US Patient Engagement Solutions Market Size 2024-2028

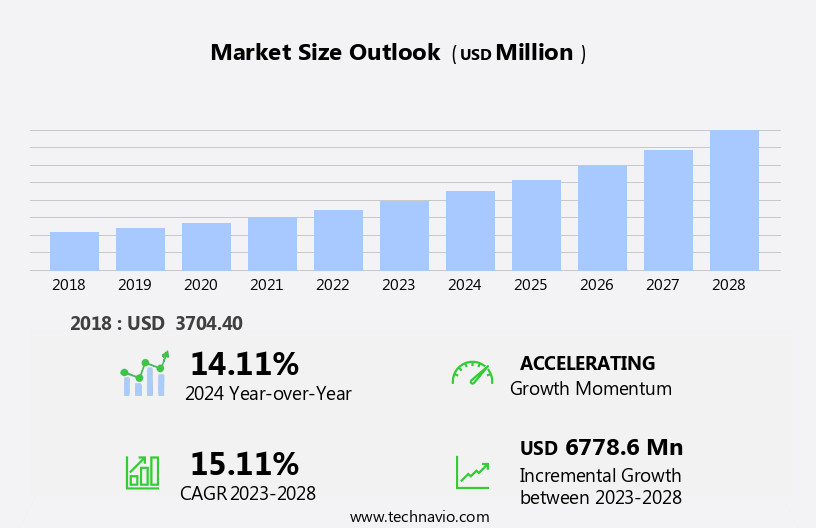

The US patient engagement solutions market size is forecast to increase by USD 6.78 billion at a CAGR of 15.11% between 2023 and 2028.

The Patient Engagement Solutions market in the US is witnessing substantial growth, fueled by regulatory requirements and incentives, value-based care initiatives, and evolving consumer expectations and empowerment. These factors are driving the demand for innovative patient engagement solutions, which are increasingly being adopted to meet the needs of a healthcare system that prioritizes efficiency, accessibility, and higher industry standards. Regulatory mandates, such as the Meaningful Use program, have played a significant role In the market's expansion. These initiatives incentivize healthcare providers to implement electronic health records and patient engagement technologies, which enable better communication between patients and healthcare providers.

Value-based care initiatives, which reward providers based on patient outcomes rather than the number of procedures performed, have also contributed to the growth of the market. Consumers are increasingly demanding more control over their healthcare, and patient engagement solutions are helping to meet this need. These solutions enable patients to access their health information, communicate with their healthcare providers, and manage their appointments and medications online. As a result, patient engagement solutions are becoming essential tools for healthcare organizations looking to meet the changing needs of their patients and remain competitive In the market.

What will be the size of the market during the forecast period?

US Patient Engagement Solutions Market Segmentation

The patient engagement solutions market in US research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- On-premises

- Web and cloud-based

- Application

- Health management

- Home health management

- Social

- Financial health management

- Component

- Software

- Services

- Hardware

- Geography

- US

Which is the largest segment driving market growth?

The on-premises segment is estimated to witness significant growth during the forecast period.

Patient engagement solutions in the US market cater to healthcare providers' needs for controlling patient data in compliance with regulations like HIPAA. Premise solutions offer personalized and adaptable patient interaction technologies, enabling seamless integration with existing infrastructure and better functionality control. These solutions enhance patient experience by facilitating digital patient engagement through software platforms, virtual healthcare, telehealth, and remote monitoring devices. Patient engagement strategies include teleconsultations, patient education, real-time data management, prescription refills, and patient portals. Key components include electronic health records, healthcare IT systems, software, hardware, infrastructure, maintenance expenses, staff training, data migration, system customization, upgradation, managed services, and patient education solutions.

The market is driven by factors like financial health management, fitness and wellbeing, home health management, social health management, and chronic diseases. Key players include Athenahealth, GetWellNetwork, Health Catalyst, MediBuddy, Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm, Well-Beat, and Wolters Kluwer. The landscape is evolving with trends like artificial intelligence, machine learning, and personalized care.

Get a glance at the market share of various regions. Download the PDF Sample

The On-premises segment was valued at USD 2.18 billion in 2018 and showed a gradual increase during the forecast period.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Technavio's patient engagement solutions market in US research and growth report provides the ranking index for the top 20 companies along with insights on the market positioning of:

- athenahealth Inc.

- Cognizant Technology Solutions Corp.

- CureMD

- Experian Plc

- GetWellNetwork Inc.

- International Business Machines Corp.

- IQVIA Holdings Inc.

- Koninklijke Philips N.V.

- Lincor Inc.

- McKesson Corp.

- MEDHOST

- Medical Information Technology Inc.

- Modernizing Medicine Inc.

- Nuance Communications Inc.

- Oracle Corp.

- ResMed Inc.

- Solutionreach Inc.

- Tebra Technologies Inc.

- TruBridge, Inc.

- Veradigm LLC

Explore our company rankings and market positioning. Request Free Sample

What is the market structure and year-over-year growth of the Patient Engagement Solutions Market in US?

|

Market structure |

Fragmented |

|

YoY growth 2023-2024 |

14.11 |

US Patient Engagement Solutions Market Dynamics

The patient engagement solutions market in the US is experiencing significant growth, driven by the increasing emphasis on patient-centric care and the integration of technology into healthcare. Mobile health apps, digital patient engagement platforms, and remote patient monitoring solutions are becoming essential tools for healthcare systems, providers, payers, life science companies, and skilled IT professionals to enhance patient outcomes. Interoperability and data sharing are critical factors fueling this trend, enabling seamless communication between various stakeholders and facilitating shared decision-making. Artificial intelligence (AI) and machine learning technologies are revolutionizing patient engagement by offering personalized care and remote monitoring capabilities. Telemedicine and remote home monitoring solutions are increasingly popular, especially among smartphone users, as they enable convenient access to healthcare services and enable continuous patient monitoring.

The global economy's shift towards next-gen healthcare and the need for cost-effective, efficient, and patient-focused care further underscore the market's direction. Overall, the patient engagement solutions market is poised for continued expansion, with a focus on improving patient experiences, enhancing care quality, and optimizing healthcare delivery.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Regulatory requirements and incentives is the key driver of the market.

Patient engagement initiatives have gained significant importance In the US healthcare landscape due to regulatory requirements and incentives. The Meaningful Use program, which promoted interoperability, required eligible healthcare providers to use approved electronic health record (EHR) technology that incorporates patient interaction functions. Providers must engage patients through secure messaging, electronic health information access, and clinical summaries to qualify for incentives. Furthermore, the Merit-Based Incentive Payment System (MIPS) and Alternative Payment Models (APMs) under the Medicare Access and CHIP Reauthorization Act (MACRA) have been established to reward quality patient care. These programs emphasize patient-centric care through digital patient engagement, telehealth, remote patient monitoring, shared decision-making, artificial intelligence, and machine learning.

Patient engagement software solutions, such as patient portals, mobile applications, and virtual healthcare services, have become essential for patient experience, financial health management, fitness and wellbeing, home health management, and social health management. Market dynamics include investment activity, patient awareness, and the integration of software platforms, services, and virtual healthcare solutions from solution providers like Athenahealth, GetWellNetwork, Health Catalyst, MediBuddy, Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm, Well-Beat, Wolters Kluwer, Upfront Healthcare, NextGen Healthcare, and others. The global economy, healthcare systems, providers, payers, and life science companies are also investing in remote home monitoring, smartphone users, and mHealth apps to improve healthcare delivery, particularly for chronic diseases like diabetes and cardiovascular disorders.

What are the significant market trends being witnessed?

mHealth apps is the upcoming market trend.

The patient engagement solutions market In the US is witnessing significant growth with the increasing adoption of mobile health (mHealth) apps. These apps, which run on mobile devices like smartphones and tablets, are designed to enhance patient engagement, streamline healthcare delivery, and improve overall health outcomes. Patients can use these apps to schedule appointments, access electronic health records, receive prescription refills, and communicate with healthcare providers. MHealth apps enable patients to manage their health more actively by tracking vital signs, monitoring chronic conditions, setting health goals, and accessing educational resources. Furthermore, these solutions facilitate remote patient monitoring, shared decision-making, and telehealth services through artificial intelligence (AI), machine learning, and virtual care.

The market is driven by the need for patient-centric care, interoperability, and digital patient engagement strategies. Healthcare providers, payers, life science companies, and individuals are investing in patient engagement software, cloud-based solutions, on-premise solutions, and web-based solutions to enhance the patient experience and optimize healthcare delivery. The market encompasses patient education solutions, financial health management, fitness and wellbeing, home health management, social health management, and virtual consultations. Key trends include investment activity in AI chatbots, such as ChatGPT, and remote home monitoring devices from companies like GE Healthcare and MediBuddy. The market is expected to continue growing due to the increasing number of smartphone users and the demand for personalized care.

What are the major market challenges?

Data security and privacy is a key challenge affecting the industry growth.

Patient engagement solutions In the US market face significant challenges related to data security and privacy. Given the sensitive nature of healthcare data, ensuring patient information is protected and privacy is preserved is crucial. The healthcare sector is subject to stringent regulations, with HIPAA being one of the most well-known. Compliance with these rules is essential to avoid legal issues and maintain patient trust. A healthcare data breach can disclose private and medical information of numerous patients, exposing institutions to legal risks and damaging their reputation. In the US market, patient engagement software includes digital patient engagement, remote patient monitoring, shared decision-making, artificial intelligence, machine learning, personalized care, telemedicine, remote monitoring devices, patient education solutions, financial health management, fitness and wellbeing, home health management, social health management, virtual consultations, prescription refills, patient portals, mobile applications, patient retention rates, clinical trials, and healthcare delivery for chronic diseases such as diabetes and cardiovascular disorders.

Market dynamics include investment activity, data analytics, AI, and various solution providers offering cloud-based, on-premise, and web-based solutions. Service segments include data migration, system customization, upgradation, managed services, and staff training. Key players include athenahealth, GetWellNetwork, Health Catalyst, MediBuddy, Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm, Well-Beat, and Wolters Kluwer, among others. The healthcare landscape is influenced by providers, payers, life science companies, and remote home monitoring solutions from companies like GE Healthcare and smartphone users utilizing mHealth apps. Market trends include the increasing use of AI chatbots like ChatGPT and services from companies like Nuance Mix, Leidos, NextGen Healthcare, and Upfront Healthcare.

Exclusive Customer Landscape

The patient engagement solutions market in US forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the patient engagement solutions market in US report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The patient engagement solutions market In the global healthcare landscape is witnessing significant growth due to the increasing emphasis on patient-centric care. This trend is driven by the need to improve patient outcomes, enhance the patient experience, and reduce healthcare costs. Patient engagement solutions encompass a range of offerings, including mobile health apps, electronic health records (EHRs), healthcare IT systems, and remote patient monitoring. The adoption of these solutions is being fueled by several factors. The availability of skilled IT professionals and the increasing importance of interoperability are key drivers. Interoperability enables seamless data exchange between different healthcare systems and devices, leading to more effective care coordination and improved patient outcomes.

Moreover, the rising adoption of cloud-based solutions, telehealth, and virtual care is transforming the healthcare landscape. These solutions offer convenience, accessibility, and cost savings, making them increasingly popular among both healthcare providers and patients. The use of artificial intelligence (AI) and machine learning in patient engagement solutions is another recent trend. These technologies enable personalized care, shared decision-making, and real-time data management. They also facilitate remote consultations, prescription refills, and patient education. Patient engagement software is a critical component of these solutions. It allows patients to access their health information, manage their appointments, and communicate with their healthcare providers.

Patient portals and mobile applications are popular patient engagement software solutions, offering convenience and accessibility. The healthcare providers segment is a significant market for patient engagement solutions. These solutions help providers improve patient retention rates, streamline operations, and enhance the patient experience. They also enable remote home monitoring for chronic diseases, such as diabetes and cardiovascular disorders. The services segment is another key market for patient engagement solutions. Managed services, system customization, upgradation, and maintenance expenses are major areas of focus for solution providers. Data migration and system integration are also critical services, ensuring seamless implementation and adoption of patient engagement solutions.

Recent investment activity In the patient engagement solutions market reflects the growing importance of these solutions. Life science companies, payers, and healthcare systems are investing in patient engagement solutions to improve patient outcomes, reduce costs, and enhance the patient experience. In conclusion, the patient engagement solutions market is witnessing significant growth due to the increasing emphasis on patient-centric care and the availability of advanced technologies. Mobile health apps, electronic health records, healthcare IT systems, and remote patient monitoring are key offerings in this market. The use of AI, machine learning, and cloud-based solutions is transforming the healthcare landscape, offering convenience, accessibility, and cost savings.

The services segment is a significant market for patient engagement solutions, with managed services, system customization, and maintenance expenses being major areas of focus. Investment activity in this market reflects the growing importance of patient engagement solutions in improving patient outcomes, reducing costs, and enhancing the patient experience.

Patient portals and telehealth apps are revolutionizing healthcare by enabling patients to easily access their health information and engage in virtual consultations. Integrated with health trackers, wearable devices, and biometric sensors, these platforms facilitate remote monitoring and provide real-time health data, empowering patients to manage chronic conditions effectively. Features like appointment reminders, secure messaging, and self-scheduling enhance patient convenience, while medication adherence tools and virtual support ensure continuous care. Digital consent and data privacy measures safeguard sensitive patient information, supporting clinical integration and seamless communication between healthcare providers. Health dashboards and patient analytics offer insights into wellness programs and care plans, promoting patient education and health literacy. Additionally, the use of patient feedback, care reminders, and telehealth notifications encourages proactive engagement and patient outreach. By leveraging these tools, healthcare providers can improve care coordination, foster patient empowerment, and optimize chronic disease management, ultimately enhancing overall health outcomes and patient satisfaction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.11% |

|

Market growth 2024-2028 |

USD 6778.6 million |

|

Regional analysis |

US |

|

Performing market contribution |

North America at 100% |

|

Key countries |

US and North America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

athenahealth Inc., Cognizant Technology Solutions Corp., CureMD, Experian Plc, GetWellNetwork Inc., International Business Machines Corp., IQVIA Holdings Inc., Koninklijke Philips N.V., Lincor Inc., McKesson Corp., MEDHOST, Medical Information Technology Inc., Modernizing Medicine Inc., Nuance Communications Inc., Oracle Corp., ResMed Inc., Solutionreach Inc., Tebra Technologies Inc., TruBridge, Inc., and Veradigm LLC |

|

Market Segmentation |

Type (On-premises and Web and cloud-based), Application (Health management, Home health management, Social, and Financial health management), Component (Software, Services, and Hardware), and Geography (North America) |

|

Customization purview |

If our patient engagement solutions market in US forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Patient Engagement Solutions Market in US Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies