VPN Market Size 2025-2029

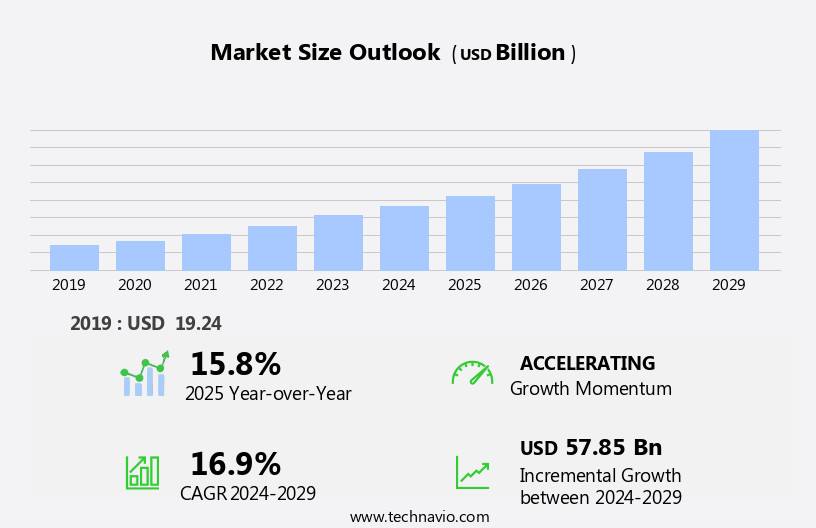

The vpn market size is forecast to increase by USD 57.85 billion, at a CAGR of 16.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of bring-your-own-device (BYOD) policies and the surge in cloud-based services. The flexibility and convenience offered by these trends have led to a rise in the number of organizations allowing employees to use their personal devices for work purposes. Simultaneously, the shift to cloud services has resulted in an increased need for secure and private connections to access sensitive data and applications. However, the market faces challenges as well. Open-source VPN solution providers are gaining traction, offering cost-effective alternatives to commercial VPN solutions. These free options can pose a threat to market players, particularly for small and medium-sized businesses with limited budgets.

- To remain competitive, companies must focus on providing value-added services and ensuring robust security features to differentiate themselves from open-source alternatives. Navigating this dynamic market landscape requires strategic planning and a deep understanding of customer needs and preferences. Companies that can effectively address the challenges and capitalize on the opportunities presented by these trends will be well-positioned for success.

What will be the Size of the VPN Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic applications across various sectors, including network infrastructure, secure remote access, and secure web browsing. Virtual networks provide entities with anonymous browsing and technical support, ensuring data security through features such as kill switches, SSL/TLS, VPN servers, and VPN security. Multi-factor authentication, VPN subscriptions, VPN software, intrusion prevention systems, no-logs policies, and identity protection are integrated components. Routing protocols, VPN appliances, and VPN stability are essential for network virtualization and data leakage prevention. Logging policies, data encryption, and VPN speed are critical for maintaining network security and privacy. Customer support, IP address masking, split tunneling, and phishing protection are integral to online privacy and VPN services.

Censorship circumvention, network security, and VPN providers are crucial for cloud computing and server infrastructure. Data compression, malware protection, and geo-restriction bypass are additional features that enhance VPN reliability and digital privacy. Encryption protocols, two-factor authentication, VPN gateways, location spoofing, L2TP/IPsec, bandwidth throttling, and network latency are ongoing concerns for VPN users. The market's continuous unfolding reveals a vibrant ecosystem, with entities adapting to evolving patterns and requirements. VPN privacy, zero-knowledge VPN, and VPN reliability remain top priorities for businesses and individuals alike.

How is this VPN Industry segmented?

