Europe Wall Decor Market Size 2025-2029

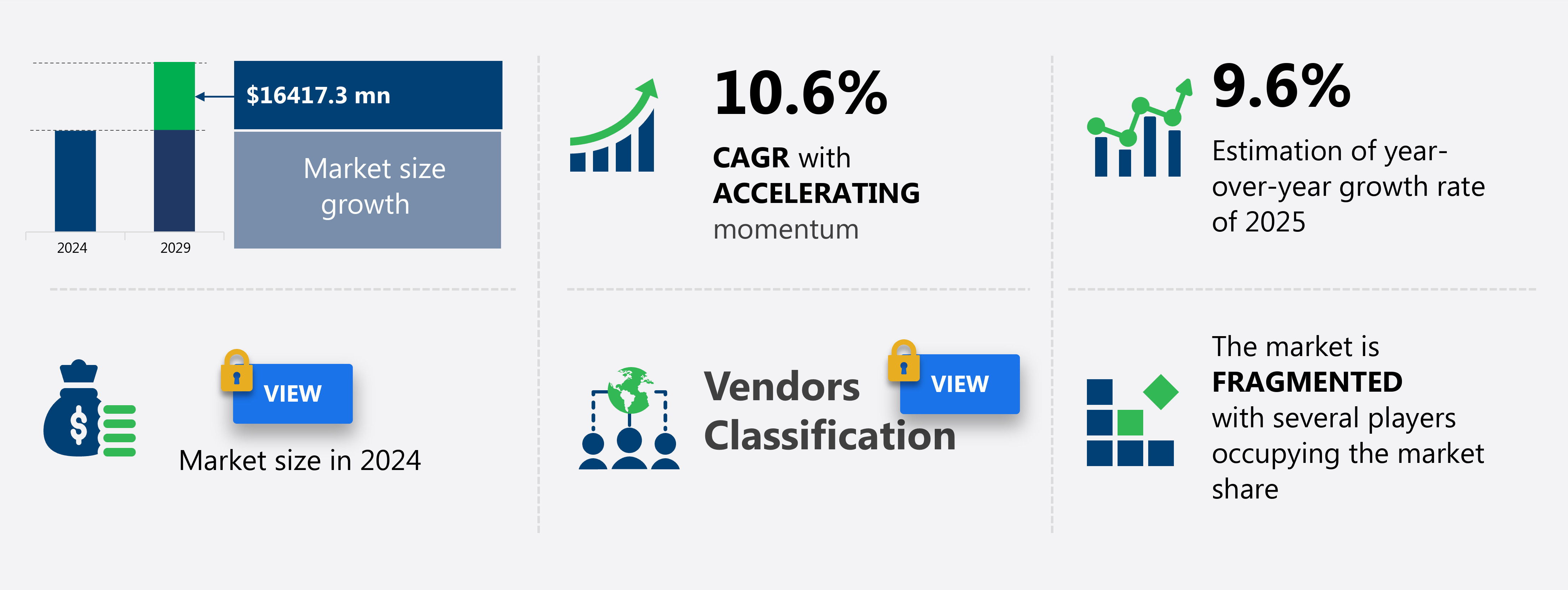

The Europe wall decor market size is forecast to increase by USD 16.42 billion at a CAGR of 10.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing sales of interior design elements such as digital print wallpaper. This trend is fueled by the growing popularity of personalized home spaces and the desire for unique and stylish wall designs. Additionally, advancements in technology, including smartphone applications and virtual reality tools, are enabling consumers to visualize and purchase wall decor online with greater ease. The adoption of smart lighting and other smart home technologies is also impacting the market, as homeowners seek convenience and energy efficiency. E-commerce platforms, including convenience stores, are capitalizing on these trends, offering a wide range of home decor options and streamlined purchasing processes. However, price wars due to low product differentiation pose a challenge for market participants, requiring them to focus on innovation and value-added services to remain competitive.

What will be the Size of the market During the Forecast Period?

- The market encompasses a diverse range of products, including paintings, wall sculptures, decals, wallpaper, and more, used to enhance interior spaces. This market exhibits strong growth, driven by the increasing popularity of smart home technology integration and the desire for personalized, unique designs. Art collections continue to be a significant segment, with consumers seeking to add character and visual interest to their living spaces. The household sector represents a substantial portion of the market, with minimalism and DIY trends influencing purchasing decisions. Nature-inspired approaches are gaining traction, as consumers seek to bring the outdoors in. Wall decor products are increasingly accessible through online shopping platforms and social media channels, enabling companies to reach a global audience.

- E-commerce sales are on the rise, with consumers drawn to the convenience and variety offered by digital marketplaces. Overall, the market is poised for continued expansion, as consumers seek to express their personal style and enhance their living environments.

