such as business card printing.

These color-changing pigments offer unique benefits, such as reciprocity of colors, hiding power, and durability. Moreover, the automotive sector is another major consumer of thermochromic materials in North America. Reversible thermochromic coatings are used in automotive coatings to create temperature-sensitive designs that change color based on external temperatures. These coatings offer a range of benefits, including improved aesthetics and enhanced consumer experience. The plastics industry is also adopting thermochromic paints and pigments for various applications, such as interior decor and temperature-sensitive coatings. Eco-friendly organic pigments and eco-friendly ingredients are increasingly being used to address durability issues and meet sustainability requirements.

In the medical field, thermochromic materials are used for various applications, including temperature indicators and drug delivery systems. The publishing industry is another emerging area of application for thermochromic materials, where they are used for creating interactive and engaging content. Overall, the market in North America is expected to continue its growth trajectory due to the increasing demand for smart materials and the diverse applications of thermochromic paints and pigments across various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Thermochromic Paint Industry?

- Increasing use in food and beverage industry is the key driver of the market.

- Thermochromic paints are a type of advanced coating that utilizes liquid crystal or leuco dye technology. These paints contain leucodyes, organic chemicals that undergo a reversible color change when exposed to heat. The energy shift caused by heat alters the crystalline structure of the pigment, enabling it to absorb light. This unique property makes thermochromic paint an ideal solution for various applications, thereby fueling the growth of the market. One significant application of thermochromic paint is in the food industry, where it is used as a temperature indicator for perishable goods such as frozen dairy and meat products. As consumer demand for food quality and safety continues to rise, the need for effective temperature monitoring solutions is increasingly important.

- Thermochromic paint offers a cost-effective and visually appealing solution to this challenge, making it a promising area of growth for the market. In summary, the market is driven by the increasing demand for temperature indicators in various industries, particularly in food and beverage. The ability of thermochromic paint to change color in response to temperature makes it a valuable tool for monitoring temperature and ensuring product quality and safety.

What are the market trends shaping the Thermochromic Paint Industry?

- Increase in adaption of cool roofing technology is the upcoming market trend.

- Thermochromic paint, a technology that changes color based on temperature, offers significant energy savings, particularly in industrial low-slope roofing. The large solar reflectance above the transition temperature and the substantial change in solar reflectance make thermochromic roof membranes an attractive solution for energy conservation. This innovation is crucial in densely populated urban areas, where the collective impact of buildings, excessive population densities, and numerous vehicles amplify the climatic effects. The production of thermochromic roof membranes involves the creation of a composite fabric in a multi-layer system to ensure optimal performance.

- By reducing power usage on both hot and cold days, this technology contributes to energy efficiency and sustainability. This development holds potential for substantial energy savings and is a promising response to the increasing demand for eco-friendly solutions.

What challenges does the Thermochromic Paint Industry face during its growth?

- Volatility in raw material prices of thermochromic paint is a key challenge affecting the industry growth.

- The market faces challenges due to the volatile pricing of raw materials, which are heavily reliant on crude oil and natural forest products. Manufacturers of thermochromic paints utilize various substrates, such as resins, polymers, solvents, pigments, and additives, to create their products. The unpredictability of petroleum-based raw material prices poses a significant hurdle to market expansion. The oil and gas industry's response to decreasing crude oil prices in recent years, which included cost-cutting measures like workforce reductions and rig idling, has further impacted the market.

- For instance, in 2023, the US exported approximately 10 million barrels of crude oil per day. This volatility in the price of crude oil significantly influences the cost structure of thermochromic paint production. Despite these challenges, innovation and technological advancements continue to drive growth in the market.

Exclusive Customer Landscape

The thermochromic paint market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the thermochromic paint market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, thermochromic paint market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axalta Coating Systems Ltd. - The company specializes in thermochromic paints, available in both liquid coatings and powder coatings categories. These innovative paints undergo color transitions in response to temperature changes, offering unique design possibilities and energy efficiency benefits. By integrating thermochromic technology into its coatings, the company positions itself at the forefront of the industry, catering to diverse applications and enhancing the value proposition for its clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axalta Coating Systems Ltd.

- BASF SE

- Chromatic Technologies Inc.

- CROMAS Srl

- Flint Group

- FX Pigments Pvt. Ltd.

- Geminnov

- Hali Pigment Co. Ltd.

- Insilico Co. Ltd.

- Kolortek Co. Ltd.

- Lawrence Industries

- LCR Hallcrest LLC

- Matsui International Inc.

- MG Chemicals Ltd.

- NanoMatriX International Ltd.

- New Color Chemical Co. Ltd.

- Olikrom SAS

- QCR Solutions Corp.

- Smarol Industry Co. Ltd.

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermochromic paint, a type of smart material, has gained significant attention in various industries due to its unique temperature-sensitive properties. This paint undergoes a visible color change when exposed to specific temperature ranges, making it an innovative solution for various applications. The printing inks industry has embraced thermochromic paint as a means to offer more engaging and interactive packaging designs. The use of these color-changing pigments in packaging inks enhances product promotion and creates a memorable consumer experience. The reversible nature of thermochromic paint allows for repeated use, making it a cost-effective solution for businesses. Technological developments in the specialty chemical industry have led to advancements in thermochromic materials, expanding the color range and hiding power of these paints.

Manufacturing procedures have become more efficient, ensuring durability and eco-friendliness. The use of eco-friendly organic pigments and ingredients in thermochromic paints aligns with the growing demand for sustainable products. The automotive sector has also adopted thermochromic paint for innovative branding and design. Temperature-sensitive coatings in automotive coatings create a unique visual effect, enhancing vehicle aesthetics and differentiating brands. The reversible thermochromic property allows for the vehicle's color to change based on temperature, providing an eye-catching effect. The textile printing industry has incorporated thermochromic pigments into their processes, leading to the creation of temperature-sensitive fabrics. These fabrics can change color based on body temperature, offering a personalized and functional solution for clothing and interior decor.

The medical field has found applications for irreversible thermochromic materials, particularly in temperature indicators for pharmaceuticals and medical devices. The ability to indicate specific temperature ranges can ensure proper storage and handling of sensitive materials, improving patient safety. The publishing industry has also explored the use of thermochromic paint for interactive books and covers. The color-changing effect can add an element of surprise and engagement for readers, making the reading experience more memorable. The plastics industry has integrated thermochromic pigments into their products, creating temperature-sensitive plastics for various applications. These plastics can change color based on temperature, offering a functional solution for industries such as construction materials and flexible packaging.

In , the market is experiencing significant growth due to its unique temperature-sensitive properties and versatility across various industries. The advancements in technology and manufacturing processes have expanded the applications and benefits of thermochromic paints, making them a valuable solution for businesses and consumers alike. The reciprocity of colors and the eco-friendly nature of these materials further add to their appeal, ensuring a sustainable and engaging future for thermochromic paint technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 619.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, Canada, China, Japan, India, Germany, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Thermochromic Paint Market Research and Growth Report?

- CAGR of the Thermochromic Paint industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the thermochromic paint market growth of industry companies

We can help! Our analysts can customize this thermochromic paint market research report to meet your requirements.