Used Construction Machinery Market Size 2023-2027

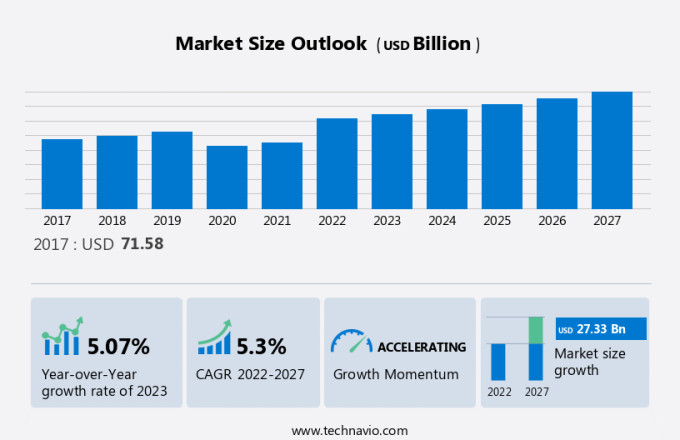

The used construction machinery market size is forecast to increase by USD 27.33 billion at a CAGR of 5.3% between 2022 and 2027.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the expanding secondhand machine market, as construction companies increasingly turn to cost-effective solutions for acquiring equipment. Another trend influencing market growth is the rising popularity of used construction equipment rentals. This allows businesses to access high-quality machinery without the substantial upfront costs of purchasing new equipment. However, stringent regulations regarding the safety and maintenance of used machinery pose challenges for market growth. Adhering to these regulations can be costly, and failure to do so can result in penalties and reputational damage. Despite these challenges, the market is expected to continue expanding, driven by the cost savings and operational flexibility offered by used equipment.

What will be the Size of the Used Construction Machinery Market During the Forecast Period?

- The market in the United States is experiencing significant growth, driven by increased construction activities in the residential and commercial sectors, as well as infrastructure projects in the civil engineering sector. Urbanization and technological innovation are key factors fueling this demand, with online platforms providing easy access to a wide range of used heavy machinery, including excavators, loaders, cranes, motor graders, and more. Contractors in the real estate industry and OEMs are turning to these platforms to source cost-effective solutions for their projects. Europe's construction industry, particularly in the infrastructure sector, is also contributing to the market's growth, with projects such as railway tunnels, port extensions, and underwater tunnels requiring large quantities of used machinery.

The Olympic Games and other major events are further driving demand for cranes and other heavy machinery services from providers like Atlas Crane Service. Overall, the market is expected to continue its robust growth trajectory in the coming years.

How is this Used Construction Machinery Industry segmented and which is the largest segment?

The used construction machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Product

- Crane

- Excavator

- Material handling equipment

- Others

- Application

- Commercial

- Residential

- Infrastructure

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

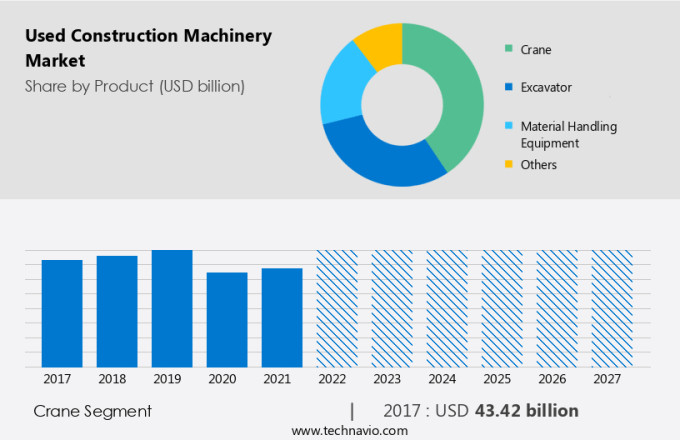

- The Crane segment is estimated to witness significant growth during the forecast period.

The market, specifically the crane segment, is experiencing consistent growth due to the increasing demand for cranes in construction and industrial applications. Cranes are essential for the construction of industrial plants in the chemical, energy, and power distribution sectors. In the construction industry, the increasing trend of building high-rise residential and commercial structures is driving the demand for used cranes. The Asia Pacific region and Nordic countries, such as Sweden and Finland, are expected to significantly contribute to the growth of the segment during the forecast period. The use of telematics in construction machinery is also gaining popularity, providing real-time data and improving efficiency and productivity.

Earthmoving equipment and loaders are other key components of the market, with their demand primarily driven by the residential and commercial construction sectors.

Get a glance at the used construction machinery industry share of various segments Request Free Sample

The Crane segment accounted for USD 43.42 billion in 2017 and showed a gradual increase during the forecast period.

