Wireless Router Market Size 2025-2029

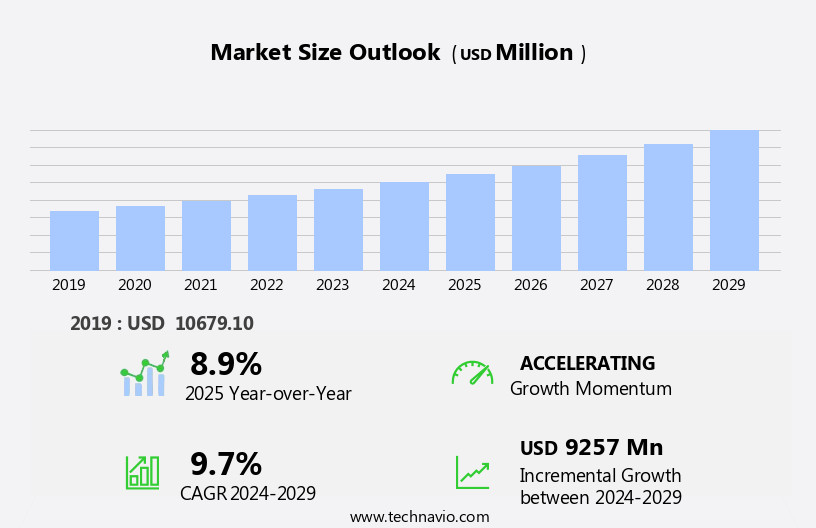

The wireless router market size is forecast to increase by USD 9.26 billion at a CAGR of 9.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of smart connected home systems and the expanding use of wireless routers in the retail industry. These trends reflect the growing importance of reliable and high-speed internet connectivity in various sectors. However, the market is not without challenges. Inferior communication network infrastructure in developing regions poses a significant obstacle to market expansion. With the proliferation of connected devices, smart home devices, bandwidth-intensive apps, and smart home gadgets such as smart TVs and security cameras, network traffic demands continue to escalate. To capitalize on the market's opportunities, companies must focus on developing innovative solutions to address the infrastructure challenges in emerging markets.

- Additionally, investing in advanced technologies such as Mesh networking and Wi-Fi 6 can help companies differentiate themselves and meet the evolving demands of consumers and businesses for faster and more reliable internet connectivity. The market for wireless routers is driven by the increasing sales of consumer electronics, such as gaming consoles, streaming devices, and smart TVs.Overall, the market presents a compelling opportunity for companies seeking to expand their footprint in the technology sector and meet the growing demand for reliable and high-speed internet connectivity.

What will be the Size of the Wireless Router Market during the forecast period?

- The market encompasses the production and sale of wireless routers and wireless access points, enabling high-speed internet access for private computer networks and wireless-only LANs.Consequently, the market is witnessing significant growth, driven by the increasing adoption of high-performance routers, including single-band, dual-band, and tri-band models. The integration of Wi-Fi technology into various IoT devices, home office equipment, and smart appliances necessitates advanced network security features, leading to an emphasis on router performance, bandwidth capacity, and IoT integration.

- The advent of 5G infrastructure, mobile broadband, M2M communication, and cloud connectivity further expands the market's scope. As network ranges expand and cybersecurity risks escalate, router firmware updates and wireless standards continue to evolve, ensuring seamless and secure home networking experiences.

How is this Wireless Router Industry segmented?

The wireless router industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Non-residential

- Residential

- Type

- Fixed

- Mobile

- Technology

- Dual band

- Tri-band

- Wi-Fi 6

- Mesh networking

- Wi-Fi 6E

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

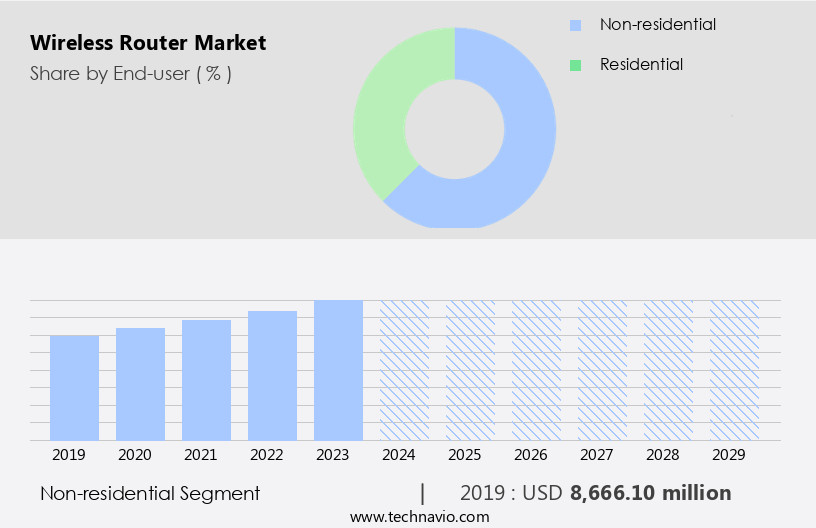

By End-user Insights

The non-residential segment is estimated to witness significant growth during the forecast period. The market caters to both residential and non-residential sectors. In the non-residential segment, wireless routers are utilized by commercial offices, enterprises, industries, transportation services, public utilities, educational institutions, and the hospitality sector. Enterprises are prioritizing digital transformation and third-platform initiatives, which necessitate high-speed internet connectivity. Wireless routers enable seamless connectivity for various devices, including smart home devices, high-speed internet access for bandwidth-intensive apps, and smart city infrastructure components such as intelligent surveillance networks and public Wi-Fi hotspots.

Additionally, the proliferation of mesh networking systems and the rise of 5G infrastructure contribute to market growth. In the non-residential sector, businesses demand reliable, secure, interoperable, and superior performance wireless routers for their high-density areas. Single-band, dual-band, and tri-band wireless routers cater to various connectivity requirements. The financial services industry, information technology, connected healthcare devices, and the internet markets are significant end-users. Security features, such as privacy-enhancing technologies and transparent data practices, are crucial considerations for businesses. Wireless standards, broadband connectivity, and internet infrastructure investments are key market trends. Despite security worries and technological fragmentation, the wireless router industry continues to expand, driven by the increasing demand for next-generation connectivity.

Get a glance at the market report of share of various segments Request Free Sample

The Non-residential segment was valued at USD 8.67 billion in 2019 and showed a gradual increase during the forecast period.

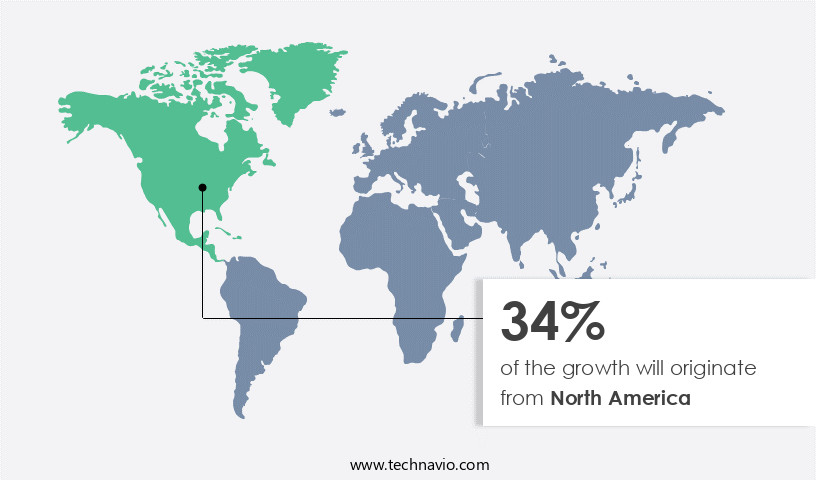

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the widespread availability of high-speed internet access, the large-scale adoption of wireless local area networks (WLAN) in various sectors, and the increasing use of advanced wireless routers. The US and Canada are significant markets for home Wi-Fi routers due to the growing number of smart devices, online learning and banking, and OTT platforms. The increasing adoption of smart appliances such as smart TVs, smartphones, smart refrigerators, and digital assistants, coupled with a mature end-user base and early adoption of new technologies, fuels the demand for high-speed internet among home users.

Factors such as superior performance, secure and reliable products, interoperability, and the availability of high-density wireless routers, including single-band, dual-band, and tri-band options, cater to the diverse needs of consumers and businesses. Wi-Fi 6 standards and mesh networking systems are gaining popularity, providing dependable internet access for simultaneous connections and high-bandwidth applications. The financial services industry, information technology, connected healthcare devices, and smart homes are key verticals driving the demand for wireless routers. Security features and privacy-enhancing technologies are essential considerations for both residential and business settings. The wireless router industry continues to evolve, offering next-generation connectivity solutions while addressing security worries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wireless Router Industry?

- Increasing adoption of smart connected home systems is the key driver of the market. The demand for wireless routers has witnessed a notable increase due to the growing adoption of smart home appliances. With the proliferation of smart devices such as refrigerators, dishwashers, smart TVs, voice assistance, and microwave ovens, the need for reliable and high-speed wireless connectivity has become essential. These smart devices can be connected to the cloud or software components, enabling them to function autonomously or based on patterns or intelligence algorithms. The IoT (Internet of Things) is a significant contributor to this trend, as it facilitates the seamless integration of various devices within a home network.

- The high adoption of such smart systems in countries like the US, Canada, the UK, Germany, and France is driving the demand for wireless routers among households. The use of advanced technologies, such as artificial intelligence-enabled smart home controllers and smart hubs, which enable remote control of appliances, is another major reason for the adoption of smart and innovative appliances, thereby fueling the demand for wireless routers.

What are the market trends shaping the Wireless Router Industry?

- Increasing use of wireless router in retail industry is the upcoming market trend. In the retail sector, wireless technologies have become essential for enhancing customer experience and streamlining operations. Solutions such as point-of-sale (POS) systems, vending machines, radio frequency identification systems, and kiosks enable automation and cost savings. POS systems facilitate flexible payment options and improved queue management, ultimately resulting in enhanced customer service.

- However, the retail industry's competitive landscape necessitates a secure and efficient environment. Remote monitoring and security systems, like machine-to-machine (M2M) security solutions, play a crucial role in mitigating risks related to inventory loss, communication, and building automation. These systems ensure uninterrupted operations and minimize potential threats, making them indispensable in the retail segment.

What challenges does the Wireless Router Industry face during its growth?

- Inferior communication network infrastructure in developing regions is a key challenge affecting the industry growth. Wireless routers are essential components of strong network infrastructure for seamless Internet communications and multimedia streaming. However, the adoption of wireless routers is influenced by the availability and penetration of high-speed Internet networks and telecom services.

- In many developing countries, such as Bangladesh, Central African Republic, Nepal, and Haiti, the required network infrastructure is lacking. In Asian countries, 4G technology, a critical enabler of error-free and uninterrupted telecom services, is still in its nascent stages and has yet to gain significant adoption in some countries like Pakistan. Consequently, the absence of 4G technology may hinder the widespread adoption of wireless routers.

Exclusive Customer Landscape

The wireless router market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wireless router market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wireless router market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adtran Holdings Inc. - The company offers wireless routers such as NetVanta series 3100, NetVanta series 3200, NetVanta series 3400 and NetVanta series 4000.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adtran Holdings Inc.

- Amped Wireless

- ASUSTeK Computer Inc.

- Broadcom Inc.

- Buffalo Americas Inc.

- China Huaxin Post and Telecom Technologies Co. Ltd.

- Cisco Systems Inc.

- D Link Corp.

- DrayTek Corp.

- EDIMAX Technology Co. Ltd.

- Extreme Networks Inc.

- Hon Hai Precision Industry Co. Ltd.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- MERCUSYS Technologies Co. Ltd.

- NETGEAR Inc.

- Shenzhen Tenda Technology Co. Ltd.

- SIA Mikrotikls

- TP Link Corp. Ltd.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and products designed to facilitate high-speed internet access for connected devices in both residential and business settings. These devices, including wireless routers and wireless access points, enable the creation of private computer networks and support the growing prevalence of wireless-only LANs. Wireless routers are essential components of Wi-Fi technology, providing superior performance and dependable internet access in high-density areas. With the proliferation of smart home devices, Wi-Fi technology has become an indispensable part of modern life, enabling seamless connectivity for an array of bandwidth-intensive apps and smart home gadgets. The wireless router industry continues to evolve, with advancements in Wi-Fi 6 standards and the emergence of high-end, secure, and reliable products.

Interoperability remains a critical consideration, as consumers and businesses seek products that can work seamlessly with their existing devices and networks. Single-band wireless routers offer basic connectivity, while dual-band and tri-band routers cater to those requiring higher bandwidths and more simultaneous connections. The financial services industry, information technology, and healthcare sectors are among the key verticals driving demand for these products, as they prioritize high-speed internet connectivity for their operations. Security features are increasingly important in the market, as concerns around cybersecurity risks and unauthorized access grow. Manufacturers are addressing these concerns by offering advanced security features and transparent data practices to ensure privacy and protect against potential threats.

The rise of smart homes and the Internet of Things (IoT) has fueled a trend towards mesh networking systems, which offer extended coverage and improved performance in larger homes and businesses. These systems enable the seamless connection of various smart devices, from smart TVs and security cameras to gaming consoles and streaming devices. The market is also impacted by technological fragmentation, as various standards and frequency bands are used to cater to different applications and regions. Broadband connectivity and internet infrastructure investments continue to be crucial factors, particularly in rural areas where high-speed internet penetration remains low. The increasing adoption of 5G infrastructure and networks is expected to further drive demand for wireless routers and accessories, such as range extenders, as they offer higher bandwidths and next-generation connectivity.

The shift towards remote work and online learning has also highlighted the importance of reliable and secure wireless networks, particularly in business settings. The market is a dynamic and evolving landscape, driven by the growing prevalence of connected devices and the need for high-speed, secure, and reliable internet access. Manufacturers must continue to innovate and address the unique requirements of various industries and applications to meet the demands of an increasingly digital world.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.7% |

|

Market growth 2025-2029 |

USD 9.25 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, Canada, China, Germany, Japan, India, UK, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wireless Router Market Research and Growth Report?

- CAGR of the Wireless Router industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wireless router market growth and forecasting

We can help! Our analysts can customize this wireless router market research report to meet your requirements.