The vpn industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- MPLS

- IP

- Others

- End-user

- Commercial

- Individual

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

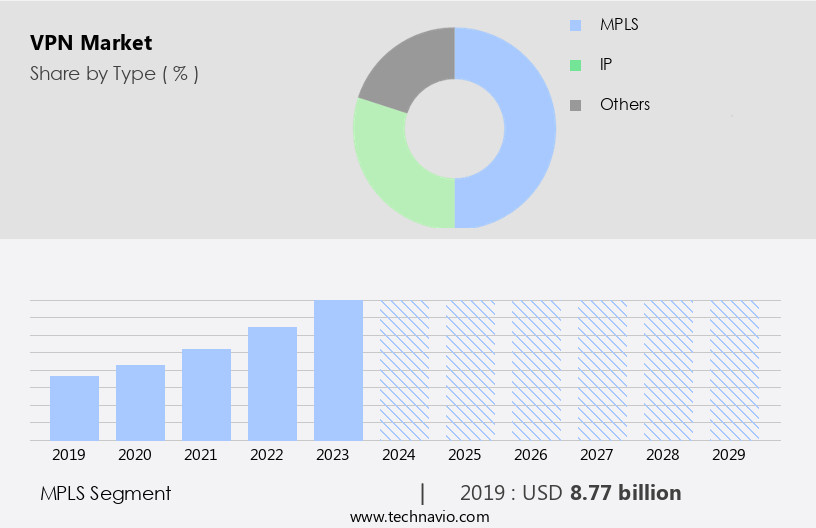

The mpls segment is estimated to witness significant growth during the forecast period.

In today's business landscape, securing network infrastructure and ensuring secure remote access have become paramount. Virtual Private Networks (VPNs) have emerged as a preferred solution, offering features such as secure web browsing, data encryption, and intrusion detection. MPLS VPNs, in particular, have gained popularity due to their superior performance and security. These networks provide uninterrupted accessibility, essential for businesses, while also offering built-in disaster recovery and business continuity features. MPLS VPNs employ advanced routing protocols, such as L2TP/IPsec, to ensure secure data transmission. Furthermore, they offer data leakage prevention, logging policy compliance, and multi-factor authentication for enhanced security. VPN appliances and concentrators ensure vpn stability, while kill switches and SSL/TLS protocols add an extra layer of protection.

Moreover, MPLS VPNs cater to the need for anonymous browsing and censorship circumvention, ensuring online privacy. They also offer data compression and malware protection, ensuring efficient and secure cloud computing. Network virtualization and identity protection are additional benefits, making MPLS VPNs an indispensable part of network security for businesses. Customer support and technical assistance are crucial for businesses, and MPLS VPN providers offer reliable and responsive support. VPN services also prioritize vpn speed and reliability, ensuring uninterrupted access to critical applications and services. In conclusion, MPLS VPNs have evolved as a comprehensive solution for businesses, addressing the need for secure network infrastructure, remote access, and data protection.

These networks offer various features, including data encryption, intrusion prevention, and phishing protection, ensuring a robust and secure digital environment for businesses.

The MPLS segment was valued at USD 8.77 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

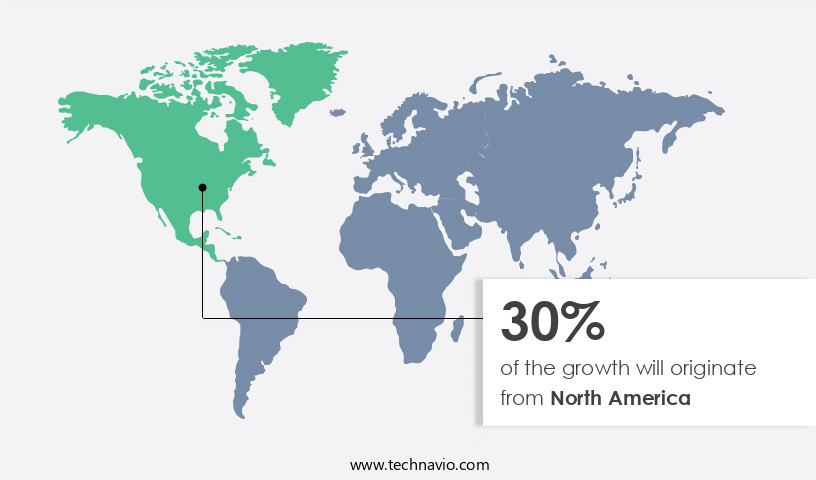

North America is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the escalating need for robust network security solutions. With the increasing adoption of bring your own device (BYOD) policies and IoT-based devices, the requirement for secure remote access and virtual networks has become imperative. The market's expansion is further fueled by the rising instances of cyberattacks and data breaches, leading to stringent regulations on data security and consumer privacy. In response, businesses are investing in advanced security measures, such as data leakage prevention, intrusion detection systems, and encryption protocols like SSL/TLS and IPsec (L2TP). VPN appliances and software provide secure web browsing and anonymous browsing, while kill switches ensure data privacy in case of network disconnections.

Additionally, VPN services offer data compression, malware protection, and geo-restriction bypass, enabling seamless access to cloud computing and server infrastructure. Network virtualization, zero-knowledge VPNs, and identity protection further bolster the market's growth. VPN reliability, vpn speed, customer support, and technical support are essential factors that influence the market's dynamics. Furthermore, multi-factor authentication, no-logs policy, vpn concentrators, and vpn gateways provide an additional layer of security and privacy. Network security providers continue to innovate, offering features like phishing protection, online privacy, and censorship circumvention to cater to the evolving needs of businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic digital landscape, the market continues to thrive, offering secure and private browsing solutions for individuals and businesses worldwide. Virtual Private Networks (VPNs) encrypt internet traffic, ensuring data security and privacy. VPN services provide access to geo-restricted content, enabling users to bypass censorship and access global streaming platforms. VPNs also offer protection against cyber threats, such as hacking and malware, making them an essential tool in today's connected world. Features like split tunneling, kill switches, and multiple devices support further enhance their appeal. The market caters to diverse needs, with various pricing plans, protocols, and server locations available. VPNs are not just for tech-savvy users but have become a must-have for anyone seeking online security and freedom.

What are the key market drivers leading to the rise in the adoption of VPN Industry?

- The increasing prevalence of bring-your-own-device (BYOD) policies is the primary factor fueling market growth. This trend, which allows employees to use their personal devices for work purposes, has gained significant traction in recent years due to its numerous benefits, including increased productivity, flexibility, and cost savings for both employers and employees.

- The Bring Your Own Device (BYOD) trend in business allows employees to use their personal devices for work-related tasks, enhancing productivity and efficiency. With the advancement of IT infrastructure, organizations are adopting this practice, enabling employees to access corporate data and resources from anywhere. A Virtual Private Network (VPN) is a crucial component of this infrastructure, ensuring secure remote access to the organization's network. VPNs offer data breach prevention through encryption, securing web browsing, and implementing intrusion detection systems. VPN appliances prioritize routing protocols, ensuring VPN stability, and provide data leakage prevention through logging policies. Data encryption is essential for maintaining the confidentiality of corporate information, while VPN speed is crucial for efficient access.

- Customer support is another essential factor in choosing a VPN solution. A reliable VPN provider offers responsive and effective support to ensure minimal downtime and maximum network uptime. In summary, VPNs are a vital aspect of an organization's network infrastructure, providing secure remote access, data breach prevention, and efficient communication for employees using personal devices.

What are the market trends shaping the VPN Industry?

- The increasing prevalence of cloud-based services represents a significant market trend in the professional world. This shift towards cloud solutions is driven by their numerous benefits, including flexibility, scalability, and cost savings.

- Virtual Private Networks (VPNs) have gained significant traction in the business world due to their ability to enhance online security and privacy. VPNs enable anonymous browsing by encrypting data transmitted over the internet, ensuring that sensitive information remains confidential. This is particularly important for businesses that handle large volumes of data, such as financial institutions and healthcare providers. VPNs also offer technical support, multi-factor authentication, and an SSL/TLS handshake for added security. A kill switch is another essential feature that disconnects the internet connection if the VPN connection drops, preventing unsecured data transmission. The adoption of VPNs is driven by the increasing need for identity protection and intrusion prevention systems.

- VPN subscriptions have become a cost-effective solution for businesses, eliminating the need for expensive hardware and maintenance costs associated with traditional VPN concentrators. VPN software is easy to install and use, making it an accessible solution for businesses of all sizes. With a no-logs policy, businesses can trust that their data is not being recorded or shared with third parties. Cloud computing solutions have become increasingly popular, and the integration of VPNs with cloud services offers additional benefits. Businesses can manage their data securely and efficiently, reducing capital expenditure and operational costs. VPNs offer a harmonious solution for businesses seeking to protect their data while leveraging the benefits of cloud computing.

What challenges does the VPN Industry face during its growth?

- Open-source VPN solution providers pose a significant threat to the industry's growth, as their offerings challenge traditional business models and pricing structures. This challenge necessitates continuous innovation and adaptation from industry players to remain competitive.

- The market faces competition from numerous open-source VPN providers, posing a significant challenge. Open-source solutions like Libreswan, OpenVPN, and OpenConnect offer enterprises cost-effective VPN functionality. These companies provide a variety of tools and applications, enabling comprehensive coverage of functionalities offered by on-premises or cloud VPN providers. Open-source VPN solutions cater to desktop applications, supporting platforms such as Linux, Mac, and Windows, and mobile applications for Android and iOS. Small and Medium Enterprises (SMEs) are the primary consumers due to their budget constraints.

- Network virtualization, VPN privacy, zero-knowledge VPN, VPN reliability, ip address masking, split tunneling, phishing protection, online privacy, VPN service, censorship circumvention, network security, and VPN provider are integral aspects of the market. Cloud computing and server infrastructure also play crucial roles in the market's growth. Open-source VPN solutions contribute significantly to the market's dynamics, offering a cost-effective alternative while maintaining security and functionality.

Exclusive Customer Landscape

The vpn market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vpn market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vpn market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Absolute Software Corp. - Our VPN network service shields users from malicious sources, adverts, adware, and trackers, ensuring a secure and uninterrupted online experience. This innovative solution blocks unwanted elements, enhancing privacy and security.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Absolute Software Corp.

- AirVPN

- Array Networks Inc.

- Avast Software sro

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Citrix Systems Inc.

- ExpressVPN

- Google LLC

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Juniper Networks Inc.

- Microsoft Corp.

- NCP engineering GmbH

- NordVPN

- Oracle Corp.

- Proton AG

- Sectra AB

- TunnelBear Inc.

- Ziff Davis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in VPN Market

- In January 2024, ExpressVPN, a leading VPN provider, announced the launch of its new Lightway protocol, designed to deliver faster and more stable connections (ExpressVPN Press Release, 2024). This technological advancement aimed to enhance user experience and strengthen the company's competitive position in the market.

- In March 2024, NordVPN, another major player, entered the Indian market, expanding its geographic reach and catering to the growing demand for online privacy and security in the region (NordVPN Press Release, 2024). This strategic move was expected to contribute significantly to the company's growth.

- In May 2024, Surfshark, a relatively new VPN provider, secured a strategic partnership with DeviceBridge, a leading IoT platform, enabling seamless integration of Surfshark's VPN services into various smart home devices (Surfshark Press Release, 2024). This collaboration aimed to expand Surfshark's customer base and broaden its market reach.

- In April 2025, ProtonVPN, a Swiss VPN provider, raised USD150 million in a Series C funding round led by KKR and DST Global (ProtonVPN Press Release, 2025). The investment was aimed at accelerating the company's product development and expanding its global presence, further solidifying its position in the competitive the market.

Research Analyst Overview

- In the dynamic the market, enterprise solutions utilizing VPN tunnels for secure network access continue to gain traction. Network Address Translation (NAT) and Port Forwarding are common techniques employed to enable secure remote access. Encryption technologies, such as AES and Chacha20, ensure data confidentiality during transmission. Weaknesses like IP and DNS leaks, however, pose potential risks. Juniper Networks and Palo Alto Networks offer robust enterprise VPN solutions, implementing military-grade encryption (RSA, AES) and public key cryptography (SSL/TLS, digital signature) for secure key exchange. Home VPN usage also persists, with streaming and gaming applications driving demand for high-speed, low-latency connections.

- Transport Layer Security (TLS) and Secure Socket Layer (SSL) provide additional layers of protection against man-in-the-middle attacks. Asymmetric encryption and certificate authorities further bolster security. Dynamic IP addresses offer flexibility, while static IP addresses ensure consistent access to specific resources. VPN connections must be configured carefully to prevent potential vulnerabilities, such as WebrTC and IP leaks. Symmetric encryption algorithms, like AES, provide strong encryption for data at rest and in transit. Overall, the market remains a crucial component of modern business infrastructure, ensuring secure and flexible access to digital resources.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled VPN Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.9% |

|

Market growth 2025-2029 |

USD 57.85 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.8 |

|

Key countries |

US, China, UK, Canada, Germany, France, India, Japan, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this VPN Market Research and Growth Report?

- CAGR of the VPN industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vpn market growth of industry companies

We can help! Our analysts can customize this vpn market research report to meet your requirements.