Two-wheeler Keyless Entry System Market Size 2024-2028

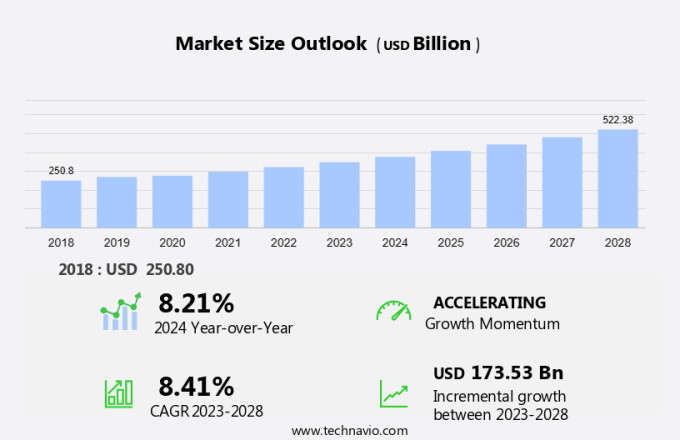

The two-wheeler keyless entry system market size is forecast to increase by USD 173.53 billion, at a CAGR of 8.41% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for safety and convenience in vehicle access solutions. Advanced technologies such as biometric-based ignition systems are gaining popularity, offering enhanced security features and eliminating the need for physical keys. However, the market is also facing challenges with the rising trend of vehicle hacking, leading to thefts and compromised security systems. In addition, the market for keyless entry systems is expected to continue growing, with a focus on integrating these systems into a wider range of two-wheelers, from Vida-a-gogo electric scooters to luxury motorcycles from leading manufacturers. Furthermore, the evolution of two-wheeler electronics has necessitated the focus of semiconductor and integrated circuit companies on the automotive industry to cater to its growing demands. These concerns are driving the development of more secure and advanced keyless entry systems to address the growing security concerns of consumers. Overall, the market is expected to grow steadily, driven by these trends and challenges.

What will be the Size of the Two-wheeler Keyless Entry System Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for electronic systems that enhance user convenience and security. Keyless entry systems, which include remote control, smart card, and biometric scan technologies, are increasingly replacing traditional physical keys in both mass-market and premium two-wheeler segments. These systems offer users the ability to unlock their vehicles with a simple press of a button on a key fob or by using a smart card or biometric scan.

- Crime rates and the need for enhanced vehicle security are also driving the adoption of keyless entry systems in the two-wheeler industry. In addition, both Original Equipment Manufacturers (OEMs) and aftermarkets are investing in the development and integration of advanced security features, such as immobilizers, into keyless entry systems.

How is this Two-wheeler Keyless Entry System Industry segmented and which is the largest segment?

The two-wheeler keyless entry system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Remote keyless entry system

- Passive keyless entry system

- Application

- Aftermarkets

- OEMs

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

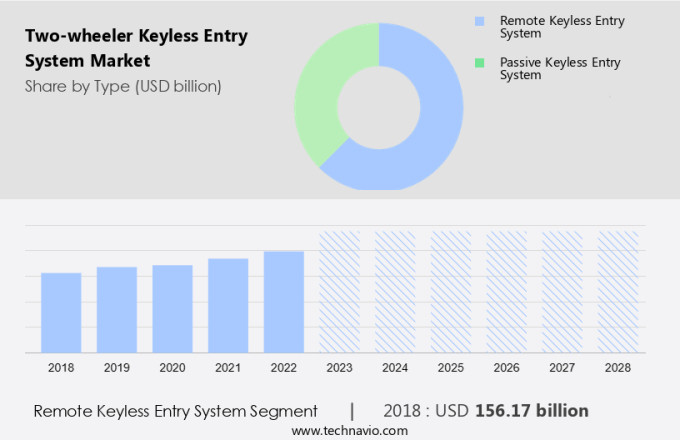

- The remote keyless entry system segment is estimated to witness significant growth during the forecast period.

