Vinyl Flooring Market Size 2024-2028

The vinyl flooring market is estimated to grow by USD 12.63 billion at a CAGR of 7.06% between 2023 and 2028. The increase in building and construction activities, particularly in residential and commercial sectors, is boosting demand for flooring materials like LVTs. The low cost and easy maintenance of LVTs make them a popular choice for consumers looking for durable and affordable flooring options. The growing demand for luxury vinyl tiles, known for their high-quality appearance and durability, is further driving market growth as consumers increasingly prefer them over traditional flooring materials. Additionally, the versatility of luxury vinyl tiles in terms of design and installation options makes them a preferred choice for various applications, further driving market growth. The durability of LVTs, which can withstand heavy foot traffic and are resistant to moisture and stains, also contributes to their popularity in both residential and commercial settings.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Segmentation

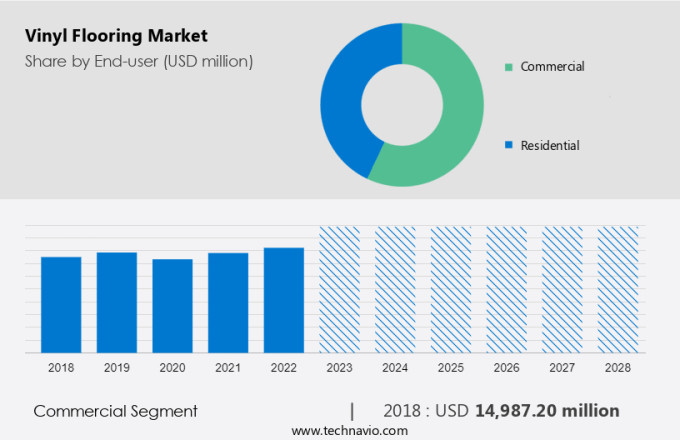

By End-User

The market share growth of the commercial segment will be significant during the forecast period. The growth of the commercial segment, which includes retail buildings and office buildings, is driving the demand for these in this segment. The number of hotels, hospitals, restaurants, educational institutions, and storage warehouses is increasing rapidly across the world. For instance, the commercial building floor space globally is expected to register a 39% increase during 2017-2050. Thus, the growth of the commercial segment will lead to an increase in demand during the forecast period.

Get a glance at the market contribution of various segments Request a PDF Sample

The commercial segment was valued at USD 14.98 billion in 2018. Demand for LVT in the commercial segment is growing at a rapid pace, given its superior ergonomics and easy upkeep. Luxury Vinyl Tile (LVT) is highly suitable for dense traffic areas as its wear-resistant properties are superior to softcover floorings. The commercial end-user segment of the market is thus expected to grow steadily during the forecast period.

By Region

For more insights on the market share of various regions Request PDF Sample now!

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. China, India, and Japan are the major countries that will contribute to the growth of the market during the forecast period. Although this is not as popular in APAC as in Europe and North America, these products, especially LVT, are expected to be increasingly accepted by the commercial and residential end-user industries during the forecast period. Therefore, the growth of the construction market, together with the increasing adoption of these materials, will fuel the growth of the market in APAC. In Australia, the construction industry's growth is spurred by renovation projects. Renovation work includes a change of paints, flooring, and expansion of bedrooms and bathrooms. Flooring is one of the major renovations carried out in the country. Vinyl tiles are more readily accepted than hardwood flooring for their cost-effectiveness and superior ergonomics. Overall, the market in APAC is expected to post strong year-over-year growth during the forecast period.

Market Dynamics and Customer Landscape

In both residential and commercial applications, the demand for innovative flooring solutions continues to grow, driven by factors such as aesthetics, moisture resistance, and sustainable practices. Flooring installers play a crucial role in implementing construction solutions that cater to diverse needs, from sports activities areas requiring slip-resistant surfaces to healthcare facilities demanding stain-resistant and waterproof floor coverings for hygiene and safety. Modern interior looks emphasize color and texture customization, enhancing the overall appeal of spaces in residential houses and commercial facilities alike. The service industry benefits from resilient floorings that withstand heavy foot traffic and maintain their integrity over time. As the flooring sector evolves, advancements in moisture-resistant materials and sustainable practices underscore a commitment to environmental responsibility while meeting the functional and aesthetic demands of diverse environments.

Key Market Driver

The low cost and easy maintenance are notably driving the market growth. Luxury Vinyl Tile (LVT) is a cost-effective flooring option, priced at nearly one-third the cost of hardwood flooring. Maintaining hardwood floors requires substantial material processing and finishing, driving up costs. In contrast, Luxury Vinyl Tile (LVT) typically uses PVC and calcium carbonate, which are more affordable materials. This cost difference is particularly beneficial for industrial structures and construction activities where cost-effective flooring solutions like LVT, Interface luxury vinyl tile, and Wood Plastic Composite (WPC) are preferred over more expensive options like hardwood or laminate flooring. Commercial builders favor LVT due to its durability and ability to withstand high-traffic areas.

Furthermore, in terms of maintenance, LVT is easier to care for compared to hardwood floors, which require regular maintenance checks. Additionally, LVT can be installed more quickly than hardwood flooring. This ease of maintenance and installation makes LVT a preferred choice for both commercial and residential builders. The combination of low cost and easy maintenance is expected to drive the growth of the LVT market in the coming years.

Significant Market Trend

Vinyl planks making a comeback is the key trend in the market. Vinyl planks are stylish, affordable, and exhibit good resilience. These advancements in vinyl planks over the first-generation have enabled vinyl planks to make a strong comeback in the commercial and residential end-user industries.

Moreover, vinyl planks are offered as 100% waterproof, which enables their use in bathroom and kitchen flooring. Contemporary these planks also meet high environmental standards in terms of low emission, according to the norms of LEED credit EQ4.3 for Low-Emitting Materials. Moreover, these planks offer finishings similar to high-end hardwood flooring material at comparatively cheaper rates. Thus, the comeback of planks with superior features is expected to be a key trend in the market during the forecast period.

Major Market Challenge

High competition from substitutes is the major challenge impeding the market growth. The global flooring market is segmented into resilient and non-resilient flooring materials. These products, which is still emerging in many markets, fall under resilient flooring. Flooring materials include carpet, cork, laminate, linoleum, hardwood, stone, and ceramic.

Furthermore, the market in APAC is dominated by ceramics and accounts for nearly 70% of the overall market volume. The market in North America is dominated by carpets and ceramics, while Europe and MEA is also major consumers of carpets and ceramics. This is facing tough competition from these substitute flooring materials. In APAC, this accounts for a very low market share in terms of volume. The perceived benefits of substitutes and their easy availability are the key reasons for customer propensity toward these flooring materials. Hence, competition from substitutes is expected to get stronger over the forecast period and will be a key challenge for the market during the forecast period.

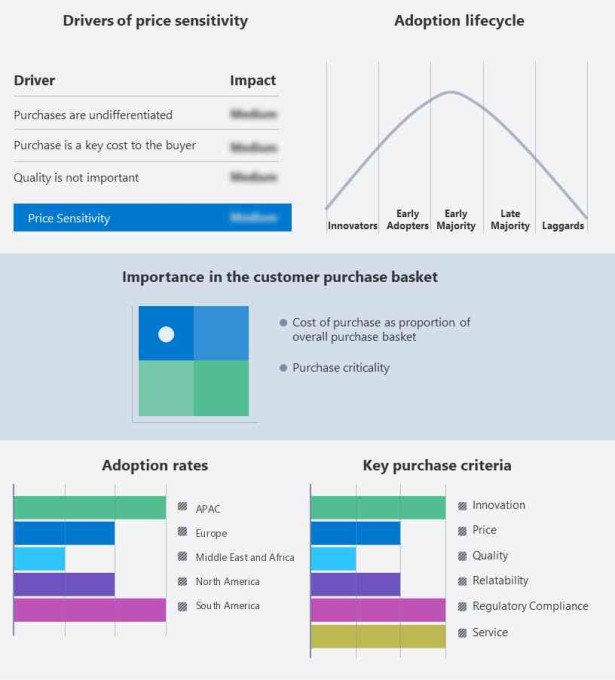

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Armstrong Flooring Inc. - The company offers vinyl flooring solutions such as Luxury Vinyl Tile. The company offers resilient flooring products for use primarily in the construction and renovation of commercial, residential and institutional buildings primarily in North America and the Pacific Rim.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- C.I. TAKIRON Corp.

- CBC Co. Ltd.

- Congoleum Corp.

- Forbo Management SA

- Gerflor

- Interface Inc.

- James Halstead plc

- LG Hausys Ltd.

- Mannington Mills Inc.

- Mohawk Industries

- Novalis Holdings

- Responsive Industries Ltd.

- Shaw Industries Group Inc.

- Tarkett

- Toli Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Commercial

- Residential

- Product Outlook

- Luxury vinyl tile

- Vinyl composite tile

- Vinyl sheet

- Region Outlook

- APAC

- China

- India

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- APAC

You may also interested in below market reports:

Luxury Vinyl Tile Floor Covering Market: Luxury Vinyl Tile Floor Covering Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, Canada, China, Japan, Germany - Size and Forecast

Resilient Flooring Market; Resilient Flooring Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, India, Germany - Size and Forecast

Saudi Arabia Vinyl Flooring Market: Saudi Arabia Vinyl Flooring Market by End-user, and Product - Forecast and Analysis

Market Analyst Overview

Vinyl sheets are versatile flooring options suitable for Residential application and commercial application, valued for their water resistance, stain resistance, and ease of installation. They offer a cushioned effect underfoot, combined with scratch resistance and UV-cured urethane coatings for durability. Their slip resistance and easy cleaning capabilities make them ideal for healthcare facilities and fitness centers, ensuring both safety and hygiene. Available in stylish designs with anti-slip properties, vinyl sheets meet modern architecture and building trends in single-family houses and commercial offices alike. Regulatory support enhances their appeal in meeting environmental objectives with low-maintenance and sustainable flooring solutions. With applications across schools, infrastructure, and luxurious housing projects, vinyl sheets contribute to aesthetic appeal and functional requirements, aligning with diverse interior designing needs and personal styles. Their use of recycled materials and eco-friendly production reflects a commitment to environmental responsibility in contemporary construction and design practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.06% |

|

Market growth 2024-2028 |

USD 12.63 billion |

|

Market structure |

USD Fragmented |

|

YoY growth 2023-2024(%) |

6.6 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AHF Products, C.I. TAKIRON Corp., CBC Co. Ltd., Congoleum Corp., Forbo Management SA, Gerflor Group, Interface Inc., James Halstead plc, LX Hausys Ltd, Mannington Mills Inc., Mohawk Industries Inc., Novalis Holdings, Responsive Industries Ltd., Shaw Industries Group Inc., Tarkett, and Toli Corp. |

|

Market dynamics |

Parent market analysis, Market forecasting growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch