Wellness Tourism Market Size 2025-2029

The wellness tourism market size is valued to increase USD 561.9 billion, at a CAGR of 9.9% from 2024 to 2029. Increase in mental illness will drive the wellness tourism market.

Major Market Trends & Insights

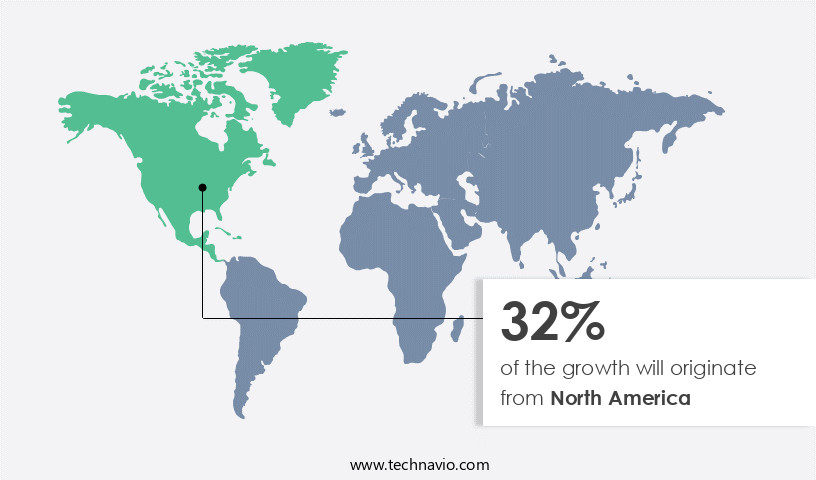

- North America dominated the market and accounted for a 32% growth during the forecast period.

- By Type - Domestic segment was valued at USD 439.80 billion in 2023

- By Application - Physical segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 111.89 billion

- Market Future Opportunities: USD 561.90 billion

- CAGR : 9.9%

- North America: Largest market in 2023

Market Summary

- The market represents a significant and continuously evolving sector, with a growing emphasis on core technologies and applications such as telemedicine and digital health platforms. These innovations are transforming the industry, enabling remote consultations, personalized wellness plans, and real-time health monitoring. Wellness tourism is no longer confined to luxury travel experiences; it has emerged as a viable solution for managing mental health issues, with an estimated 1 in 4 adults experiencing mental health concerns worldwide. Furthermore, the rise of online wellness aggregators has made it easier for consumers to access and compare services, leading to increased competition and innovation.

- Despite these opportunities, regulatory frameworks and standards vary significantly across regions, posing challenges for market growth and consumer safety. For instance, Europe accounts for over 50% of the market share, driven by stringent regulations and a strong focus on preventive healthcare.

What will be the Size of the Wellness Tourism Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Wellness Tourism Market Segmented and what are the key trends of market segmentation?

The wellness tourism industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Domestic

- International

- Application

- Physical

- Psychological

- Spiritual

- Mode Of Booking

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The domestic segment is estimated to witness significant growth during the forecast period.

Wellness tourism, a segment of the global travel industry, encompasses domestic and international travel for the purpose of enhancing mental and physical health. Domestic wellness tourism, which involves travel within a country, holds a significant market share due to the appeal of affordable, easily accessible facilities. According to recent data, this segment accounts for approximately 75% of the market. Primary wellness travelers, who constitute a substantial portion of this market, primarily seek out spa treatments, fitness programs, and cultural experiences. Spa and beauty treatments, including anti-aging therapies, generate around USD639 billion in revenue, while fitness tourism facilities contribute approximately USD141 billion.

These offerings attract a large number of domestic wellness travelers, contributing to the market's growth. Mental health tourism, another segment of the wellness tourism industry, is also gaining popularity. This includes mindfulness retreats, stress reduction techniques, and therapeutic tourism benefits. The market for mental health tourism is projected to grow by 25% in the coming years. Moreover, the wellness tourism industry is expanding to include preventative health programs, nutritional services, and disease prevention programs. These offerings cater to the increasing demand for holistic wellness solutions. Additionally, sustainable tourism practices, such as eco-tourism certifications and nature-based tourism experiences, are becoming increasingly important to consumers.

The market also includes adventure tourism activities, physical therapy tourism, spiritual tourism offerings, and medical tourism procedures. These various segments cater to diverse traveler preferences and contribute to the market's continuous growth. In terms of economic impact, the wellness tourism industry is projected to reach USD919 billion by 2022. This growth is driven by the increasing awareness of the importance of mental and physical health, as well as the evolving preferences of travelers. Overall, the market is a dynamic and evolving industry that caters to a diverse range of traveler preferences. From spa treatments and fitness programs to mental health retreats and preventative health services, the market offers a wide range of offerings that prioritize holistic wellness.

The Domestic segment was valued at USD 439.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wellness Tourism Market Demand is Rising in North America Request Free Sample

The market in the US and Canada is a significant revenue generator, driven by high health and wellness expenditures. Factors contributing to this trend include the availability of spa treatments, anti-aging therapies, and a large fitness-conscious population. Increased awareness about disease prevention and a growing focus on personal well-being, particularly among Generation Z, further fuel this industry's growth. According to recent statistics, over 23% of the US population falls into this demographic, actively engaging in health and wellness programs. Moreover, the prevalence of chronic diseases and an aging population in these countries create a substantial demand for wellness tourism services.

In 2020, the US spent approximately USD113 billion on health and wellness tourism, while Canada allocated around USD6.5 billion. These figures underscore the market's potential and the increasing importance of wellness tourism in the healthcare landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various sectors, including measuring effectiveness of wellness programs, nature-based tourism's impact on mental health, sustainable practices in adventure tourism, and the role of community tourism in economic development. Holistic wellness retreats offer numerous benefits, integrating cultural experiences into wellness journeys, while spa treatments are increasingly adopted for their therapeutic properties. Accessibility improvements and health and safety regulations are essential considerations in health tourism, contributing significantly to global health. The economic benefits of medical tourism are substantial, with many countries leveraging this sector for revenue growth. However, ethical considerations and collaboration among tourism stakeholders are crucial in ensuring wellness tourism's sustainable development.

The importance of sustainable tourism development is evident as more than 70% of new product developments focus on eco-tourism, addressing tourism's environmental impact. In rural development, wellness tourism plays a pivotal role, with community tourism projects contributing to local economies. Wellness program adoption and efficacy are essential factors driving market growth, with a growing number of travelers prioritizing wellness experiences. The industry's contribution to global health is substantial, with adoption rates in developed regions being nearly double those in developing ones. Tourism's social responsibility is increasingly recognized, with stakeholders emphasizing ethical considerations and collaboration to create a sustainable and inclusive industry.

The industrial application segment accounts for a significantly larger share than the academic segment in the market, highlighting the sector's growing commercial importance.

What are the key market drivers leading to the rise in the adoption of Wellness Tourism Industry?

- Mental illnesses have been on the rise, serving as the primary catalyst for the growth of the related market.

- Mental health issues, such as stress, anxiety, depression, and insomnia, are prevalent concerns in today's fast-paced world. These conditions, if left unaddressed, can lead to chronic health issues like obesity, diabetes, heart disease, and cancer. Stress, a common mental health issue, can stem from various sources, including work pressures, societal expectations, and financial struggles. In the US, for example, approximately 20% of adults experience stress each year. Depression and bipolar disorders rank among the third major causes of hospitalization in the country.

- It's crucial to recognize the significance of mental health and address these conditions promptly to mitigate their impact on overall well-being. The ongoing evolution of mental health treatments and interventions offers various options for individuals seeking help. These include therapy, medication, mindfulness practices, and lifestyle modifications. By staying informed about mental health trends and resources, we can collectively promote better mental health and well-being for all.

What are the market trends shaping the Wellness Tourism Industry?

- The emergence of online wellness aggregators represents a significant market trend. These platforms consolidate various health and wellness resources, providing users with convenient access to a wealth of information.

- The digital transformation of the wellness travel industry is gaining momentum, with small online firms specializing in aggregating information on wellness travel and accommodation. The Internet's widespread accessibility plays a crucial role in this market's growth, enabling customers worldwide to access comprehensive data on various wellness services and centers. This online repository facilitates informed decision-making based on user reviews and preferences. The trend towards utilizing the Internet for tracking customer needs is a significant development in the industry. Wellness travelers from diverse regions can connect and plan their tours together, fostering a community of like-minded individuals.

- This digital marketplace offers immense potential for hotels and wellness centers to cater to evolving customer expectations. The online platform's convenience and accessibility are shaping the future of wellness tourism, making it an essential sector for businesses to watch.

What challenges does the Wellness Tourism Industry face during its growth?

- The perception of wellness tourism as a luxury market poses a significant challenge to the industry's growth. This perspective may limit the accessibility of wellness tourism experiences for a larger audience, potentially hindering the industry's expansion and reach.

- The market showcases a significant trend in the global travel industry, with indexed growth reaching 630 billion U.S. Dollars in 2020, representing a substantial 20% increase compared to the previous year. This market is characterized by its association with luxury travel experiences, as travelers seek rejuvenation in the finest environmental surroundings, cultural destinations, and gourmet food offerings. Wellness packages often come at a premium, with international travelers expecting high-end services commensurate with their investment.

- Despite regional variations, the expectation for luxury remains consistent, making this market a dynamic and evolving sector in the travel industry.

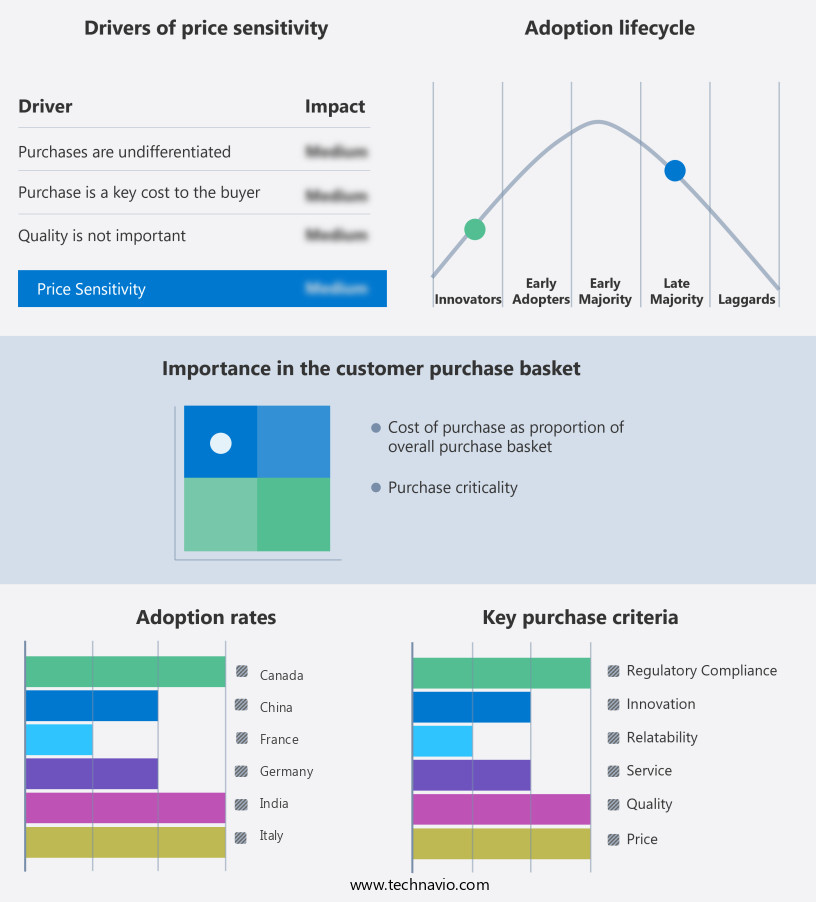

Exclusive Customer Landscape

The wellness tourism market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wellness tourism market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wellness Tourism Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, wellness tourism market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accor S.A. - This company specializes in providing diverse wellness tourism experiences, encompassing steam baths, relaxation retreats, and invigorating treatments, catering to global clientele seeking rejuvenation and self-care.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accor S.A.

- Cal A Vie Health Spa

- CR Operating LLC

- Clinique La Prairie

- Four Seasons Hotels Ltd.

- Gaia Retreat and Spa

- Hand and Stone Franchise Corp.

- HOT SPRINGS RESORT and SPA

- Hyatt Hotels Corp.

- Intrepid Group Pty Ltd.

- Jade Mountain

- Kempinski Hotels SA

- Lanserhof Management GmbH

- Marriott International Inc.

- Mekosha

- Osthoff Resort

- Rancho La Puerta Inc.

- Red Carnation Hotels UK Ltd.

- Six Senses Hotels Resorts Spas

- Wyndham Hotels and Resorts Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wellness Tourism Market

- In January 2024, the Four Seasons Resort and Spa announced the launch of its new "Wellness Warrior" program, offering personalized wellness plans and holistic treatments to guests at their properties worldwide (Four Seasons Press Release). In March 2024, Hilton Hotels and Resorts entered into a strategic partnership with Headspace, the mindfulness and meditation app, to integrate their services and offer guests exclusive content and experiences (Hilton Press Release).

- In April 2024, MindBody, a leading technology platform for the wellness industry, raised USD150 million in a funding round, enabling further expansion of their software solutions for businesses in the wellness tourism sector (MindBody Press Release). In May 2025, the European Union passed the Wellness Tourism Regulation, setting standards for wellness services, certifications, and accreditation, aiming to boost the sector's growth and competitiveness (European Parliament Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wellness Tourism Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 561.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

US, Germany, China, UK, Canada, France, Italy, Japan, Spain, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The dynamic and evolving the market encompasses a range of offerings, from community tourism projects and fitness tourism facilities to mental health tourism and spiritual tourism. This sector continues to gain traction, with employment opportunities in the industry projected to expand alongside it. Fitness tourism facilities, a key component of wellness travel, have seen significant growth. These establishments offer visitors access to various workout facilities and wellness programs, fostering an active lifestyle. Cultural tourism experiences, another popular draw, provide unique opportunities for travelers to learn about local traditions and practices, often contributing to overall well-being. Mental health tourism, including mindfulness retreats and stress reduction techniques, has gained increasing attention due to their effectiveness in addressing mental health concerns.

- Spa treatments, a staple in wellness tourism, have shown efficacy in promoting relaxation and stress relief. Physical therapy tourism and rehabilitation services cater to those seeking recovery and improved mobility. The economic impact of wellness tourism is substantial, with tourism activities contributing significantly to local economies. Preventative health programs, such as nutritional tourism services and disease prevention programs, have gained popularity as travelers seek to maintain their well-being. Sustainable tourism practices, including eco-tourism certifications and nature-based tourism, are increasingly important in this market. Active tourism experiences, like adventure tourism activities and yoga retreat packages, offer visitors unique opportunities to engage in physical and mental challenges.

- The Destination Wellness Index and health promotion strategies have emerged as valuable tools for measuring and improving the overall wellness offerings of travel destinations. Rural tourism development and medical tourism procedures also play a role in the wellness tourism landscape. Therapeutic tourism benefits extend beyond physical and mental well-being, with accessibility standards ensuring that travelers of all abilities can enjoy these experiences. In summary, the market continues to evolve, offering a diverse range of experiences and services that cater to various aspects of travelers' well-being. From community projects and fitness facilities to mental health tourism and spiritual offerings, this sector is poised for continued growth.

What are the Key Data Covered in this Wellness Tourism Market Research and Growth Report?

-

What is the expected growth of the Wellness Tourism Market between 2025 and 2029?

-

USD 561.9 billion, at a CAGR of 9.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Domestic and International), Application (Physical, Psychological, and Spiritual), Mode Of Booking (Offline and Online), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in mental illness, Perception of wellness tourism as luxury travel market

-

-

Who are the major players in the Wellness Tourism Market?

-

Key Companies Accor S.A., Cal A Vie Health Spa, CR Operating LLC, Clinique La Prairie, Four Seasons Hotels Ltd., Gaia Retreat and Spa, Hand and Stone Franchise Corp., HOT SPRINGS RESORT and SPA, Hyatt Hotels Corp., Intrepid Group Pty Ltd., Jade Mountain, Kempinski Hotels SA, Lanserhof Management GmbH, Marriott International Inc., Mekosha, Osthoff Resort, Rancho La Puerta Inc., Red Carnation Hotels UK Ltd., Six Senses Hotels Resorts Spas, and Wyndham Hotels and Resorts Inc.

-

Market Research Insights

- The market continues to expand, with an estimated 700 million global wellness tourists in 2025, up from 573 million in 2020. This growth is driven by the increasing demand for healthy lifestyle choices and tourism offerings that cater to wellness needs. Health resorts and wellness centers provide a range of amenities, including therapeutic massage techniques, acupuncture, and alternative medicine therapies, to promote relaxation and stress management. Notably, medical tourism accreditation and community involvement tourism are gaining traction, with 25% of wellness tourists opting for accredited medical treatments and 30% engaging in community activities during their travels.

- These trends reflect a growing emphasis on tourism sustainability initiatives and ethical considerations, as well as the integration of traditional practices such as Ayurveda and traditional Chinese medicine into wellness offerings. The market's evolution also includes a focus on sleep improvement methods, mindfulness practices, and nature conservation tourism, as travelers seek to enhance their overall well-being. With continued innovation and collaboration among industry professionals, wellness tourism is poised to remain a significant contributor to the tourism industry.

We can help! Our analysts can customize this wellness tourism market research report to meet your requirements.