Video Streaming And Broadcasting Equipment Market Size 2025-2029

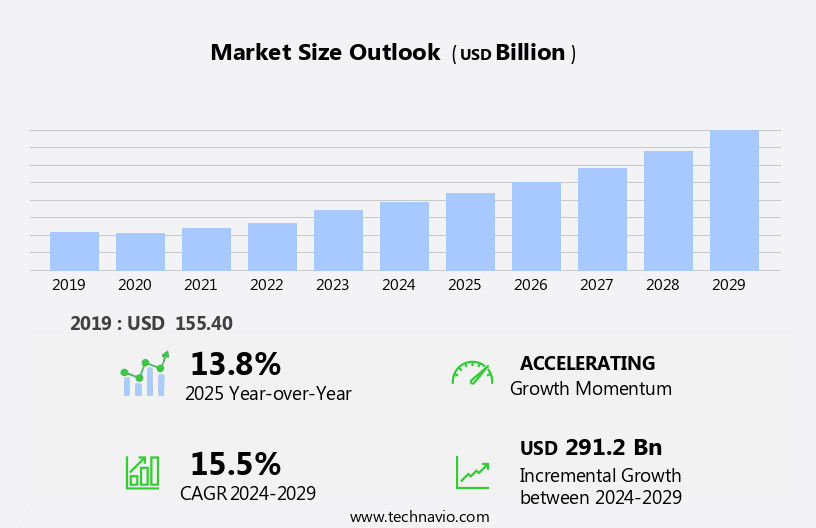

The video streaming and broadcasting equipment market size is forecast to increase by USD 291.2 billion, at a CAGR of 15.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the heightened demand for encoders capable of supporting multiple broadcasting formats. This trend reflects the increasing consumer preference for diverse content offerings and the need for broadcasters to remain competitive in the market. Additionally, the application of advanced technologies such as artificial intelligence (AI), deep learning (DL), and machine learning (ML) is on the rise, enabling more personalized content recommendations and enhancing viewer experience. However, this market landscape is not without challenges.

- The increase in cyberattacks poses a significant threat, with sensitive data and intellectual property at risk. Companies must prioritize cybersecurity measures to mitigate these risks and safeguard their operations. To capitalize on market opportunities and navigate challenges effectively, industry players must stay abreast of emerging trends and invest in innovative solutions to meet evolving consumer demands.

What will be the Size of the Video Streaming And Broadcasting Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the increasing demand for high-quality content delivery across various sectors. Video analytics, closed captioning, and virtual studios are increasingly integrated into the broadcasting landscape, enhancing the viewer experience and enabling more personalized content. Video cameras capture 4K and even 8K resolution footage, while audio processing ensures crystal-clear sound. Broadcast automation streamlines production workflows, allowing for more efficient and cost-effective operations. Unicast streaming and on-demand viewing are complemented by live streaming, which requires robust network infrastructure and low-latency streaming capabilities. Signal processing and video transcoding are essential for ensuring seamless delivery of content across different platforms and devices.

The market dynamics are continuously unfolding, with emerging technologies such as fiber optic cables, wireless transmission, and cloud-based streaming reshaping the industry. Virtual production and remote production are gaining traction, while video players and digital signage applications expand the reach of video content. HDR video and ultra-high-definition (UHD) video further enhance the visual experience, pushing the boundaries of what is possible in video streaming and broadcasting. The integration of various technologies, including video codecs, streaming protocols, and broadcast encoders, enables the delivery of high-quality content with minimal latency and maximum reliability. The market's ongoing evolution reflects the industry's commitment to meeting the ever-evolving demands of content creators and consumers alike.

How is this Video Streaming And Broadcasting Equipment Industry segmented?

The video streaming and broadcasting equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Video streaming

- Broadcasting equipment

- Application

- Private

- Commerce

- Service Type

- Over-the-top

- Satellite

- Cable

- Terrestrial

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

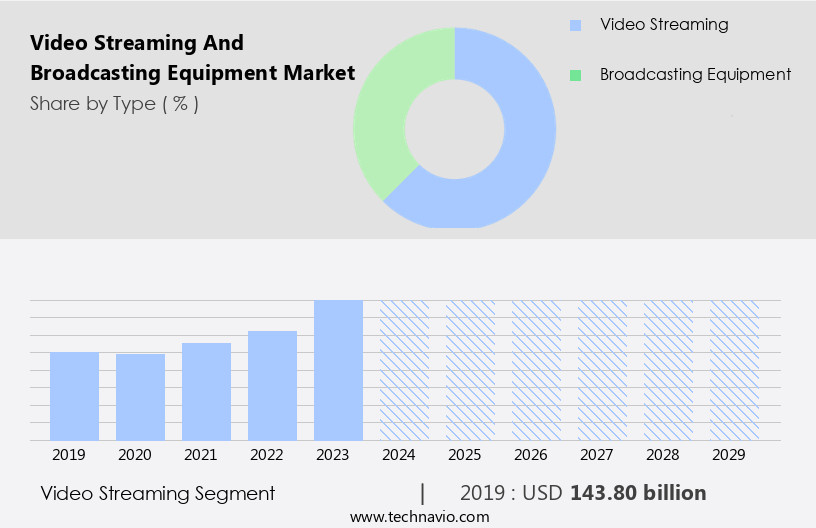

The video streaming segment is estimated to witness significant growth during the forecast period.

The video streaming market is experiencing significant growth due to the increasing popularity of online video platforms for various applications. IP video streaming, a key technology, enables uninterrupted viewing and listening to content as it downloads. This feature is particularly valuable in educational settings, where professors and teachers can conduct lectures and classes using video capture tools and software, and then publish them online for students to access. Video compression, satellite transmission, and microwave transmission technologies facilitate efficient and reliable delivery of video content. Moreover, streaming protocols such as adaptive bitrate streaming ensure optimal video quality based on available bandwidth.

The integration of metadata tagging, video analytics, and closed captioning enhances the user experience. Video conferencing and virtual studios enable remote production and broadcast automation, further expanding the market's reach. Technologies like 8k video, high-definition (HD) video, ultra-high-definition (UHD) video, and HDR video offer improved visual quality, driving demand. Network infrastructure, including fiber optic cables and wireless transmission, supports the delivery of these advanced video formats. Video transcoding, signal processing, and audio processing technologies ensure compatibility and optimal playback across various devices. Cloud-based streaming and on-premise streaming solutions cater to diverse business needs. In summary, the video streaming market is evolving to meet the demands of various industries and applications, driven by advancements in video technologies and the increasing importance of online content delivery.

The Video streaming segment was valued at USD 143.80 billion in 2019 and showed a gradual increase during the forecast period.

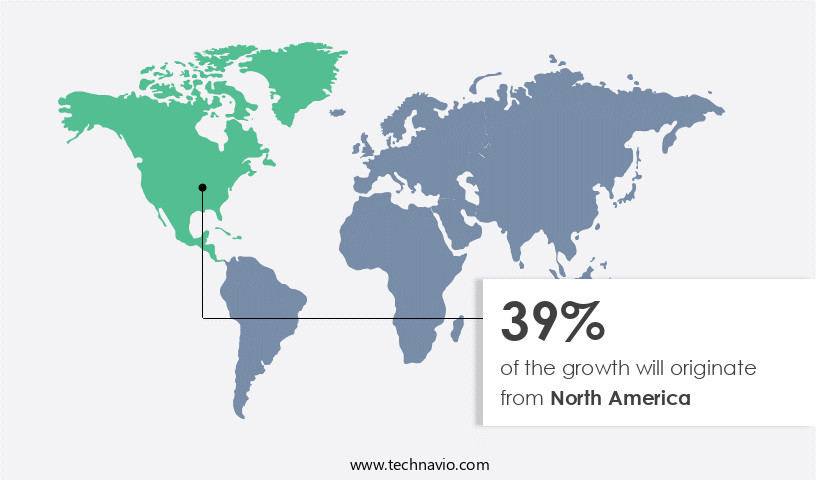

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for video streaming and broadcasting equipment is experiencing notable growth due to several key factors. The region's substantial media and entertainment industry, marked by a large number of cable and satellite TV channels and the presence of prominent broadcasting companies and satellite manufacturers, significantly contributes to market expansion. Furthermore, the increasing cultural diversity in North America has led to an increase in the number of broadcast channels, thereby fueling demand for advanced broadcasting equipment. Advancements in technology have also played a pivotal role in market growth. The launch of new TVs and radios with advanced features, such as high-definition (HD) and ultra-high-definition (UHD) displays, 8k video, HDR video, and adaptive bitrate streaming, have driven the adoption of advanced video streaming and broadcasting equipment.

Moreover, the emergence of cloud-based streaming, remote production, and virtual studios has enabled broadcasters to produce and distribute content more efficiently and cost-effectively. Additionally, the integration of video analytics, closed captioning, and video monitoring tools has facilitated better content management and audience engagement. The market's growth is further propelled by the adoption of fiber optic cables, satellite transmission, microwave transmission, and wireless transmission for network infrastructure. Broadcast encoders, streaming servers, and video transcoding solutions have become essential components of the broadcasting ecosystem, ensuring seamless content delivery to viewers. In conclusion, the North American market for video streaming and broadcasting equipment is poised for significant growth due to the increasing number of broadcast channels, the presence of a well-established media and entertainment industry, and the adoption of advanced technologies.

The integration of various components, such as video codecs, streaming protocols, video analytics, and video conferencing, has enabled broadcasters to deliver high-quality content to viewers in a timely and efficient manner.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, encompassing technologies that enable the production, transmission, and playback of high-quality video content. This market caters to various sectors, including media and entertainment, education, healthcare, and corporate communications. Key players in this market offer solutions for live streaming, video on demand, and broadcast automation. Advanced video compression algorithms, such as H.264 and H.265, ensure efficient delivery of content over the internet. Meanwhile, adaptive bitrate streaming ensures seamless viewing experiences across different network conditions. Integration of social media platforms and real-time analytics further enhances audience engagement and monetization opportunities. Moreover, the market is witnessing the rise of 4K and 8K video resolutions, immersive audio formats like Dolby Atmos, and the integration of artificial intelligence and machine learning for content recommendation and personalization. Additionally, the increasing adoption of cloud-based solutions and the Internet of Things (IoT) in broadcasting and streaming applications further propels market growth.

What are the key market drivers leading to the rise in the adoption of Video Streaming And Broadcasting Equipment Industry?

- The escalating requirement for encoders capable of handling multiple broadcasting formats is the primary market driver.

- In the realm of media broadcasting, encoders play a pivotal role in ensuring accurate conversion of input signals into coded output signals, supporting various formats such as audio, video, and image data. The increasing popularity of Over-The-Top (OTT) services has propelled the demand for encoders in the broadcasting industry. OTT platforms deliver media content over the Internet without relying on cable technology, necessitating superior video quality for subscribers. Encoders enable the sports and media and entertainment industry to facilitate remote production, operation, and live production from the cloud, making them an indispensable component in this sector. Additionally, technologies like fiber optic cables, wireless transmission, video transcoding, adaptive bitrate streaming, and broadcast encoders fortify the network infrastructure.

- Furthermore, video conferencing applications benefit from encoders to deliver high-quality visuals and seamless communication. Graphics rendering also relies on encoders to ensure smooth and immersive experiences for end-users. Overall, encoders' significance in media broadcasting is emphasized by their ability to optimize content delivery and enhance viewer experience.

What are the market trends shaping the Video Streaming And Broadcasting Equipment Industry?

- The application of artificial intelligence (AI), deep learning (DL), and machine learning (ML) technologies is gaining significant momentum in the market. These advanced technologies are increasingly being adopted to improve efficiency, automate processes, and enhance productivity across various industries.

- The market is experiencing significant growth due to technological advancements and the increasing popularity of online video platforms. Artificial intelligence (AI) is a key technology driving innovation in this industry, enhancing various aspects of video production and delivery. AI applications include content scoring, editing, cinematography, scriptwriting, voice-overs, and more. Major streaming providers are utilizing AI to improve content quality and engage audiences. Furthermore, the continuous growth of online streaming services on various media platforms, such as YouTube and Netflix, is projected to continue in the near future. Additionally, platforms like Facebook use AI to remove offensive content, ensuring a positive user experience.

- High-definition (HD) video and 4k resolution are becoming industry standards, necessitating advanced signal processing and audio processing technologies. Virtual studios and broadcast automation systems are also gaining traction, enabling cost-effective and efficient production. Overall, the market is poised for growth, with technological advancements and evolving consumer preferences shaping its future.

What challenges does the Video Streaming And Broadcasting Equipment Industry face during its growth?

- The escalating number of cyberattacks poses a significant threat to industry growth, requiring heightened vigilance and advanced security measures to mitigate potential damages and ensure business continuity.

- In the realm of video streaming and broadcasting, cybersecurity remains a paramount concern due to the increasing threat of cyberattacks. These attacks can result in significant financial and reputational damage for companies, as sensitive information such as user content and data can be compromised. Cybercriminals often target broadcasting operators, disrupting operational networks and posing significant challenges to market growth. Identifying and preventing cyberattacks in real-time is a complex task, making them a persistent hurdle for the market. Despite these challenges, the market continues to evolve, driven by advancements in technology. On-premise streaming solutions offer improved control and security, while low-latency streaming ensures a seamless user experience.

- Audio mixing and video monitoring tools enhance production quality, and digital signage solutions expand advertising opportunities. Cloud-based streaming and remote production enable cost savings and increased flexibility, while video players support advanced formats such as HDR video and ultra-high-definition (UHD) video. As the market adapts to these trends, it remains committed to addressing cybersecurity challenges and delivering high-quality, immersive experiences for users.

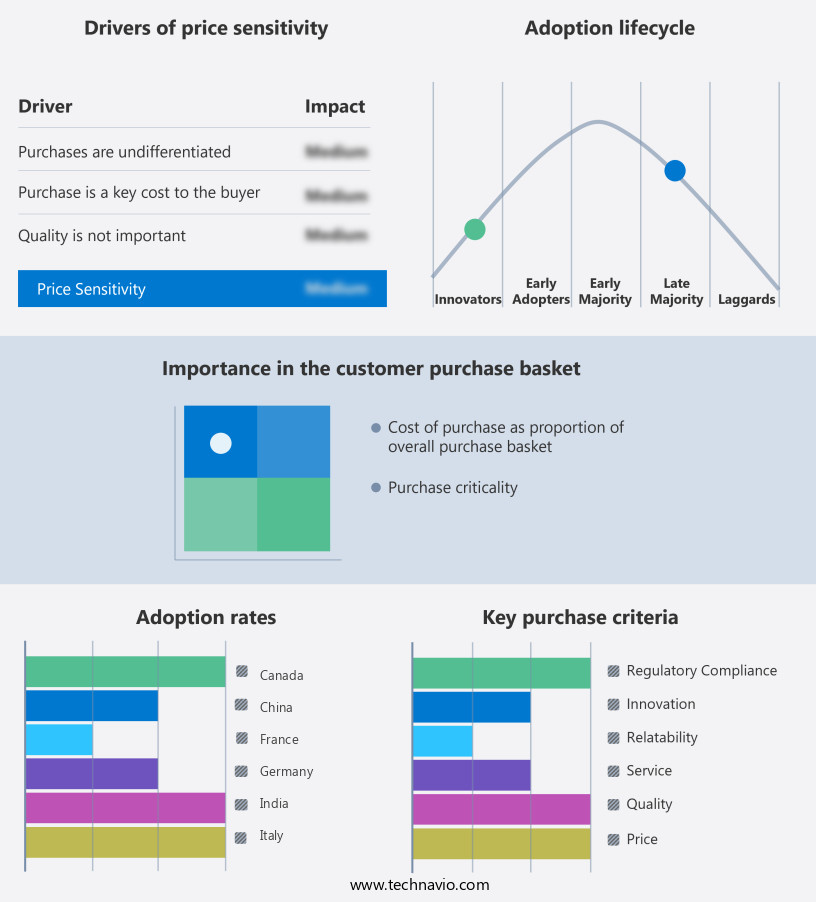

Exclusive Customer Landscape

The video streaming and broadcasting equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the video streaming and broadcasting equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, video streaming and broadcasting equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akamai Technologies Inc. - This company specializes in video streaming and broadcast technology, providing a cloud video intelligence API that supports industry-standard protocols such as RTSP, RTMP, and HLS for seamless live streaming experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Alphabet Inc.

- Apple Inc.

- Belden Inc.

- Brightcove Inc.

- Cisco Systems Inc.

- Clyde Broadcast

- CommScope Holding Co. Inc.

- ETL Systems Ltd.

- EVS Broadcast Equipment S.A.

- Global Invacom Group Limited

- Grass Valley Canada

- Harmonic Inc.

- International Business Machines Corp.

- Kaltura Inc.

- Roku Inc.

- Telefonaktiebolaget LM Ericsson

- Wilhelm Sihn jr. GmbH and Co. KG

- Wowza Media Systems LLC

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Video Streaming And Broadcasting Equipment Market

- In January 2024, Comcast Corporation announced the launch of its new streaming service, Peacock Free, offering free ad-supported content to attract a broader audience. This strategic move aimed to compete more effectively with other major streaming platforms (Comcast Corporation Press Release, 2024).

- In March 2024, Amazon Web Services (AWS) and Disney Media & Entertainment Distribution entered into a multi-year agreement for Disney to use AWS as its preferred cloud provider for media workflows and streaming services, such as Disney+ (Amazon Web Services Press Release, 2024).

- In May 2024, Sony Corporation completed its acquisition of Brightcove Inc., a leading video technology company, for approximately USD625 million. This acquisition was aimed at expanding Sony's video streaming capabilities and enhancing its position in the market (Sony Corporation Press Release, 2024).

- In April 2025, the European Union (EU) approved the merger of Discovery, Inc. And WarnerMedia, creating a new global media powerhouse. The combined entity will have a significant impact on the video streaming and broadcasting market, with a vast content library and increased scale (European Commission Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant advancements, with OTT platforms leading the charge in delivering personalized content to viewers. Targeted advertising and audience measurement are key drivers, enabling content personalization and optimizing content delivery. Social media video and 360-degree video are transforming audience engagement, while video advertising platforms leverage access control and digital watermarking for monetization. Interactive video and live event streaming require robust content delivery optimization and bandwidth management.

- Broadcast monitoring, channel branding, and network monitoring ensure regulatory compliance and maintain security protocols. Streaming analytics dashboards and playout systems provide valuable user engagement metrics and streamline ad insertion. Video editing software and security protocols are essential components of the ecosystem, ensuring high-quality content and protecting intellectual property.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Video Streaming And Broadcasting Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.5% |

|

Market growth 2025-2029 |

USD 291.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.8 |

|

Key countries |

US, Canada, UK, Germany, China, Italy, Mexico, France, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Video Streaming And Broadcasting Equipment Market Research and Growth Report?

- CAGR of the Video Streaming And Broadcasting Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the video streaming and broadcasting equipment market growth of industry companies

We can help! Our analysts can customize this video streaming and broadcasting equipment market research report to meet your requirements.