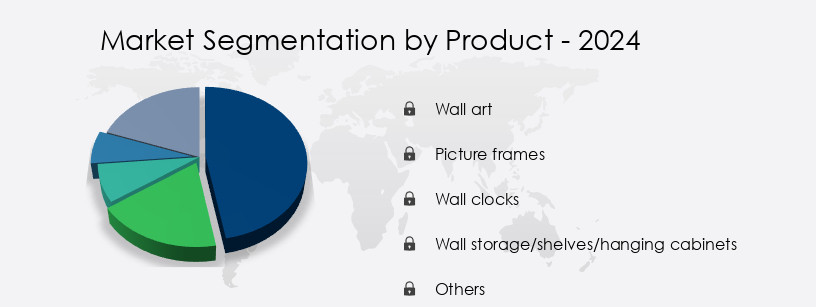

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Wall art

- Picture frames

- Wall clocks

- Wall storage/shelves/hanging cabinets

- Others

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Price

- Mass

- High/premium

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Product Insights

- The wall art segment is estimated to witness significant growth during the forecast period. The market is dominated by the wall art segment, which accounts for the largest share due to the growing trend of online shopping and the high value placed on artistic creations. With the widespread adoption of smartphones, tablets, and personal digital assistants, consumers increasingly purchase wall art online. Wall art, which is priced higher due to the intricacy and skill involved in its creation, is a popular choice for those seeking unique and personalized home decor. Major European countries, such as the UK and Germany, with their high purchasing power, are prime targets for wall art sales. Digital printing technology, including digital wallpaper printing and custom murals, is a significant trend In the wall decor industry, offering a wide range of designs, patterns, and personalized prints. Additionally, the use of sustainable materials, recycled materials, and minimalist designs are gaining popularity In the market. Wall decor companies offer a variety of products, including paintings, wall sculptures, decals, wallpaper, and interactive displays, catering to diverse interior design trends and home decor styles. Wall decor products are also increasingly being used in educational institutes, public places, and high-end showrooms. The market is expected to continue growing, driven by the increasing popularity of digital alternatives, such as virtual reality and digital displays, and the rise of social media platforms and DIY trends.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Wall Decor Market?

- Increasing sales of wall decor is the key driver of the market. The market is experiencing notable growth, driven by the increasing demand for a wide range of wall decor products. This expansion is in line with the rising sales of gifts and home accents. Over the past decade, the market has seen a 30% increase In the sales value of merchants specializing in gift and home accents. Wall decor offerings, including art, mirrors, tapestries, and digital print wallpaper, cater to diverse consumer preferences. Furthermore, the emergence of online retail platforms, such as Wayfair, Amazon, and IKEA, has broadened market reach and boosted sales. In the household sector, trends include the use of smart home technology, earthen luxury components, earthy colors, and digital printing technology for custom murals and wallpapers.

- Public places, educational institutes, and high-end showrooms are also significant markets for wall decor products. The market dynamics are influenced by factors like the growing popularity of minimalist designs, DIY trend, and social media platforms, which provide opportunities for personalized prints, photo collages, and simple designs in neutral colors. Additionally, the use of sustainable materials, such as recycled materials, and modern looks, like digital art and non-fungible tokens, are gaining traction. Wall decor companies offer various designs, patterns, and interactive displays, including foldable desks, handmade pieces, lighting, and mirror works. Wall decor trends also include e-commerce sales, residential construction, and the integration of digital alternatives, such as virtual reality and digital displays, for festive times.

What are the market trends shaping the Europe Wall Decor Market?

- Increasing adoption of digital printing is the upcoming trend In the market. Wall decor is a significant segment of the home decor market experiencing digital integration. Manufacturers are leveraging digital printing technology to create innovative wall decor products. Digital printing is extensively used in wall art, which includes various categories such as ancient and classic art, contemporary art, folk art, impressionism and post-impressionism, modern art, realism, and regional art. Wall decor items with digital prints encompass fine art prints, wall sculptures, posters and prints, decorative plaques, decorative signs, wall stickers and murals, and wallpaper. Additionally, custom murals, decals, and personalized prints are gaining popularity. Digital art and non-fungible tokens are emerging trends in this space.

- Wall decor companies offer a wide range of designs and patterns, catering to interior design trends and home decor preferences. Wall decor products are also being used in public places like educational institutes, high-end showrooms, and offices. Wall decor trends include earthy colors, minimalism, and a nature-inspired approach, incorporating earthen luxury components and sustainable materials. Wall-mounted shelves, lighting, interactive displays, mirrors, clocks, and frameworks are also popular wall decor items. E-commerce sales are driving the demand for digital alternatives like virtual reality, digital displays, and DIY projects. The DIY trend is fueled by social media platforms, allowing users to create and share their personalized wall decor projects.

Artisans and craftspeople continue to contribute to the market with handmade pieces.

What challenges doesEurope Wall Decor Market face during the growth?

- Price wars due to low product differentiation is a key challenge affecting the market growth. The market faces a challenge due to the lack of product diversification among market participants. Retailers primarily differentiate themselves through pricing strategies, offering a range of collections and goods at various price points. However, opportunities for unique product differentiation are limited in this market. Consequently, many shops engage in price competition to gain an edge, prioritizing affordability over innovation. Wall decor trends in Europe include a nature-inspired approach, earthen luxury components, and earthy colors. Digital printing technology, such as digital wallpaper printing and custom murals, has gained popularity. Wall arts, including paintings, wall sculptures, decals, and wallpaper, remain in demand.

- Wall decor companies offer designs and patterns that cater to interior design trends and home decor preferences. Educational institutes and high-end showrooms are significant buyers of wall decor products. Wall decor trends extend to digital alternatives, such as virtual reality and digital displays, during festive times. Recycled materials and personalized prints, including photo collages and simple designs, are popular choices. Neutral colors and a modern look are favored in contemporary interior design. Wall decor products encompass a variety of items, such as wall hangings, shelves, clocks, frameworks, mirror works, and lighting. Interactive displays and foldable desks have emerged as innovative solutions In the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Amazon.com Inc. - The company offers wall decor such as Solimo PVC vinyl wall sticker.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Artemest s.r.l.

- Bed Bath and Beyond Inc.

- Carrefour SA

- Costco Wholesale Corp.

- Debenhams Plc

- Dunelm Group Plc

- Home24 SE

- Inter IKEA Holding BV

- JUNIQE GmbH

- Kingfisher Plc

- Maisons du Monde

- Matalan Retail Ltd.

- Next Retail Ltd.

- Oliver Bonas Ltd.

- Otto GmbH and Co. KG

- The Range

- Walmart Inc.

- Wayfair Inc.

- Williams Sonoma Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide array of products and trends, catering to various sectors and consumer preferences. This dynamic industry continues to evolve, incorporating innovative technologies and sustainable materials to meet the demands of modern consumers. One notable trend In the market is the integration of smart home technology. This technological advancement allows for interactive and customizable wall decor, enhancing the overall aesthetic and functionality of living spaces. Digital printing technology plays a significant role in this trend, enabling the production of custom murals, wall arts, and decals with ease. Another popular approach In the market is the use of natural and earthen luxury components.

In addition, earthy colors and nature-inspired designs have gained significant traction, as they evoke a sense of calm and relaxation. Wall-mounted shelves and earthenware pieces are prime examples of this trend, adding a touch of organic elegance to any space. The educational institutes sector has also embraced the market, with digital displays and interactive installations becoming increasingly common. These digital alternatives provide a modern and engaging learning environment, fostering creativity and knowledge retention. High-end showrooms and interior design firms continue to be key players in the market, showcasing the latest trends and designs. Wall decor products, such as paintings, wall sculptures, and mirror works, are essential components of their offerings, ensuring that their clients receive the best and most current options.

The household sector remains a significant contributor to the market, with a growing emphasis on personalized prints and photo collages. Simple designs and neutral colors are also popular choices, as they offer versatility and timeless appeal. Recycled materials have gained popularity in the market due to their sustainability and eco-friendliness. Foldable desks, handmade pieces, and wall hangings made from recycled materials are just a few examples of this trend. The market also extends to seasonal and festive times, with various wallpapers or stickers, clocks, and frameworks available to celebrate special occasions.

In recent years, the market has seen a increase in digital art and non-fungible tokens (NFTs). These innovative offerings provide collectors with unique and exclusive pieces, adding value and exclusivity to their living spaces. The DIY trend continues to be a significant force in the market, with social media platforms serving as a hub for inspiration and collaboration. DIY projects, such as creating custom wall art and decals, have become increasingly popular, allowing consumers to express their creativity and individuality. Artisans and local craftspeople have also found a place in the market, offering unique and authentic pieces that cannot be found elsewhere.

Furthermore, sustainable materials, such as bamboo, cork, and reclaimed wood, are often used In their creations, further emphasizing the eco-consciousness of the industry. The market is expected to continue growing, as consumers seek innovative and sustainable solutions for enhancing their living spaces. With a focus on technology, eco-friendliness, and personalization, this dynamic industry is poised to meet and exceed the demands of modern consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.6% |

|

Market growth 2025-2029 |

USD 16.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.6 |

|

Key countries |

Germany, UK, France, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch