Truck Platooning System Market Size 2024-2028

The truck platooning system market size is forecast to increase by USD 2.25 billion at a CAGR of 77.99% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand from fleet operators to reduce operating costs and fuel consumption. This trend is being driven by the adoption of self-driving trucks, which allow for closer vehicle following and aerodynamic benefits, leading to improved fuel efficiency. However, the high cost of implementing truck platooning systems remains a significant challenge for market growth. This includes the expense of purchasing the necessary technology and infrastructure, as well as the training and certification of drivers to operate in platoons.

- Despite this, companies seeking to capitalize on the market opportunities presented by truck platooning should focus on collaborating with technology providers and industry partners to share costs and resources, as well as exploring government incentives and grants to offset implementation costs. By navigating these challenges effectively, companies can position themselves to benefit from the growing demand for fuel-efficient and cost-effective transportation solutions.

What will be the Size of the Truck Platooning System Market during the forecast period?

- The truck platooning market is experiencing significant growth as vehicle-to-infrastructure (V2I) technology gains traction. IVECO S and the Ensemble Consortium are spearheading this innovation through their collaborative efforts. Autonomous truck platooning, a type of platooning, leverages v2v communication to enhance efficiency and reduce fuel consumption. Technology advancements in automation and connected vehicle technology are driving this trend. Private-public partnerships are essential for the market's expansion, with vehicle manufacturers and component suppliers playing pivotal roles. High costs associated with hardware and communication technology implementation remain a challenge.

- Road safety benefits, such as forward collision avoidance and active brake assist, are compelling reasons for the trucking industry's adoption of platooning technology. Market expansion is expected to continue, with software advancements and the evolution of peloton technology being key factors. (March 2022)

How is this Truck Platooning System Industry segmented?

The truck platooning system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Hardware

- Software

- Services

- Vehicle Type

- HCV

- LCV

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- South America

- Rest of World (ROW)

- North America

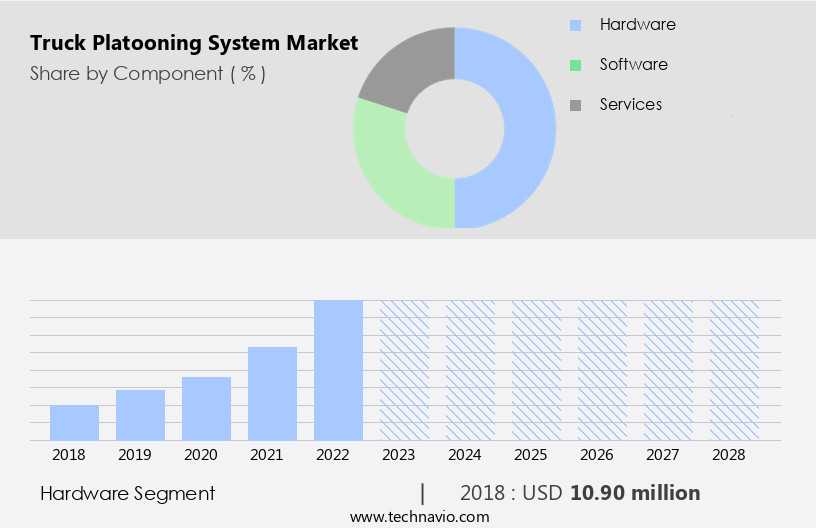

By Component Insights

The hardware segment is estimated to witness significant growth during the forecast period.

Truck platooning, a form of vehicle automation, relies on advanced hardware components to function effectively. These components include cameras, sensors, radar, and communication devices. The system's cameras, installed on the front, sides, and back of trucks, offer real-time video feeds to both the driver and platoon coordinator. They aid in detecting obstacles, monitoring traffic, and facilitating communication between platoon trucks. Sensors, primarily radio frequency and electronic types, are essential for detecting the distance between trucks and ensuring safe driving. They help maintain a safe following distance and regulate the relative speed of trucks in the platoon. Moreover, regulations, such as European Emission Standards, are driving the adoption of fuel-efficient technologies in the trucking industry.

Autonomous driving components, including adaptive cruise control and active brake assist, are becoming increasingly popular. These technologies optimize fuel consumption, reduce emissions, and enhance road safety. Private-public partnerships and smart driving technologies, such as Vehicle-to-Infrastructure (V2I) and Vehicle-to-Vehicle (V2V) communication, are also transforming the trucking landscape. V2I enables real-time data exchange between vehicles and infrastructure, while V2V communication facilitates communication between vehicles. These technologies help improve traffic flow, reduce congestion, and enhance safety. Furthermore, the logistics industry is embracing truck platooning to improve efficiency and reduce costs. Platooning lanes and platoon coordination systems, like PlatoonPro, are being developed to facilitate the deployment of autonomous truck platoons.

These systems optimize fuel savings by reducing wind resistance and aerodynamic drafting. However, challenges such as high costs, human error, and weather conditions pose hurdles to the widespread adoption of truck platooning. Market expansion and development work in communication technology and automation are ongoing to address these challenges. The future of truck platooning lies in the integration of fully autonomous vehicles and high-speed communication networks. In summary, hardware components, including cameras, sensors, radar, and communication devices, play a crucial role in the functioning of truck platooning systems. Regulations, smart driving technologies, and private-public partnerships are driving the growth of the market.

Challenges, such as high costs and human error, are being addressed through ongoing development work in communication technology and automation.

Get a glance at the market report of share of various segments Request Free Sample

The Hardware segment was valued at USD 10.90 billion in 2018 and showed a gradual increase during the forecast period.

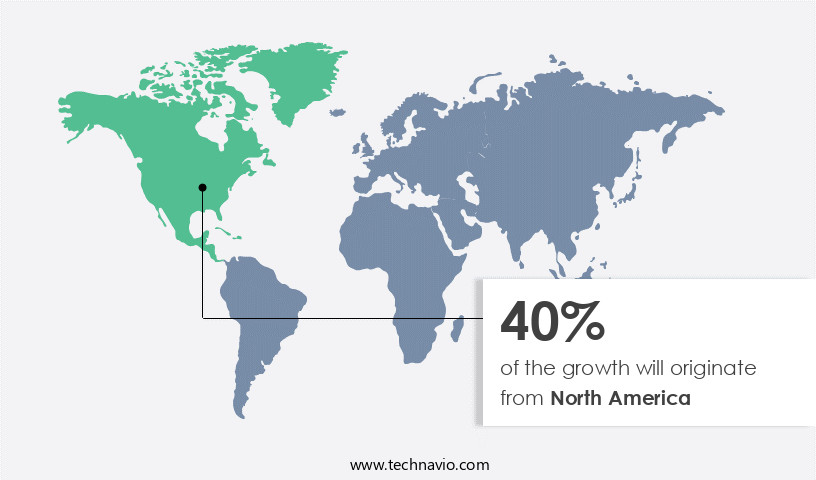

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to various factors. One key driver is the integration of advanced technologies, such as hardware upgrades and software upgrades, into vehicles. For instance, the adoption of forward collision avoidance systems, adaptive cruise control, and platooning type technologies is increasing, enabling trucks to maintain a safe distance from each other and optimize fuel consumption. Moreover, private-public partnerships and collaborations, such as the ENSEMBLE consortium, are fostering the development of smart driving technologies, including vehicle-to-vehicle (V2V) communication and vehicle-to-infrastructure (V2I) systems. These technologies enable real-time data exchange between vehicles and infrastructure, improving road safety and traffic flow.

Another significant trend is the increasing focus on reducing emissions and improving fuel efficiency. Euro Norms and other regulations are driving the adoption of fuel-efficient technologies, such as aerodynamic drafting and platooning, which can reduce wind resistance and save fuel. Additionally, the logistics industry is adopting truck platooning to optimize long-haul operations and reduce traffic congestion. However, challenges such as high costs, human error, and weather conditions pose significant hurdles to market growth. To address these challenges, companies are investing in communication technology and developing autonomous driving components, such as lidar and radar sensors, to enhance safety and efficiency.

Furthermore, the market is witnessing the emergence of fully autonomous vehicles and autonomous truck platooning, which offer significant growth opportunities. These technologies enable vehicles to communicate with each other and adapt to changing traffic conditions, improving overall road safety and reducing the need for human intervention. In conclusion, the market is witnessing significant advancements, driven by the integration of advanced technologies, growing demand for eco-friendly transportation solutions, and the need to improve road safety and reduce traffic congestion. Despite challenges, the market is expected to continue growing, with significant opportunities in the development of autonomous driving components and fully autonomous vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Truck Platooning System Industry?

- Increase in demand to reduce operating cost and fuel consumption by fleet is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand from fleet operators to minimize operating costs and optimize fuel consumption. This trend is driven by the need to enhance fuel efficiency and reduce emissions. By enabling trucks to travel in close formation, platooning systems decrease air resistance and aerodynamic drag, resulting in lower fuel usage and emissions. In the face of mounting pressure to cut operational expenses, these systems offer a viable solution. They boost efficiency, allowing fleets to transport larger volumes of goods and expedite deliveries.

- Furthermore, automating the driving process through platooning systems reduces the risk of human error, ensuring safer and more dependable operations. Fleet operators stand to benefit immensely from the implementation of these systems.

What are the market trends shaping the Truck Platooning System Industry?

- Increase in adoption of self-driving trucks is the upcoming market trend.

- The market is witnessing a notable growth due to the rising demand for efficient and safe transportation of goods over long distances. Self-driving trucks, a key component of this market, are equipped with advanced technologies such as sensors, cameras, and GPS systems, enabling them to navigate roads autonomously. This feature allows self-driving trucks to travel long distances without requiring rest breaks, which is a significant advantage over human-driven trucks.

- Another major advantage of self-driving trucks is their ability to travel in platoons, where trucks move closely together, reducing air resistance and improving fuel efficiency. The increasing adoption of self-driving trucks is expected to revolutionize the transportation industry by enhancing productivity, reducing fuel consumption, and ensuring road safety.

What challenges does the Truck Platooning System Industry face during its growth?

- High cost of implementing truck platooning system is a key challenge affecting the industry growth.

- Truck platooning, an advanced technology, is gaining traction in the logistics industry. This system enables a group of trucks to travel in a convoy, with the lead truck controlling the others via communication technology. The benefits of truck platooning are substantial, including reduced fuel consumption and increased efficiency for goods transportation. However, the high implementation cost is a significant barrier to widespread adoption.

- Estimates suggest the cost can range from USD40,000 to USD100,000 per truck, which includes expenses for sensors, cameras, software, and driver training. This financial hurdle poses a challenge for many trucking companies. Despite the initial investment, the long-term savings and operational improvements may justify the expense for those in the transportation sector.

Exclusive Customer Landscape

The truck platooning system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the truck platooning system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, truck platooning system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - Volvo Trucks introduces advanced truck platooning technology, enabling seamless vehicle synchronization and fuel efficiency improvements for commercial fleets. This cutting-edge system streamlines transportation logistics by reducing gaps between trucks, optimizing fuel consumption, and enhancing road safety. By leveraging connectivity and automation, Volvo Trucks empowers fleet operators to boost productivity and reduce operational costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Aptiv Plc

- Continental AG

- Daimler Truck AG

- Iveco SpA

- PACCAR Inc.

- Peloton Technology Inc.

- Robert Bosch GmbH

- Toyota Tsusho Corp.

- Traton SE

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth as the logistics industry seeks to enhance road safety, reduce fuel consumption, and mitigate the impact of environmental regulations. This market is characterized by the collaboration of various stakeholders, including vehicle manufacturers, technology developers, and government entities. Hardware upgrades are a crucial aspect of the truck platooning system, with the integration of advanced sensors and communication technologies playing a pivotal role. Ensemble consortiums, comprised of industry leaders, are spearheading the development of these systems, focusing on vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication. Platooning technology is designed to optimize fuel efficiency by reducing air resistance through aerodynamic drafting.

However, challenges such as accidents, terrain, weather conditions, and human error necessitate continuous software upgrades and the implementation of advanced safety features like active brake assist and adaptive cruise control. The adoption of platooning systems is gaining traction in the logistics industry due to their potential to alleviate the shortage of drivers and reduce fuel consumption. The growth opportunity is immense, with the market expansion expected to be driven by the increasing demand for real-time data and the implementation of European emission norms. Private-public partnerships are essential for the successful implementation of platooning systems, with governments and industry players collaborating to establish platooning lanes and supplementary infrastructure.

The development work involves the integration of various components, including radars, lidar, and forward collision avoidance systems, to ensure seamless communication and coordination between vehicles. The trucking industry is embracing smart driving technologies to improve efficiency and reduce emissions. Platooning systems are a significant step towards autonomous trucking, with the potential to revolutionize long-haul operations. However, the high costs associated with the development and implementation of these systems pose a challenge. The evolving stage of platooning technology is marked by the integration of autonomous driving components and the gradual shift towards fully autonomous vehicles. The technology is expected to have a significant impact on the logistics sectors, with breakouts in various industries, including transportation and logistics, expected in the coming years.

Despite the numerous benefits of platooning systems, challenges remain, including the need for reliable communication technology, the optimization of fuel-efficient platooning types, and the development of entrance/exit points for platoons. The market is expected to continue growing, driven by the need for improved road safety, optimized fuel consumption, and the reduction of greenhouse gas emissions. In conclusion, the market is a dynamic and evolving space, driven by the need for improved road safety, reduced fuel consumption, and the implementation of emission norms. The collaboration of various stakeholders, including vehicle manufacturers, technology developers, and government entities, is essential for the successful implementation of these systems.

The challenges remain significant, but the potential benefits are immense, making the market an exciting and innovative space to watch.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 77.99% |

|

Market growth 2024-2028 |

USD 2246.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

59.83 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Truck Platooning System Market Research and Growth Report?

- CAGR of the Truck Platooning System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the truck platooning system market growth of industry companies

We can help! Our analysts can customize this truck platooning system market research report to meet your requirements.