Water And Wastewater Treatment Chemicals Market Size 2024-2028

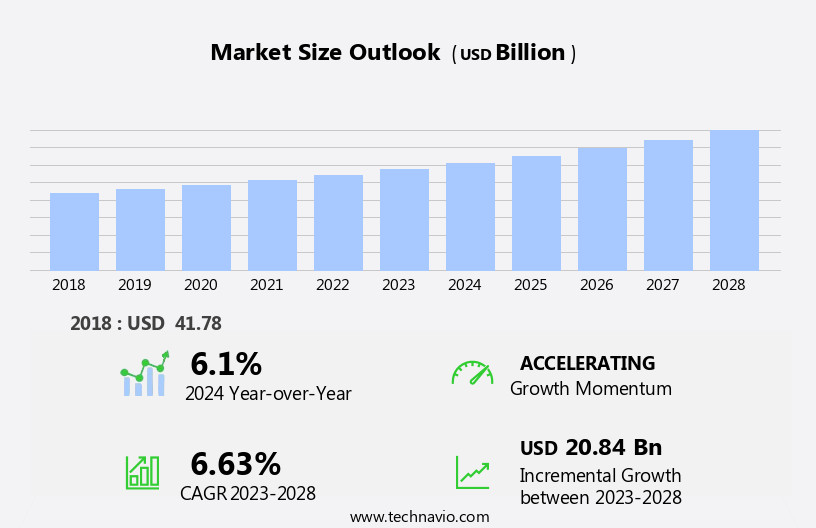

The water and wastewater treatment chemicals market size is forecast to increase by USD 20.84 billion at a CAGR of 6.63% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market expansion is the increasing demand for freshwater as a result of population growth. As populations continue to rise, the need for clean water becomes increasingly important, driving the demand for commercial water treatment equipment.

- Another trend influencing market growth is the use of analytics to optimize treatment processes and improve efficiency. Furthermore, the availability of a skilled workforce in treatment plants is crucial for the effective implementation of advanced technologies and processes.

What will be the Size of the Water And Wastewater Treatment Chemicals Market During the Forecast Period?

- The market encompasses a range of solutions designed to address impurities in water sources, ensuring compliance with environmental regulations and safeguarding global water quality. Impurities, including metallic, organic, and non-organic contaminants, pose significant challenges to the water treatment sector.

- Eco-friendly chemicals and biodegradable compounds are increasingly preferred due to their minimal impact on the environment. Advanced treatment chemicals, such as corrosion inhibitors, desalination, and oil & gas sector applications, are essential for addressing diverse water treatment needs. Environmental compliance, driven by regulations like the Clean Water Act, and the growing demand for freshwater resources due to urbanization and economic development, are key market dynamics.

- Emerging concerns over microplastics and waste & energy usage further shape market trends. Key players include Kemira Oyj, BWA Water Additives, and Solenis, among others.

How is this Water And Wastewater Treatment Chemicals Industry segmented and which is the largest segment?

The water and wastewater treatment chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Coagulants and flocculants

- Corrosion and scale inhibitors

- Biocides and disinfectants

- pH adjusters and softeners

- Others

- Application

- Municipality

- Power generation

- Pulp and paper

- Metal and mining

- Oil and gas and others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

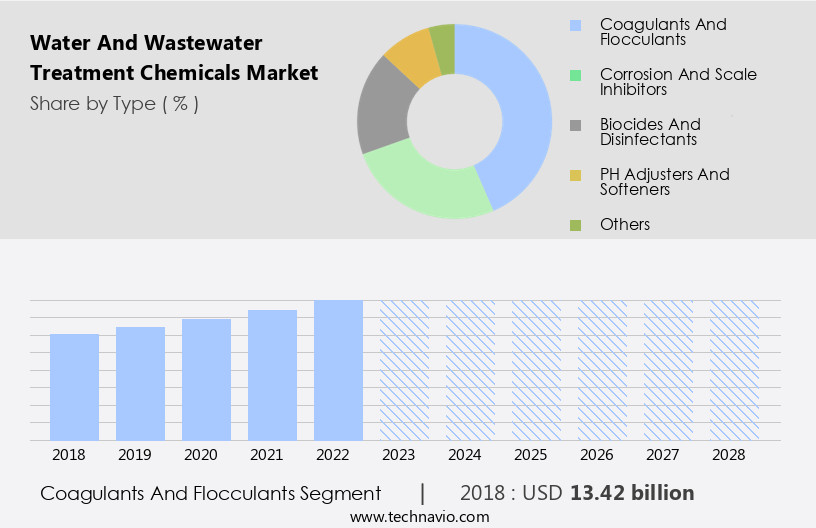

- The coagulants and flocculants segment is estimated to witness significant growth during the forecast period.

Coagulants and flocculants play a crucial role in water and wastewater treatment processes, facilitating solid removal, water clarification, lime softening, sludge thickening, and solids dewatering. These chemicals enable the separation of impurities through coagulation and flocculation. Coagulation induces particles to aggregate, while flocculation forms large clusters of dirt with high molecular weight, allowing for easy settlement and removal. The utilization of these compounds reduces water treatment costs by eliminating sedimentary and particulate matter in contaminated water. The coagulants and flocculants market is poised for growth due to increasing water demand, population expansion, and urbanization in emerging economies. The need for potable water and sustainable water management solutions further drives market expansion.

Coagulants and flocculants are essential components in various industries, including the power, oil & gas, and pulp & paper sectors, necessitating eco-friendly and efficient water treatment technologies. Membrane filtration systems, UV disinfection systems, and advanced treatment chemicals are some of the technologies employed to ensure water quality compliance with environmental regulations. Green alternatives, such as biodegradable compounds, are gaining popularity due to their reduced carbon footprint and environmental impact. The market is expected to witness significant advancements in intelligent monitoring systems, process optimization, and real-time monitoring to enhance water infrastructure resilience and climate-related mitigation.

Get a glance at the Water And Wastewater Treatment Chemicals Industry report of share of various segments Request Free Sample

The Coagulants and flocculants segment was valued at USD 13.42 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

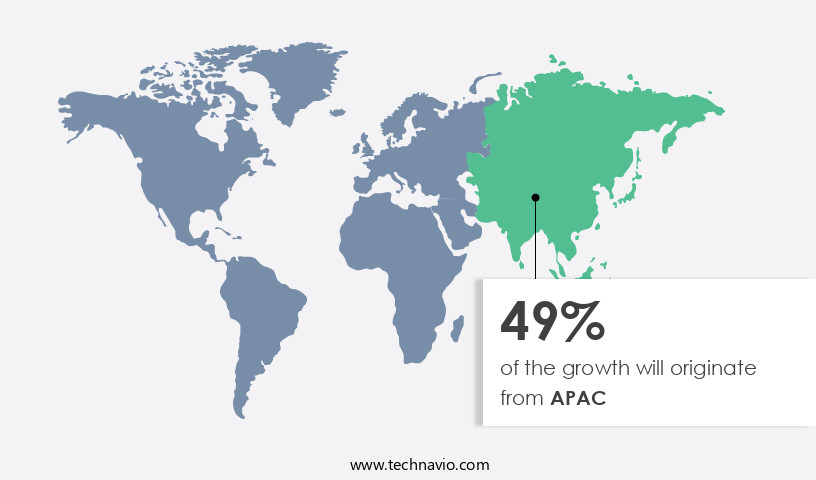

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) market for water and wastewater treatment chemicals is experiencing significant growth due to increasing water demand from various industries and stricter environmental regulations. Industrialization and urbanization in the region have led to a surge in water usage and the need for effective treatment solutions. Key industries such as food and beverage, pharmaceuticals, pulp and paper, and power generation are major consumers of water and wastewater treatment chemicals. In addition, stringent regulations on water pollution have driven market growth. The APAC region, home to some of the world's fastest-growing economies, including China and India, is a significant consumer of water and wastewater treatment chemicals.

Compliance with environmental regulations and sustainable water management practices are key trends In the market. Eco-friendly chemicals, such as biodegradable compounds, are gaining popularity due to their minimal impact on the environment. Advanced treatment technologies, including membrane filtration systems, UV disinfection systems, and oxidation procedures, are also driving market growth. The market is expected to continue growing due to increasing water demand, infrastructure renovations, and investments in resilience planning.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Water And Wastewater Treatment Chemicals Industry?

Increasing demand for freshwater due to the rise in population is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for freshwater resources and the need for environmental compliance in various industries. Impurities, including metallic, organic, and non-organic varieties, pose challenges to water quality and require the use of advanced treatment chemicals. The power, oil & gas, and pulp & paper industries are major consumers of water treatment chemicals, with the oil & gas sector subject to stringent environmental regulations under the Clean Water Act. Membrane filtration technologies, such as microfiltration, ultrafiltration, and nanofiltration, are gaining popularity for their ability to remove impurities and provide eco-friendly solutions. Membrane filtration systems and UV disinfection systems are also being adopted for water recycling and desalination processes.

- The commercial segment of the water treatment sector is driving the market growth, with a focus on eco-friendly chemicals, biodegradable compounds, and green alternatives. Coagulants & flocculants, disinfectants, pH adjusters, corrosion inhibitors, and oxidation procedures are some of the key water treatment chemicals used in various applications. The global water quality is under constant scrutiny due to the emergence of new contaminants, such as microplastics, and the need for sustainable water management. Technological infrastructure investments, climate-related mitigation, and infrastructure renovations are essential for enhancing water infrastructure resilience and reducing the carbon footprint and environmental impact of water treatment processes.

- Intelligent monitoring systems and digital advancements, including real-time monitoring and process optimization, are transforming the water treatment sector by enabling efficient and cost-effective solutions. The Asset Management Plan, Drinking Water Directive, and Water Framework Directive are some of the key regulations driving the market growth in Europe. In conclusion, the market is expected to continue its growth trajectory due to the increasing water demand, the need for environmental compliance, and the adoption of advanced treatment technologies. The market dynamics are influenced by various factors, including population growth, urbanization, economic development, and regulatory requirements. The market players are focusing on developing sustainable solutions and reducing waste and energy usage to minimize the environmental impact and carbon footprint.

What are the market trends shaping the Water And Wastewater Treatment Chemicals Industry?

Use of analytics to drive efficiency is the upcoming market trend.

- Water and wastewater treatment chemicals play a crucial role in ensuring the quality and sustainability of freshwater resources, addressing impurities from organic, non-organic, and metallic origins. Environmental compliance is a significant driver for the water treatment sector, as industries such as oil & gas, power, and pulp & paper rely on advanced treatment technologies like membrane filtration systems and UV disinfection systems. Emerging economies also contribute to the market's growth due to increasing urbanization and economic development. Water demand and supply imbalances, as well as water recycling, necessitate eco-friendly chemicals and biodegradable compounds. Membrane filtration technologies, including microfiltration, ultrafiltration, and nanofiltration, are gaining popularity for their ability to remove microplastics and other contaminants.

- Green alternatives, such as coagulants & flocculants, are also essential for sustainable water management. Environmental regulations, such as the Clean Water Act and the Drinking Water Directive, set stringent standards for water quality. Technological infrastructure investments in intelligent monitoring systems and digital advancements enable real-time monitoring and process optimization. Waste & energy usage reduction is another critical aspect of the water treatment sector, with a focus on climate-related mitigation, infrastructure renovations, and resilience planning investments. The water treatment sector encompasses potable water production and chlorine-free water treatment, with a growing emphasis on sustainable solutions and greener chemical formulations.

- The carbon footprint and environmental impact of water treatment chemicals are becoming increasingly important considerations. New contaminants, such as pharmaceuticals and endocrine disruptors, require advanced treatment chemicals and oxidation procedures for effective removal. In summary, the market is driven by the need for environmental compliance, water demand and supply imbalances, and the development of advanced treatment technologies. The market is diverse, with applications in various industries, and is subject to stringent regulations and a growing focus on sustainability and eco-friendly solutions.

What challenges does the Water And Wastewater Treatment Chemicals Industry face during its growth?

Availability of skilled workforce in treatment plants is a key challenge affecting the industry growth.

- Water and wastewater treatment chemicals play a crucial role in ensuring the quality and sustainability of freshwater resources, addressing impurities such as metallic, organic, and non-organic contaminants. Environmental compliance is a significant driver In the market, as industries like oil & gas, power, and pulp & paper seek to minimize their environmental footprint and adhere to regulations. Emerging economies are also increasing their focus on sustainable water management, leading to a growing demand for advanced treatment chemicals and technologies. Membrane filtration systems, including microfiltration, ultrafiltration, and nanofiltration, are gaining popularity due to their ability to remove even the smallest contaminants.

- UV disinfection systems and oxidation procedures are also essential for ensuring water quality and preventing the spread of waterborne diseases. Eco-friendly chemicals, such as biodegradable compounds and green alternatives, are becoming increasingly important as the industry shifts towards more sustainable solutions. Coagulants & flocculants are a significant segment of the market, with applications in both commercial and industrial settings. The water treatment sector is undergoing significant technological advancements, with intelligent monitoring systems and digital advancements enabling real-time monitoring and process optimization. Infrastructure renovations and climate-related mitigation efforts are also driving investments in water infrastructure. The global water quality landscape is shaped by various regulations, including the Clean Water Act and the Drinking Water Directive, among others.

- Wastewater treatment chemicals are also essential for industries to comply with these regulations and minimize their environmental impact. Companies like Kemira OYJ, BWA Water Additives, Solenis, Nouryon, and Brenntag Specialties are key players In the market. Microplastics and new contaminants pose new challenges for the industry, requiring ongoing research and development of sustainable solutions. The market is expected to continue growing as the world's population and industrialization increase water demand and put pressure on freshwater resources.

Exclusive Customer Landscape

The water and wastewater treatment chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the water and wastewater treatment chemicals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, water and wastewater treatment chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accepta Water Treatment

- Akzo Nobel NV

- Albemarle Corp.

- Arkema Group

- Buckman Laboratories lnternational Inc.

- Carus Group Inc.

- Chembond Chemicals Ltd.

- Cortec Corp.

- Danaher Corp.

- Dow Chemical Co.

- Ecolab Inc.

- Hydrite Chemical Co.

- Ion Exchange India Ltd.

- Kemira Oyj

- Kurita Water Industries Ltd

- Lonza Group Ltd.

- Solenis

- Solvay SA

- SUEZ SA

- Thermax Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of substances used to address various impurities in water sources. These impurities can be categorized as metallic, organic, and non-organic. Environmental compliance is a significant driver for the water treatment sector, as freshwater resources face increasing demand and depletion. Water demand is fueled by various industries, including oil & gas, power, and pulp & paper, as well as emerging economies. The need for water recycling and desalination processes is on the rise, further expanding the market. Advanced treatment chemicals, such as membrane filtration technologies and oxidation procedures, play a crucial role in ensuring global water quality.

Membrane filtration systems, including microfiltration, ultrafiltration, and nanofiltration, are gaining popularity due to their ability to remove contaminants effectively. Eco-friendly chemicals, such as biodegradable compounds, are increasingly being adopted to minimize waste and energy usage. Environmental regulations, including those related to climate-related mitigation and infrastructure renovations, are shaping the water treatment sector. The growing concern over microplastics and other emerging contaminants is leading to the development of sustainable solutions. The power industry, healthcare, food production, and industrialization are significant consumers of water and wastewater treatment chemicals. The industrial landscape is continuously evolving, with a focus on process optimization, intelligent monitoring systems, and digital advancements.

Real-time monitoring and process optimization are essential for maintaining water infrastructure and ensuring potable water quality. Climate-related mitigation and resilience planning investments are becoming increasingly important to ensure water security. The water treatment sector is witnessing a shift towards chlorine-free water and greener chemical formulations to minimize the carbon footprint and environmental impact. Technological infrastructure is advancing, with a focus on biocide chemicals for microbial control and disinfection to prevent waterborne diseases. The water treatment chemicals market is diverse and dynamic, with various segments, including coagulants & flocculants, commercial, and wastewater treatment chemicals.

Urbanization and economic development are driving the demand for water and wastewater treatment chemicals. Regulations, such as the Clean Water Act and the Drinking Water Directive, are in place to ensure water quality and protect public health. The Water Framework Directive and the Public Utilities Board are examples of regulatory bodies that set standards for water treatment in Europe. In conclusion, the market is a critical component of ensuring a sustainable water supply and maintaining water quality. The market is driven by various factors, including environmental regulations, industrial demand, and technological advancements. The sector is continuously evolving to meet the changing needs of industries and societies, with a focus on eco-friendly and sustainable solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.63% |

|

Market growth 2024-2028 |

USD 20.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.1 |

|

Key countries |

China, US, Japan, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Water And Wastewater Treatment Chemicals Market Research and Growth Report?

- CAGR of the Water And Wastewater Treatment Chemicals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the water and wastewater treatment chemicals market growth of industry companies

We can help! Our analysts can customize this water and wastewater treatment chemicals market research report to meet your requirements.