Regional Insights

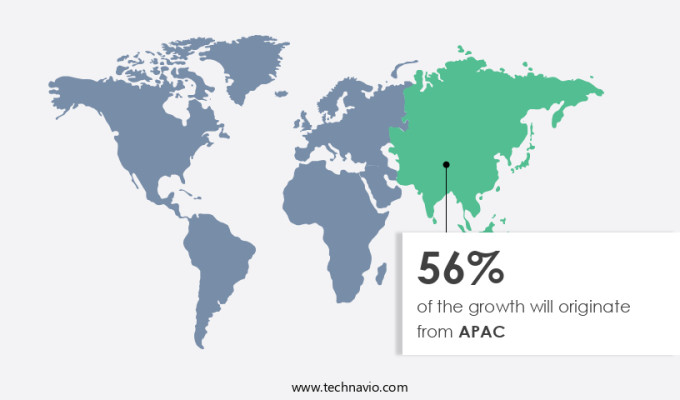

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in APAC is experiencing steady growth due to increasing construction activities in emerging economies such as India and China. The demand for used machinery is being driven by the need to provide residential and commercial spaces for expanding urban populations and infrastructure projects. In India, for instance, the Odisha Economic Corridor Project received a USD8.58 billion investment in 2020, leading to the development of industrial clusters in Gopalpur, Bhubaneswar, Kalinganagar, Paradip, Kendrapada, Dhamra, and Subarnarekha. The real estate industry and infrastructure projects are the primary drivers of this market, with motor graders being a significant type of machinery in high demand.

Third-party e-commerce websites facilitate the buying and selling of used construction machinery, increasing operational efficiency and accessibility.

Market Dynamics

Our used construction machinery market researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Used Construction Machinery Industry?

Growing secondhand machine market is the key driver of the market.

- The market in the US and Europe is experiencing significant growth due to the high demand for secondhand machinery in emerging economies, particularly in Asia. Urbanization and infrastructure development projects in regions like China, India, and Pakistan have led to a surge in the need for heavy machinery such as excavators, loaders, cranes, and earthmoving equipment. This trend is further fueled by technological innovations, including telematics, GPS tracking, autonomous features, automation, and technology-enabled equipment. Online platforms and third-party e-commerce websites have made it easier for contractors and dealers to buy and sell used machinery. Economic uncertainty and depreciation have also contributed to the growth of the market.

Modern innovations in fuel efficiency and equipment fleet control have made used machinery a cost-effective alternative to new equipment. The construction industry, including residential and commercial construction, is a significant consumer of used machinery. The real estate industry, civil engineering sector, and infrastructure projects, such as Olympic Games, high-speed rail markets, railway tunnels, port extensions, underwater tunnels, and power sector projects, are major users of heavy machinery. Motor graders are also in high demand for traffic linking and road construction projects.

What are the market trends shaping the Used Construction Machinery Industry?

Growing trend of used construction equipment rentals is the upcoming trend in the market.

- The market in the US is experiencing significant growth due to the surge in construction activities, driven by urbanization and infrastructure development. Online platforms have become a popular avenue for procuring used heavy machinery, including excavators, loaders, cranes, earthmoving equipment, and motor graders. Technological innovation, such as telematics, GPS tracking, autonomous features, automation, and technology-enabled equipment, is transforming the industry by enhancing operational efficiency, reducing downtime, and improving equipment fleet control. The real estate industry and commercial construction sectors are major consumers of used construction machinery, while the civil engineering sector is also a significant contributor to the market's growth.

- Rapid urbanization and economic uncertainty have led to an increase in the demand for cost-effective solutions, making rental equipment a popular choice. Modern innovations, such as fuel efficiency and economic certifications like the Certified Pre-Owned Program, are gaining popularity among contractors and OEMs. The construction machinery market is also witnessing significant growth in the high-speed rail market, Olympic Games, infrastructure projects, railway tunnels, port extensions, underwater tunnels, and power sector. Environmental regulations, such as the EU's Stage V exhaust emission regulation and the US's strict emission regulations for construction machinery, are driving the market towards technology-enabled equipment and cleaner, greener manufacturing and construction processes.

- Online marketplaces and third-party e-commerce websites, such as Atlas Crane Service, are providing dealers with a wider reach and greater market penetration. In conclusion, the market in the US is poised for significant growth, driven by construction activities, technological innovation, and environmental regulations. Online platforms, rental equipment, and technology-enabled equipment are key trends shaping the market, while the real estate industry, commercial construction, and civil engineering sectors are major consumers.

What challenges does Used Construction Machinery Industry face during the growth?

Stringent regulations is a key challenge affecting the market growth.

- Amidst the economic uncertainty following the 2008 financial crisis, construction and mining companies have been seeking cost-effective solutions for their machinery needs. High-priced, heavy construction equipment, such as excavators, loaders, and cranes, pose significant initial investment challenges for companies engaged in residential or commercial construction projects of modest scale or short duration. To address this issue, these firms have increasingly turned to renting used machinery as an alternative to purchasing new equipment. Renting offers several advantages, including reduced capital expenditures and lower maintenance costs. Online platforms have emerged as popular channels for renting construction machinery, providing easy access to a wide range of equipment from various dealers.

- Rapid urbanization and infrastructure development projects, such as Olympic Games, high-speed rail markets, power sector expansion, and traffic linking, have further fueled the demand for used machinery. Technological innovations, like telematics, GPS tracking, autonomous features, automation, and technology-enabled equipment, have transformed the construction industry. These advancements have led to increased operational efficiency, reduced downtime, and improved equipment fleet control. As a result, rental companies offer certified pre-owned machinery that is equipped with these modern innovations, ensuring that customers receive machinery that is fuel-efficient, reliable, and technologically advanced. The real estate industry and civil engineering sector are significant consumers of used construction machinery.

- Dealers play a crucial role in providing these companies with access to a diverse range of machinery, ensuring that they can meet the demands of their projects efficiently and cost-effectively. In conclusion, the market is a dynamic and evolving landscape, driven by the need for flexibility, cost savings, and technological innovation. Online marketplaces have emerged as essential intermediaries, connecting buyers and sellers, and enabling the efficient use of machinery in various construction activities.

Exclusive Customer Landscape

The used construction machinery market market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB Volvo - Our company specializes in the sale of high-quality used construction machinery in the United States. Equipment offerings include excavators, wheel loaders, dump trucks, dozers, and numerous other machines to meet the diverse needs of the construction industry. We ensure each piece of machinery undergoes thorough inspections and maintenance before being sold, providing our clients with reliable and efficient solutions for their projects.

The market research and growth report includes detailed analyses of the competitive landscape of the used construction machinery market industry and information about key companies, including:

- AB Volvo

- Ais Construction Equipment Service Corp.

- Caterpillar Inc.

- Deere and Co.

- Equippo AG

- Guangxi LiuGong Machinery Co. Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Construction Equipment Co. Ltd.

- Infra Bazaar

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr International AG

- Mico Cranes & Equipment LLC

- Plantmaster UK

- Ritchie Bros. Auctioneers Inc.

- Shriram Automall India Ltd.

- Tadano Ltd.

- Terex Corp.

- Vintage Infra Equipment Solution Pvt. Ltd.

- XCMG Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for infrastructure development and urbanization. With technological innovation at the forefront, online platforms have become a popular avenue for procuring used heavy machinery, including excavators, loaders, cranes, and earthmoving equipment. Urbanization has led to an increase in residential and commercial construction projects, driving the demand for construction machinery. Technological advancements, such as telematics, GPS tracking, autonomous features, and automation, have transformed technology-enabled equipment into valuable assets for contractors in various sectors. Rapid urbanization and economic uncertainty have led to a growing preference for used machinery, as they offer cost savings and flexibility.

Depreciation of new machinery and the availability of modern innovations in used machinery have made it an attractive option for contractors. Fuel efficiency is a critical factor in the market, as it directly impacts operational efficiency and reduces overall costs. Rental equipment has become increasingly popular due to its flexibility and cost-effectiveness, particularly in the real estate industry and infrastructure projects. The construction sector is undergoing a digital transformation, with online marketplaces and third-party e-commerce websites offering a wide range of used machinery options. Atlas Crane Service and other dealers are leveraging technology to provide certified pre-owned programs, ensuring the quality and reliability of used machinery.

The civil engineering sector is a significant contributor to the market, with a high demand for motor graders and other earthmoving equipment. Infrastructure projects, such as railway tunnels, port extensions, underwater tunnels, and power sector development, require large quantities of used machinery to meet project deadlines. The high-speed rail market and Olympic games have further boosted the demand for used machinery, as they require significant infrastructure development and construction activities. Economic uncertainty and the need for operational efficiency have led contractors to seek out used machinery with the latest technological features, such as telematics and GPS tracking. In conclusion, the market is experiencing robust growth due to the increasing demand for infrastructure development and urbanization.

Technological innovation, cost savings, and operational efficiency are key drivers in the market, with online platforms and dealers offering a wide range of options for contractors. The future of the market looks promising, as it continues to play a vital role in meeting the infrastructure needs of various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2023-2027 |

USD 27.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

5.07 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB Volvo, Ais Construction Equipment Service Corp., Caterpillar Inc., Deere and Co., Equippo AG, Guangxi LiuGong Machinery Co. Ltd., Hitachi Construction Machinery Co. Ltd., Hyundai Construction Equipment Co. Ltd., Infra Bazaar, Kobelco Construction Machinery Co. Ltd., Komatsu Ltd., Liebherr International AG, Mico Cranes & Equipment LLC, Plantmaster UK, Ritchie Bros. Auctioneers Inc., Shriram Automall India Ltd., Tadano Ltd., Terex Corp., Vintage Infra Equipment Solution Pvt. Ltd., and XCMG Group |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the used construction machinery market industry growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch