Warehouse Management Systems Market Size 2025-2029

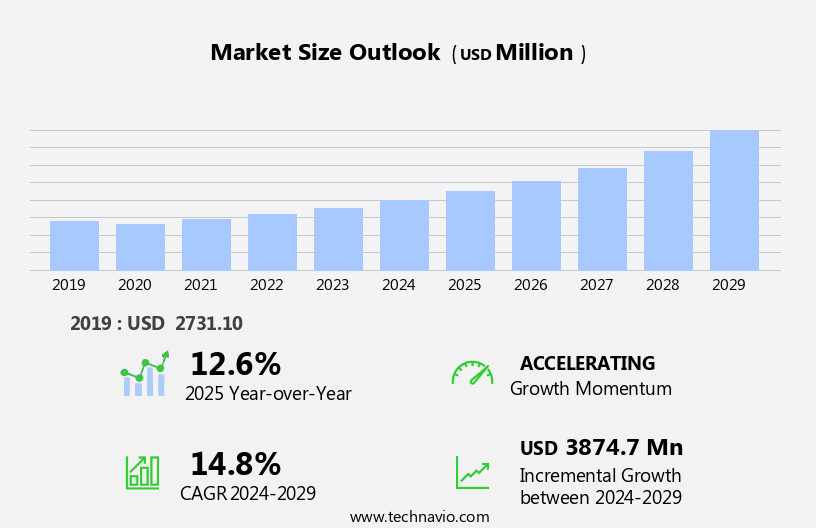

The warehouse management systems market size is forecast to increase by USD 3.87 billion at a CAGR of 14.8% between 2024 and 2029.

- The Warehouse Management Systems (WMS) market is experiencing significant growth, driven by the increasing demand for inventory control and the expansion of e-commerce businesses. With the rise of e-commerce, there is a growing need for efficient and accurate warehouse management to meet the demands of online shoppers for fast and reliable delivery. WMS solutions enable businesses to streamline their warehouse operations, optimize inventory levels, and improve order fulfillment accuracy. However, the implementation cost of on-premises WMS remains a challenge for many businesses, particularly small and medium-sized enterprises (SMEs). These systems require significant upfront investment for hardware, software, and implementation, making them less accessible to some organizations.

- As a result, there is growing interest in cloud-based WMS solutions, which offer lower upfront costs and greater scalability. Despite this challenge, the market's strategic landscape remains favorable for companies seeking to capitalize on the growing demand for efficient warehouse management solutions. By investing in innovative technologies and offering flexible pricing models, WMS companies can differentiate themselves and capture market share. Companies that can effectively navigate these challenges and leverage the opportunities presented by the growing e-commerce market will be well-positioned for success in the WMS market.

What will be the Size of the Warehouse Management Systems Market during the forecast period?

- The warehouse management systems (WMS) market encompasses a range of solutions designed to optimize the day-to-day operations of various warehousing facilities. These systems facilitate inventory management, order fulfillment, and logistics processes for industries spanning retail, manufacturing, and logistics. The market's growth is driven by the increasing adoption of digital technologies, such as RFID, smart devices, smart tablets, and mobile phones, which enhance product tracking, lead time reduction, and product delivery speed. Small-scale industries are also embracing WMS solutions to streamline their operations and remain competitive.

- The retail sector, in particular, is experiencing significant growth in the implementation of WMS, as consumer expectations for fast and accurate order fulfillment continue to rise. Overall, the WMS market is poised for continued expansion as businesses seek to improve their product markets' efficiency and competitiveness.

How is this Warehouse Management Systems Industry segmented?

The warehouse management systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Hardware

- Integrated WMS software

- Services

- Others

- Application

- Inventory management

- Supply chain management

- Purchase and order management

- Asset management

- Others

- End-user

- Retail and consumer goods

- Transport and logistics

- Automotive

- Healthcare and pharmaceuticals

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The market encompasses software applications that streamline and manage warehouse operations for businesses. Warehouse management software automates and optimizes inventory processes, including inbound freight handling, put-away, picking, packing, shipping, and real-time inventory tracking. The market growth is fueled by the need for efficient supply chain management in various industries, such as retail, e-commerce, healthcare, and manufacturing. Advanced technologies, like IoT, AI, and ML, are revolutionizing warehouse management, leading to the development of sophisticated solutions. Digital technologies, including web-based portals, smart devices, and RFID technology, are transforming warehouse management systems. Small-scale industries and logistics companies are also adopting these solutions to enhance productivity and reduce costs.

Additionally, renewable sources, such as solar energy and electric automotive, are being integrated into warehouse operations to promote sustainability. Business analytics, slotting management, yard management, and implementation cost are essential factors influencing the market. The cloud-based system offers flexibility and ease of access, while on-premises WMS ensures data security and control. E-commerce demand and automation technology further drive the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Software segment was valued at USD 984.90 billion in 2019 and showed a gradual increase during the forecast period.

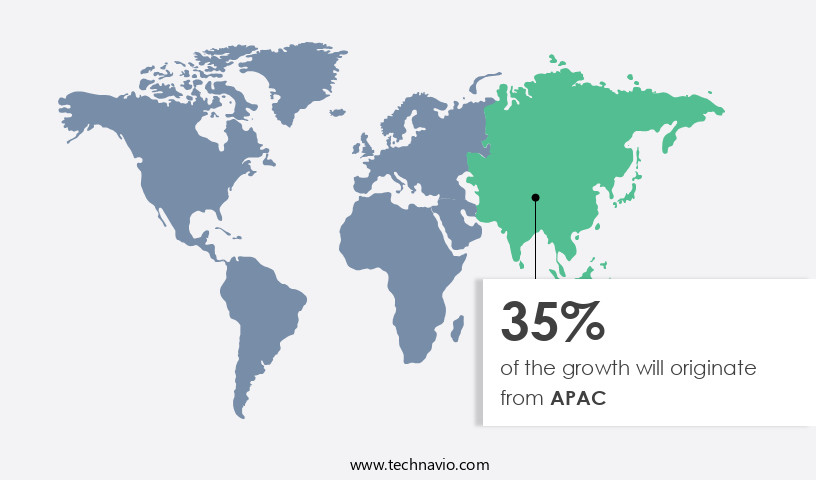

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is experiencing significant growth due to the increasing presence of multinational corporations with extensive warehousing and distribution networks, the expanding regional e-commerce industry, and advancements in third-party logistics (3PL) networks. The transformation of the North American supply chain market is impacting the fundamental aspects of distribution and warehousing in the warehouse management systems sector. This evolution is primarily driven by emerging digital technologies, such as on-premise WMS solutions, digital twin, cloud-based systems, RFID technology, artificial intelligence, and the Internet of Things. These innovations have bridged the gap between supply chain operations and customers, enabling real-time demand influence on order fulfillment.

The integration of business analytics, slotting management, yard management, web-based portals, and automation technology in warehouse management systems is further enhancing product manufacturers' and logistics companies' capabilities to optimize inbound and outbound freight, manage labor and trade compliance, and ensure real-time visibility into inventory control.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Warehouse Management Systems Industry?

- Rising need for inventory control is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for efficient inventory control. Warehouse management systems are essential software applications that optimize warehouse operations, including inventory management, order fulfillment, and shipping. Effective inventory control is crucial for businesses to maintain the right quantities of products at the right time, ensuring customer satisfaction and reducing costs. As businesses expand their operations and e-commerce continues to thrive, the need for streamlined inventory management becomes even more vital.

- Warehouse management systems offer real-time inventory visibility, enabling businesses to track inventory movement and optimize warehouse space. By implementing these systems, businesses can increase operational efficiency and reduce costs, ultimately contributing to their overall success.

What are the market trends shaping the Warehouse Management Systems Industry?

- Growth of e-commerce is the upcoming market trend.

- The market is experiencing significant growth due to the increasing influence of e-commerce. As online shopping gains popularity, businesses are under increasing pressure to efficiently manage their inventory and fulfill orders promptly. Warehouse management systems software automates and optimizes various warehouse processes, from receiving and putting away to picking and shipping, enabling companies to streamline their operations and effectively manage their supply chain.

- The pandemic has further accelerated the growth of e-commerce, making warehouse management systems an essential tool for businesses to meet customer demand. By implementing these systems, companies can enhance their operational efficiency, reduce errors, and improve customer satisfaction.

What challenges does the Warehouse Management Systems Industry face during its growth?

- Implementation cost of on-premises WMS is a key challenge affecting the industry growth.

- Warehouse Management Systems (WMS) are essential enterprise software solutions for managing and optimizing the day-to-day operations of a warehouse or distribution center. Two primary pricing models exist for WMS: perpetual licensing and subscription (typically monthly). The choice between these models significantly impacts both preliminary and annual budgets. Perpetual licenses, which are commonly used for on-premise solutions, involve a higher upfront cost but offer greater control and customization. In contrast, subscription models, operating under the Software-as-a-Service (SaaS) model, use the cloud for data storage or processing and require ongoing monthly payments.

- Organizations and enterprises are responsible for managing and maintaining these systems on their premises with in-house IT staff. The decision between these pricing structures should be based on a thorough of the specific needs and resources of your business.

Exclusive Customer Landscape

The warehouse management systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the warehouse management systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, warehouse management systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3PL Central LLC - Third-party logistics providers require efficient warehouse management solutions to streamline their operations. Our company delivers a comprehensive system, incorporating inventory management, order fulfillment, and billing features, to optimize their logistics processes. This approach enhances search engine visibility and ensures a clear, informative message from a research analyst's perspective. Our warehouse management system is designed to cater to the unique needs of third-party logistics providers, aligning with our commitment to delivering innovative and effective solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3PL Central LLC

- Blue Yonder Inc.

- Daifuku Co. Ltd.

- Datapel Systems

- Epicor Software Corp.

- Generix Group

- Infor Inc.

- Korber Supply Chain Software

- Manhattan Associates Inc.

- Mantis Informatics S.A

- Microsoft (Dynamics 365 SCM)

- Oracle Corp.

- PSI Software AG

- SAP SE

- Softeon

- SSI Schafer

- Tecsys Inc.

- Vinculum Solutions Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Warehouse Management Systems (WMS) have become an essential component of modern business operations, particularly in industries with high product turnover and complex supply chain models. The market for these systems continues to evolve, driven by digital technologies and the shifting demands of various product markets. Small-scale industries, in particular, have recognized the benefits of implementing WMS solutions to optimize their warehousing facilities. These systems enable efficient inbound and outbound freight management, inventory control, and real-time visibility into stock levels and order fulfillment. Digital technologies, such as business analytics, slotting management, yard management, and web-based portals, have revolutionized the way WMS functions.

Renewable sources, like solar energy and electric automotive, are also gaining traction in the industry, contributing to more sustainable and cost-effective operations. Logistics companies are increasingly adopting WMS to streamline their operations and improve product delivery speed. Manufacturing companies, too, are recognizing the value of these systems in managing their supply chain models and ensuring trade compliance. The implementation cost of WMS has become a significant consideration for businesses, with cloud deployment becoming a popular option due to its affordability and flexibility. The shift towards cloud-based systems has also facilitated the integration of advanced technologies, such as RFID technology, artificial intelligence, and the Internet of Things (IoT).

The digital twin, a virtual representation of a physical system, is another emerging trend in the WMS market. This technology enables real-time monitoring and analysis of warehouse operations, allowing for more informed decision-making and improved efficiency. The WMS market is dynamic, with multinational companies leading the charge in innovation and adoption. However, labor restrictions and movement restrictions, due to the ongoing global health crisis, have presented challenges to the industry. Despite these challenges, the market for WMS solutions remains , driven by e-commerce demand and automation technology. Smart devices, such as smart tablets, mobile phones, and handheld devices, have become essential tools for warehouse workers, further enhancing the functionality and accessibility of these systems.

In , the WMS market is a critical component of modern business operations, driven by digital technologies and the evolving demands of various product markets. The trend towards cloud-based systems and advanced technologies, such as RFID, AI, and IoT, is set to continue, enabling more efficient, sustainable, and cost-effective warehousing solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.8% |

|

Market growth 2025-2029 |

USD 3874.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.6 |

|

Key countries |

US, Germany, Canada, China, UK, France, Japan, India, The Netherlands, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Warehouse Management Systems Market Research and Growth Report?

- CAGR of the Warehouse Management Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the warehouse management systems market growth of industry companies

We can help! Our analysts can customize this warehouse management systems market research report to meet your requirements.