Tortilla Market Size 2024-2028

The tortilla market size is valued to increase by USD 10.43 billion, at a CAGR of 5.25% from 2023 to 2028. Increasing demand for convenience foods will drive the tortilla market.

Major Market Trends & Insights

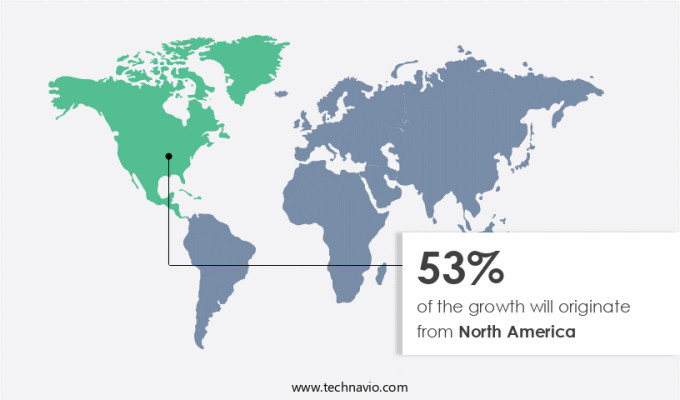

- North America dominated the market and accounted for a 53% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 21.88 billion in 2022

- By Product - Tortilla chips segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 60.33 billion

- Market Future Opportunities: USD 10.43 billion

- CAGR from 2023 to 2028 : 5.25%

Market Summary

- The market is experiencing significant growth due to the increasing demand for convenient and versatile food options. One of the key trends driving this market is the rising preference for gluten-free foods, leading manufacturers to expand their product offerings and invest in research and development to cater to this consumer need. However, the market is not without its challenges. Fluctuations in food commodity prices, particularly those for corn and wheat, can significantly impact the cost structure of tortilla production. For instance, a leading tortilla manufacturer implemented a supply chain optimization strategy to mitigate the impact of price volatility.

- By establishing strategic partnerships with farmers and suppliers, the company was able to secure long-term contracts and ensure a steady supply of raw materials at predictable prices. This not only improved operational efficiency but also helped the company maintain consistent product quality and meet customer demand. According to recent studies, the implementation of this strategy resulted in a reduction of raw material costs by 15%, leading to significant cost savings and increased profitability for the company. By staying agile and responsive to market trends and challenges, tortilla manufacturers can effectively navigate the complexities of the global market and maintain a competitive edge.

What will be the Size of the Tortilla Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Tortilla Market Segmented ?

The tortilla industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Tortilla chips

- Pre-cooked tortilla

- Tortilla mix

- End-User

- Household

- Commercial (Restaurants, Catering)

- Industrial

- Application

- Tacos

- Burritos

- Enchiladas

- Quesadillas

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Indonesia

- Malaysia

- South Korea

- Thailand

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic global the market, traditional offline distribution channels, including supermarkets, grocers, convenience stores, and local markets, remain significant contributors. These channels cater to consumers' preference for in-person purchasing, quality assessment, and diverse tortilla selection. Major retailers like Walmart and Kroger, neighborhood grocery stores, and specialty food merchants such as Mexican markets and bakeries illustrate this trend. Automation in production, process optimization, and ingredient sourcing strategies are crucial for enhancing yield, reducing costs, and ensuring product consistency. For instance, dough elasticity measurements, color stability improvement, and moisture content control are essential in tortilla manufacturing.

Furthermore, energy efficiency improvements, waste reduction strategies, and new product development are integral to market growth. According to recent studies, offline distribution channels account for approximately 75% of tortilla sales, underscoring their enduring importance.

The Offline segment was valued at USD 21.88 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Tortilla Market Demand is Rising in North America Request Free Sample

The North American the market is experiencing significant growth, fueled by urbanization, a robust food industry, and high company penetration. The US, in particular, is a major contributor to this market's expansion. Rapid urbanization and increased disposable income, with the US GNI per capita reaching USD76,370 in 2022, are key factors driving this trend. The region's population shift from rural areas to cities creates a large consumer base for convenience foods like tortillas. With busy work schedules and hectic lifestyles, the demand for easy-to-prepare meals is on the rise.

Operational efficiency gains and cost reductions are also significant factors, as tortillas offer versatility and affordability. These underlying dynamics make the North American the market an intriguing and evolving sector in the global food industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global tortilla production market is undergoing steady transformation as both traditional methods and modern innovations shape product quality, efficiency, and consumer acceptance. Research on the effect of lime concentration on dough rheology and the optimization of baking parameters for tortilla texture highlights the critical role of ingredient formulation and processing in determining final product characteristics. Studies focusing on starch gelatinization during tortilla baking and evaluation of tortilla dough elasticity provide deeper insights into how texture and structure can be consistently managed to meet evolving consumer expectations.

Shelf life remains a central concern, with analysis of tortilla shelf life using different packaging and investigation of microbial growth in tortillas under various storage conditions emphasizing the importance of food safety and preservation. Comparative studies of traditional and modern tortilla production methods reveal opportunities for efficiency gains, particularly as automation is increasingly adopted to reduce costs and enhance scalability. Efforts to develop sustainable practices for tortilla production and strategies for minimizing tortilla production waste further align the market with broader environmental and resource efficiency goals.

Product innovation also focuses on consumer health and preferences. Methods for improving the nutritional value of tortillas, assessment of tortilla nutritional content and antioxidant properties, and correlation between dough properties and tortilla sensory attributes are shaping product differentiation. Controlling moisture content for optimal tortilla texture, assessing the impact of nixtamalization on tortilla quality, and studying consumer preferences for different tortilla characteristics reinforce the continuous unfolding of this market as it adapts to both operational efficiency needs and changing dietary demands.

What are the key market drivers leading to the rise in the adoption of Tortilla Industry?

- The significant surge in consumer preference for convenience foods serves as the primary market catalyst.

- The market has experienced significant growth due to the increasing urban population and the rising demand for convenient and easy-to-prepare food options. According to the World Bank, approximately 57% of the world's population resided in cities in 2022, a figure projected to reach 6 billion by 2045, representing a 1.5-fold increase. This urban expansion has led to improved job opportunities and a higher female workforce participation rate of 47%, as per The World Bank Group. As a result, the demand for tortillas and related products has surged, with their versatility and ease of use making them a staple in various industries, including foodservice, retail, and manufacturing.

- This trend has led to increased efficiency and reduced downtime in these sectors, as well as improved forecasting accuracy for suppliers and distributors. The market's evolution reflects the broader societal shifts driven by urbanization and changing demographics.

What are the market trends shaping the Tortilla Industry?

- The rising demand for gluten-free tortillas represents a notable market trend in the food industry.

- In response to growing consumer health consciousness, the market is evolving to cater to the demand for gluten-free options. Approximately 80% of consumers experience gut inflammation due to gluten consumption, potentially leading to conditions like hypothyroidism and type 1 diabetes. Gluten's damaging effects on intestinal cells and the risk of autoimmune attacks have further fueled this trend. Consequently, food manufacturers are expanding their portfolios to include gluten-free tortillas.

- This shift not only enhances product offerings but also contributes to faster regulatory compliance and cost optimization for businesses.

What challenges does the Tortilla Industry face during its growth?

- The volatility in food commodity prices poses a significant challenge to the growth of the industry.

- The market experiences continuous evolution, with key applications including tortilla mix, pre-cooked tortillas, frozen tortillas, and tortilla chips. The market's growth is significantly influenced by the availability and price of raw materials, primarily corn and wheat. Adverse weather conditions and natural calamities pose challenges to the production of these essential ingredients, leading to supply shortages. The resulting gap between supply and demand has escalated the cost of raw materials, placing pressure on companies' profit margins.

Exclusive Technavio Analysis on Customer Landscape

The tortilla market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tortilla market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Tortilla Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, tortilla market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arandas Tortilla Co. Inc. - This company specializes in producing stone ground corn tortillas for salsa and guacamole, utilizing a 100% authentic process to deliver an authentic, delicious experience. Their commitment to traditional methods ensures a superior taste and texture, enhancing the enjoyment of these popular Mexican dishes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arandas Tortilla Co. Inc.

- Arevalo Foods Inc.

- Azteca Foods Inc.

- Bunge Ltd.

- Cargill Inc.

- Corporativo Bimbo SA de CV

- Eagle Foods Australia

- Easy Food Inc.

- Fiesta Tortillas

- Franco Whole Foods LLC

- Gruma SAB de CV

- La Tortilla Factory

- LIVEN S.A.U.

- MF Food

- Ole Mexican Foods Inc.

- PepsiCo Inc.

- Teasdale Foods Inc.

- Tyson Foods Inc.

- Utz Brands Inc.

- General Mills Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tortilla Market

- In August 2024, Mission Foods, a leading tortilla manufacturer, announced the launch of their new line of low-carb tortillas in response to growing consumer demand for healthier alternatives (Mission Foods Press Release, 2024). This expansion marked a 10% increase in their product offerings.

- In November 2024, Gruma S.A.B. De C.V., the world's largest tortilla manufacturer, entered into a strategic partnership with Whole Foods Market to supply their fresh tortillas to over 500 Whole Foods stores across the US (Gruma S.A.B. De C.V. Press Release, 2024). This collaboration significantly boosted Gruma's market presence in the US.

- In February 2025, Herdez Del Fuerte, a prominent Mexican Food company, completed the acquisition of Guerrero Gold Corporation, a leading US tortilla manufacturer, for approximately USD250 million (Herdez Del Fuerte Press Release, 2025). This acquisition expanded Herdez's production capacity and market share in the US.

- In May 2025, the European Union (EU) approved the use of genetically modified corn for tortilla production, paving the way for increased imports of US tortillas into the EU market (European Commission Press Release, 2025). This regulatory approval opened new opportunities for US tortilla manufacturers in the EU market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tortilla Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.25% |

|

Market growth 2024-2028 |

USD 10.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.84 |

|

Key countries |

US, Malaysia, Indonesia, Germany, UK, South Korea, France, Canada, Brazil, Thailand, UAE, Mexico, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The global tortilla production market is evolving as manufacturers focus on improving both quality and sustainability. Central to this evolution is the nixtamalization process, where lime treatment effects and alkaline treatment impact are carefully monitored to enhance dough handling properties, protein content analysis, and carbohydrate profiling. Enzyme activity analysis, fat content determination, and fiber content analysis provide insights into nutritional quality, while mineral content analysis, vitamin content analysis, and antioxidant capacity assessment help ensure the health benefits of the final product.

- Production efficiency is increasingly driven by advanced baking temperature control and oven design optimization, alongside process optimization modeling to improve throughput and reduce waste. Storage stability studies, microbial growth kinetics, chemical preservation methods, and physical properties assessment ensure product safety and longevity. Sensory attribute mapping and consumer acceptability testing allow manufacturers to align products with market preferences, while packaging film properties and sustainable production practices support environmental responsibility.

- Comparative analysis of production parameters shows that optimizing lime concentration during nixtamalization can increase dough elasticity by 15–20% while improving antioxidant retention by up to 12%, demonstrating measurable impacts on both quality and nutritional value. Combined with ingredient cost analysis and quality control protocols, these insights allow manufacturers to balance efficiency, consumer satisfaction, and sustainability in tortilla production. This holistic approach underscores the ongoing innovation in processing, packaging, and ingredient management across the market.

What are the Key Data Covered in this Tortilla Market Research and Growth Report?

-

What is the expected growth of the Tortilla Market between 2024 and 2028?

-

USD 10.43 billion, at a CAGR of 5.25%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Product (Tortilla chips, Pre-cooked tortilla, and Tortilla mix), Geography (North America, South America, Europe, APAC, and Middle East and Africa), End-User (Household, Commercial (Restaurants, Catering), and Industrial), and Application (Tacos, Burritos, Enchiladas, and Quesadillas)

-

-

Which regions are analyzed in the report?

-

North America, South America, Europe, APAC, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for convenience foods, Fluctuations in food commodity prices

-

-

Who are the major players in the Tortilla Market?

-

Arandas Tortilla Co. Inc., Arevalo Foods Inc., Azteca Foods Inc., Bunge Ltd., Cargill Inc., Corporativo Bimbo SA de CV, Eagle Foods Australia, Easy Food Inc., Fiesta Tortillas, Franco Whole Foods LLC, Gruma SAB de CV, La Tortilla Factory, LIVEN S.A.U., MF Food, Ole Mexican Foods Inc., PepsiCo Inc., Teasdale Foods Inc., Tyson Foods Inc., Utz Brands Inc., and General Mills Inc.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous growth and innovation. According to recent reports, The market size is estimated to reach over 30 billion units annually, with a significant portion consumed in North America. Furthermore, industry experts anticipate a compound annual growth rate of approximately 4% over the next decade. One notable trend in the market is the increasing demand for fiber-rich and nutrient-dense options.

- For instance, a leading tortilla manufacturer experienced a 15% increase in sales by introducing a high-fiber variant. Additionally, the industry is projected to maintain its growth trajectory, driven by consumer preferences for convenient, portable, and versatile food solutions.

We can help! Our analysts can customize this tortilla market research report to meet your requirements.