Unified Endpoint Management Market Size 2025-2029

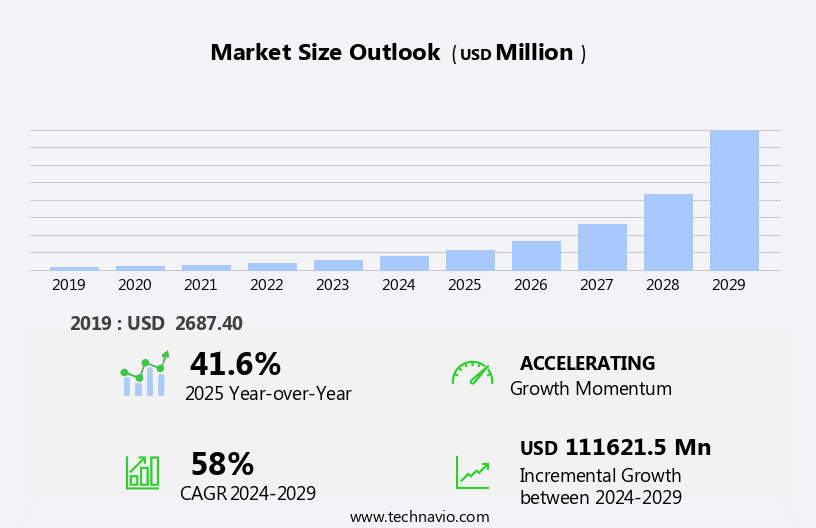

The unified endpoint management (UEM) market size is forecast to increase by USD 111.62 billion, at a CAGR of 58% between 2024 and 2029. The market is experiencing significant growth due to the increasing need for integrated solutions to manage both traditional and non-traditional endpoints.

Major Market Trends & Insights

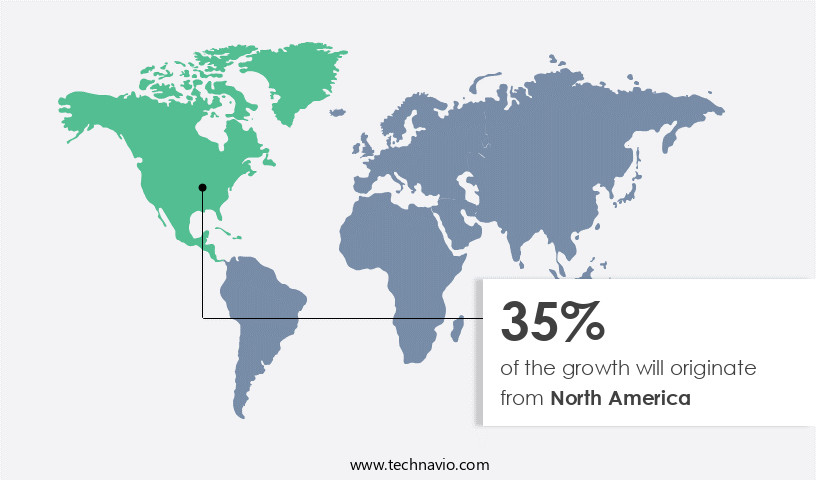

- North America dominated the market and contributed 35% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

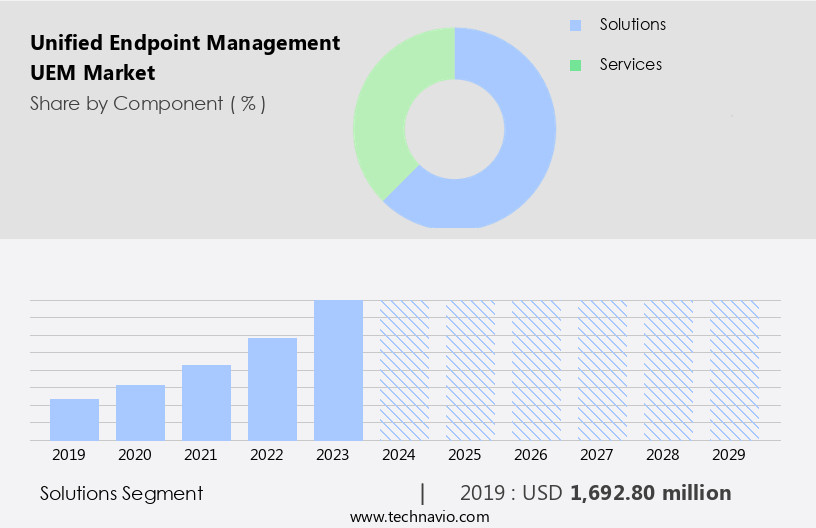

- Based on the Component, the solutions segment led the market and was valued at USD 5.72 billion of the global revenue in 2023.

