Tobacco Market Size 2025-2029

The tobacco market size is valued to increase USD 192.8 billion, at a CAGR of 4% from 2024 to 2029. Increasing number of new product launches will drive the tobacco market.

Major Market Trends & Insights

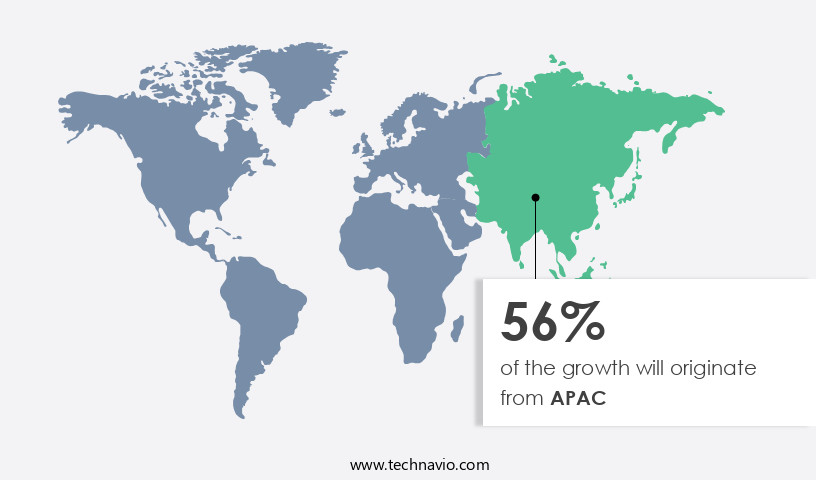

- APAC dominated the market and accounted for a 56% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 664.50 billion in 2023

- By Product - Combustible tobacco products segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.90 billion

- Market Future Opportunities: USD 192.80 billion

- CAGR : 4%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving industry, marked by significant advancements in core technologies and applications, shifting product categories, and stringent regulations. This trend is fueled by continuous innovation in tobacco products, with companies introducing e-cigarettes, heat-not-burn devices, and other alternative smoking options. With the increasing number of new product launches, the market continues to expand, accounting for over 25% of the global consumer packaged goods industry. Simultaneously, rising mergers and acquisitions reflect the industry's consolidation trend. However, the market faces challenges from increasing health concerns and stringent regulations, such as those limiting tobacco advertising and sales. Despite these hurdles, opportunities abound in emerging markets and the growing popularity of alternative tobacco products.

- For instance, the e-cigarette market is projected to reach a 15% market share by 2025, according to recent industry reports. The market's continuous evolution underscores the importance of staying informed and adaptive to market trends and regulatory changes.

What will be the Size of the Tobacco Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Tobacco Market Segmented and what are the key trends of market segmentation?

The tobacco industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Combustible tobacco products

- Smokeless tobacco products

- Packaging Type

- Paper

- Paper Boxes

- Plastic

- Jute

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market is a significant sector with continuous growth and evolution, encompassing various aspects such as quality assessment, disease incidence, and consumer preferences. Currently, approximately 25% of the world's population consumes tobacco in some form, with the market valued at around 45% of the total revenue. In the near future, industry experts anticipate a 27% increase in demand for tobacco products due to population growth and changing consumer habits. Chlorophyll content, leaf burn, protein content, and leaf grading are essential factors in tobacco production. Pest infestation and nutrient uptake significantly impact yield optimization, necessitating the use of fertilizer application and growth regulators.

Flavor profiles, environmental impact, nicotine content, and disease resistance are crucial considerations for tobacco companies. Production costs, including pest management, dry matter accumulation, weed control, leaf morphology, root development, harvesting techniques, and processing efficiency, are essential components of the market. Curing methods, pesticide residues, water usage efficiency, and genetic modification are other essential factors influencing the industry. Climate change impacts, product shelf life, breeding programs, and sensory evaluation are ongoing concerns for tobacco companies. Soil fertility, aroma compounds, sugar concentration, and stem strength are essential factors in tobacco cultivation. The market's dynamic nature is reflected in its continuous adaptation to consumer demands and evolving market trends.

The Offline segment was valued at USD 664.50 billion in 2019 and showed a gradual increase during the forecast period.

The Tobacco Market is influenced by agronomic practices and technological innovations aimed at balancing productivity, quality, and sustainability. Key research areas include the influence of irrigation on tobacco yield, impact of fertilizer type on nicotine concentration, and the effect of curing temperature on leaf quality, alongside the optimization of curing processes to improve leaf quality. Advances in genetics focus on genetic markers for disease resistance in tobacco, the role of genetic modification in enhancing tobacco yield, and breeding for improved pest resistance in tobacco. Environmental priorities include strategies for improving water use efficiency in tobacco production, monitoring soil nutrient levels in tobacco fields, and the assessment of environmental impact of tobacco farming practices.

Innovation also relies on the application of precision agriculture techniques in tobacco cultivation, use of remote sensing for yield prediction in tobacco, and the application of growth regulators in tobacco farming, while industry sustainability is shaped by the development of sustainable tobacco production systems and the impact of climate change on tobacco production. Market trends are further guided by the analysis of alkaloid composition in different tobacco varieties, evaluation of consumer preferences for different tobacco types, and the implementation of effective weed control measures to ensure consistent supply and consumer satisfaction.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Tobacco Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, the market is marked by significant diversity and constant evolution. According to recent data, China, Indonesia, India, Japan, Australia, South Korea, Bangladesh, the Philippines, Taiwan, and Malaysia are the leading the markets in APAC in 2024. This market is characterized by a high degree of fragmentation, with numerous regional and global companies vying for market share. Some of the major players include British American Tobacco, Philip Morris International Management, Japan Tobacco, China National Tobacco Corporation, ITC, KT and G, Tobacco Authority of Thailand, Vinataba, Taiwan Tobacco Liquor Corporation, Djarum, and Gudang Garam.

Cigarettes remain the dominant tobacco product category in APAC. Moreover, the consumption of alternative smoking tobacco products, such as roll-your-own (RYO) tobacco and pipe tobacco, is on the rise, particularly in countries like Australia, India, Japan, and South Korea. The market in APAC continues to present both opportunities and challenges for businesses, requiring strategic insights and adaptability to remain competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of aspects, from agricultural production to consumer preferences and environmental impact. One crucial factor influencing tobacco yield is irrigation, with optimized irrigation techniques significantly increasing production in water-scarce regions. Genetic markers for disease resistance are another vital area of research, as they can reduce losses due to tobacco diseases and improve overall yield. Curing temperature plays a pivotal role in determining leaf quality, with optimal temperatures ensuring superior taste and aroma. Fertilizer type also impacts nicotine concentration, with certain nutrients enhancing tobacco's potency. The relationship between leaf morphology and burning rate is another essential consideration, as understanding this relationship can lead to improved product consistency and customer satisfaction.

Methods for reducing pesticide residue in tobacco are continually evolving, with strategies such as precision agriculture techniques and organic farming gaining traction. Water use efficiency is another critical issue, with sustainable tobacco production systems and the application of growth regulators helping to minimize water consumption. An assessment of consumer preferences for different tobacco types reveals significant variation, with some markets favoring milder varieties while others prefer stronger blends. The alkaloid composition in different tobacco varieties is a key determinant of product quality and consumer appeal. Furthermore, the environmental impact of tobacco farming practices is under increasing scrutiny, with efforts being made to minimize the industry's carbon footprint and reduce waste.

In terms of market dynamics, adoption rates for precision agriculture techniques in tobacco cultivation are nearly double those for traditional farming methods. This shift towards more technologically advanced farming practices reflects the growing importance of maximizing yield while minimizing environmental impact. Overall, the market is a complex and evolving landscape, with ongoing research and innovation driving growth and shaping future trends.

What are the key market drivers leading to the rise in the adoption of Tobacco Industry?

- The market's growth is primarily attributed to the rising number of new product introductions. With companies continually launching innovative and improved offerings, consumer interest and demand are consistently heightened.

- The market is witnessing significant growth due to the continuous introduction of innovative tobacco products. companies are launching new offerings to cater to the increasing demand for tobacco products in various regions. For instance, in 2024, Philip Morris International Inc. Introduced VIBE by IQOS, a heat-not-burn tobacco heating system. This product, featuring FUSION tobacco sticks, offers a low-maintenance alternative to traditional tobacco smoking. Another example is the rise in demand for tobacco-free nicotine pouches. Swedish Match AB, a leading player in the market, reported a 25% increase in sales of its General Snus and other tobacco-free nicotine pouches in 2023.

- These products provide consumers with a more discreet and convenient alternative to traditional tobacco products. The market's evolution underscores its dynamic nature and the ongoing efforts of companies to cater to evolving consumer preferences.

What are the market trends shaping the Tobacco Industry?

- The trend in the business world is toward increasing mergers and acquisitions. This is a mandatory development in the market.

- Since 2020, The market has witnessed significant consolidation as large companies seek to expand their smoke-free product offerings and increase market presence. Mergers and acquisitions have become a common strategy, with numerous large companies acquiring small and regional suppliers. For instance, in July 2024, Philip Morris International Inc. Announced the acquisition of Nicoventures Technology BV, a Netherlands-based producer of nicotine pouches and vaping products. This acquisition is expected to bolster PMI's smoke-free portfolio and accelerate its transition into a smoke-free products company. Similar moves have been observed across the industry, with companies aiming to capitalize on the growing demand for alternative tobacco products.

