US Gluten-Free Food Market Size 2024-2028

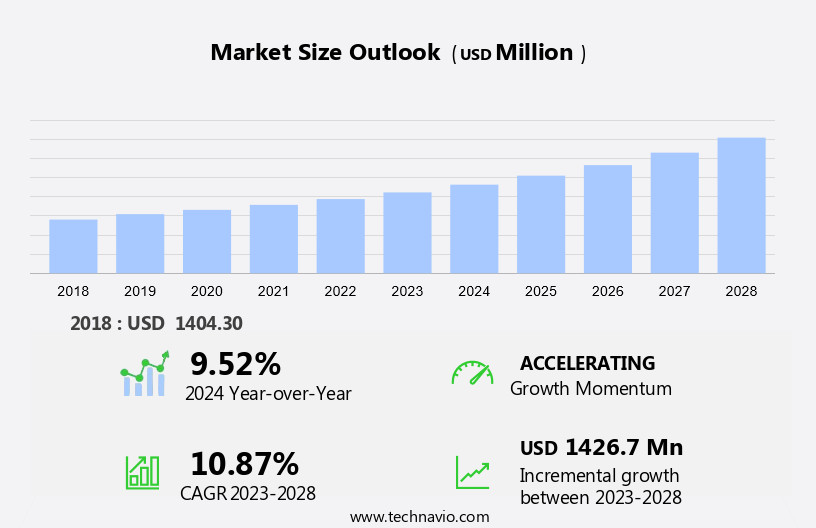

The US gluten-free food market size is forecast to increase by USD 1.43 billion at a CAGR of 10.87% between 2023 and 2028.

- The market is witnessing significant growth due to increasing consumer preference for healthier food options. A key trend driving market growth is the expanding demand for bakery products. Moreover, wider distribution channels for gluten-free foods are contributing to market expansion. Online shopping and e-commerce platforms have made it easier for consumers to access these products, contributing to the market's growth. However, the high price point of gluten-free food products poses a challenge to market growth. Consumers are looking for affordable options while maintaining their gluten-free diet. Adherence to stringent labeling regulations and innovation in product offerings is essential for market success. The market analysis report provides a comprehensive study of these factors and more, offering insights into the future growth prospects of the gluten-free food market In the US.

What will be the size of the US Gluten-Free Food Market during the forecast period?

- The market continues to experience strong growth due to the rising prevalence of celiac disease, food allergies, and other health disorders such as chronic pulmonary disease, metabolic syndrome, heart disease, diabetes, and obesity. Consumers seeking healthier options and improved nutritional functioning, as well as those with emotional well-being and energy needs, are increasingly turning to gluten-free foods.

- This trend is particularly evident In the ready-to-eat foods segment, which includes gluten-free bakery products, snacks, and organic baked goods. The market's expansion is driven by the growing awareness of the health benefits associated with gluten-free diets, including improved digestion and weight loss. As a result, the market for gluten-free products is expected to remain a significant contributor to the overall health and wellness industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bakery