- Based on the Deployment, the cloud segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 4.52 Billion

- Future Opportunities: USD 111.62 Billion

- CAGR (2024-2029): 58%

- North America: Largest market in 2023

The market continues to evolve, with a growing emphasis on centralized management and automation workflows. Device compliance is a critical concern, as organizations seek to ensure their endpoints adhere to security policies. UEM solutions offer software deployment, compliance reporting, application management, and network access control, among other features. For instance, a leading financial services firm reported a 30% increase in sales following the implementation of a UEM solution with remote device control and endpoint security capabilities. The global UEM market is expected to grow by over 15% annually, driven by the need for multi-platform support, endpoint detection response, and data loss prevention.

UEM solutions also provide vulnerability assessment, patch management systems, mobile device management, endpoint configuration management, and inventory management tools. Additionally, they offer endpoint analytics, endpoint security, zero trust access, and risk mitigation strategies. Furthermore, UEM solutions integrate threat intelligence and offer remote assistance tools, user experience monitoring, and hardware inventory management. Conditional access policies and endpoint analytics enable organizations to optimize their IT assets and improve endpoint security. Overall, UEM solutions provide a unified console management system that streamlines IT operations and enhances security posture.

What will be the Size of the Unified Endpoint Management (UEM) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

With the proliferation of Internet of Things (IoT) devices, organizations are recognizing the importance of managing these devices alongside traditional computers and mobile devices to ensure security and productivity. This trend is driving the demand for UEM solutions that can handle diverse endpoint types and environments. However, the UEM market also faces challenges. One major obstacle is the availability of open-source UEM solutions, which can make it difficult for companies to differentiate their offerings and maintain a competitive edge. Additionally, ensuring seamless integration of these solutions with existing IT infrastructure and applications can be a complex undertaking for organizations. Navigating these challenges requires a strategic approach, with a focus on differentiating through value-added services and robust integration capabilities. Companies seeking to capitalize on the opportunities presented by the UEM market must prioritize these areas to effectively meet the evolving needs of their customers.

How is this Unified Endpoint Management (UEM) Industry segmented?

The unified endpoint management (UEM) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Services

- Deployment

- Cloud

- On-premises

- Hybrid

- Organization Size

- SMEs

- Large Enterprises

- SMEs

- Large Enterprises

- End-User

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare

- Government and Defense

- Manufacturing

- Others

- Device Type

- Traditional Endpoints

- Non-Traditional Endpoints

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The solutions segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 5.72 billion in 2022. It continued to the largest segment at a CAGR of 26.59%.

UEM solutions are critical for businesses aiming to oversee and protect varied endpoints via a single platform. These systems simplify device enrollment and provisioning and configuration management, while enabling automation workflows for software deployment. They support compliance reporting, application management, and network access control, alongside vulnerability assessment and patch management systems. Capabilities like mobile device management, remote device control, and device lifecycle management boost efficiency. With unified console management and multi-platform support, UEMs offer remote wipe functionality and security posture management. Features such as endpoint detection response, data loss prevention, and user experience monitoring enhance security. Threat intelligence integration, remote assistance tools, IT asset tracking, endpoint configuration management, software license management, inventory management tools, device health monitoring, endpoint analytics, conditional access policies, hardware inventory, endpoint security, zero trust access, and risk mitigation strategies ensure robust oversight and protection.

For instance, a large financial institution reported a 30% increase in IT efficiency after implementing a UEM solution to manage and secure their endpoints. Furthermore, the UEM market is expected to grow by over 20% in the next year as businesses continue to prioritize endpoint security and management in the face of increasing cyber threats.

The Solutions segment was valued at USD 1.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 111.62 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth as businesses increasingly adopt centralized management solutions to ensure device compliance, automate workflows, deploy software, report on compliance, manage applications, control network access, assess vulnerabilities, manage patches, and monitor device health. In North America, where the use of connected devices in enterprises is widespread, UEM solutions have gained early adoption, accounting for a majority of the market share. For instance, JetRight Aerospace Holdings (JetRight), a US-based provider of on-demand charter and managed services, implemented JAMFSoftware LLC (JAMF) Now to manage its mobile devices and fleets across numerous countries. This enabled JetRight to streamline device management, improve security posture, and enhance endpoint analytics.