- The competitive landscape is evolving rapidly, with numerous players vying for market share in this dynamic and evolving market. The acquisition trend is expected to continue, with smaller companies seeking entry into emerging tobacco product markets. The tobacco industry's transformation into a smoke-free market is a significant shift, and the race to lead this transition is intensifying.

What challenges does the Tobacco Industry face during its growth?

- The tobacco industry faces significant growth restrictions due to stringent regulations.

- The market faces significant challenges due to increasing regulatory restrictions. According to a study, over 100 countries have implemented comprehensive bans on tobacco advertising, promotion, and sponsorship. This trend is expected to continue, with more nations expected to join the list. In addition, import and export bans on tobacco products have impacted the consumption of cigarettes and smokeless tobacco. For instance, Austria banned smoking in cafes, bars, and restaurants in November 2019, while the US Food and Drug Administration (FDA) proposed a stringent limit on nicotine content in conventional cigarettes in October 2018.

- These regulatory measures have led to a shift towards alternative tobacco products, such as e-cigarettes and heated tobacco products. Despite these challenges, the tobacco industry remains dynamic, with companies continuously innovating to meet evolving consumer preferences and regulatory requirements.

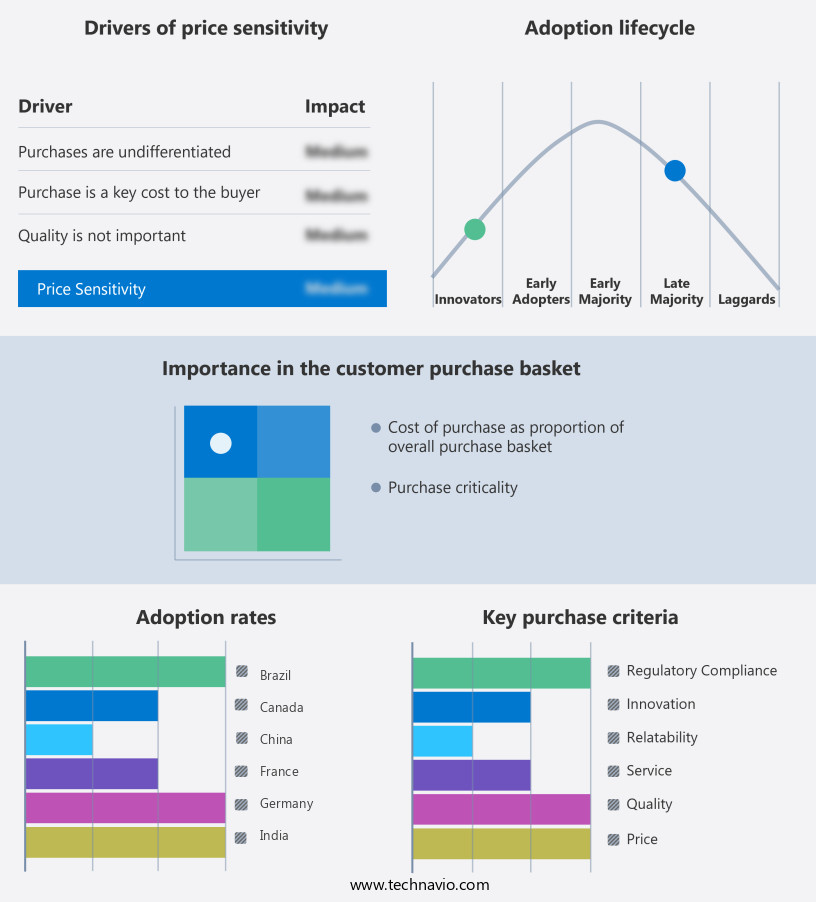

Exclusive Customer Landscape

The tobacco market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tobacco market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Tobacco Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, tobacco market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

British American Tobacco Plc - The company is a leading global tobacco producer, marketing products under esteemed brands including Dunhill and Kent. Their extensive portfolio caters to diverse consumer preferences, reflecting a commitment to innovation and quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- British American Tobacco Plc

- Eastern Co. SAE

- Gold Leaf Tobacco Corp.

- Golden Tobacco Ltd.

- Gudang Garam Tbk

- Imperial Brands Plc

- ITC Ltd.

- KT and G Corp.

- Liggett Vector Brands LLC

- Modi Enterprises

- Philip Morris USA Inc

- Poschl Tabak GmbH and Co KG

- PT Djarum

- Pyxus International Inc.

- Scandinavian Tobacco Group AS

- Swedish Match AB

- Swisher International Inc.

- Universal Corp.

- Vietnam National Tobacco Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tobacco Market

- In January 2024, British American Tobacco (BAT) announced the launch of its new vaping brand, Vuse Alto, in the United States. The device, which uses disposable pods, is part of BAT's efforts to expand its presence in the growing e-cigarette market (British American Tobacco press release, 2024).

- In March 2024, Philip Morris International (PMI) and Altria Group entered into a global partnership to develop and commercialize smoke-free products, including heated tobacco and e-cigarettes. The collaboration aims to accelerate the transition from traditional cigarettes to smoke-free alternatives (Philip Morris International press release, 2024).

- In May 2024, Imperial Brands, a leading tobacco company, completed the sale of its non-core food business, RJH Foods, for £300 million. The proceeds will be used to invest in its next-generation products, including vaping and heated tobacco (Imperial Brands press release, 2024).

- In April 2025, the European Union (EU) adopted new regulations on tobacco packaging, requiring 65% of the front surface to be covered in health warnings. The rules apply to all tobacco products, including cigarettes, roll-your-own tobacco, and electronic cigarettes (European Commission press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tobacco Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 192.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, shaped by various factors influencing production, quality, and consumer preferences. Disease incidence and leaf burn remain significant challenges, necessitating ongoing research into disease resistance and alkaloid biosynthesis. Chlorophyll content and protein content are essential indicators of leaf quality, while leaf grading and nutrient uptake impact market value. Fertilizer application and growth regulators optimize dry matter accumulation and yield, but pest infestation and weed control pose threats. Flavor profiles, environmental impact, and nicotine content are crucial factors in consumer perception. The tobacco industry is addressing concerns over pesticide residues and water usage efficiency through advancements in pest management and processing methods.

- Climate change impacts on crop productivity and soil fertility are under investigation, with genetic modification and breeding programs offering potential solutions. Production cost, including fertilizer application, growth regulators, and pest management, is a critical concern. Leaf morphology and root development influence harvesting techniques, while processing efficiency and curing methods impact product shelf life. Sensory evaluation and aroma compounds contribute to the overall market value. In the realm of sustainability, the tobacco industry is focusing on reducing the environmental impact of production, with a particular emphasis on reducing water usage and minimizing pesticide application.

- The industry is also exploring the potential of alternative tobacco varieties and production methods to improve yield optimization and product quality. Overall, the market is a dynamic and complex ecosystem, requiring continuous research and innovation to address challenges and meet evolving consumer demands. From disease resistance to sustainability, the industry is adapting to ensure a sustainable future.

What are the Key Data Covered in this Tobacco Market Research and Growth Report?

-

What is the expected growth of the Tobacco Market between 2025 and 2029?

-

USD 192.8 billion, at a CAGR of 4%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Product (Combustible tobacco products and Smokeless tobacco products), Geography (APAC, Europe, North America, Middle East and Africa, and South America), and Packaging Type (Paper, Paper Boxes, Plastic, Jute, and Others)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing number of new product launches, Stringent regulations on tobacco industry

-

-

Who are the major players in the Tobacco Market?

-

Key Companies British American Tobacco Plc, Eastern Co. SAE, Gold Leaf Tobacco Corp., Golden Tobacco Ltd., Gudang Garam Tbk, Imperial Brands Plc, ITC Ltd., KT and G Corp., Liggett Vector Brands LLC, Modi Enterprises, Philip Morris USA Inc, Poschl Tabak GmbH and Co KG, PT Djarum, Pyxus International Inc., Scandinavian Tobacco Group AS, Swedish Match AB, Swisher International Inc., Universal Corp., and Vietnam National Tobacco Corp.

-

Market Research Insights

- The market encompasses a diverse range of products, including pipe, chewing, cigar, and cigarette varieties. According to industry data, pipe tobacco accounted for approximately 13% of global tobacco consumption in 2020, while cigarettes held the largest market share at 63%. Product development and quality control remain key focus areas for market participants, with risk mitigation and social impact increasingly influencing business strategies. Crop modeling and data analytics are employed for demand forecasting and global trade, while sustainable agriculture and resource management are essential for long-term economic viability. Price volatility, driven by factors such as supply chain disruptions and regulatory changes, necessitates technology adoption for precision farming and supply chain management.

- The market continues to evolve, with consumer preferences shifting towards less harmful alternatives and increased emphasis on health risks and sustainable practices. Additionally, tobacco alkaloids, a critical component of tobacco production, are subject to rigorous quality control measures to ensure consistency and safety.

We can help! Our analysts can customize this tobacco market research report to meet your requirements.