Wheeled Excavators Market Size 2024-2028

The wheeled excavators market size is forecast to increase by USD 1.29 billion at a CAGR of 4.36% between 2023 and 2028.

- Wheeled excavators, a type of construction machinery, have gained significant traction In the US market due to the surge in civil engineering projects and the rise of smart city initiatives. The construction sector's growth, driven by the increasing demand for smart buildings and infrastructure, is a primary factor fueling the market's expansion.

- Additionally, companies in the market are introducing innovative solutions, such as smart technology integration and lithium-ion batteries, to enhance the travel capabilities and productivity of wheeled excavators. However, the market's growth is challenged by the volatility in raw material prices and the ongoing competition with crawler excavators. Overall, the US the market is poised for growth, with key trends including the increasing adoption of advanced technology and the shift towards sustainable energy sources.

What will be the Size of the Wheeled Excavators Market During the Forecast Period?

- The global wheeled excavator market encompasses a range of versatile construction equipment, offering advantages in various sectors, including mining and infrastructure development. These machines, also known as mobile excavators, provide agility and maneuverability, making them suitable for megacities and smart city projects.

- Wheeled excavators are distinguished from crawler excavators and dragline excavators by their ability to travel on wheels, enabling easier transportation between job sites. Key features of wheeled excavators include ride control systems, swing pumps, and load-sensing hydraulics, enhancing operational efficiency and productivity. These machines are well-suited for hilly areas and soil excavation, with adjustable arm length and boom length, as well as high hydraulic force and operational speed.

- The market is witnessing a trend towards sustainable practices and reduced carbon footprints, leading to an increasing demand for electric-powered wheel excavators in addition to hydraulic excavators. Infrastructure development projects, such as road construction, are major growth drivers for the market. Overall, the wheeled excavator market is experiencing significant growth, driven by the construction sector's increasing demand for efficient, versatile, and eco-friendly equipment.

How is this Wheeled Excavators Industry segmented and which is the largest segment?

The wheeled excavators industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Construction

- Utility

- Mining

- End-user

- Contractors

- Rental providers

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

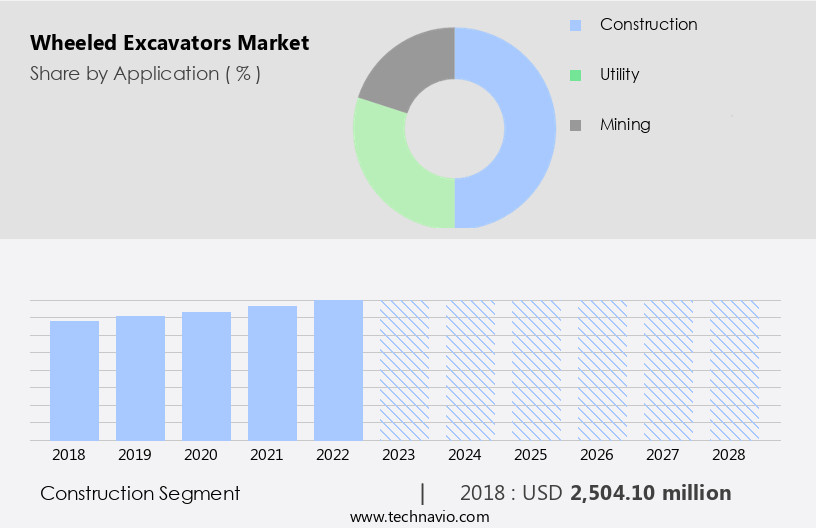

By Application Insights

- The construction segment is estimated to witness significant growth during the forecast period.

Wheeled excavators are essential machinery in infrastructure development, serving both large-scale and small-scale projects involving demolition, excavation, and material transportation. Companies offer specialized wheeled excavators for various applications, including construction, road construction, and civil engineering. The digging range of wheeled excavators extends from 30 to 45 degrees. These machines are employed in residential projects, landfilling, and extensive applications such as marine structures and road development. Wheeled excavators are utilized for placing protective layers of large rocks at construction sites. In hilly areas, these machines ensure optimal ground grip for stability. Smart cities and megacities increasingly use wheeled excavators due to their ride control, swing pump, and load-sensing hydraulics features.

Maintenance costs are minimized with advanced technology, such as hydraulic force optimization and machine diagnostics. Compliance with stringent regulations, emission control, and sustainability practices are key considerations In the market. Electric-powered wheel excavators with lithium-ion technology are gaining popularity in mining projects, commercial projects, and infrastructural activities.

Get a glance at the Wheeled Excavators Industry report of share of various segments. Request Free Sample

The Construction segment was valued at USD 2.5 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

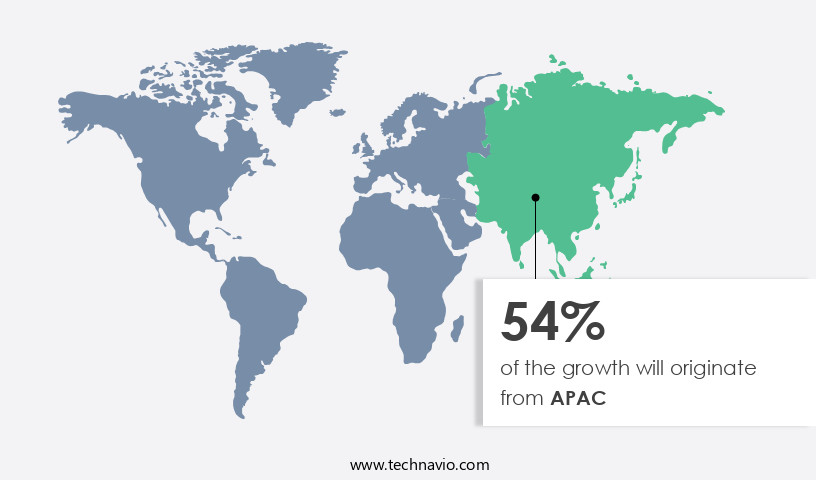

- APAC is estimated to contribute 54% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The wheeled excavator market in APAC is experiencing significant growth due to the increasing construction activity in countries like India, China, and Japan. This growth is driven by the demand for new commercial and residential real estate to accommodate the expanding urban population. In addition, mining and quarrying, waste and recycling, forestry, demolition, and infrastructure development sectors are also contributing to the market expansion. For instance, the M6 Motorway Expansion project in Australia is a notable commercial construction project that started in Q4 2021 and is expected to be completed in Q4 2025. Wheeled excavators offer advantages such as ride control, swing pump, load-sensing hydraulics, and smart technologies like stabilizers for improved ground grip and stability.

Additionally, the trend towards sustainable practices and environment-friendly machines is driving the adoption of electric-powered wheel excavators with lithium-ion technology. The market is expected to grow steadily, with key factors including load lifting capacity, operational speed, and maintenance cost. However, stringent regulations regarding emission control and safety standards are challenges that market players must address.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Wheeled Excavators Industry?

Rise in residential and commercial construction activities is the key driver of the market.

Growth in urbanization and infrastructure investments are driving the growth of the global wheeled excavators market. There is an increase in the demand for infrastructure development, both residential and commercial building projects. The demand for greater maneuverability and less road resistance while moving is increasing the demand for wheeled excavators in construction. The demand for construction equipment is growing in APAC due to the increasing investments in infrastructure projects. For instance, China invested around USD13.1 billion in the development and construction of the Beijing International Airport in 2020, which is designed to handle about 72 million passengers by 2025.

Furthermore, construction companies that had been awarded government contracts witnessed fewer project suspensions during the lockdowns implemented in various regions during the COVID-19 pandemic in 2020. In addition, governments across the globe also focused considerably on enhancing their healthcare infrastructure and building new healthcare facilities to accommodate the increasing number of COVID-19 patients, which generated immense business opportunities for the use of wheeled excavators in the construction industry.Developing countries experienced a rise in per capita income levels in 2023. Thus, the increase in urbanization is contributing to an increase in the number of construction projects, especially in emerging economies

What are the market trends shaping the Wheeled Excavators Industry?

New product launches by market vendors is the upcoming market trend.

The global wheeled excavators market has a fragmented structure, with various international and domestic vendors operating in the market in focus. These vendors are offering wheeled excavator products, backed by several new product launches and innovations in the market to attract more end-users and increase their visibility in the market. For instance, in February 2024, Hitachi announced the launch of new compact wheeled excavators. In response to the growing need for versatile equipment to work in narrow spaces or restricted areas, Hitachi Construction Machinery (Europe) N.V. (HCME) launched its smallest wheeled excavator, the ZX95W-7. Compact, agile, and with impressive lifting capacity, it is an ideal solution for urban job sites.

In September 2022, Hyundai announced the launch of the A-series of wheeled excavator HW150A CR, powered by EU Stage V diesel engines. Also, in December 2022, CNH Industrial brand CASE announced the launch of its four-model E-Series wheeled excavator range, with a fifth, larger model expected to join the series during the forecast period. The CASE wheeled excavator line-up will include the conventional tail swing WX140E and WX160E, along with the short radius WX155E SR and the WX175E SR. These four models will be joined by a conventional tail swing WX210E later. Thus, the increasing number of new product launches by several manufacturers across the world is expected to drive the growth of the global wheeled excavators market during the forecast period.

What challenges does the Wheeled Excavators Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

Raw materials, such as steel and iron, are primarily used in the manufacturing of wheeled excavators. The costs of these raw materials are volatile in nature, which adversely affects the financial returns of market vendors. The fluctuations in steel prices have been high since 2016. Globally, China was one of the leading manufacturers of steel in 2023 also. However, the steel industry was found to be one of the major contributors to air, water, and soil pollution in China. Thus, the implementation of stringent anti-pollution regulations in China has led to a reduction in the production volume of steel and resulted in the closure of numerous steel mills.

Furthermore, there has been a decrease in the supply of steel globally along with fluctuating steel prices. Global trends in steel prices have a significant impact on the global wheeled excavators market. Iron ore and steel scrap are used as the major raw materials for the production of steel. The demand for steel scrap is highly influenced by the fluctuations in the prices of iron ore. According to the World Bank, the price of iron ore averaged USD 100/ton?in 2023, dropping from USD 120/ton in 2022. However, iron ore prices increased as China witnessed an increase in imports in the first quarter of 2024. Therefore, due to such fluctuations in the prices of steel and iron ore, manufacturers find it challenging to produce high-quality wheeled excavators at affordable prices. Hence, the fluctuating prices of steel and iron ore will have a major impact on the global sales of wheeled excavators, thereby restricting the growth of the global wheeled excavators market during the forecast period.

Exclusive Customer Landscape

The wheeled excavators market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wheeled excavators market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wheeled excavators market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Caterpillar Inc.

- China National Machinery Industry Corp. Ltd.

- CNH Industrial N.V.

- Deere and Co.

- Groupe Mecalac SAS

- HD Hyundai Construction Equipment Co. Ltd.

- Hitachi Ltd.

- J C Bamford Excavators Ltd.

- Karmica Global

- Komatsu Ltd.

- Liebherr International AG

- MaxPower Corp.`

- Podlasly Baumaschinen GmbH

- Sany Group

- SHANDONG KEN STONE HEAVY MACHINERY CO. LTD

- Wacker Neuson SE

- Xuzhou Construction Machinery Group Co. Ltd.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wheeled excavators, a type of versatile construction machinery, have gained significant traction in various sectors due to their maneuverability and efficiency. These machines, also known as mobile excavators, offer numerous advantages over their crawler counterparts in hilly areas and urban environments. The mining sectors have long been a significant consumer of excavators, with both wheeled and crawler models finding extensive applications. In megacities and smart cities, the demand for these machines is on the rise due to the increasing infrastructural activities and commercial development. Ride control and swing pump technologies have been instrumental in enhancing the operational efficiency of wheeled excavators.

Load-sensing hydraulics have further optimized the hydraulic force distribution, ensuring improved performance and reduced fuel consumption. Ground grip and maintenance cost are crucial factors influencing the market dynamics of wheeled excavators. The machines' ability to maintain ground contact during heavy construction activities and their lower maintenance costs compared to crawler excavators make them a popular choice. Soil manipulation is a primary function of excavators, and wheeled models are no exception. The bucket's size, arm length, and boom length are essential factors determining the machine's load lifting capacity and operational speed. The construction sector, including road constructions, is a major consumer of wheeled excavators.

Stringent regulations governing emission control and the growing emphasis on environmentally friendly machines have led to the development of electric-powered wheel excavators using lithium-ion technology. Mining & quarrying, waste & recycling, forestry, demolition, and various commercial activities are other sectors where wheeled excavators find extensive applications. Urbanization and sustainable practices have further increased the demand for these machines in various projects, from residential to commercial. Hilly areas pose unique challenges for excavators, and wheeled models offer advantages in terms of maneuverability and ground contact. However, the choice between wheeled and crawler excavators depends on various factors, including the specific application requirements, terrain conditions, and budget considerations.

The market for wheeled excavators is diverse and competitive, with various models catering to different applications and customer preferences. The ongoing technological advancements, including the integration of smart technologies, are expected to further enhance the machines' capabilities and efficiency. In conclusion, wheeled excavators have become indispensable in various sectors due to their versatility, maneuverability, and efficiency. The market dynamics are influenced by factors such as application requirements, terrain conditions, technological advancements, and regulatory considerations. The ongoing urbanization and infrastructure development are expected to continue driving the demand for these machines in the future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wheeled Excavators Market Research and Growth Report?

- CAGR of the Wheeled Excavators industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wheeled excavators market growth of industry companies

We can help! Our analysts can customize this wheeled excavators market research report to meet your requirements.