The Two-wheeler Keyless Entry System (RKES) market refers to the use of electronic locks and radio frequency identification (RFID) technology to grant access to two-wheeler vehicles without the need for a conventional mechanical key. This system enhances convenience and security by enabling users to lock and unlock their vehicles with the simple press of a button. The integration of electronics in two-wheeler vehicles has accelerated in recent years due to the electrification of mechanical components and the adoption of advanced safety, security, and propulsion technologies. This trend is expected to continue, with RKES becoming a standard feature in upcoming two-wheeler models.

Get a glance at the Two-wheeler Keyless Entry System Industry report of share of various segments Request Free Sample

The remote keyless entry system segment was valued at USD 156.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

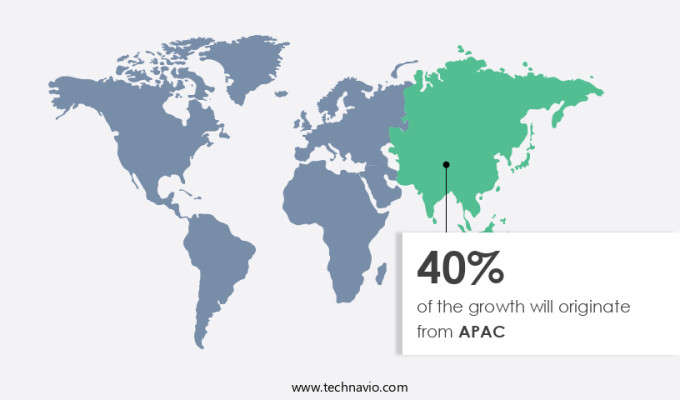

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth in Asia Pacific (APAC) regions, including China, Japan, India, Indonesia, South Korea, Thailand, and Australia. The high demand for two-wheelers in these countries, driven by economic growth and industrial development, is the primary factor fueling market expansion. Additionally, the increasing concern for vehicle security due to rising theft incidents is compelling automakers to incorporate advanced security features, such as keyless entry systems, in their offerings. The penetration rate for keyless entry systems in two-wheelers sold in the region is increasing, making it a lucrative market for manufacturers. APAC's rapid industrialization and expanding middle class population have created a significant demand for passenger two-wheelers, further boosting market growth.

Market Dynamics

Our two-wheeler keyless entry system market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Two-wheeler Keyless Entry System Industry?

Safety and convenience associated with advanced vehicle access solutions are the key drivers of the market.

- The market is experiencing significant growth due to the increasing sales volume of two-wheelers and the high penetration rate of these systems in the automotive industry. Advanced keyless entry systems, which include remote control, smart card, and biometric scan, are becoming increasingly popular among users. These systems offer enhanced security features, such as immobilizers, and provide convenience and comfort. Modern two-wheeler manufacturers, including luxury brands, are integrating these systems into their vehicles to cater to the demand for advanced security and convenience features. In addition, the aftermarkets and OEMs are also offering keyless entry systems as an upgrade for existing two-wheelers.

- Furthermore, crime rates have been a major concern for homeowners and business owners, leading to an increased demand for security systems, including CCTV systems, alarm systems, and video surveillance. Two-wheeler keyless entry systems are an essential component of these security systems, providing an additional layer of security. The automotive market is witnessing significant advancements in technology, with a focus on smart and intelligent vehicle access systems. Keyless entry systems are at the forefront of these advancements, offering users the convenience of hands-free access to their vehicles. These systems have evolved to include advanced features such as proximity sensors and voice recognition, making them even more user-friendly.

What are the market trends shaping the Two-wheeler Keyless Entry System Industry?

The development of biometric-based ignition systems is the upcoming trend in the market.

- The market is witnessing significant growth as electronic systems replace traditional physical keys. Keyless entry systems, which include remote control, smart card, and biometric scan technologies, offer enhanced security and convenience for users. These systems are increasingly being adopted by both homeowners and business owners for their vehicles and buildings. The automotive market, including premium motorcycle manufacturers, is a major contributor to this trend. Biometric systems, which require a user's unique biological data for access, are a new development in the market. Initially, these systems are expected to be adopted in high-end and luxury motorcycles. Consumers have become familiar with biometric systems through the widespread use of smartphones, making the technology more accessible and desirable.

- In addition, the integration of smartphones into two-wheelers is also expected to drive the adoption rate of biometric systems. Security is a major concern for two-wheeler owners, and keyless entry systems offer an effective solution. These systems prevent unauthorized access, reducing crime rates and providing peace of mind. In addition to keyless entry systems, other security measures such as alarm systems, CCTV systems, and immobilizers are also being integrated into two-wheelers. The aftermarkets and OEMs are investing in the development and implementation of these advanced security systems. The market is poised for growth, driven by the increasing demand for security and convenience.

What challenges does Two-wheeler Keyless Entry System Industry face during the growth?

Thefts owing to hacking of vehicles security system is a key challenge affecting the industry growth.

- The market has gained significant traction in recent years due to the increasing demand for advanced security features in vehicles. Keyless entry systems, which utilize electronic systems such as remote controls, smart cards, and biometric scans, offer convenience and enhanced security compared to traditional physical keys. However, these systems are not immune to security threats. Hackers have been exploiting vulnerabilities in these systems to gain unauthorized access to vehicles. They use sophisticated hacking tools to amplify signals and reprogram security systems, allowing them to unlock and start two-wheeler engines. This trend has led to a rise in vehicle thefts, posing a major concern for both homeowners and business owners.

- Moreover, in response, automotive manufacturers and OEMs have been investing in developing more secure keyless entry systems, such as immobilizers and aftermarket security systems. These systems employ advanced security features, including video surveillance, alarm systems, CCTV, and biometric authentication, to deter hacking attempts. The automotive market for keyless entry systems is expected to grow significantly in the coming years, driven by increasing crime rates and the demand for premium motorcycles and luxury two-wheeler manufacturers.

Exclusive Customer Landscape

The two-wheeler keyless entry system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The two-wheeler keyless entry system industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Denso Co., Ltd.

- Changzhou Wujin Blector Electronic Co.Ltd.

- Continental AG

- Coocase

- Digital Guard Dawg Inc.

- Fuzhou PEPE Electronics Technology Co., Ltd

- Guangdong Jianya Motorcycle Technology Co., Ltd.

- Honda Motor Co. Ltd.

- LINKA Smart Locks

- Steelmate Co Ltd.

- TSS Group

- Kawasaki Heavy Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Two-wheeler keyless entry systems have revolutionized the way users interact with their vehicles and buildings. These electronic systems offer convenience and enhanced security features, eliminating the need for traditional physical keys. The market for two-wheeler keyless entry systems is witnessing significant growth due to various factors. Users value the convenience offered by keyless entry systems. With a simple press of a button on a remote control or a smart card, they can unlock their vehicles or gain access to secure areas. This feature is particularly appealing to those who frequently use their two-wheelers for commuting or have multiple vehicles or buildings to manage.

In addition, security is another major driving factor for the adoption of keyless entry systems in two-wheelers. These systems provide an additional layer of security by preventing unauthorized access. For instance, some systems use biometric scans, such as fingerprint recognition, to grant access. This feature ensures that only authorized users can access the vehicle or building. The market for keyless entry systems in two-wheelers is not limited to original equipment manufacturers (OEMs) alone. Aftermarkets also offer these systems for various types of two-wheelers, catering to the increasing demand from users. The growth of the automotive market, particularly in the premium and luxury segments, is also contributing to the growth of the keyless entry systems market for two-wheelers.

Furthermore, high-end motorcycle manufacturers are incorporating advanced security features, including keyless entry systems, to differentiate their offerings and cater to the demands of their discerning clientele. However, the increasing adoption of keyless entry systems also presents new challenges. For instance, the risk of hacking and theft is a growing concern. Criminals can use various methods to gain unauthorized access to vehicles or buildings with keyless entry systems. This issue is particularly relevant in the context of rising crime rates and the increasing number of homeowners and business owners investing in security systems, including CCTV systems, alarm systems, and video surveillance.

|

Two-wheeler Keyless Entry System Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.41% |

|

Market Growth 2024-2028 |

USD 173.53 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.21 |

|

Key countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Two-wheeler Keyless Entry System industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.