- Snacks

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Specialty stores

- Online retails

- Drug stores

- Geography

- US

By Product Insights

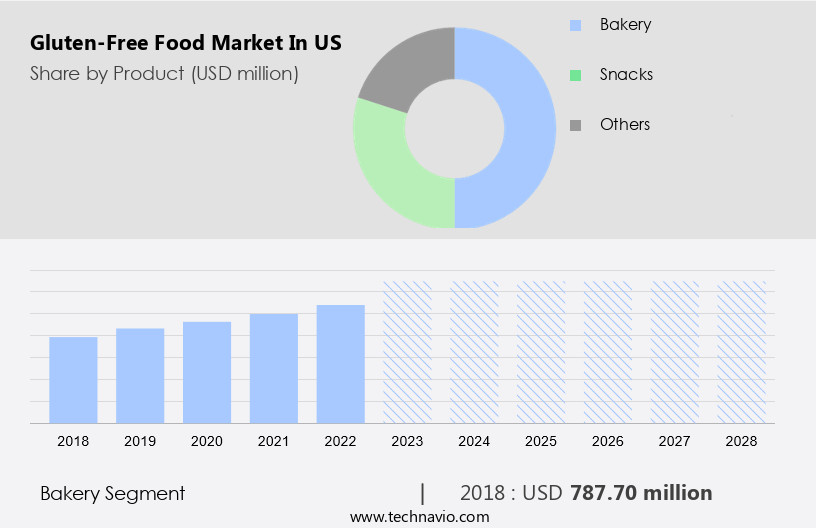

- The bakery segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth due to increasing health consciousness and the prevalence of chronic health issues such as celiac disease and food allergies. Among various categories, gluten-free bakery products have been leading the market, driven by the demand for gluten-free alternatives to traditional baked goods. These products include bread, biscuits, cookies, and confectionery items like cakes and pastries. Consumers opt for gluten-free bakery and confectionery food products for medical necessity due to celiac disease or as a preventive measure for gluten sensitivity. Additionally, the market for gluten-free products extends to ready-to-eat meals, snacks, infant formulas, dairy products, and pulses.

Moreover, the food processing sector is responding to this trend by introducing gluten-free options in various categories. Health-conscious consumers also prefer gluten-free products as part of diets like Paleo, Keto, and low-fat, or for managing health disorders such as heart disease, diabetes, chronic pulmonary disease, and metabolic syndrome. The market for gluten-free products also includes functional foods, free-from food, and clean-label convenience foods. The demand for gluten-free alternatives offers numerous health advantages, including improved digestion, increased energy, and weight loss. Gluten-free snacks are also popular due to their convenience and nutritional value, making them a preferred choice for healthful snacking options.

Get a glance at the market share of various segments Request Free Sample

The Bakery segment was valued at USD 787.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Gluten-Free Food Market?

Growing demand for gluten-free bakery products is the key driver of the market.

- The gluten-free food market In the US experienced significant growth in 2023, with the bakery products segment leading the way. This segment encompasses a wide range of offerings, including gluten-free bagels, baking mixes, muffins, rolls and buns, cornbread, focaccia, croissants, pies and cakes, bread, crackers, pretzels, cookies and wafers, baking powder, and more. The introduction of new products and rebranding efforts have been instrumental in driving sales in this segment. The health-conscious consumer trend, fueled by the increasing awareness of chronic health issues such as Celiac disease, food allergies, obesity, heart disease, diabetes, chronic pulmonary disease, metabolic syndrome, and other health disorders, has been a major factor In the market's expansion.

- The COVID-19 pandemic further accelerated this trend, as consumers prioritized their health and well-being by opting for gluten-free alternatives. Moreover, the demand for low-fat, organic baked goods, dairy-free products, pulses, and other nutritional and functional foods has increased. Home-cooked food and ready-to-eat meals have become popular options for those following gluten-free diets. Online shopping and e-commerce platforms have made it easier for consumers to access these products, even during lockdowns and social distancing measures. The food processing sector has responded to this trend by introducing more gluten-free snacks, infant formulas, and other non-allergic food products. The market for gluten-free products is expected to continue growing as consumers prioritize their health and wellness, focusing on nutritional functioning, emotional well-being, and healthy weight loss.

What are the market trends shaping the US Gluten-Free Food Market?

Wider distribution of gluten-free foods is the upcoming trend In the market.

- In response to the rising prevalence of celiac disease and food allergies In the US, the demand for gluten-free food products continues to grow. This trend is driving the expansion of the gluten-free food market, with an increasing number of ready-to-eat foods, organic baked goods, and snacks becoming available. Health-conscious consumers, particularly those with chronic health issues such as obesity, heart disease, diabetes, chronic pulmonary disease, and metabolic syndrome, are turning to gluten-free diets for their nutritional benefits. To cater to this market, many local bakeries are partnering with supermarkets and retailers to offer gluten-free baked items with extended shelf life through technologies like microencapsulation.

- Walmart, for instance, has introduced a range of gluten-free products under its private label, including cookies, pretzels, pasta dishes, and granola bars. Wegmans, another major supermarket chain, has collaborated with a New Jersey-based gluten-free bakery to offer prepared baked goods in all its stores. The food processing sector is also responding to this trend by producing a wider range of gluten-free alternatives for consumers. These include dairy-free products, pulses, and functional foods. With the increasing awareness of health and wellness, consumers are seeking guilt-free snacking options that provide health advantages and cater to their dietary requirements. Online shopping and e-commerce platforms are making it easier for consumers to access these products, while wellness tourism and ready-to-eat meals are further fueling the growth of the gluten-free food market.

What challenges does US Gluten-Free Food Market face during the growth?

The high price of gluten-free food products is a key challenge affecting the market growth.

- The gluten-free food market In the US continues to expand as health-conscious consumers seek alternatives due to celiac disease, food allergies, or gluten sensitivity. This market encompasses ready-to-eat foods, organic baked goods, low-fat dairy products, and pulses, among others. The demand for gluten-free products extends beyond those with chronic health issues, with an increasing number of individuals adhering to diets such as Paleo and Keto. Manufacturing gluten-free food involves additional costs due to the complexity of the process. Rice and corn, primary ingredients in gluten-free food, are more expensive than wheat. Certifications, specialized carriers, and logistics also add to the expenses.

- As a result, the manufacturing cost of gluten-free products is higher than that of their gluten-containing counterparts, which is reflected In their selling price. Gluten-free alternatives to conventional snacks, baked items, and ready-to-eat meals offer numerous health benefits. These include improved digestion, increased energy, and nutritional value for individuals with gluten allergies or sensitivities. Furthermore, the health advantages of gluten-free diets extend to those with chronic health disorders such as heart disease, diabetes, chronic pulmonary disease, and metabolic syndrome. The food processing sector responds to this trend by offering a wide range of gluten-free products. These include non-allergic food products, functional foods, and free-from food.

Exclusive US Gluten-Free Food Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aleias Gluten Free Foods LLC

- Amys Kitchen Inc.

- B and G Foods Inc.

- Blue Diamond Growers

- Bobs Red Mill Natural Foods Inc.

- Chobani Global Holdings LLC

- Conagra Brands Inc.

- Doves Farm Foods Ltd.

- Dr. Schar

- Flowers Foods Inc.

- General Mills Inc.

- Genius Foods Ltd.

- Gruma SAB de CV

- Hero AG

- Kellogg Co.

- Mondelez International Inc.

- Nestle SA

- PepsiCo Inc.

- The J.M Smucker Co.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by a rising awareness of health and wellness among consumers. This trend is not limited to individuals with celiac disease or gluten sensitivity but also extends to those following various dietary regimens for chronic health issues such as heart disease, diabetes, chronic pulmonary disease, metabolic syndrome, and others. Health-conscious consumers are increasingly seeking out gluten-free alternatives to their favorite foods, including baked items, snacks, and ready-to-eat meals. The demand for these products is not limited to traditional grocery stores but also extends to online shopping platforms and e-commerce channels.

Moreover, the food processing sector has responded to this trend by introducing a wide range of gluten-free offerings. These include not only baked goods but also dairy products, infant formulas, and even pulses. The use of microencapsulation technology has enabled the production of gluten-free versions of various foods, ensuring a longer shelf life and maintaining the nutritional value of the products. The convenience factor is another key driver of the gluten-free food market In the US. With busy lifestyles and the need for quick and easy meal options, consumers are turning to ready-to-eat meals and snacks. Gluten-free versions of these products cater to the dietary requirements of health-conscious individuals without compromising on taste or convenience.

Furthermore, the rise of wellness tourism has also contributed to the growth of the gluten-free food market. Travelers seeking healthy and nutritious food options while on vacation or business trips are increasingly opting for gluten-free alternatives. This trend is particularly prevalent In the artisanal bakery sector, where consumers are willing to pay a premium for high-quality, clean-label, and guilt-free snacking options. The health advantages of gluten-free diets are well-documented, with many consumers reporting improved digestion, increased energy levels, and weight loss. The nutritional benefit of these diets is not limited to individuals with medical necessity but also extends to those seeking to maintain a healthy weight or improve their emotional well-being.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market Growth 2024-2028 |

USD 1.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.52 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch