Used Car Market Size 2025-2029

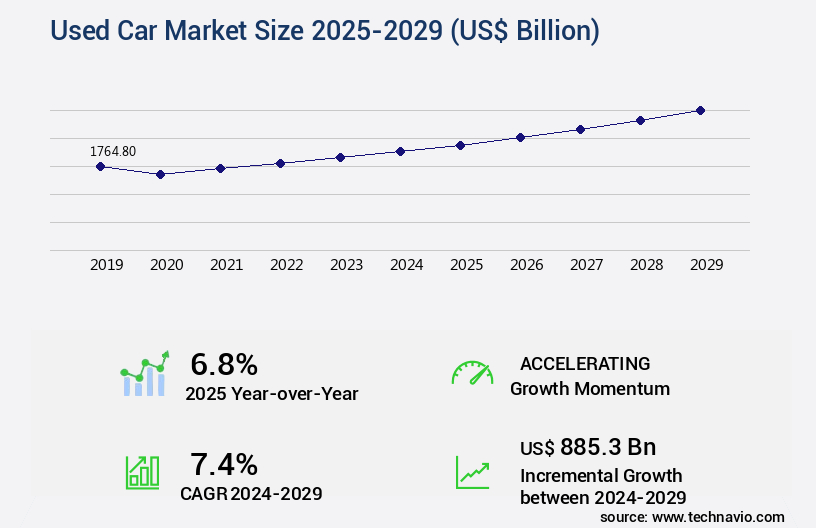

The used car market size is valued to increase by USD 885.3 billion, at a CAGR of 7.4% from 2024 to 2029. Increasing number of new models of cars launched due to high competition will drive the used car market.

Major Market Trends & Insights

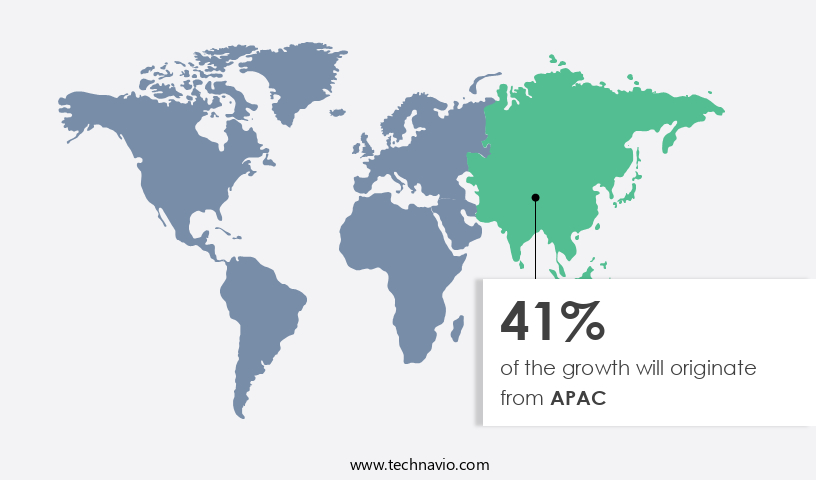

- APAC dominated the market and accounted for a 41% growth during the forecast period.

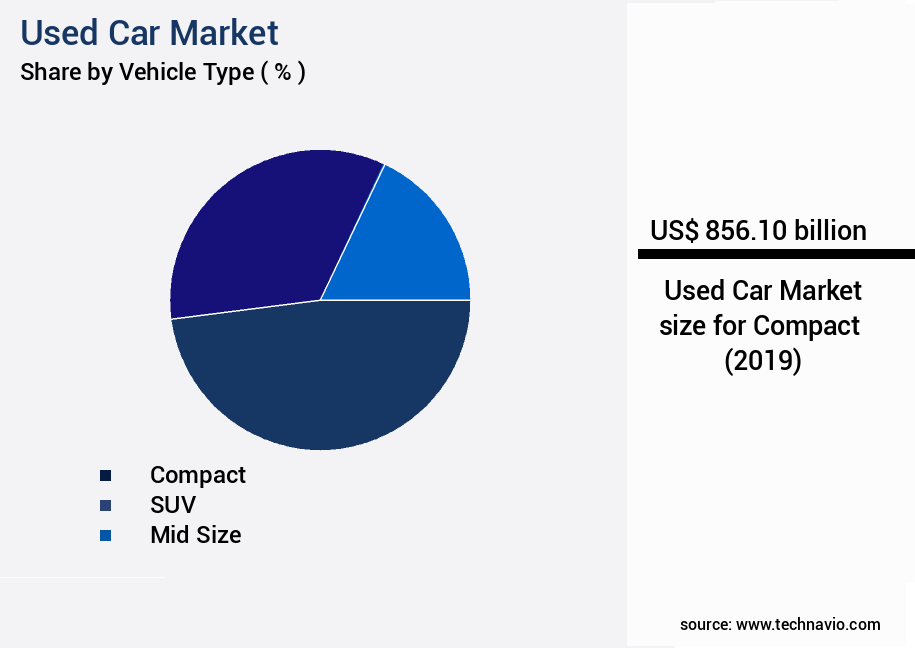

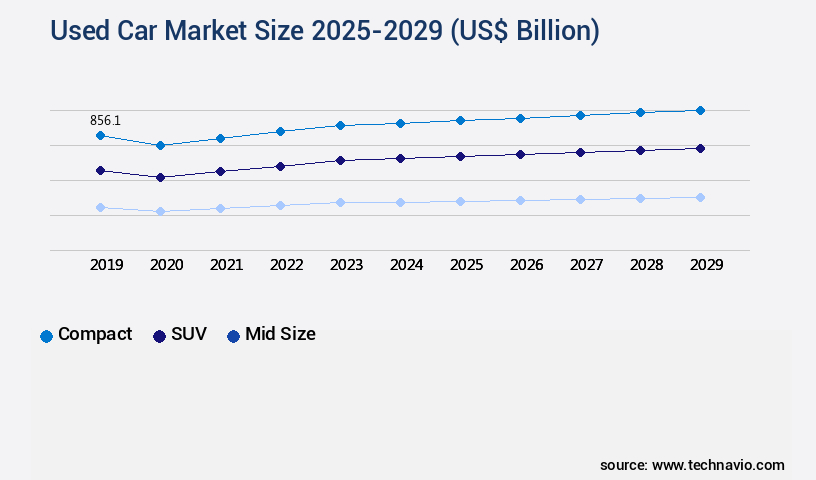

- By Vehicle Type - Compact segment was valued at USD 856.10 billion in 2023

- By Channel - Organized segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 67.95 billion

- Market Future Opportunities: USD 885.30 billion

- CAGR from 2024 to 2029 : 7.4%

Market Summary

- The market, a significant and dynamic sector of the global automotive industry, experienced a record-breaking year in 2021. According to the International Organization of Motor Vehicle Manufacturers, approximately 35 million used cars were sold worldwide, marking a 5% increase compared to the previous year. This growth can be attributed to several key drivers. First, the increasing number of new models launching due to heightened competition has led to a larger supply of used cars. Moreover, the growing demand for car subscription services and car-sharing platforms has created new opportunities for consumers to access affordable, flexible transportation solutions. The market's evolution has been shaped by various trends and challenges.

- Technological advancements, such as the integration of electric and autonomous vehicle technologies, have transformed the market landscape. Additionally, changing consumer preferences, including a focus on sustainability and cost savings, have influenced market dynamics. Looking ahead, the market is expected to continue its growth trajectory. As the global population becomes increasingly urbanized and transportation needs become more diverse, the demand for used cars is likely to increase. Furthermore, the ongoing digitalization of the automotive industry will create new opportunities for innovation and disruption. In conclusion, the market is a vital and evolving sector that offers significant opportunities for businesses.

- Its growth is driven by factors such as increased competition, the rise of car subscription services, and changing consumer preferences. As the market continues to adapt to technological advancements and shifting trends, it will remain a dynamic and exciting space for innovation and growth.

What will be the Size of the Used Car Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Used Car Market Segmented ?

The used car industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Vehicle Type

- Compact

- SUV

- Mid size

- Channel

- Organized

- Unorganized

- Fuel Type

- Diesel

- Petrol

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Vehicle Type Insights

The compact segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with the compact segment experiencing significant growth in APAC and Europe. This class of vehicles, positioned between subcompact and mid-size cars, gains popularity due to increasing consumer demand for personal mobility and more efficient, eco-friendly options. In densely populated regions, compact cars offer easier handling and lower emissions, contributing to a 50% market share in some regions. Popular pre-owned models like the Fiat Panda and Volkswagen Golf in Europe undergo rigorous pre-sale inspections, including body damage assessment, suspension component inspection, and mileage verification methods. Refurbishment techniques, such as automotive diagnostic tools and mechanical inspection procedures, ensure optimal engine performance and safety.

Consumer review aggregation and title verification services provide transparency, while repair cost estimation and parts replacement costs inform potential buyers. Fuel efficiency ratings, detailing services, and pre-purchase inspection checklists further enhance the buying experience. Online vehicle marketplaces employ pricing algorithms, vehicle financing options, and auction platform data to facilitate sales. Electrical system testing, maintenance record analysis, and emissions testing standards ensure transparency and safety. Safety recall checks, brake system evaluation, and fluid level checks complete the comprehensive assessment process.

The Compact segment was valued at USD 856.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Used Car Market Demand is Rising in APAC Request Free Sample

The Asia-Pacific (APAC) the market is experiencing significant growth, driven by the high demand for four-wheelers, particularly in China. In 2024, APAC accounted for over 80% of the total vehicle sales in the region, with China contributing a substantial portion. Furthermore, the increasing popularity of used car retailing in emerging markets, such as India, is fueling market expansion. In India, the trend of first-time car buyers opting for used cars instead of new ones is shifting the sales pattern.

This shift, while decreasing the demand for new vehicles, is creating new opportunities in the market in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and complex industry that requires meticulous analysis and evaluation to ensure optimal business performance. Key aspects of this market include the utilization of a comprehensive used car mechanical inspection checklist to assess vehicle condition, the verification of vehicle history report accuracy, and the estimation of repair costs after accidents. Calculating depreciation of used vehicles is also crucial in determining their value, with mileage being a significant factor. Effectiveness of different detailing techniques can enhance the presentation of used cars, while comparing pricing algorithms helps in setting competitive prices. Analyzing consumer reviews on used cars provides valuable insights into customer preferences and expectations. Vehicle features significantly influence pricing, and optimizing used car inventory management is essential for maintaining a profitable stock.

Predicting used car sales conversion rates and measuring the return on investment (ROI) of the marketing campaigns are essential for effective marketing strategies. Assessing risk in used car financing and detecting fraud in transactions are critical aspects of maintaining a trustworthy business. Evaluating the effectiveness of CRM systems in used car sales can improve sales processes, and determining an optimal pricing strategy is essential for maximizing profits. Improving customer acquisition cost through targeted marketing and analyzing sales data can lead to increased revenue. Managing used car inventory effectively and measuring customer satisfaction with used car purchases are ongoing priorities for any successful used car business.

What are the key market drivers leading to the rise in the adoption of Used Car Industry?

- The intensifying competition within the automotive industry drives the market's growth by prompting an increasing number of new car models to be launched.

- The automotive market is experiencing significant shifts due to various determinants. Rising income levels and increased purchasing power among households, easy credit access, and rapid automotive technological advancements are key drivers for consumers to purchase newer car models. This trend has shortened the car ownership cycle, leading to a surge in demand for both new and used cars. Many car owners opt for upgraded versions, creating a competitive landscape for Original Equipment Manufacturers (OEMs). In response, OEMs introduce cars with advanced features at affordable prices to maintain market share and stay competitive.

- Consequently, the market is witnessing an influx of new car models, which in turn fuels the availability and sales of used cars. This dynamic market scenario underscores the importance of continuous innovation and adaptation for businesses operating in the automotive sector.

What are the market trends shaping the Used Car Industry?

- The increasing demand for car subscription services represents a notable market trend in the present day. This trend signifies a shift towards flexible and customizable automotive solutions for consumers.

- In the ever-evolving automotive landscape, core offerings of car subscription services continue to gain traction as a flexible alternative to traditional vehicle ownership. These services enable consumers to access a diverse range of vehicles for an all-inclusive monthly fee, which typically covers insurance, maintenance, and roadside assistance. The flexibility extends to the ability to swap cars with short notice, allowing users to tailor their driving experience to their needs. Subscription plans cater to various market segments, including short-term leases of used cars and long-term rentals. Some services focus on the luxury car market, emphasizing convenience and comfort.

- Others provide the flexibility to switch between sedans, SUVs, and sports cars on a weekly or monthly basis. The car subscription market's continuous growth is driven by the desire for hassle-free mobility solutions and the increasing popularity of the sharing economy. This data-driven narrative underscores the market's dynamism and its potential to disrupt traditional automotive sales and leasing models.

What challenges does the Used Car Industry face during its growth?

- The surge in demand for car-sharing services poses a significant challenge to the automotive industry's growth trajectory.

- The shift towards cost-effective mobility solutions has resulted in a decline in car ownership, as consumers increasingly opt for alternatives such as car-sharing services. In China, a private car is estimated to spend approximately 93% of its time parked and unused, while a car used for car-sharing services has a utilization rate of up to 60%. This optimal use of vehicles and shared maintenance costs make car-sharing an attractive option for consumers.

- Moreover, domestic taxi rates in China are relatively low compared to developed countries, further encouraging the use of shared transportation. This trend signifies the evolving preferences and patterns in the mobility market, as consumers seek efficient and cost-effective solutions for their commuting needs.

Exclusive Technavio Analysis on Customer Landscape

The used car market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the used car market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Used Car Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, used car market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group Holding Ltd. - This company specializes in selling pre-owned vehicles, providing warranty coverage and personalized wrap designs, in addition to offering second-hand electric cars. The warranty and customization options distinguish the purchasing experience, while the electric car selection caters to the growing demand for eco-friendly transportation solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader.com Inc.

- Berman Auto Group

- CarGurus Inc.

- CarMax Inc.

- Cars24 Services Pvt. Ltd.

- DriveTime Automotive Group Inc.

- eBay Inc.

- Group 1 Automotive Inc.

- Hendrick Automotive Group

- Hertz Global Holdings Inc.

- Lithia Motors Inc.

- Mahindra and Mahindra Ltd.

- Penske Corp.

- Scout24 AG

- Sonic Automotive Inc.

- Toyota Motor Corp.

- TrueCar Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Used Car Market

- In January 2024, CarMax, a leading used car retailer, announced the acquisition of a significant stake in Carvana Co., a major online used car seller, for approximately USD2.2 billion. This strategic partnership aimed to expand CarMax's digital presence and reach a broader customer base (CarMax Press Release).

- In March 2024, Tesla, the electric vehicle pioneer, unveiled its new "Used Tesla Certified Vehicles" program. This initiative aimed to provide certified pre-owned electric vehicles with warranties, inspections, and discounts, entering the market with a tech-driven, sustainable approach (Tesla Press Release).

- In April 2025, the European Union approved the new "Right to Repair" regulation, enabling consumers to access repair manuals, parts, and tools for used cars, promoting a more sustainable and cost-effective aftermarket (European Commission Press Release).

- In May 2025, General Motors and CarParts.Com, a leading online automotive parts retailer, announced a strategic partnership to sell refurbished used cars alongside automotive parts. This collaboration aimed to provide customers with a one-stop-shop for both car parts and used vehicles (General Motors Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Used Car Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 885.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Japan, Germany, India, UK, Canada, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, presenting dynamic opportunities across various sectors. Body damage assessment plays a crucial role in determining a vehicle's value, with consumer review aggregation providing insights into the reliability and quality of refurbishment techniques. Mileage verification methods ensure authenticity, while suspension component inspection and reconditioning processes restore vehicles to optimal condition. Auction platform data offers valuable information for pricing, with electrical system testing and transmission diagnostics ensuring vehicle functionality. Paint depth measurement and mechanical inspection procedures assess a car's condition, while automotive diagnostic tools and vehicle history reports provide essential background information. Carfax report interpretation and title verification services add transparency, enabling accurate repair cost estimation and parts replacement costs.

- Fuel efficiency ratings and detailing services enhance a vehicle's appeal, while pre-purchase inspection checklists and warranty coverage terms protect buyers. Engine performance metrics and emissions testing standards ensure environmental compliance, with safety recall checks and brake system evaluations prioritizing safety. Online vehicle marketplaces facilitate transactions, and fluid level checks and vehicle financing options cater to diverse customer needs. Industry growth in the market is projected to reach 3% annually, reflecting the continuous unfolding of market activities and evolving patterns. For instance, a recent study revealed a 15% increase in sales for dealerships employing advanced refurbishment techniques.

- This underscores the importance of staying informed about the latest market trends and best practices.

What are the Key Data Covered in this Used Car Market Research and Growth Report?

-

What is the expected growth of the Used Car Market between 2025 and 2029?

-

USD 885.3 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Vehicle Type (Compact, SUV, and Mid size), Channel (Organized and Unorganized), Fuel Type (Diesel and Petrol), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing number of new models of cars launched due to high competition, Increasing demand for car-sharing services

-

-

Who are the major players in the Used Car Market?

-

Alibaba Group Holding Ltd., Asbury Automotive Group Inc., AutoNation Inc., Autotrader.com Inc., Berman Auto Group, CarGurus Inc., CarMax Inc., Cars24 Services Pvt. Ltd., DriveTime Automotive Group Inc., eBay Inc., Group 1 Automotive Inc., Hendrick Automotive Group, Hertz Global Holdings Inc., Lithia Motors Inc., Mahindra and Mahindra Ltd., Penske Corp., Scout24 AG, Sonic Automotive Inc., Toyota Motor Corp., and TrueCar Inc.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, with continuous changes in consumer preferences, market trends, and business strategies. According to recent industry reports, the number of used cars sold in the U.S. Reached over 36 million units in 2020, representing a significant increase of 3% compared to the previous year. This growth is expected to continue, with industry analysts projecting a steady expansion of up to 2% annually over the next five years. One notable example of market evolution is the increasing popularity of digital sales channels. In 2021, online sales accounted for approximately 25% of all used car transactions, up from just 15% in 2018.

- This shift has been driven by the convenience and flexibility offered by digital platforms, as well as the growing importance of data-driven insights in the sales process. Despite these positive trends, used car businesses face numerous challenges, including inventory management, pricing strategy, and customer satisfaction. Effective inventory management is crucial to maintaining a competitive edge, with an optimal inventory turnover rate of 6-8 units per month considered ideal. Meanwhile, customer satisfaction surveys and data analytics dashboards can help dealers identify trends and opportunities for improvement, enabling them to optimize pricing strategies and enhance the overall customer experience.

- By staying informed of these market developments and adopting innovative solutions, used car businesses can thrive in an increasingly competitive landscape.

We can help! Our analysts can customize this used car market research report to meet your requirements.