Industry experts anticipate that the UEM market will continue to expand, with estimates suggesting that over 60% of enterprises will adopt UEM solutions by 2026. These solutions offer multi-platform support, remote wipe functionality, endpoint configuration management, software license management, inventory management tools, and conditional access policies, among other features. Additionally, UEM solutions integrate threat intelligence, remote assistance tools, data loss prevention, user experience monitoring, and endpoint security, providing a harmonious approach to managing the IT environment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Unified Endpoint Management (UEM) Market advances through UEM integration with SIEM and implementing zero trust architecture to bolster managing endpoint security posture. Automating UEM workflows and centralized UEM dashboard streamline operations, while endpoint device inventory software ensures accurate tracking. Managing compliance with UEM and UEM and data encryption enhance improving security posture via UEM, particularly for UEM for remote workers. Deployment of UEM system and UEM platform capabilities drive efficiency, with UEM reporting and analytics providing insights. Enhancing mobile application security and reducing UEM management costs are key, supported by UEM solution provider selection and UEM vendor comparison to ensure robust, cost-effective solutions.

The market is experiencing significant growth as organizations seek to manage their endpoint security posture in an increasingly complex digital landscape. UEM solutions enable businesses to automate workflows, implement zero trust architecture, and configure device policies for remote device management best practices. Integration with security information and event management (SIEM) systems is a crucial capability, allowing organizations to enhance their security posture via real-time threat detection and response. UEM platforms offer comprehensive device inventory software, enabling organizations to manage compliance with ease. Deploying a UEM system involves careful consideration of company comparison and solution provider selection.

Capabilities such as reporting and analytics provide valuable insights into endpoint security and usage trends. Mobile application security is a growing concern, and UEM solutions offer essential features to improve security posture. These include containerization, application control, and data encryption. Centralized UEM dashboards provide a single pane of glass for managing UEM and device security, reducing management costs and improving overall efficiency. Configuring UEM device policies is essential for maintaining a secure environment. Policies can include password complexity requirements, software updates, and access controls. UEM solutions also offer features to automate these workflows, ensuring consistent enforcement across the organization. UEM solutions play a vital role in enabling secure remote work. By providing centralized management and security features, organizations can ensure their endpoint devices remain compliant and secure, even when employees are working from home. Ultimately, UEM is an essential tool for any business seeking to manage its endpoint security effectively and efficiently.

What are the key market drivers leading to the rise in the adoption of Unified Endpoint Management (UEM) Industry?

- The increasing requirement for managing both traditional and non-traditional endpoints through integrated Unified Endpoint Management (UEM) solutions serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand for integrated solutions to manage and secure various endpoints within an enterprise network. UEM solutions enable organizations to centrally manage devices such as smartphones, PCs, tablets, servers, printers, and more, providing a unified view and simplifying management complexities. However, implementing multiple endpoint solutions from different companies can lead to integration issues, making the adoption of a single UEM suite an attractive option. According to recent industry reports, the global UEM market is expected to grow by over 15% annually, underscoring its increasing importance in the digital business landscape.

- For instance, a large financial services firm reported a 30% increase in productivity after implementing a UEM solution, demonstrating the potential benefits of streamlined endpoint management.

What are the market trends shaping the Unified Endpoint Management (UEM) Industry?

- The increasing adoption of Internet of Things (IoT) devices represents a significant market trend. A growing number of businesses and consumers are integrating IoT technologies into their operations and daily lives.

- The Internet of Things (IoT) market is experiencing a significant surge in adoption due to its ability to optimize services, products, and operations through machine-to-machine communication. IoT systems consist of interconnected devices embedded with electronics, software, sensors, and network connectivity. According to industry estimates, the number of IoT-connected devices is predicted to reach approximately 21 billion by 2023, representing a robust growth trajectory.

- This connectivity bridge between the physical and virtual world enables objects and data to provide real-time insights, leading to improved business processes and operational efficiency. The integration of IoT technology is becoming increasingly essential for organizations to remain competitive in today's market landscape.

What challenges does the Unified Endpoint Management (UEM) Industry face during its growth?

- The expansion of the industry is significantly influenced by the limited availability of open-source User Experience Management (UEM) solutions, which poses a substantial challenge for organizations seeking cost-effective and innovative UEM solutions.

- The market faces significant challenges due to the availability of open-source UEM solutions. These free solutions, developed by organizations or developer communities, have gained popularity among businesses with limited IT budgets. Open-source UEM offerings, such as OSSEC, ClamAV, and JumpCloud, provide cost-effective alternatives to proprietary software. However, they offer limited functionalities and lack advanced features. For instance, OSSEC primarily focuses on checking intrusions in a system or endpoint network. Despite these limitations, some organizations are enhancing and developing open-source UEM solutions to offer complete solutions to their clients. The global UEM market is expected to grow at a robust pace, with industry reports suggesting a 20% increase in demand over the next few years.

- This growth is driven by the increasing adoption of bring-your-own-device (BYOD) policies and the need for organizations to manage and secure diverse endpoints. Organizations must carefully evaluate the trade-offs between cost savings and advanced functionality when considering open-source UEM solutions.

Exclusive Customer Landscape

The unified endpoint management (UEM) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the unified endpoint management (UEM) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, unified endpoint management (UEM) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

42Gears Mobility Systems Pvt. Ltd. - This company specializes in unified endpoint management solutions, including SureMDM.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 42Gears Mobility Systems Pvt. Ltd.

- BlackBerry Ltd.

- Broadcom Inc.

- Cisco Systems Inc.

- Cloud Software Group Inc.

- Dell Technologies Inc.

- International Business Machines Corp.

- Ivanti Software Inc.

- JAMF HOLDING CORP.

- Matrix42 GmbH

- Microsoft Corp

- Mitsogo Inc.

- Open Text Corporation

- ProMobi Technologies Pvt. Ltd.

- Snow Software

- Sophos Ltd.

- SOTI Inc.

- Syxsense Inc.

- VMware Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Unified Endpoint Management (UEM) Market

- In January 2024, VMware announced the acquisition of AetherPal, a leading digital support and remote resolution platform, to enhance its UEM solution, Workspace ONE. This acquisition aimed to provide VMware with advanced capabilities in endpoint resilience and zero-touch IT, strengthening its position in the UEM market (VMware Press Release, 2024).

- In March 2024, Microsoft introduced Microsoft Endpoint Manager (MEM), an advanced UEM solution that combined Configuration Manager and Intune, offering a unified experience for managing and securing endpoints. This integration aimed to simplify IT management and improve security for organizations (Microsoft Press Release, 2024).

- In May 2024, IBM Security announced a strategic partnership with SOTI, a leading UEM provider, to offer a comprehensive endpoint management solution. This collaboration aimed to combine IBM's security expertise with SOTI's UEM capabilities, providing a more robust solution for managing and securing endpoints across diverse environments (IBM Security Press Release, 2024).

- In April 2025, Jamf, a UEM solution provider, announced a significant funding round of USD150 million, led by JMI Equity. This investment aimed to fuel Jamf's continued growth and product innovation, solidifying its position as a major player in the UEM market (Jamf Press Release, 2025).

Research Analyst Overview

- The market for Unified Endpoint Management (UEM) solutions continues to evolve, with new applications and capabilities emerging across various sectors. Real-time alerts and application blacklisting are becoming increasingly important for maintaining endpoint security, while customizable dashboards and endpoint visibility enable proactive threat detection and policy enforcement. Security auditing and cost reduction strategies are also key focus areas, with integration capabilities enabling seamless adoption of UEM solutions into existing IT environments. For instance, a large financial services organization reported a 30% increase in application performance after implementing UEM solutions with application performance monitoring and optimization features. The global UEM market is expected to grow by over 15% annually, driven by the need for enhanced security and improved user productivity.

- Encryption keys, security event correlation, and mobile threat defense are among the advanced features gaining traction in the market. Additionally, UEM solutions offer automation capabilities, such as remote troubleshooting, automated remediation, and access control lists, to streamline IT operations and incident response management. Compliance automation, role-based access control, and user productivity enhancements are other areas of investment for organizations seeking to optimize their UEM strategies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Unified Endpoint Management (UEM) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 58% |

|

Market growth 2025-2029 |

USD 111621.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

41.6 |

|

Key countries |

US, China, UK, Germany, Japan, Canada, India, France, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Unified Endpoint Management (UEM) Market Research and Growth Report?

- CAGR of the Unified Endpoint Management (UEM) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the unified endpoint management (UEM) market growth of industry companies

We can help! Our analysts can customize this unified endpoint management (UEM) market research report to meet your requirements.